SCHEDULE 14C

(Rule 14c-101)

INFORMATION REQUIRED IN INFORMATION STATEMENT

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities

Exchange Act of 1934

(Amendment No. __________)

Check the appropriate box:

☐ Preliminary Information Statement

☐ Confidential, For Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

☒ Definitive Information Statement

TWINLAB CONSOLIDATED HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

TWINLAB CONSOLIDATED HOLDINGS, INC.

4800 T-Rex Avenue, Suite 305

Boca Raton, Florida 33431

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

July 17, 2019

To our Stockholders:

Twinlab Consolidated Holdings, Inc. (the "Company") hereby gives notice to the holders of its common stock, $0.001 par value (the "Common Stock") that certain stockholders of the Company holding a majority in voting power of its outstanding Common Stock have taken certain actions by written consent to adopt amended and restated articles of incorporation (the "Amended and Restated Articles"), a copy of which is set forth herein as Annex A (i) to expressly provide for shares of blank- check preferred stock pursuant to which the Board would have the authority to provide for one or more classes or series of preferred stock and with respect to each class or series, fix the number of shares constituting such class or series, the designation, voting powers, preferences and relative, participating, optional or other special rights; and (ii) make such additional changes to the articles of incorporation as the Company believes is appropriate under Nevada law, its status as a public reporting company and for corporate governance purposes.

The Company's Common Stock is quoted on the OTC Markets PK ("OTCPK") and traded in the OTCPK under the symbol "TLCC." Section 78.320 of the Nevada Revised Statutes ("NRS") and our organizational documents permit any action that may be taken at a meeting of the stockholders to be taken by written consent by the holders of the number of shares of voting stock required to approve the action at a meeting. Accordingly, the holders of a majority in voting power of the outstanding shares of the Common Stock have approved the adoption of the Amended and Restated Articles.

All necessary corporate approvals in connection with the matters referred to in this Information Statement have been obtained, and the Company may file the Amended and Restated Articles with the Secretary of State of Nevada and subsequently authorize and issue shares of preferred stock upon providing the necessary notice to its non-consenting stockholders in accordance with NRS and the U.S. Federal securities laws. This Information Statement is being furnished to all stockholders of the Company pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the rules and regulations promulgated thereunder, solely for the purpose of informing the non-consenting stockholders of these corporate actions before the Company takes the actions set forth in the written consent. In accordance with Rule 14c-2 under the Exchange Act, the Company may file the Amended and Restated Articles with the Secretary of State of Nevada and subsequently authorize and issue shares of preferred stock on the date that is the twenty-first (21st) day following the mailing of this Information Statement to the Company's non-consenting stockholders.

We are mailing this Information Statement to our holders of record as of the close of business on July 9, 2019. These actions will take effect at such time within eleven months of the date hereof, as determined by the Board of Directors in its discretion. These actions were approved by written consent by the Special Committee, the Board of Directors and then by written consent in lieu of a meeting of stockholders by four (4) stockholders holding a majority of our issued and outstanding Common Stock entitled to vote on the record date. This Information Statement is being provided to you for your information to comply with the Exchange Act requirements. You are urged to read this Information Statement carefully in its entirety. No action is required on your part in connection with this document. No stockholder meeting will be held in connection with this Information Statement.

We are not asking you for a proxy and you are requested not to send us a proxy.

Your vote is not required to approve any of these actions, and the enclosed Information Statement is not a request for your vote or a proxy.

The accompanying Information Statement is for information purposes. Please read the accompanying Information Statement carefully.

By Order of the Board of Directors,

Shari Gottesman

Corporate Secretary, General Counsel &

Senior Vice President, Legal & Regulatory

INFORMATION STATEMENT FOR

TWINLAB CONSOLIDATED HOLDINGS, INC.

4800 T-Rex Avenue, Suite 305

Boca Raton, Florida 33431

Telephone Number: (561) 443-5301

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This Information Statement is first being furnished on or about July 17, 2019, to the holders of record as of the close of business on July 9, 2019, of the common stock, par value $0.001 per share (the "Common Stock"), of Twinlab Consolidated Holdings, Inc. (referred to in this Information Statement as "we", "us", "our", the "Company"). The record date is the latest date that the stockholders giving their consent to the proposals described herein acted.

This Information Statement is being furnished to our stockholders to inform them about the actions described in this Information Statement. This Information Statement is being filed with the U.S. Securities and Exchange Commission pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and provided to the Company's stockholders pursuant to Rule 14c-2 promulgated under the Exchange Act.

We will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of our Common Stock.

The date of this Information Statement is July 17, 2019.

QUESTIONS AND ANSWERS ABOUT THIS INFORMATION STATEMENT

Twinlab Consolidated Holdings, Inc.'s Common Stock is quoted on the OTC Markets PK ("OTCPK") and traded in the OTCPK under the symbol "TLCC." Section 78.320 of the NRS and the Company's organizational documents permit any action that may be taken at a meeting of the stockholders to be taken by written consent by the holders of the number of shares of voting stock required to approve the action at a meeting. Accordingly, four (4) stockholders of the Company holding a majority in voting power of its outstanding Common Stock have taken certain actions to approve and adopt the Amended and Restated Articles (i) to expressly provide for shares of blank-check preferred stock pursuant to which the Board would have the authority to provide for one or more classes or series of preferred stock and with respect to each class or series, fix the number of shares constituting such class or series, the designation, voting powers, preferences and relative, participating, optional or other special rights; and (ii) make such additional changes to the articles of incorporation as the Company believes is appropriate under Nevada law, its status as a public reporting company and for corporate governance purposes.

