Table of Contents

|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule 424(b)(5)

|

|

To Prospectus Dated September 29, 2017

|

Registration No.

333-220461

|

8,653,846

Shares of Common Stock

We are offering directly to selected purchasers 8,653,846 shares of the Company’s common stock, par value $0.01 per share. The shares of common stock will be sold for a purchase price equal to $0.26 per share. For a more detailed description of our common stock, see section entitled “

Description of Common Stock

” beginning on page S-10.

In a concurrent private placement, we are also issuing to such purchasers Series A warrants to purchase up to 8,653,846 shares of our common stock (the “Series A Warrants”), which represents 100% of the number of shares of our common stock being purchased in this offering. Each Warrant will be exercisable for one share of our common stock at an exercise price of $0.35 per share, will be exercisable six months from the date of issuance and has a term expiring five years after such initial exercise date. Furthermore, each of the purchasers in this Offering holds warrants that were issued by the Company in May 2016 and are exercisable until November 2021. In connection with this Offering, the Company has agreed to exchange the May 2016 warrants for Series B warrants to purchase 4,500,000 shares of our common stock with an exercise price of $0.35 exercisable until May 2022 (the “Series B Warrants”, collectively with the Series A Warrants, the “Warrants”). The Series B Warrants will otherwise be identical to the Series A Warrants. The Warrants and the shares of our common stock issuable upon the exercise of the Warrants are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. There is no established public trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend to list the Warrants on the NYSE American, any other national securities exchange or any other nationally recognized trading system.

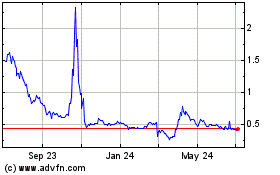

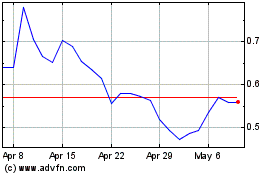

Our common stock is traded on the NYSE American LLC (“NYSE American”) and on the Toronto Stock Exchange (“TSX”) under the symbol “AUMN.” The last sale price for our common stock on July 16, 2019 was $0.33 per share on the NYSE American and Cdn$0.43 per share on the TSX.

As of July 16, 2019, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $18,083,001, based on 97,768,433 shares of outstanding common stock, of which 54,796,973 shares were held by non-affiliates, and a per share price of $0.33 based on the closing price of our common stock on July 16, 2019. During the prior twelve-calendar-month period that ends on, and includes, the date of this prospectus supplement, and including this offering we offered securities with an aggregate market value of approximately $2,859,000 pursuant to General Instruction I.B.6. of Form S-3.

We have retained H.C. Wainwright & Co., LLC, to act as our exclusive placement agent for this offering. We have agreed to pay the placement agent the placement agent fee set forth in the table below, which assumes that we sell all of the securities we are offering. We have also agreed to reimburse the placement agent for certain of its expenses as described under “

Plan of Distribution

” in this prospectus supplement. The placement agent is not required to arrange for the sale of any specific number of securities or dollar amount but will use reasonable best efforts to arrange for the sale of the securities.

Investing in our securities involves risks. See “

Risk Factors

” beginning on page S-

8

of this prospectus supplement and elsewhere in this prospectus supplement and the accompanying base prospectus for a discussion of information that should be considered in connection with an investment in our securities.

|

|

|

Per Share

|

|

Total

|

|

|

Offering price

|

|

$

|

0.26

|

|

$

|

2,250,000

|

|

|

Placement agent fees (1)

|

|

$

|

0.0156

|

|

$

|

135,000

|

|

|

Proceeds to us, before expenses

|

|

$

|

0.2444

|

|

$

|

2,115,000

|

|

(1)

In addition, we have agreed to reimburse the placement agent for certain expenses. See “

Plan of Distribution

” on page S-16 of this prospectus supplement for additional information.

We estimate the total expenses of this offering, excluding the placement agent’s fees, will be approximately $150,000. The placement agent is not purchasing or selling any of our shares of common stock pursuant to this prospectus supplement or the accompanying prospectus, nor are we requiring any minimum purchase or sale of any specific number of shares of common stock. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement agent’s fees and proceeds to us may be substantially less than the maximum amounts set forth above. We expect that delivery of the securities being offered pursuant to this prospectus supplement will be made to purchasers on or about July 19, 2019.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is July 17, 2019.

H.C. Wainwright & Co.

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of a “shelf” registration statement that we filed with the U.S. Securities and Exchange Commission (“SEC”) on Form S-3. This prospectus supplement provides specific details regarding this offer by us for 8,653,846 shares of common stock to certain investors (the “Offering”). The accompanying prospectus provides general information about us, our common stock and warrants, and certain other securities we may offer from time to time. Some of the information in the accompanying prospectus may not apply to this Offering. If information in this prospectus supplement is inconsistent with the accompanying prospectus or the documents incorporated by reference herein, you should rely on this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying base prospectus—the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial conditions, results of operations and prospects may have changed since the earlier dates.

Before purchasing any securities, you should carefully read both the accompanying prospectus and this prospectus supplement, together with the additional information described in this prospectus supplement under the headings “

Where You Can Find More Information

” and “

Documents Incorporated by Reference

.” You should also carefully consider the matters discussed under “

Risk Factors

” in this prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus relating to this Offering. Neither the placement agent nor we have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither the placement agent nor we are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein relating to this Offering is accurate only as of the date of the document in which the information appears. Our business, financial condition, results of operations and prospects may have changed since that date. Information in this prospectus supplement updates and modifies the information in the accompanying prospectus.

