Coca-Cola Sales Boosted by Soda Gains, Coffee Push -- 2nd Update

July 23 2019 - 7:21PM

Dow Jones News

By Charlie McGee and Allison Prang

Coca-Cola Co.'s quarterly profit and sales rose, boosted by

higher demand for its namesake soft drinks and the introduction of

coffee, energy drinks and other products.

Organic revenue, which excludes currency swings, acquisitions

and divestitures, increased 6%, with gains in each of Coke's four

major geographies.

Sagging demand for sugary drinks has driven Coke's push to roll

out Coke Zero Sugar, new flavors and diversify its offerings in

recent years.

The product launches have helped revive its core soda business,

where volumes rose 4% in the quarter. Volumes of Coke Zero Sugar, a

reformulated diet soda, rose more than 10% globally, the company

said Tuesday.

Coca-Cola CEO James Quincey said Tuesday on a conference call

that the company has seen steady progress in North America for

sugar-free versions of its drinks. Coke's sales volume in the U.S.

was slightly negative, Mr. Quincey said, as the company raised

prices and focused on smaller-size packaging.

After tempering expectations earlier this year, the company

lifted its forecasts for organic revenue growth and operating

profits for the full year. Shares of Coca-Cola rose 6% on Tuesday

and during the session traded above multidecade highs.

John Murphy, Coke's chief financial officer, said Orange Vanilla

Coca-Cola, rolled out earlier this year as the first new flavor in

a decade, performed strongly in the U.S., while Coca-Cola Plus

Coffee helped sales in Europe.

Mr. Murphy said the company's traditional soda still sells well

in lower per capita markets. He said growth in India was strong,

but in Mexico it has been "a little slower than we would have

liked."

Earlier this month, rival PepsiCo Inc. also posted strong sales

helped by increased advertising and new product launches. The

snacks-and-drinks giant posted a 2.5% increase in North American

beverages revenue with volume rising in its ready-to-drink coffee

and water brands like Lifewtr and Bubly.

Coke is integrating British coffee shop-chain Costa after

closing its $5.1 billion acquisition earlier this year. Mr. Quincey

added Coke has placed 1,200 Costa vending machines so far with

plans for "many more" this year. The machines have only been placed

in current Costa markets, which is primarily the U.K., where most

of the coffee chain's nearly 4,000 cafes are located, and

increasingly in Asia.

Mr. Murphy declined to discuss plans for rolling out the bottled

coffee or vending machines in the U.S. He said the long-term plan

is for Costa to have a global footprint and the company expects to

launch the bottled coffee in six markets before the year's end.

The Costa acquisition gave Coke a recognized coffee brand in the

U.K. But some analysts have questioned the high price Coke paid for

a direct competitor of Starbucks Corp.

Coca-Cola Energy, the company's first energy drink product

bearing its namesake, is now available in more than a dozen

countries, including Japan and Australia. The company expects to

make Coke Energy available in 20 markets, including Mexico, by

year's end.

The company won an arbitration claim against partner Monster

Beverage Corp. in June, allowing Coke to roll out its own energy

drink. Monster had accused Coke of violating a noncompete agreement

the companies struck in 2015, when Coke bought a significant stake

in Monster and became its distribution partner.

"We think there's a lot of room inside the category for both

Coke Energy and Monster to coexist together," Mr. Murphy said. Mr.

Quincey told analysts the company remains committed to its

relationship with Monster.

Not all of the company's products are doing well. Mr. Quincey

said the company's mainstream water brands, which include Dasani,

have been under pressure this year and its main sports drink,

Powerade, hasn't had a good start to the year.

Still, the company now expects organic revenue to rise by 5% in

2019. It had previously expected it to increase by about 4%.

Coca-Cola also raised its guidance for operating income on a

currency neutral basis, and now expects it to increase between 11%

and 12%, instead of between 10% and 11%.

For the second quarter, Coca-Cola reported a profit of $2.61

billion, or 61 cents a share, on revenue of $10 billion. A year

ago, Coke had a profit of $2.32 billion, or 54 cents a share, on

revenue of $9.42 billion.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

July 23, 2019 19:06 ET (23:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

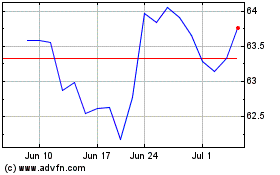

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024