All necessary corporate approvals in connection with the matters referred to in this Information Statement have been obtained, and the Company may file the Amended and Restated Articles with the Secretary of State of Nevada and subsequently authorize and issue shares of preferred stock upon providing necessary notice to its non-consenting stockholders in accordance with NRS and the U.S. Federal securities laws. This Information Statement is being furnished to all stockholders of the Company pursuant to Section 14(c) of the Exchange Act, and the rules and regulations promulgated thereunder, solely for the purpose of informing the non-consenting stockholders of these corporate actions before the Company takes the actions set forth in the written consent. In accordance with Rule 14c-2 under the Exchange Act, the Company may file the Amended and Restated Articles with the Secretary of State of Nevada and subsequently authorize and issue shares of preferred stock on the date that is the twenty-first (21st) day following the mailing of this Information Statement to the Company's non-consenting stockholders.

The following questions and answers briefly address some questions you may have regarding this Information Statement. These questions and answers may not address all questions that may be important to you as a stockholder. Please refer to the more detailed information contained elsewhere in this Information Statement.

|

|

Q:

|

Why did you send me this Information Statement?

|

|

|

A:

|

We sent you this Information Statement to inform you about recent actions taken by the Special Committee, the Board of Directors and the holders of a majority of the voting power of the Company's issued and outstanding Common Stock by executing a written consent in lieu of a meeting. You are not required to take any action with respect to any of the information set forth in this Information Statement.

|

|

|

Q:

|

What is the record date for Stockholders entitled to receive this Information Statement?

|

|

|

A:

|

The record date is July 9, 2019.

|

|

|

Q:

|

Will the actions taken by written consent also be submitted to all of the Company's stockholders for approval?

|

|

|

A:

|

No. Under Section 78.320 of the NRS, stockholder action taken by written consent in lieu of a meeting is effective as if taken at a meeting of the Company's stockholders. No further stockholder approval is necessary, and there will be no meeting specifically called for the purpose of approving again the actions taken by written consent described herein.

|

|

|

Q:

|

How many shares of the Common Stock were eligible to consent to the actions described in this Information Statement?

|

|

|

A:

|

On July 9, 2019, there were issued and outstanding 255,643,828 shares of Common Stock. The holders of Common Stock are entitled to vote as a single class. Four (4) of our stockholders holding an aggregate of 205,513,410 voting shares took action by written consent.

|

|

|

Q:

|

What vote was required to authorize and approve the actions taken by written consent in lieu of a meeting?

|

|

|

A:

|

Under Nevada law and pursuant to the Company's bylaws, any action required or permitted to be taken at a meeting of the Company's stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power entitled to consent thereto on the record date. Our stockholders holding an approximate aggregate of 81% of the Company's voting power executed the written consent.

|

|

|

Q:

|

Do the Company's stockholders have any dissenters' rights or rights of appraisal with respect to the actions described in this Information Statement?

|

|

|

A:

|

No. Under Nevada law, our stockholders do not have dissenters' or appraisal rights in connection with the stockholder actions taken by written consent in lieu of a meeting described in this Information Statement.

|

|

|

Q:

|

At what point may the Company take the actions approved in the written consent in lieu of a meeting?

|

|

|

A:

|

We may effect the actions approved in the written consent by filing the Amended and Restated Articles no sooner than the twenty-first (21st) day and no later than eleven months after the mailing of the definitive Information Statement to our stockholders. The exact dates for each action will be determined by our Board of Directors and announced in a Current Report on Form 8-K.

|

|

|

Q:

|

What special interests apart from the other stockholders do the Company's directors and executive officers have in these actions?

|

|

|

A:

|

The Company is pursuing a potential transaction involving the restructuring of obligations owed to some of its affiliates and warrant holders. No definitive documentation has been executed and there can be no guarantee that such a transaction will be successfully negotiated and consummated.

|

On January 15, 2019, the Board of the Company formed a special committee of the Board (the "Special Committee") and appointed Messrs. David Still and Anthony Zolezzi as its only members. The Special Committee was formed for the purpose of reviewing and negotiating the terms and fairness of a potential transaction involving the restructuring of certain obligations owed to Little Harbor, LLC, Great Harbor Capital, LLC and Golisano Holdings LLC, as well as certain of the Company's outstanding warrants. Those entities are related to certain Company directors, executive officers or stockholders owning 5% or more of the Company's outstanding common stock. Specifically, Mr. David L. Van Andel, the Chairman of the Company's Board of Directors, is the owner and principal of Great Harbor Capital LLC and Little Harbor Capital LLC, lenders to the Company. Mr. Mark Bugge, a former director of our company, was Chief Financial Officer of VA Enterprises, LLC ("VAE") the family office representing the Van Andel family and the Secretary of Great Harbor Capital LLC and Little Harbor, LLC. Additionally, Mr. B. Thomas Golisano, a member of the Company's Board of Directors is a principal of Golisano Holdings LLC. The Board will not approve or authorize any potential transaction without the recommendation of the Special Committee. The Special Committee has wide discretion and may retain legal, financial and other advisors to assist the Special Committee in its review and consideration of a potential transaction.