As used in this prospectus supplement, the terms “Golden Minerals,” “our,” “we,” or “us” refer to Golden Minerals Company, including its subsidiaries and predecessors, except where it is clear that the term refers only to Golden Minerals Company.

CURRENCY AND EXCHANGE RATE INFORMATION

Unless otherwise indicated, all references to “$” or “dollars” in this prospectus supplement and the accompanying prospectus refer to United States dollars. References to “Cdn$” in this prospectus supplement and the accompanying prospectus refer to Canadian dollars.

The indicative rate of exchange on July 16, 2019, as reported by the Bank of Canada for the conversion of Canadian dollars to U.S. dollars, was Cdn$1.00 equals $1.3052 and, for the conversion of U.S. dollars to Canadian dollars, was $1.00 equals Cdn$0.7662.

CAUTIONARY STATEMENT REGARDING MINERALIZED MATERIAL

“

Mineralized material” as used in this prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein and therein, although permissible under the SEC’s Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any deposits at the El Quevar property, the Velardeña Properties (as defined below), the, Santa Maria property or the Rodeo property or any deposits at our other exploration properties, will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”. Any investor is cautioned not to assume that all or any part of the disclosed mineralized material estimates will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

S-

1

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein and therein, and any free writing prospectus that we have authorized for use in connection with this Offering contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We use the words “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “could,” “will,” “project,” “should,” “believe” and similar expressions (including negative and grammatical variations) to identify forward-looking statements and information. Statements that contain these words discuss our future expectations, contain projections or state other forward-looking information. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct.

Our actual results could differ materially from those expressed or implied in these forward-looking statements and information as a result of the factors described under the caption “

Risk Factors

” in this prospectus supplement and other factors set forth in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein, including:

·

Failure to close the proposed sale of certain assets to Compañía Minera Autlán S.A.B. de C.V.;

·

Lower revenue than anticipated from the oxide plant lease, which could result from delays or problems at the third party’s mine or at the oxide plant, permitting problems at the third party’s mine or the oxide plant, delays in constructing additional tailings capacity at the oxide plant, earlier than expected termination of the lease or other causes;

·

Higher than anticipated care and maintenance costs at the Velardeña Properties in Mexico or at El Quevar in Argentina;

·

Decreases or insufficient increases in silver and gold prices;

·

Whether we are able to raise the necessary capital required to continue our business on terms acceptable to us or at all, and the likely negative effect of continued low silver and gold prices or unfavorable exploration results;

·

Unfavorable results from exploration at the Santa Maria, Rodeo, Yoquivo, Navegantes or other exploration properties and whether we will be able to advance these or other exploration properties;

·

Risks related to the El Quevar project in Argentina, including unfavorable results from our evaluation activities, the feasibility and economic viability and unexpected costs of maintaining the project, and whether we will be able to find a joint venture partner or secure adequate financing to further advance the project

·

Variations in the nature, quality and quantity of any mineral deposits that are or may be located at the Velardeña Properties or the Company’s exploration properties, changes in interpretations of geological information, and unfavorable results of metallurgical and other tests;

·

Whether we will be able to mine and sell minerals successfully or profitably at any of our current properties at current or future silver and gold prices and achieve our objective of becoming a mid-tier mining company;

·

Potential delays in our exploration activities or other activities to advance properties towards mining resulting from environmental consents or permitting delays or problems, accidents, problems with

S-

2

Table of Contents

contractors, disputes under agreements related to exploration properties, unanticipated costs and other unexpected events;

·

Our ability to hire or retain key management and mining personnel necessary to successfully manage and grow our business;

·

Economic and political events affecting the market prices for silver, gold, zinc, lead and other minerals which may be found on our exploration properties;

·

Political and economic instability in Mexico and Argentina and other countries in which we may conduct our business and future actions of any of these governments with respect to nationalization of natural resources or other changes in mining or taxation policies;

·

Volatility in the market price of our common stock; and

·

The factors set forth in “

Risk Factors

” on page S-9 of this prospectus supplement.

These factors are not intended to represent a complete list of the general or specific factors that could affect us. We may note additional factors elsewhere in this prospectus supplement, the accompanying prospectus and in any documents incorporated by reference herein. Many of these factors are beyond our ability to control or predict. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, such expectations may prove to be materially incorrect due to known and unknown risks and uncertainties. You should not unduly rely on any of our forward-looking statements. These statements speak only as of the date of this prospectus supplement. Except as required by law, we are not obligated to publicly release any revisions to these forward-looking statements to reflect future events or developments. All subsequent written and oral forward-looking statements attributable to us and persons acting on our behalf are qualified in their entirety by the cautionary statements contained in this section and elsewhere in this prospectus supplement.

S-

3

Table of Contents

SUMMARY

The following is a summary of the principal features of this Offering and should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents incorporated by reference herein and therein. This summary does not contain all of the information you should consider before investing in our securities and is qualified in its entirety by the information contained elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein. You should carefully read the entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein, including our historical financial statements and the notes to these financial statements in our most recently filed

annual report on Form 10-K for the fiscal year ended December 31, 2018

and our

quarterly report on Form 10-Q for the fiscal quarter ended March 31, 2019.

