Vodafone to Separate European Tower Infrastructure Unit; 1Q Revenue Fell

July 26 2019 - 2:52AM

Dow Jones News

By Adria Calatayud

Vodafone Group PLC (VOD.LN) said Friday that it will separate

its European tower infrastructure business and consider

monetization options, including via a potential initial public

offering, as it posted a 2.3% fall in first-quarter revenue.

The U.K. telecommunications said its European tower

infrastructure into a new organization, which will be operational

by May 2020. The new business will comprise the company's 61,700

towers in ten markets. Preparations are under way for a variety of

monetization alternatives to be executed over the next 18 months,

including a potential IPO, Vodafone said.

Proceeds from the separation will be used to reduce the group's

debt, Vodafone said. The company said the separation will depend on

market conditions.

Separately, Vodafone said revenue for the quarter to June 30

fell to 10.65 billion euros ($11.87 billion) from EUR10.90 billion

in the year-earlier period due to foreign-exchange movements, and

backed its guidance for fiscal 2020

Quarterly organic service revenue--a closely-watched metric for

Vodafone--was down 0.2%, following a 0.7% decline in the previous

quarter, the company said.

The company confirmed that it is confident in delivering

adjusted earnings before interest, taxes, depreciation and

amortization of between EUR13.8 billion and EUR14.2 billion and

free cash flow, excluding spectrum costs, of at least EUR5.4

billion in fiscal 2020.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

July 26, 2019 02:37 ET (06:37 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

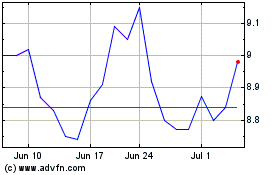

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

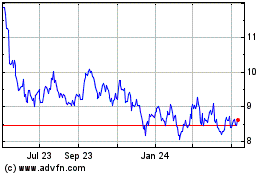

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024