The Company is undertaking the approval of the adoption of the Amended and Restated Articles to provide the authority and capability to issue an appropriate amount and type of capital stock that may be exchanged for certain existing outstanding debt of the Company.

|

|

Q:

|

Where can I find out more information about the Company?

|

|

|

A:

|

We are subject to the informational requirements of the Exchange Act which require that we file reports, proxy statements and other information with the SEC. The SEC maintains a website on the Internet that contains reports, proxy and information statements and other information regarding registrants, including us, that file electronically with the SEC. The SEC's website address is http://www.sec.gov. In addition, our Exchange Act filings may be inspected and copied at the SEC's Public Reference Room located at 100 F. Street, N.E., Washington, D.C. 20549. Copies of our Annual Report on Form 10-K for the year ended December 31, 2018 may be obtained without charge upon request made to Twinlab Consolidated Holdings, Inc., 4800 T-Rex Avenue, Suite 305, Boca Raton, Florida 33431, Attention: Investor Relations.

|

ADOPTION OF AMENDED AND RESTATED ARTICLES OF INCORPORATION

General

On April 30, 2019, the Special Committee, Board of Directors and the consenting stockholders approved resolutions to adopt and approve Amended and Restated Articles to (i) expressly provide for shares of blank-check preferred stock pursuant to which the Board would have the authority to provide for one or more classes or series of preferred stock and with respect to each class or series, fix the number of shares constituting such class or series, the designation, voting powers, preferences and relative, participating, optional or other special rights; and (ii) make such additional changes to the articles of incorporation as the Company believes is appropriate under Nevada law, its status as a public reporting company and for corporate governance purposes.

Reasons for the Creation of "Blank Check" Preferred Stock

We believe that for us to successfully execute our business strategy we will need to restructure certain existing outstanding debt of the Company and raise additional investment capital in the future and it is preferable or necessary to issue preferred stock to certain of the Company's debt holders and warrant holders. Preferred stock usually grants the holders certain preferential rights in voting, dividends, liquidation or other rights in preference over a company's common stock. Accordingly, in order to grant us the flexibility to issue our equity securities in the manner best suited for our Company, or as may be required by the capital markets, the Amended and Restated Articles will expressly create authorized shares of "blank check" preferred stock for us to issue.

The term "blank check" refers to preferred stock, the creation and issuance of which is authorized in advance by our stockholders and the terms, rights and features of which are determined by our Board of Directors prior to or simultaneous with the issuance of such preferred stock. The authorization of such "blank check" preferred stock permits our Board of Directors to authorize and issue preferred stock from time to time in one or more series without seeking further action or vote of our stockholders.

Lastly, we believe it was the original intention of the incorporator and Board to provide for "blank check" preferred stock through the original language in the articles of incorporation relating to "Stock Rights and Options" but in an abundance of caution and following good corporate governance, the Board of Directors believed it was appropriate to clarify this point and expressly provide for shares of blank-check preferred stock and the Board of Director's ability to authorize, set the powers, designate the preferences and rights and issue shares of preferred stock.

Principal Effects of the Creation of "Blank Check" Preferred Stock

Subject to the provisions of the Amended and Restated Articles and the limitations prescribed by law, our Board of Directors would be expressly authorized, at its discretion, to adopt resolutions to issue shares, to fix the number of shares and to change the number of shares constituting any series and to provide for or change the voting powers, designations, preferences and relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, including dividend rights (including whether the dividends are cumulative), dividend rates, terms of redemption (including sinking fund provisions), redemption prices, conversion rights and liquidation preferences of the shares constituting any series of the preferred stock, in each case without any further action or vote by our stockholders. The Amended and Restated Articles will give our Board of Directors flexibility, without further stockholder action, to issue preferred stock on such terms and conditions as our Board of Directors deems to be in our best interests and the best interests of our stockholders.

The authorization of the "blank check" preferred stock will provide us with increased financial flexibility to restructure a significant amount of our outstanding indebtedness and warrants and meet future capital requirements. It will allow preferred stock to be available for issuance in exchange for outstanding indebtedness and warrants as well as be available for issuance from time to time and with such features as determined by our Board of Directors for any proper corporate purpose. It is anticipated that such purposes may include, without limitation, exchanging preferred stock for outstanding indebtedness, warrants or common stock, the issuance of preferred stock for cash as a means of obtaining capital for our use, or issuance of preferred stock as part or all of the consideration required to be paid by us for acquisitions of other businesses or assets.

The issuance by us of preferred stock could dilute both the equity interests and the earnings per share of existing holders of our common stock. Such dilution may be substantial, depending upon the number of shares issued. The newly authorized shares of preferred stock could also have voting rights superior to our common stock, and therefore would have a dilutive effect on the voting power of our existing stockholders.

Any issuance of preferred stock with voting rights could, under certain circumstances, have the effect of delaying or preventing a change in control of our Company by increasing the number of outstanding shares entitled to vote and by increasing

the number of votes required to approve a change in control of our Company. Shares of voting or convertible preferred stock could be issued, or rights to purchase such shares could be issued, to render more difficult or discourage an attempt to obtain control of our Company by means of a tender offer, proxy contest, merger or otherwise. The ability of our Board of Directors to issue such shares of preferred stock, with the rights and preferences it deems advisable, could discourage an attempt by a party to acquire control of our Company by tender offer or other means. Such issuances could therefore deprive our stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price that such an attempt could cause. Moreover, the issuance of such shares of preferred stock to affiliates or persons friendly to our Board of Directors could make it more difficult to remove incumbent directors from office even if such change were to be favorable to stockholders generally.

The Special Committee has commenced negotiating a potential transaction involving the restructuring of approximately

$80,000,000 of outstanding principal and accrued interest (the "Specified Debt") owed to Little Harbor, LLC, Great Harbor Capital, LLC and Golisano Holdings LLC ("Specified Debt Holders"), as well as certain of the Company's outstanding warrants. The Special Committee has engaged legal counsel and financial advisors with respect to the potential transaction. The Board will not approve or authorize any potential transaction without the recommendation of the Special Committee.