You should also carefully consider the matters discussed under “Risk Factors,” “Cautionary Note Regarding Mineralized Material,” and “Cautionary Note Regarding Forward-looking Statements” in this prospectus supplement before deciding to invest in our securities.

Our Business

We are a mining company holding a 100% interest in the El Quevar advanced exploration silver property in the province of Salta, Argentina, the Velardeña and Chicago precious metals mining properties and associated oxide and sulfide processing plants in the State of Durango, Mexico (the “Velardeña Properties”), and a diversified portfolio of precious metals and other mineral exploration properties located primarily in or near historical precious metals producing regions of Mexico. The El Quevar advanced exploration property and the Velardeña Properties are our only material properties.

We remain focused on evaluation activities at our El Quevar exploration property in Argentina and on evaluating and searching for mining opportunities in North America with near term prospects of mining, including properties within reasonable haulage distances of our Velardeña processing plants. We are also focused and are continuing our exploration efforts on selected properties in our portfolio of approximately 12 exploration properties located primarily in Mexico. Our management team is comprised of experienced mining professionals with extensive expertise in mineral exploration, mine construction and development, and mine operations. Our principal office is located in Golden, Colorado at 350 Indiana Street, Suite 650, Golden, CO 80401, and our registered office is the Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801. We also maintain an office at the Velardeña Properties in Mexico and exploration offices in Argentina and Mexico.

We are considered an exploration stage company under SEC criteria since we have not yet demonstrated the existence of proven or probable mineral reserves, as defined by SEC Industry Guide 7, at any of our properties. Until such time, if ever, that we demonstrate the existence of proven or probable reserves pursuant to SEC Industry Guide 7 we expect to remain as an exploration stage company.

Recent Developments

On June 26, 2019, we entered into a Purchase and Sale Agreement (the “Agreement”) along with our indirectly wholly-owned subsidiary, Minera de Cordilleras S. de R.L. de C.V., to sell certain assets to Compañía Minera Autlán S.A.B. de C.V. (“Autlán”) for US$22.0 million. Under the terms of the Agreement, Autlán will purchase three of our Mexican subsidiaries, which together hold the Velardeña Properties, including the Velardeña and Chicago mines (which are currently on care and maintenance), two processing plants, mining equipment and other adjacent exploration properties. The sale includes the lease agreement pursuant to which we have leased the Velardeña oxide plant to Minera Hecla, S.A. de C.V. through December 31, 2020. The proposed transaction also includes the sale of the Rodeo and Santa Maria project concessions.

The Agreement provides for a period of up to 75 days for Autlán to conduct due diligence related to the three subsidiary companies, the Rodeo concessions and the Santa Maria concessions. Closing of the transaction is subject to the satisfactory completion by Autlán of its due diligence review and other customary closing

S-

4

Table of Contents

conditions. The transaction is also subject to approval by the Mexican antitrust authority (the

Comisión Federal de Competencia Económica

), such approval which must be obtained without the imposition of any material conditions, restrictions or limitations on Autlán or the conduct of our business. This approval is expected to be obtained prior to closing. Following completion of its due diligence review, Autlán may elect to terminate the Agreement with no further obligation. The Agreement also contains customary representations, warranties, covenants and indemnification rights and obligations of the parties. We will be entitled to retain proceeds from the lease of the Velardeña oxide plant that are received prior to closing. We anticipate that closing of the transaction will occur during the third quarter 2019.

Upon execution of the Agreement, Autlán paid us a deposit of US$1.5 million. If the transaction is consummated, the deposit will be applied against the US$22.0 million purchase price at closing. If the transaction does not close for any reason, we have the option to repay the deposit amount within 90 days following termination or elect to convey the Rodeo concessions to Autlán in full settlement of the deposit. If the Rodeo concessions cannot be conveyed for any reason, we will be required to repay the deposit by making dedicated monthly payments equal to approximately 60 percent of the anticipated cash flow from the lease of the Velardeña oxide plant until the deposit amount is repaid with interest.

S-

5

Table of Contents

THE OFFERING

The following is a brief summary of certain terms of this Offering and is not intended to be complete. It does not contain all of the information that will be important to investors with regard to our securities. For a more complete description of our common stock, see the section titled “

Description of Common Stock

” in this prospectus supplement.

|

Issuer:

|

|

Golden Minerals Company

|

|

|

|

|

|

Common Stock offered by Golden Minerals:

|

|

8,653,846 shares

|

|

|

|

|

|

Common Stock outstanding:

|

|

As of July 17, 2019, we had 97,768,433 shares of common stock outstanding. (1)

|

|

|

|

|

|

|

|

Following the Offering, we will have 106,422,279 shares of common stock outstanding, exclusive of the shares of common stock underlying the warrants offered in the Private Placement Transaction (as described below).(1)

|

|

|

|

|

|

Use of proceeds:

|

|

We estimate that our net proceeds from this Offering and Private Placement Transaction, after deducting the placement agent fee of $135,000 and estimated offering expenses of $150,000, will be approximately $1,965,000.

|

|

|

|

|

|

|

|

We intend to use the net proceeds from this Offering and the Private Placement Transaction, if completed, for working capital requirements and general corporate purposes. See “

Use of Proceeds

” in this prospectus supplement.

|

|

|

|

|

|

Market for our common stock:

|

|

Our common stock is traded on the NYSE American and the TSX under the symbol “AUMN.”

|

|

|

|

|

|

Restrictions on Resale to Residents in Canada:

|

|

See “

Restrictions on Resale to Residents of Canada

” in this prospectus supplement for information regarding restrictions on resale to residents of Canada.”

|

|

|

|

|

|

Risk Factors:

|

|

An investment in our securities is subject to a number of risks. You should carefully consider the information under the heading “

Risk Factors,

” “

Cautionary Note Regarding Mineralized Material”

and “

Cautionary Note Regarding Forward-looking Statements

” and all other information included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein before deciding to invest in our securities.

|

(1)

Includes 236,669 shares of unvested restricted common stock outstanding pursuant to our Amended and Restated 2009 Equity Incentive Plan.

