Lockheed Martin Raises 2019 Profit Guidance

July 23 2019 - 9:03AM

Dow Jones News

By Doug Cameron

Lockheed Martin Corp. reported forecast-beating quarterly

profits and raised its full-year guidance, just as a proposed new

budget compromise lifted a cloud hanging over U.S. defense

companies.

The world's largest defense contractor by sales benefited from

more shipments of missiles and additional classified work, as well

as higher production of its F-35 stealth fighter.

Lockheed Martin opened the defense reporting season Tuesday,

just hours after the Trump administration reached a compromise deal

with Congress to lift the national debt ceiling, clearing the way

for approval of a fiscal 2020 defense budget that would boost

spending by around 3% over 2019 levels.

Defense companies have underperformed the broader market in

recent weeks because of the budget impasse. Lockheed Martin's

latest results helped lift its shares almost 3% in pre-open trade.

Other defense contractors also moved ahead, with Northrop Grumman

Corp. and Raytheon Co. both up almost 1%.

Lockheed Martin reported profits of $1.42 billion for the

quarter compared with $1.16 billion a year earlier. Earnings per

share rose to $5 from $4.05, well above the $4.77 consensus among

analysts polled by FactSet. Sales climbed to $14.43 billion from

$13.4 billion.

The company lifted the midpoint of its 2019 profit guidance by

4% to a range of $20.85 to $21.15, with sales and free cash flow

also guided higher for 2019. However, it said the guidance didn't

include any potential impact from the administration's decision to

exclude Turkey from the F-35 program.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

July 23, 2019 08:48 ET (12:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

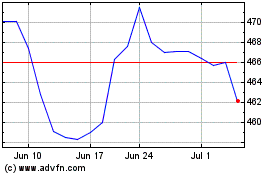

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

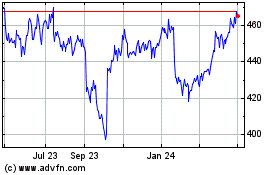

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024