The Specified Debt Holders are related to certain Company directors, executive officers or stockholders owning 5% or more of the Company's outstanding common stock. Specifically, Mr. David L. Van Andel, the Chairman of the Company's Board of Directors, is the owner and principal of Great Harbor Capital LLC and Little Harbor Capital LLC, lenders to the Company. Mr. Mark Bugge, a former director of our company, was Chief Financial Officer of VAE, the family office representing the Van Andel family, and the Secretary of Great Harbor Capital LLC and Little Harbor, LLC. Additionally, Mr. B. Thomas Golisano, a member of the Company's Board of Directors is a principal of Golisano Holdings LLC.

Since the formation of the Special Committee, it has commenced discussions with the Specified Debt Holders with respect to a potential transaction to restructure the Specified Debt. The current negotiations contemplate an exchange of the Specified Debt for shares of a newly designated Series A Preferred Stock. In addition, as a result of satisfying the Specified Debt, certain warrants being held in escrow in connection with the Specified Debt would be returned to the Company. No definitive documentation has been drafted or executed and there can be no guarantee that such a transaction will be successfully negotiated and consummated.

Anti-Takeover Effects

The Amended and Restated Articles will provide us with shares of preferred stock which would permit us to issue additional shares of capital stock that could dilute the ownership of the holders of our common stock by one or more persons seeking to effect a change in the composition of our Board of Directors or contemplating a tender offer or other transaction for the combination of the Company with another company. The creation of the preferred stock is not being undertaken in response to any effort of which our Board of Directors is aware to enable anyone to accumulate shares of our common stock or gain control of the Company. The purpose of the creation of the preferred stock is to grant us the flexibility to issue our equity securities in the manner best suited for our Company, including to restructure our current indebtedness or as may be required by the capital markets.

Other than the creation of the "blank check" preferred stock and the additional revisions discussed herein, our Board of Directors does not currently contemplate the adoption of any other amendments to our articles of incorporation that could be construed to affect the ability of third parties to take over or change the control of the Company. While it is possible that management could use the blank check preferred stock to resist or frustrate a third-party transaction that is favored by a majority of the independent stockholders, we have no intent, plans or proposals to use the newly created preferred stock as an anti-takeover mechanism or to adopt other provisions or enter into other arrangements that may have anti-takeover consequences.

While the creation of the "blank check" preferred stock may have anti-takeover ramifications, our Board of Directors believes that the financial flexibility offered by such corporate actions will outweigh the disadvantages. To the extent that these corporate actions may have anti-takeover effects, third parties seeking to acquire us may be encouraged to negotiate directly with our Board of Directors, enabling us to consider the proposed transaction in a manner that best serves the stockholders' interests.

Additional Revisions

Indemnification; Limitation of Liability

Though Nevada law and our bylaws provide that a corporation may indemnify directors and officers and that directors and officers are not liable to a corporation for certain actions, it is customary for public companies to provide in their organizational documents that the corporation will indemnify its present and former directors and officers and limit the liability of its directors and officers to the fullest extent permitted by the laws of its jurisdiction of formation. Our Board believes that persons otherwise qualified to serve as a directors and officers of our Company may be reluctant to do so unless we provide these

protections to our directors and officers. We may in the future seek to add qualified independent directors and new officers and the omission of these provisions from our articles of incorporation could deter them from accepting a position with our Company.

Our Amended and Restated Articles protect our officers and directors against personal liability for damages for their conduct or omissions as officers or directors, to the fullest extent permitted by Nevada law. In addition, our Amended and Restated Articles require us to indemnify any present and former officer or director who was or is a party or is threatened to be made a party to any action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that such person was or has agreed to become a director or officer of the Company or is or was serving at the request of the Company as a director or officer of another corporation, partnership, joint venture, trust, employee benefits plan or other enterprise, against and from all loss, liabilities and expense (including attorneys' fees, costs, damages, judgments, fines, amounts paid in settlement and ERISA excise taxes or penalties), actually and reasonably incurred by or on behalf of such person in connection therewith, and to pay such expenses in advance of the final disposition of such action, suit or proceeding. The Board believes that providing for maximum indemnification and limiting the liability of our directors and officers will better enable us to engage and retain qualified officers and directors, as it is consistent with the practices of many public companies and, accordingly, believes that the adoption of the Amended and Restated Articles provides such protections and is in the best interests of the Company and its stockholders.

Corporate Governance Changes

The Amended and Restated Articles also make certain changes that we believe are beneficial from a corporate governance perspective, including to simplify the purpose of the Company as meaning any lawful activity under Nevada law, the elimination of the provision regarding the powers of the Company since we believe this information is not necessary and Nevada law and all other applicable laws already define and/or limit the Company's powers, and the elimination of the powers of the Board of Directors since we believe Nevada corporate law and federal securities laws already define and/or limit the powers of the Board of Directors and its committees. Additionally, we expanded the provision on the Board of Directors to specifically cover the process of electing directors, the terms of directors, how vacancies and newly created directorships may be filled and how directors may be removed from office. We believe these changes are appropriate from a corporate governance perspective.

Updating Changes

The Amended and Restated Articles also make certain changes that we believe are beneficial for purposes of updating the articles of incorporation, including updating the information regarding the Company's registered agent and its address to reflect the Company's current registered agent and address of the registered agent, and deleting outdated or unnecessary information, including deleting the name and address of the initial member of the Board of Directors and the incorporator of the Company.

Effective Date

In accordance with Rule 14c-2 under the Exchange Act, the Company may file the Amended and Restated Articles with the Secretary of State of Nevada and subsequently authorize and issue shares of preferred stock on the date that is the twenty-first (21st) day following the mailing of this Information Statement to the Company's non-consenting stockholders.