Does not include (i) 2,830,038 shares of common stock reserved for issuance under the Amended and Restated 2009 Equity Incentive Plan in exchange for restricted stock units issued to our non-employee directors under the terms of our Non-Employee Directors Deferred Compensation and Equity Award Plan; (ii) 2,325,000 shares of common stock that can be acquired under KELTIP units; (iii) 27,248 outstanding options to purchase our common stock at a weighted exercise price of $8.06; (iv) 5,551,344 shares of common stock issuable upon the exercise of currently outstanding warrants with an exercise price of $0.84 per share, though we expect the exercise price to be reduced to $0.80 and the number of shares of common stock issuable on exercise of the warrants to increase to approximately 5,687,421, assuming both the Offering and the Private Placement Transaction are completed, pursuant to a weighted

S-

6

Table of Contents

average dilution calculation based on the pricing in this Offering and the Private Placement Transaction; (v) 8,653,846 shares of common stock issuable upon exercise of the Series A Warrants to be issued to the investors in the private placement concurrent with this offering with an exercise price of $0.35 per share; and (vi) 6,000,000 shares of common stock issuable upon the exercise of currently outstanding warrants with an exercise price of $0.75 per share, of which warrants to purchase 4,500,000 shares of common stock will be exchanged for new Series B Warrants with an exercise price of $0.35 in connection with the Private Placement Transaction.

S-

7

Table of Contents

RISK FACTORS

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2018,

which is incorporated by reference into this prospectus supplement, as well as our other filings with the SEC, include material risk factors relating to our business. Those risks and uncertainties and the risks and uncertainties described below are not the only risks and uncertainties that we face. Additional risks and uncertainties that are not presently known to us or that we currently deem immaterial or that are not specific to us, such as general economic conditions, may also materially and adversely affect our business and operations. If any of those risks and uncertainties or the risks and uncertainties described below actually occurs, our business, financial condition or results of operations could be harmed substantially. In such a case, you may lose all or part of your investment. You should carefully consider the risks and uncertainties described below and those risks and uncertainties incorporated by reference into this prospectus supplement, as well as the other information included in this prospectus supplement, before making an investment decision with respect to our common stock.

Risks Related to this Offering

Our management team may invest or spend the proceeds of this Offering in ways with which you may not agree or in ways which may not yield a significant return.

We expect to use the net proceeds from this Offering and the Private Placement Transaction, if completed, for working capital requirements and general corporate purposes. For a more detailed discussion, see “

Use of Proceeds

” below. Our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not increase our operating results or enhance the value of our common stock.

Investors in this Offering may suffer additional dilution to their equity and voting interests as a result of future financing transactions.

We could require additional funding to support our business, and expect to require additional funding beyond this Offering and the Private Placement Transaction to fund our administrative costs and other working capital needs related to our continuing business activities. Because debt financing is difficult to obtain for early-stage mining companies, it is likely that we will seek such financing in the equity markets. If we were to engage in additional equity financings, the current voting and ownership interests of the purchasers in this Offering and our other stockholders would be diluted.

The market price of our common stock may fluctuate significantly.

The market price of our common stock has fluctuated and could fluctuate substantially in the future. This volatility may subject our stock price to material fluctuations due to the factors in this prospectus supplement, the accompanying prospectus and the documents incorporated herein by reference, and other factors including market reaction to the estimated fair value of our portfolio; rumors or dissemination of false information; changes in coverage or earnings estimates by analysts; our ability to meet analysts’ or market expectations; and sales of common stock by existing stockholders.

USE OF PROCEEDS

We estimate that our net proceeds from this Offering, after deducting the placement agent fee of $135,000 and estimated offering expenses of $150,000, will be approximately $1,965,000.

We intend to use the net proceeds from this Offering and the Private Placement Transaction, if completed, for

working capital requirements and general corporate purposes

.

S-

8

Table of Contents

Our actual expenditures may vary from those described above, and will depend on a number of factors, including the results of exploration at our properties, and those risks described in the “

Risk Factors

” section of this prospectus supplement.

DESCRIPTION OF COMMON STOCK

In this Offering, we are offering 8,653,846 shares of common stock. The material terms and provisions of our common stock are described under the caption “Description of Common Stock” starting on page 30 in the accompanying base prospectus.

We currently have 200,000,000 shares of common stock authorized, of which 97,768,433 shares are issued and outstanding, plus 16,869,707 shares issuable upon exercise of outstanding warrants, KELTIP units, restricted stock units and options.

WARRANT ADJUSTMENTS

As a result of anti-dilution provisions in certain of our outstanding warrants, the consummation of the Offering and Private Placement Transaction will result in adjustments that reduce the exercise price and increase the number of shares issuable under certain of our outstanding warrants.

