Novartis Sets $700 Million Provision to Settle Bribery Allegations -- Update

July 18 2019 - 7:33AM

Dow Jones News

By Denise Roland

Novartis AG set aside $700 million to settle a long-running

lawsuit alleging the drugmaker treated U.S. doctors to lavish

dinners and other events in return for boosting prescriptions.

The case centers on 80,000 events Novartis held between 2002 and

2011 that federal prosecutors allege amounted to kickbacks

masquerading as educational meetings. Those included fishing trips

off the Florida coast, expensive meals at high-end restaurants like

Nobu in Manhattan, and trips to Hooters locations across the

country, according to court documents.

Novartis, which has denied wrongdoing, is currently in

negotiations with prosecutors to reach a settlement. Chief

Executive Vas Narasimhan said settling the matter was "consistent

with our efforts to resolve legacy compliance issues."

The case is the highest-profile of a number of allegations of

wrongdoing by the company in recent years, as Dr. Narasimhan, who

took the helm in early 2018, seeks to overhaul the drug giant.

The company disclosed the provision as it reported a strong set

of second-quarter earnings, prompting it to raise its full-year

guidance for the second time this year. It now expects sales to

grow by a mid- to high-single-digit percentage and for core

operating income to increase by a low-double-digit to midteen

percentage. Shares in Novartis gained more than 5% on the news.

Novartis attributed the gains to newer drugs like Entresto, for

heart failure, and Cosentyx, which treats a range of skin and

rheumatic disorders. It also highlighted Lutathera, a new kind of

cancer drug that delivers a dose of radiation to a tumor at close

range.

The encouraging performance of Novartis's newer drugs bolsters

Dr. Narasimhan's strategy to focus the company on high-value

prescription medicines. That has involved shedding eye-care

business Alcon, parts of the company's generic-drug division Sandoz

and exiting a consumer health-care joint venture with

GlaxoSmithKline PLC. At the same time, it has spent around $15

billion to bulk up its pipeline of new medicines through

acquisitions.

That strategy is currently facing a big test as Novartis seeks

to persuade insurers to pay for its newest treatment, Zolgensma,

which at $2.1 million is the world's most expensive drug. Zolgensma

treats babies with a disease called spinal muscular atrophy, whose

victims lack a gene essential for muscle control. It works by

providing a working copy of that gene.

To allay concerns over the cost, Novartis said it would offer

insurers the option to pay for the treatment in equal annual

installments over five years. The company also pledged to issue

partial refunds if the treatment doesn't work.

Dr. Narasimhan declined to provide details on how many insurers

have taken up those offers but said that plans covering around 40%

of Americans had so far agreed to cover Zolgensma. Novartis has

defended the price tag by comparing it to a treatment already on

the market, which would cost more in the long term because it is

taken for the duration of a patient's life.

In the three months to June 30, Novartis said overall sales rose

4% to $11.8 billion. Core operating income, a measure that strips

out certain items and is closely watched by analysts, climbed 14%

to $3.6 billion. Those numbers exclude Alcon, which was spun out of

the company in April.

Net income fell 73% to $2.1 billion, largely because the

prior-year figure included a $5.7 billion payment from Glaxo to buy

Novartis's stake in their consumer-health-care venture.

(END) Dow Jones Newswires

July 18, 2019 07:18 ET (11:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

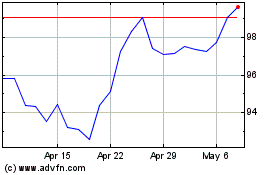

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

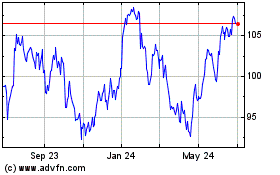

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024