PRINCIPAL SHAREHOLDERS

Security Ownership of Certain Beneficial Owners and Management

The following table presents information about the beneficial ownership of the Company's Common Stock as of June 30, 2019 by those persons known to beneficially own more than 5% of our capital stock and by our directors, named executive officers, and current executive officers and directors as a group. The percentage of beneficial ownership for the following table is based on 255,643,828 shares of Common Stock outstanding.

Beneficial ownership is determined in accordance with the rules of the SEC and does not necessarily indicate beneficial ownership for any other purpose. Under these rules, beneficial ownership includes those shares of Common Stock over which the stockholder has sole or shared voting or investment power. It also includes shares of Common Stock that the stockholder has a right to acquire within 60 days after June 30, 2019, pursuant to options, warrants, restricted stock units or other rights. The percentage of ownership of the outstanding Common Stock, however, is based on the assumption, expressly required by the rules of the SEC, that only the person or entity whose ownership is being reported has vested restricted stock units or converted options or warrants into shares of our Common Stock.

|

|

|

Beneficial Ownership

|

|

|

Name and Address of beneficial owner

1

|

|

Shares of

Common

Stock

|

|

|

Percentage of

Class

|

|

|

5% Stockholders

|

|

|

|

|

|

|

|

|

|

Little Harbor LLC2

|

|

|

33,168,948

|

|

|

|

12.97

|

%

|

|

Great Harbor Capital, LLC3

|

|

|

52,832,266

|

|

|

|

20.31

|

%

|

|

David L. Van Andel Trust u/a dated November 19934

|

|

|

34,791,814

|

|

|

|

13.61

|

%

|

|

Golisano Holdings LLC5

|

|

|

90,090,000

|

|

|

|

35.12

|

%

|

|

Named Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

Anthony Zolezzi

|

|

|

-

|

|

|

|

-

|

|

|

Naomi L. Whittel6

|

|

|

3,493,450

|

|

|

|

1.37

|

%

|

|

Alan S. Gever7

|

|

|

-

|

|

|

|

-

|

|

|

Gregory Thomas Grochoski

|

|

|

1,200,000

|

|

|

|

*

|

|

|

Seth D. Ellis8

|

|

|

5,767,758

|

|

|

|

2.21

|

%

|

|

David L. Van Andel9

|

|

|

120,793,028

|

|

|

|

46.43

|

%

|

|

B. Thomas Golisano5

|

|

|

90,090,000

|

|

|

|

35.12

|

%

|

|

David A. Still10

|

|

|

50,000

|

10

|

|

|

*

|

|

|

All executive officers and directors as a group (8 persons)

|

|

|

222,400,786

|

11

|

|

|

83.13

|

%

|

_____________

|

*

|

Less than 1% of the applicable class or combined voting power.

|

|

1

|

Except as otherwise provided, each party's address is care of the Company at 4800 T-Rex Avenue, Suite 305, Boca Raton, Florida 33431.

|

|

2

|

These shares are owned by Little Harbor LLC, a Nevada limited liability company, of which David L. Van Andel is the sole manager and a holder as sole trustee of the David L. Van Andel Trust u/a dated November 30, 1993 of 80.5% of the membership interests. This number does not include a warrant issued into escrow in favor of Little Harbor LLC on July 21, 2016 and exercisable for up to 2,168,178 shares of the Company's common stock but which only become exercisable if removed from escrow upon the failure of the Company to make payment in full of the promissory note at maturity, as the same may be accelerated in accordance with the terms of the note. The business address of Little Harbor LLC is 3133 Orchard Vista Drive SE, Grand Rapids, Michigan 49546.

|

|

3

|

These shares are owned by Great Harbor Capital, LLC, a Delaware limited liability company, of which David L. Van Andel is the sole manager and a holder as sole trustee of the David L. Van Andel Trust of 100% of the membership interests. This number includes 4,500,000 shares that are issuable upon the exercise of warrants that have vested or will vest within 60 days after June 30, 2019. This number does not include warrants issued into escrow in favor of Great Harbor Capital, LLC on January 28, 2016, March 21, 2016, December 31, 2016, August 30, 2017 and February 6, 2018 and exercisable for up to 1,136,363, 3,181,816, 1,136,363, 1,363,636 and 1,818,182 shares of the Company's common stock, respectively, but which only become exercisable if removed from escrow upon the failure of the Company to make payment in full of the promissory note in connection with which each warrant was issued at maturity, as the same may be accelerated in accordance with the terms of each respective note. The business address of Great Harbor Capital, LLC is 3133 Orchard Vista Drive SE, Grand Rapids, Michigan 49546.

|

|

4

|

These shares are owned by the David L. Van Andel Trust u/a dated November 30, 1993, of which David L. Van Andel is the sole trustee and the principal beneficiary. The business address of the David L. Van Andel Trust u/a dated November 30, 1993 is 3133 Orchard Vista Drive SE, Grand Rapids, Michigan 49546.

|

|

5

|

By Schedule 13D/A, filed with the SEC on March 20, 2017, Golisano Holdings LLC reported that as of March 8, 2017, it has sole voting power and sole dispositive power over 90,090,000 shares. This number also includes shares that may be issuable pursuant to the exercise of warrants for up to 869,618 and 807,018 shares that Golisano Holdings LLC acquired in March of 2017 in connection with its acquisition of promissory notes from Penta Mezzanine SBIC Fund I, L.P. ("Penta"). This number does not include shares that may be issuable pursuant to the exercise of warrants for up to 4,960,740 shares that Golisano Holdings LLC acquired in March of 2017 in connection with its acquisition of promissory notes from Penta as this warrant is only exercisable after the occurrence of certain put events set forth in the warrant. This number does not include shared voting power held by Golisano Holdings LLC over 251,241,650 shares of the Company's common stock with respect solely to the right to have certain shareholders vote in favor of electing two nominees of Golisano Holdings LLC to the Company's Board of Directors pursuant to a voting agreement. This number does not include a contingent warrant issued to Golisano LLC on October 5, 2015 and exercisable as of December 31, 2016 (reflecting certain exercises and cancellations in part) for