In September 2014, the Company closed on a public offering in which it sold units consisting of one share of common stock and a five-year warrant to acquire one half of a share of common stock at an exercise price of $1.21 per share (the “2014 Warrants”). The exercise price was subsequently adjusted downward after a number of anti-dilution adjustments and is currently at, prior to the Offering and Private Placement Transaction, $0.84 per share with warrant holders having the right to purchase in the aggregate

5,551,344

shares of common stock for the 9,492,000 outstanding 2014 Warrants. Pursuant to the anti-dilution provisions in the 2014 Warrants, as a result of the Offering and Private Placement Transaction, the number of shares of common stock issuable upon exercise of the 2014 Warrants will be increased from 5,551,344 shares to 5,687,421 shares (136,077 share increase), and the 2014 Warrants’ exercise price will be decreased from $0.84 per share to approximately $0.80 per share.

U.S. INCOME TAX CONSIDERATIONS

The following is a general summary of the material U.S. federal income tax considerations of the purchase, ownership, and disposition of our common stock. This summary does not describe all of the potential tax considerations that may be relevant in light of a holder’s particular circumstances. For example, it does not address special classes of holders, such as banks, thrifts, real estate investment trusts, regulated investment companies, passive foreign investment companies, insurance companies, dealers in securities or currencies, or tax-exempt investors. This summary is limited to holders that acquire our common stock in the Offering and hold such common stock as a capital asset within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended (the “Code”) (generally, property held for investment purposes). Further, it does not include any description of any alternative minimum tax consequences, estate, gift, or generation-skipping tax consequences, or consequences under the tax laws of any state or local jurisdiction or of any foreign jurisdiction that may be applicable to our shares of common stock. This summary is based on the Code, the U.S. Treasury regulations promulgated thereunder, the United States-Canada income tax treaty as in effect on the date of the Offering, and administrative and judicial decisions, all as in effect on the date hereof, and all of which are subject to change or differing interpretations, possibly on a retroactive basis. There can be no assurance that the Internal Revenue Service (the “IRS”) will not challenge one or more of the descriptions of the tax consequences described herein, and we have not obtained, nor do we intend to obtain, a ruling from the IRS with respect to the U.S. federal income tax consequences of the purchase, ownership and disposition of our shares of common stock.

As used in this prospectus, the term “U.S. Holder” means:

·

a citizen or resident of the United States;

S-

9

Table of Contents

·

a corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized in, or under the laws of, the United States, any state thereof, or the District of Columbia;

·

an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or

·

a trust, if either (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more United States persons have the authority to control all substantial decisions of the trust, or (ii) such trust has made a valid election under applicable Treasury regulations to be treated as a United States person.

As used in this prospectus, the term “Non-U.S. Holder” means a beneficial owner of our securities that is not a U.S. Holder.

If an entity or arrangement that is classified as a partnership (or other “pass-through” entity) for U.S. federal income tax purposes holds our common stock, the U.S. federal income tax consequences to such entity and the partners (or other owners) of such entity generally will depend on the activities of the entity and the status of such partners (or owners). This summary does not address the tax consequences to any such partner (or owner). Partners (or other owners) of entities or arrangements that are classified as partnerships or as “pass-through” entities for U.S. federal income tax purposes should consult their own tax advisors regarding the U.S. federal income tax consequences arising from and relating to the purchase, ownership, and disposition of our common stock.

WE URGE ALL PROSPECTIVE HOLDERS TO CONSULT THEIR TAX ADVISORS REGARDING THE U.S. FEDERAL, STATE, LOCAL AND NON-U.S. INCOME, ESTATE AND OTHER TAX CONSIDERATIONS OF ACQUIRING, HOLDING AND DISPOSING OF OUR COMMON STOCK.

General

The purchase price paid for a share of common stock must be allocated between the share of common stock and any associated warrants for the purchase of our common stock that are included in the purchase price based on their respective relative fair market values. We will determine this allocation based upon our determination, which we will complete following the closing of the Offering, of the relative values of such warrants and of our common stock. This allocation will be reported to any person to which we transfer such common stock and warrants that acts as a custodian of securities in the ordinary course of its trade or business, or that effects sales of securities by others in the ordinary course of its trade or business, and may be reported to the IRS by such persons. This allocation is not binding on purchasers in the Offering, the IRS, or the courts. Prospective investors are urged to consult their tax advisors regarding the United States federal income tax consequences of an investment in our common stock (and associated warrants) and the allocation of the purchase price paid in the offering.

Taxation of U.S. Holders

The following is a summary of the material U.S. federal income tax consequences to U.S. Holders of the ownership and disposition of the shares of common stock purchased in the Offering.

Dividends and Other Distributions on Shares of Common Stock

Distributions on shares of our common stock will constitute dividends for U.S. federal income tax

purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. If a distribution exceeds our current or accumulated earnings and profits, the excess will be treated first as a tax-free return of capital and will reduce (but not below zero) the U.S. Holder’s adjusted tax basis in such shares of our common stock, and any remaining excess will be treated as capital gain from a sale or exchange of shares of our common stock, subject to the tax treatment described below in “—Sale, Exchange or Other Disposition of Shares of our Common Stock.”

S-

10

Table of Contents

Dividends received by a corporate U.S. Holder generally will qualify for the dividends received deduction if the

requisite holding period is satisfied. With certain exceptions, and provided certain holding period requirements are met, dividends received by a non-corporate U.S. Holder generally will constitute “qualified dividends” that will be subject to tax at the tax rate accorded to long-term capital gains.

