Amended Current Report Filing (8-k/a)

July 23 2019 - 7:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report: May 8, 2019

TPT

Global Tech, Inc.

(Exact name of

registrant as specified in its charter)

|

Florida

|

|

333-222094

|

|

81-3903357

|

|

(State or other

jurisdiction of incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification Number)

|

501 West Broadway, Suite 800, San

Diego, CA 92101

(Address of

Principal Executive Offices) (Zip Code)

(619)301-4200

Registrant's

telephone number, including area code

(Former name or

former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[

] Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[

] Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

None

Indicate by check

mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter)

Emerging Growth

Company ⌧

If an emerging

growth company, indicate by check mark if the registrant has

elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange

Act. ◻

EXPLANATORY

NOTE

This Form 8-K/A is being filed to disclose the fact that audited

financial statements of an acquiree, required pursuant to an

acquisition by TPT Global Tech, Inc., of the Speed Connect assets

will be late in being filed as required, by the rules of the

Securities Exchange Commission .

Item 2.01 Completion of Acquisition or

Disposition of Assets

Effective April 3,

2019, and reported under Item 1.01 on Form 8-K dated April 8, 2019,

TPT Global Tech, Inc. (the “Company”) entered into an

Asset Purchase Agreement with SpeedConnect, LLC

(“SpeedConnect”) to acquire substantially all of the

assets of SpeedConnect for $2 million and the assumption of certain

liabilities.

On May 7, 2019, as reported under Item 1.01 on Form 8-K dated

May 8, 2019, TPT Global Tech, Inc. (the

“Company”) closed the transaction underlying the Asset

Purchase Agreement dated with SpeedConnect, LLC

(“SpeedConnect”) to acquire substantially all of the

assets of SpeedConnect for $1.75 million and the

assumption of certain liabilities. The Asset Purchase Agreement

required a deposit of $500,000 made in April and an additional

$500,000 payment to close. The additional $500,000 was paid and all

other conditions were met to effectuate the sale of substantially

all of the assets of SpeedConnect to the Company. As part of the

closing, the Company entered into a Promissory Note to pay

SpeedConnect $1,000,000 in two equal installments of $500,000 plus

applicable interest at 10% per annum with the first installment

payable within 30 days of closing and the second installment

payable within 60 days of closing. The payments were

subsequently made under the Promissory Note, which total payments

were reduced to $750,000 by the Seller. The Company is

required to have SpeedConnect’s financial information audited

for the last two years, which audits are in process and expected to

be completed by August 31, 2019.

Item 2.03 Creation of Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant

The disclosures

under Item 1.01 of this Current Report on Form 8-K.

In conjunction with

the close of the SpeedConnect transaction, the Company entered into

an Agreement for the Purchase and Sale of Future Receipts dated May

8, 2019 (“Financing Agreement”). The balance to be

purchased and sold is $753,610 for which the Company received

$527,000. Under the Financing Agreement, the Company will pay

$18,840.25 per week until fully paid which is expected to be in

February 2020. The Financing Agreement includes a guaranty by the

CEO of the Company, Stephen Thomas.

Item 9.01 Exhibits

The following exhibits were filed with the

original Form 8-K dated May 8, 2019.

|

Exhibit Number

|

Exhibit

|

|

10.1

|

|

|

10.2

|

|

|

10.3

|

|

|

10.4

|

|

|

99.1

|

|

|

|

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this Report to be signed on its behalf by the

undersigned, hereunto duly authorized.

TPT GLOBAL TECH, INC.

By:

/s/ Stephen J. Thomas

III

Stephen J. Thomas

III,

Title: Chief

Operating Officer

Date: July

22, 2019

2

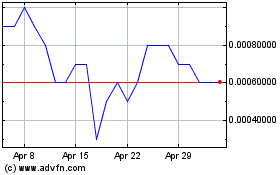

TPT Global Tech (CE) (USOTC:TPTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

TPT Global Tech (CE) (USOTC:TPTW)

Historical Stock Chart

From Apr 2023 to Apr 2024