|

|

|

up to 4,756,505 shares of the Company's common stock, but which is only exercisable if and when other warrants that existed as of the issue date are exercised by the holders thereof. This number does not include warrants issued into escrow in favor of Golisano LLC on January 28, 2016, March 21, 2016, July 21, 2016, December 30, 2016, March 14, 2017 and February 6, 2018 and exercisable for up to 1,136,363, 3,181,816, 2,168,178, 1,136,363, 1,484,847 and 1,818,182 shares of the Company's common stock, respectively, but which only become exercisable if removed from escrow upon the failure of the Company to make payment in full of the promissory note in connection with which each warrant was issued at maturity, as the same may be accelerated in accordance with the terms of each respective note. Golisano Holdings LLC shares beneficial ownership of the reported shares with Mr. Golisano, the controlling member of Golisano Holdings LLC. The business address of Golisano Holdings is: 1 Fishers Road, Pittsford, New York 14534.

|

|

6

|

Ms. Whittel left the Company effective as of April 25, 2018. We have no information regarding her ownership of Company securities as of June 30, 2019. Accordingly, information regarding the number of shares of common stock owned is based on her Section 16 filings and Company records. These 3,493,450 shares are owned by Health KP, LLC ("HKP"), a Delaware limited liability company, of which Ms. Whittel owns a 65% membership interest. Ms. Whittel disclaims beneficial ownership of any shares held by Health KP except to the extent of her pecuniary interest therein.

|

|

7

|

Mr. Gever left the Company effective as of August 16, 2018. We have no information regarding his ownership of Company securities as of June 30, 2019. Accordingly, information regarding the number of shares of common stock owned is based on his Section 16 filings and Company records.

|

|

8

|

These shares are owned by Penta. Mr. Ellis disclaims beneficial ownership of any shares held by Penta except to the extent of his pecuniary interest therein. Mr. Ellis has a business address at c/o Penta Mezzanine, 20 N. Orange Avenue, Orlando, Florida 32801. This number includes 4,960,740 shares that are issuable upon the exercise of warrants that have vested or will vest within 60 days after June 30, 2019.

|

|

9

|

Includes 34,791,814 shares owned by the Van Andel Trust, of which Mr. Van Andel is the sole trustee and the principal beneficiary, 33,168,948 shares owned by Little Harbor of which he is the sole manager and a holder as sole trustee of the Van Andel Trust of 80.5% of the membership interests, 52,832,266 shares owned by Great Harbor Capital, LLC, a Delaware limited liability company, of which he is the sole manager and a holder as sole trustee of the Van Andel Trust of 100% of the membership interests and 4,500,000 shares that are issuable to Great Harbor Capital, LLC upon the exercise of warrants that have vested or will vest within 60 days after June 30, 2019. Mr. Van Andel disclaims beneficial ownership of any shares held by the limited liability companies named above except to the extent of his pecuniary interest therein. This number does not include shared voting power held by Great Harbor Capital, LLC, and beneficially by Mr. Van Andel as the controlling member of Great Harbor Capital, LLC, over 212,559,664 shares of the Company's common stock with respect solely to the right to have certain shareholders vote in favor of electing two nominees of Great Harbor Capital, LLC to the Company's Board of Directors pursuant to a voting agreement. The business address of Mr. Van Andel is 3133 Orchard Vista Drive SE, Grand Rapids, Michigan 49546.

|

|

10

|

Includes 50,000 shares that are issuable upon the exercise of stock options that have vested or will vest within 60 days after June 30, 2019.

|

|

11

|

Includes 50,000 shares that are issuable upon the exercise of stock options that have vested or will vest within 60 days after June 30, 2019 and 4,500,000 shares that are issuable upon the exercise of warrants that have vested or will vest within 60 days after June 30, 2019.

|

HOUSEHOLDING

The SEC's rules permit us to deliver a single Information Statement to one address shared by two or more of our stockholders. This delivery method is referred to as "householding" and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one Information Statement to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the Information Statement, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered.

If you are currently a stockholder sharing an address with another stockholder and wish to receive an additional copy of the Information Statement for your household, please contact Broadridge Financial Solutions, Inc. at (800) 542-1061 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

ANNEX A

AMENDED AND RESTATED ARTICLES OF INCORPORATION OF

TWINLAB CONSOLIDATED HOLDINGS, INC.

Article I - NAME

The exact name of this corporation is: TWINLAB CONSOLIDATED HOLDINGS, INC.

Article II - REGISTERED OFFICE AND RESIDENT AGENT

The registered office and place of business in the State of Nevada of this corporation shall be located at 321 W. Winnie Lane, #104, Carson City, NV 89703. The resident agent of the corporation is Cogency Global Inc., whose address is 321 W. Winnie Lane, #104, Carson City, NV 89703.

Article III - DURATION

The Corporation shall have perpetual existence.

Article IV - PURPOSES

The purpose of the corporation shall be to engage in any lawful act or activity for which corporations may be organized and incorporated under the laws of the state of Nevada.

Article V - CAPITAL STOCK

Section 1.

Authorized Shares

. The total number of shares which this corporation is authorized to issue is 5,000,000,000 shares of Common Stock and 500,000,000 shares of Preferred Stock valued at $0.001 par value.

Section 2.

Voting

Rights

of

Stockholders

. Each holder of the Common Stock shall be entitled to one vote for each share of stock standing in his name on the books of the corporation.

Section 3.