Sale, Exchange or Other Disposition of Shares of Our Common Stock

Upon the sale, exchange or other disposition of shares of our common stock, a U.S. Holder will recognize gain or loss in an amount equal to the difference between the amount realized upon such event and the U.S. Holder’s adjusted tax basis in such shares of common stock. Generally, such gain or loss will be capital gain or loss. Any such capital gain or loss will be long-term capital gain or loss if the U.S. Holder’s holding period for the shares exceeds one year, and will otherwise be short-term capital gain or loss.

Tax Rates Applicable to Ordinary Income and Capital Gains

Ordinary income and short-term capital gains of non-corporate U.S. Holders are generally taxable at rates of up to 37%. Long-term capital gains of non-corporate U.S. Holders are subject to a maximum rate of 20%. See “

—

Surtax on Net Investment Income

,” below, regarding the applicability of a 3.8% surtax to certain investment income.

Taxation of Non-U.S. Holders

The following is a summary of the material U.S. federal income tax consequences to Non-U.S. Holders of the ownership and disposition of the shares of common stock purchased in the Offering.

Distributions

Distributions on shares of our common stock will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. If a distribution exceeds our current and accumulated earnings and profits, the excess will be treated first as a tax-free return of capital and will reduce (but not below zero) the Non-U.S. Holder’s adjusted tax basis in such shares of our common stock, and any remaining excess will be treated as gain realized from the sale or exchange of the shares of our common stock, the treatment of which is described below under the section entitled “—Sale, Exchange or Other Disposition of Shares of Common Stock.”

Subject to the discussion below under “Foreign Accounts,” dividends paid to a Non-U.S. Holder generally will be subject to withholding of U.S. federal income tax at the rate of 30%, or such lower rate as may be specified by an applicable income tax treaty. U.S. withholding tax on dividends paid to an individual Non-U.S. Holder who is resident of Canada for purposes of the United States- Canada income tax treaty is generally reduced to 15% pursuant to the United States-Canada income tax treaty. If a dividend is effectively connected with the Non-U.S.

Holder’s conduct of a trade or business in the United States (and, if an applicable tax treaty requires, is also attributable to a U.S. permanent establishment maintained by such Non-U.S. Holder), the dividend will not be subject to any withholding tax, provided certain certification requirements are satisfied (as described below), and subject to the discussion below under “Foreign Accounts.” Instead, such dividends will be subject to U.S. federal income tax imposed on net income on the same basis that applies to U.S. persons generally. A corporate Non-U.S. Holder under certain circumstances also may be subject to an additional branch profits tax equal to 30%, or such lower rate as may be specified by an applicable income tax treaty, on a portion of its effectively connected earnings and profits for the taxable year.

To claim the benefit of a tax treaty or to claim exemption from withholding on the ground that income is effectively connected with the conduct of a trade or business in the United States, a Non-U.S. Holder must provide a properly executed form, generally on IRS Form W-8BEN for treaty benefits or Form W-8ECI for effectively

connected income, or such successor forms as the IRS designates, prior to the payment of dividends.

S-

11

Table of Contents

These forms must be periodically updated. Non-U.S. Holders generally may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS.

Non-U.S. Holders should consult their own tax advisors regarding the potential applicability of any income tax treaty in their particular circumstances.

Sale, Exchange or Other Disposition of Shares of Common Stock

A Non-U.S. Holder generally will not be subject to U.S. federal income tax and, in certain cases, withholding tax on the sale, exchange or other disposition of shares of our common stock purchased in the Offering unless:

·

the gain is effectively connected with a U.S. trade or business of the Non-U.S. Holder (and, if an applicable tax treaty requires, is also attributable to a U.S. permanent establishment maintained by such Non-U.S. Holder),

·

in the case of a Non-U.S. Holder who is an individual, such holder is present in the United States for a period or periods aggregating 183 or more days (as calculated for U.S. federal income tax purposes) during the taxable year of the disposition, and certain other conditions are satisfied, or

·

we are or have been a “United States real property holding corporation,” or “USRPHC,” as defined for U.S. federal income tax purposes.

Gain described in the first bullet point above will be subject to tax at generally applicable U.S. federal income tax rates in the same manner as gain is taxable to U.S. Holders. Any gain described in the first bullet point above of a Non-U.S. Holder that is a foreign corporation may also be subject to an additional “branch profits tax” at a 30% rate or such lower rate as may be specified by an applicable income tax treaty.

An individual Non-U.S. Holder described in the second bullet point above generally will be subject to U.S. federal income tax at a flat rate of 30% (or at a reduced rate under an applicable income tax treaty) on any gain recognized on the

sale, exchange or other disposition of our common stock, which may be offset by certain U.S.-source capital losses (even though such individual is not considered a resident of the United States).

With respect to the third bullet point above, a U.S. corporation is generally a USRPHC if the fair market value of its “United

States real property interests” equals or exceeds 50% of the fair market value of its real property and trade or business assets. We believe that we currently are not, and have not been, a USRPHC, although there can be no assurance that we will not become a USRPHC in future years. Even if we are or become a USRPHC, so long as our common stock is regularly traded on an established securities market, under applicable U.S. Treasury regulations, a Non-U.S. Holder generally will not be subject to U.S. federal income tax on any gain realized on the sale, exchange or other disposition of shares of our common stock, unless the Non-U.S. Holder has owned, directly or by attribution, more than 5% of our common stock during the shorter of the five-year period preceding the disposition or the Non-U.S. Holder’s holding period for the shares of our common stock (a “greater than 5% stockholder”).

