Amidst a slowing local economy, Yelp’s economic

measure identifies five outlier boomtowns

Yelp Inc. (NYSE: YELP), the company that connects people with

great local businesses, today released second quarter data for the

Yelp Economic Average (YEA), a benchmark of local economic strength

in the U.S. The report finds a sluggish local economy, as well as

five metros that have bucked the national trend due to growing

development. YEA is calculated from the fourth quarter of 2016,

nationally and for 50 metros, reflecting data from millions of

local businesses and tens of millions of users on Yelp’s

platform.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190725005249/en/

Yelp Economic Average (Graphic: Business

Wire)

The YEA ticked down by 0.2% from the first quarter of 2019 to

99.2, reversing a brief and modest recovery. YEA grew with the

economy in 2017, but is now down 2% from its peak and has been

performing below its baseline level of 100 for the past three

quarters. According to researchers, Yelp provides a timely and

accurate measure of a huge swath of the economy that is often

missed by many major indicators. The YEA measures strength using

two signals: business survival and consumer interest. The opening

of new businesses and an increase in consumer engagement both boost

the YEA.

“The U.S. economy is setting new records every month for its

longest ever recession-free streak, but Yelp data about the Main

Street local economy may be showing warning signs,” said Carl

Bialik, Yelp’s data science editor. “Currently below 2017, the Yelp

Economic Average shows a cooling brick-and-mortar economy across

the U.S. that’s signaling a potential slowdown in consumer demand

and business growth.”

Five Boomtowns Have Struck Gold in Development

The cities of Honolulu, Hawaii; Louisville, Ky; Memphis, Tenn.;

Milwaukee, Wis.; and Portland, Maine had the country’s strongest

combination of business growth and consumer demand, according to

the YEA analysis across 50 top metros around the country. These

cities grew in the second quarter of 2019 primarily due to real

estate related business — agents, lawyers, services — indicative of

a boom in development, sometimes aided by permissive local

laws.

Development is among the factors driving growth in the five Yelp

boomtowns, the fastest growing metros since our measurement of

their local business health began in the fourth quarter of 2016.

Milwaukee, Wis. is benefiting from hosting privileges for next

year’s Democratic National Convention, and a new NBA arena.

Developers are scrambling to meet demand for downtown housing in

Memphis, Tenn. And Portland, Maine is drawing people from out of

state, driving up residential permits.

Meanwhile, some of the most sluggish local economies are wealthy

metro areas on the West Coast that have resisted development amid a

national debate about how much to build: Portland, Ore.; San

Francisco, Calif.; and San Jose, Calif. all are among the bottom

five metros for growth.

Other Key Findings from the Second Quarter

Beyond the slowing brick-and-mortar economy, and boomtowns and

laggards, other patterns emerged in the second quarter. More

Americans were relying on paid professionals to clean in the second

quarter — including their cars, clothes, carpets and homes.

Americans also sought out their local watering holes with gains in

lounges, pubs, and sports bars. And more of them passed on dessert,

with a dip in results for businesses selling donuts and ice

creams.

For more assets and images, please find them here. For more

information and Yelp’s latest metrics, visit:

https://www.yelp.com/factsheet

Methodology

The Yelp Economic Average (YEA) is a composite measure of the

economy, reflecting both business health and consumer demand among

businesses in 30 sectors.

The eight root categories

The 30 business sectors, or categories — the “Yelp 30” — are

drawn from eight umbrella business categories on Yelp: restaurants,

food, nightlife, local services, automotive, professional services,

home services, and shopping.

Root categories’ share of the 30 components

The share of YEA components from each of these eight categories

is based on each one’s share of the economy, as estimated from

County Business Patterns reports.

Choosing the Yelp 30

Each of the Yelp 30 is chosen based on maximizing four criteria,

relative to other candidates within its family of categories, as

measured in the first quarter of 2016:

- Number of businesses on Yelp in the category;

- Consumer interest on Yelp for businesses in the category;

- Number of the 50 metro areas — whose economic health Yelp has

been measuring for a year and a half, originally as part of the

company’s Local Economic Outlook — in which the category is

present;

- Uniform spread across the four Census Bureau-defined regions of

the country.

Choosing baseline categories

Yelp’s data science team then chose baseline categories against

which to compare the fortunes of the Yelp 30. This step helps

remove changes due to seasonality and Yelp’s internal growth; what

remains is a reflection of real economic patterns. The team

selected all other root categories not represented by the YEA

components as baselines because they provided the most robust

controls against seasonality and activity on Yelp.

Calculating the YEA scores

For each of the Yelp 30 in each quarter, its two scores — one

for business population and one for consumer interest — are

calculated as follows:

- Count the component’s total for the quarter;

- For consumer interest only: Count the baseline’s total for the

quarter;

- For consumer interest only: Divide the component’s total by the

baseline total to get the component’s score;

- Divide the component’s score for the quarter of interest by the

component’s score in the equivalent quarter in 2016 — comparing,

for instance, the fourth quarter of 2018 to the fourth quarter of

2016, to adjust for seasonality;

- Multiply by 100 to make 100 a typical score.

Then the two scores are normalized to have the same variance, so

that each contributes equally across components.

To reduce the effect of outliers, the overall score for both

consumer engagement and business count is the median of each

component’s score.

The YEA is the mean of the overall consumer engagement score and

business-count score.

The YEA is separate from, and not meant to inform or predict,

Yelp's financial performance because our figures are adjusted to

remove the effects of changes to usage of our product.

Yelp calculated equivalent scores at the regional and metro

level to provide a local look at the state of the local

economy.

About Yelp Inc.

Yelp Inc. (www.yelp.com) connects people with great local

businesses. With unmatched local business information, photos and

review content, Yelp provides a one-stop local platform for

consumers to discover, connect and transact with local businesses

of all sizes by making it easy to request a quote, join a waitlist,

and make a reservation, appointment or purchase. Yelp was founded

in San Francisco in July 2004. Since then, Yelp has taken root in

major metros in more than 30 countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190725005249/en/

Yelp Inc. Kathleen Liu press@yelp.com

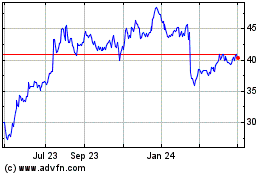

Yelp (NYSE:YELP)

Historical Stock Chart

From Mar 2024 to Apr 2024

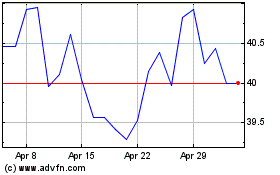

Yelp (NYSE:YELP)

Historical Stock Chart

From Apr 2023 to Apr 2024