Consideration for Shares

. The Common Stock shall be issued for such consideration, as shall be fixed from time to time by the Board of Directors. In the absence of fraud, the judgment of the Directors as to the value of any property or services received in full or partial payment for shares shall be conclusive. When shares are issued upon payment of the consideration fixed by the Board of Directors, such shares shall be taken to be fully paid stock and shall be non- assessable. The Articles shall not be amended in this particular.

Section 4.

Stock Rights and Options

. The corporation shall have the power to create and issue rights, warrants, or options entitling the holders thereof to purchase from the corporation any shares of its capital stock of any class or classes, upon such terms and conditions and at such times and prices as the Board of Directors may provide, which terms and conditions shall be incorporated in an instrument or instruments evidencing such rights. In the absence of fraud, the judgment of the Directors as to the adequacy of consideration for the issuance of such rights or options and the sufficiency thereof shall be conclusive.

Section 5.

Blank Check Preferred Stock

. The Board of Directors is hereby expressly authorized to provide, out of the unissued shares of preferred stock, for one or more class or series of preferred stock and, with respect to each such class or series, to fix the number of shares constituting such class or series and the designation of such class or series, the voting powers, if any, of the shares of such class or series, and the preferences and relative, participating, optional, or other special rights, if any, and any qualifications, limitations, or restrictions thereof, of the shares of such class or series. The powers, preferences and relative, participating, optional and other special rights of each class or series of preferred stock, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other class or series at any time outstanding.

Article VI - MANAGEMENT

Section 1.

Size of Board of Directors

. The business and affairs of the corporation shall be managed by, or under the direction of, the Board of Directors. Unless and except to the extent that the Bylaws of the corporation, as amended (the "By-laws"), shall so require, the election of the Directors of the corporation need not be by written ballot. Except as

otherwise provided for or fixed pursuant to the provisions of Article V of these Articles of Incorporation relating to the rights of the holders of any class or series of Preferred Stock to elect additional Directors, the total number of Directors constituting the entire Board shall be set in accordance with the By-Laws, with the then-authorized number of Directors being fixed from time to time by the Board of Directors.

During any period when the holders of any class or series of Preferred Stock have the right to elect additional Directors as provided for or fixed pursuant to the provisions of Article V hereof, then upon commencement and for the duration of the period during which such right continues: (i) the then otherwise total authorized number of Directors of the Corporation shall automatically be increased by such specified number of Directors, and the holders of such Preferred Stock shall be entitled to elect the additional Directors so provided for or fixed pursuant to said provisions, and (ii) each such additional Director shall serve until such Director's successor shall have been duly elected and qualified, or until such Director's right to hold such office terminates pursuant to said provisions, whichever occurs earlier, subject to his or her earlier death, disqualification, resignation or removal. Except as otherwise provided by the Board of Directors in the resolution or resolutions establishing such class or series, whenever the holders of any class or series of Preferred Stock having such right to elect additional Directors are divested of such right pursuant to the provisions of such stock, the terms of office of all such additional Directors elected by the holders of such stock, or elected to fill any vacancies resulting from the death, resignation, disqualification or removal of such additional Directors, shall forthwith terminate and the total and authorized number of Directors of the Corporation shall be reduced accordingly.

Section 2.

Terms

. Other than those Directors elected by the holders of any class or series of Preferred Stock provided for or fixed pursuant to the provisions of Article V hereof (the "Preferred Stock Directors"), each Director shall be elected to hold office for a term expiring at the next annual meeting of stockholders and until the election and qualification of his or her successor in office or such Director's earlier death, resignation, disqualification or removal from office.

Section 3.

Vacancies and Newly Created Directorships

. Subject to the rights of the holders of any one or more class or series of Preferred Stock then outstanding, newly created directorships resulting from any increase in the authorized number of Directors or any vacancies on the Board resulting from death, resignation, disqualification, removal from office or other cause shall be filled solely by the affirmative vote of a majority of the remaining Directors then in office, even though less than a quorum of the Board. Any Director so chosen shall hold office until the next annual meeting of stockholders and until the election and qualification of his or her successor in office or such Director's earlier death, resignation, disqualification or removal from office. No decrease in the number of Directors shall shorten the term of any incumbent Director.

Section 4.

Removal of Directors

. Except for such additional Directors, if any, as are elected by the holders of any class or series of Preferred Stock as provided for or fixed pursuant to the provisions of Article V hereof, any Director, or the entire Board of Directors, may be removed from office at any time, but only for cause and only by the affirmative vote of at least 66-2/3% of the total voting power of the outstanding shares of capital stock of the corporation entitled to vote generally in the election of Directors, voting together as a single class.

Section 5.

Interested Directors

. No contract or transaction between this corporation and any of its directors, or between this corporation and any other corporation, firm, association, or other legal entity shall be invalidated by reason of the fact that the director of the corporation has a direct or indirect interest, pecuniary or otherwise, in such corporation, firm, association, or legal entity, or because the interested director was present at the meeting of the Board of Directors which acted upon or in reference to such contract or transaction, or because he participated in such action, provided that: (1) the interest of each such director shall have been disclosed to or known by the Board and a disinterested majority of the Board shall have, nonetheless, ratified and approved such contract or transaction (such interested director or directors may be counted in determining whether a quorum is present for the meeting at which such ratification or approval is given); or (2) the conditions of Nevada Revised Statutes ("NRS") §78.140 are met.

Article VII - PLACE OF MEETING; CORPORATE BOOKS

Subject to the laws of the State of Nevada, the stockholders and the directors shall have the power to hold their meetings, and the directors shall have the power to have an office or offices and to maintain the books of the Corporation outside the State of Nevada, at such place or places as may from time to time be designated in the By-laws or by appropriate resolution.