Information Reporting and Backup Withholding Tax

Information reporting and backup withholding at a rate of 24% may apply to dividends paid with respect to our common stock and to proceeds from the sale, exchange or other disposition of our common stock. In certain circumstances, Non-U.S. Holders will not be subject to information reporting and backup withholding if they certify under penalties of perjury as to their status as Non-U.S. Holders or otherwise establish an exemption and certain other requirements are met. Non-U.S. Holders should consult their own tax advisors regarding the application of the information reporting and backup withholding rules to them.

S-

12

Table of Contents

Backup withholding is not an additional tax. Amounts withheld under the backup withholding rules from a payment to a Non-U.S. Holder generally may be refunded or credited against the Non-U.S. Holder’s U.S. federal income tax liability, if

any, provided that certain required information is timely furnished to the IRS.

Surtax on Net Investment Income

Individuals, estates and trusts will be required to pay a 3.8% Medicare surtax on “net investment income” (in the case of an individual) or “undistributed net investment income” (in the case of a trust or estate)

in excess of a certain threshold amount. Net investment income includes, among other things, dividends and net gain from disposition of property (other than property held in certain trades or businesses). Net investment income is reduced by deductions that are properly allocable to such income. U.S. Holders should consult their own tax advisors regarding the application, if any, of this tax on their ownership and disposition of our common stock.

Foreign Accounts

Legislation enacted

in 2010, commonly known as “FATCA,” generally imposes a 30% withholding tax on dividends on shares of common stock paid to (i) a foreign financial institutions (as defined in section 1471 of the Code) unless it enters into an agreement to collect and disclose to the IRS information regarding direct and indirect U.S. account holders, and (ii) certain other foreign entities unless they certify certain information regarding their direct and indirect U.S. owners. If the payee is a foreign financial institution, it must enter into an agreement with the U.S. Department of the Treasury requiring, among other things, that it undertake to identify accounts held by certain U.S. persons or U.S.-owned foreign entities, annually report certain information about such accounts, and withhold 30% on payments to account holders whose actions prevent it from complying with these reporting and other requirements. In certain circumstances, an account holder may be eligible for refunds or credits of such taxes. We will not pay any additional amounts in respect to any amounts withheld. An intergovernmental agreement between the United States and an applicable foreign country, or future Treasury regulations, may modify these requirements.

While the withholding obligations described above would also apply to gross proceeds from the sale of assets that could produce U.S.-source dividends and interest, recently proposed Treasury regulations, which state that taxpayers may rely on the proposed regulations until final regulations are issued, eliminate this requirement.

The FATCA withholding tax will apply to all withholdable payments without regard to whether the beneficial owner of the payment would otherwise be entitled to an exemption from imposition of withholding tax pursuant to an applicable tax treaty with the United States or U.S. domestic law.

THE UNITED STATES FEDERAL INCOME TAX DISCUSSION SET FORTH ABOVE IS INCLUDED FOR GENERAL INFORMATION ONLY AND MAY NOT BE APPLICABLE DEPENDING UPON A HOLDER’S PARTICULAR SITUATION. HOLDERS SHOULD CONSULT THEIR OWN TAX ADVISORS WITH RESPECT TO ALL TAX CONSEQUENCES TO THEM OF THE ACQUISITION OF UNITS AND THE OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK, INCLUDING THE TAX CONSEQUENCES UNDER STATE, LOCAL, FOREIGN AND OTHER TAX LAWS, AND THE POSSIBLE EFFECTS OF ANY CHANGES THEREIN.

PRIVATE PLACEMENT TRANSACTION

Concurrently with the closing of the sale of common stock in this Offering, for each share of common stock purchased, each purchaser will receive a warrant to purchase one share of common stock in a private placement transaction. The investors will receive Series A Warrants to purchase an aggregate of

8,653,846 shares of common stock, at an initial exercise price equal to $0.35. Each Series A Warrant will be exercisable six months from the date of issuance and has a term expiring five years after such initial exercise date. Subject to limited exceptions, a holder of warrants will not have the right to exercise any portion of the warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or 9.99% at the election of the holder prior to the date of issuance) of the number of shares of our common stock outstanding immediately after giving effect to the issuance of shares upon exercise of the warrants, provided that the holder may increase or decrease the beneficial ownership limitation up to 9.99%, provided, further, that any increase in the beneficial ownership limitation shall not be effective until 61 days following notice of such change to the Company.

S-

13

Table of Contents

The warrants provide that in the event of certain enumerated fundamental transactions, each holder of warrants will have the option to require us to purchase its warrants in cash for the Black-Scholes value of the warrants. In addition, if at the time of the exercise of the warrants, there is no effective registration statement registering, or the prospectus contained therein is not available for, the resale of the shares of common stock underlying the warrants, then the warrant may be exercised by means of a “cashless exercise.”

Furthermore, each of the investors in this Offering holds warrants that were issued by the Company in May 2016 and are exercisable until November 2021. In connection with this Offering, the Company has agreed to exchange the May 2016 warrants for Series B Warrants to purchase an aggregate of 4,500,000 shares of common stock with an exercise price of $0.35 exercisable until May 2022. The Series B Warrants will otherwise be identical to the Series A Warrants.