Article VIII - AMENDMENT OF ARTICLES

The provisions of these Articles of Incorporation may be amended, altered or repealed from time to time to the extent and in the manner now or hereafter prescribed by the laws of the State of Nevada or by these Articles of Incorporation. All rights herein conferred on the directors, officers and stockholders are granted subject to this reservation.

Article IX - LIMITED LIABILITY OF OFFICERS AND DIRECTORS

The liability of directors and officers of the corporation shall be eliminated or limited to the fullest extent permitted by Nevada law. If Nevada law is amended to further eliminate or limit or authorize corporate action to further eliminate or limit the liability of directors or officers, the liability of directors and officers of the corporation shall be eliminated or limited to the fullest extent permitted by Nevada law, as so amended from time to time. If Nevada law is amended after approval by the stockholders of this Article IX to authorize corporate action further eliminating or limiting the personal liability of directors or officers, the liability of a director or officer of the corporation shall be eliminated or limited to the fullest extent permitted by Nevada law, as so amended from time to time. No repeal or modification of this Article IX by the stockholders shall adversely affect any right or protection of a director or officer of the corporation existing by virtue of this Article IX at the time of such repeal or modification.

Article X – INDEMNIFICATION

Section 1.

Indemnification

. The corporation shall indemnify and hold harmless any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he or she is or was or has agreed to become a director or officer of the corporation or is serving at the request of the corporation as a director or officer of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise or by reason of actions alleged to have been taken or omitted in such capacity or in any other capacity while serving as a director or officer. The indemnification of directors and officers by the corporation shall be to the fullest extent authorized or permitted by applicable law, as such law exists or may hereafter be amended (but only to the extent that such amendment permits the corporation to provide broader indemnification rights than permitted prior to the amendment). The indemnification of directors and officers shall be against all loss, liability and expense (including attorney's fees, costs, damages, judgments, fines, amounts paid in settlement and ERISA excise taxes or penalties) actually and reasonably incurred by or on behalf of a director or officer in connection with such action, suit or proceeding, including any appeal; provided, however, that with respect to any action, suit or proceeding initiated by a director or officer, the corporation shall indemnify such director or officer only if the action, suit or proceeding was authorized by the board of directors of the corporation, except with respect to a suit for the enforcement of rights to indemnification or advancement of expenses in accordance with Section 3 hereof.

Section 2.

Expenses

. The expenses of directors and officers incurred as a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative shall be paid by the corporation as they are incurred and in advance of the final disposition of the action, suit or proceeding; provided, however, that if applicable law so requires, the advance payment of expenses shall be made only upon receipt by the corporation of an undertaking by or on behalf of the director or officer to repay all amounts so advanced in the event that it is ultimately determined by a final decision, order or decree of a court of competent jurisdiction that the director or officer is not entitled to be indemnified for such expenses under this Article X.

Section 3.

Non-exclusivity of Rights

. The right to indemnification and to the payment of expenses as they are incurred and in advance of the final disposition of the action, suit or proceeding shall not be exclusive of any other right to which a person may be entitled under these articles of incorporation or any by-law, agreement, statute, vote of stockholders or disinterested directors or otherwise. The right to indemnification under Section 1 hereof shall continue for a person who has ceased to be a director or officer and shall inure to the benefit of his or her heirs, next of kin, executors, administrators and legal representatives.

Section 4.

Insurance

. The corporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the corporation or another corporation, partnership, joint venture, trust or other enterprise against any loss, liability or expense, whether or not the corporation would have the power to indemnify such person against such loss, liability or expense under Nevada law.

Section 5.

Settlements

. The corporation shall not be obligated to reimburse the amount of any settlement unless it has agreed to such settlement. If any person shall unreasonably fail to enter into a settlement of any action, suit or proceeding within the scope of Section 1 hereof, offered or assented to by the opposing party or parties and which is acceptable to the corporation, then, notwithstanding any other provision of this Article X, the indemnification obligation of the corporation in connection with such action, suit or proceeding shall be limited to the total of the amount at which settlement could have been made and the expenses incurred by such person prior to the time the settlement could reasonably have been effected.

Section 6.

Other Indemnification and Advancement of Expenses

. The corporation may, to the extent authorized from time to time by the board of directors, grant rights to indemnification and to the advancement of expenses to any employee or agent of the corporation or to any director, officer, employee or agent of any of its subsidiaries to the fullest extent of the provisions of this Article X subject to the imposition of any conditions or limitations as the board of directors of the corporation may deem necessary or appropriate.

Article XI – TRANSACTIONS WITH STOCKHOLDERS

Section 1.

CONTROL SHARE ACQUISITION EXEMPTION

. The corporation elects not to be governed by the provisions of NRS §78.378 to NRS §78.3793 generally known as the "Control Share Acquisition Statute" under the Nevada Business Corporation Law, which contains a provision governing "Acquisition of Controlling Interest."

Section 2.

COMBINATIONS WITH INTERESTED STOCKHOLDERS

. The corporation elects not to be governed by the provisions of NRS §78.411 through NRS §78.444, inclusive, of the Nevada Business Corporation Law.

4

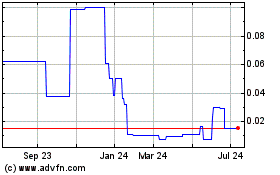

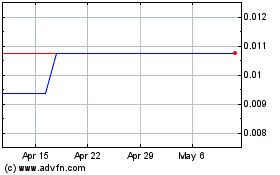

Twinlab Consolidated (PK) (USOTC:TLCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Twinlab Consolidated (PK) (USOTC:TLCC)

Historical Stock Chart

From Apr 2023 to Apr 2024