The issuance of the Series A Warrants and the Series B Warrants is together referred to as the “Private Placement Transaction”.

The warrants will be issued and sold without registration under the Securities Act of 1933, as amended (the “Act”), or state securities laws, in reliance on the exemptions provided by Section 4(a)(2) of the Act and/or Regulation D promulgated thereunder and in reliance on similar exemptions under applicable state laws. Accordingly, investors may exercise those warrants and sell the underlying shares only pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities Act.

S-

14

Table of Contents

PLAN OF DISTRIBUTION

H.C. Wainwright & Co., LLC (“Wainwright”) has agreed to act as placement agent in connection with this offering subject to the terms and conditions of the letter agreement dated July 15, 2019 (the “Letter Agreement”). The placement agent is not purchasing or selling any shares of common stock offered by this prospectus supplement, nor is it required to arrange the purchase or sale of any specific number or dollar amount of common stock, but has agreed to use its best efforts to arrange for the sale of all of the shares of common stock offered hereby. We will enter into a securities purchase agreement (the “Securities Purchase Agreement”) directly with investors in connection with this offering and we may not sell the entire amount of shares of common stock offered pursuant to this prospectus supplement. The placement agent may engage one or more sub-agents or selected dealers to assist with the offering.

We have agreed to pay the placement agent a placement agent’s fee equal to six percent (6%) of the aggregate purchase price of the shares of common stock sold in this Offering and pursuant to the Private Placement Transaction described above under the caption “

Private Placement Transaction

.”

Out of the proceeds of the Offering and the Private Placement Transaction, we will also reimburse the placement agent an expense allowance of up to $35,000 for legal fees and other out-of-pocket expenses, and $10,000 for the placement agent’s clearing expenses, provided, however, that such reimbursement amount in no way limits or impairs the indemnification and contribution provisions the placement agent is entitled to under the Letter Agreement.

We have also agreed to give the placement agent a right of first refusal to act as our exclusive underwriter or placement agent for any further capital raising transactions undertaken by us until December 31, 2019.

The following table shows the per share and total placement agent’s fees that we will pay to the placement agent in connection with the sale of the shares of common stock offered pursuant to this prospectus supplement assuming the purchase of all of the shares offered hereby.

|

Maximum offering total

|

|

$

|

2,250,000

|

|

|

Per share placement agent’s fees

|

|

$

|

0.0156

|

|

|

Total placement agent’s fees

|

|

$

|

135,000

|

|

Because there is no minimum amount required as a condition to the closing in this offering, the actual total offering commissions, if any, are not presently determinable and may be substantially less than the maximum amount set forth above.

Our obligation to issue and sell common stock to the purchasers is subject to the conditions set forth in the Securities Purchase Agreement. A purchaser’s obligation to purchase common stock is subject to the conditions set forth in the Securities Purchase Agreement as well.

We estimate the total expenses that will be payable by us, excluding the placement agent’s fees, will be approximately $150,000, which include legal, accounting and printing costs, various other fees and reimbursement of the placement agent’s expenses.

The foregoing does not purport to be a complete statement of the terms and conditions of the Letter Agreement and the Securities Purchase Agreement. A copy of the Letter Agreement and the form of Securities Purchase Agreement with investors are included as exhibits to a Current Report on Form 8-K to be filed with the SEC in connection with this Offering and is incorporated by reference into the registration statement of which this prospectus supplement is part.

The placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of the common stock sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply with the Securities Act and the Securities Exchange Act of 1934, as amended, or Exchange Act, including without limitation, Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares of common stock and warrants by the placement agent acting as principal. Under these rules and regulations, the placement agent:

S-

15

Table of Contents

·

may not engage in any stabilization activity in connection with our securities; and

·

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act, until it has completed its participation in the distribution.

We have agreed to indemnify the placement agent against certain liabilities, including liabilities under the Securities Act and liabilities arising from breaches of representations and warranties contained in our engagement letter with the placement agent. We have also agreed to contribute to payments the placement agent may be required to make in respect of such liabilities.

In addition, we will indemnify the purchaser of shares of our common stock in this offering against liabilities arising out of or relating to (i) any breach of any of the representations, warranties, covenants or agreements made by us in the securities purchase agreement or related documents or (ii) any action instituted against a purchaser by a third party (other than a third party who is affiliated with such purchaser) with respect to the securities purchase agreement or related documents and the transactions contemplated thereby, subject to certain exceptions.

From time to time, Wainwright may provide in the future various advisory, investment and commercial banking and other services to us in the ordinary course of business, for which they have received and may continue to receive customary fees and commissions. However, except as disclosed in this prospectus supplement and as set forth in the At the Market Offering Agreement dated as of December 20, 2016, as amended, by and between the Company and Wainwright, we have no present arrangements with Wainwright for any further services.

Our common stock is traded on the NYSE American and on the Toronto Stock Exchange under the symbol “AUMN.”

RESTRICTIONS ON RESALE TO RESIDENTS OF CANADA

The Company is a “reporting issuer” (within the meaning of applicable Canadian securities laws) in each of the provinces of Canada. However, as the offering of shares of common stock is being made solely outside of Canada, the Company is exempt from the requirement to prepare and file a prospectus with the securities regulatory authorities in each of the provinces of Canada to qualify the distribution of the shares of common stock. Accordingly, each purchaser of the shares of common stock acknowledges that the shares of common stock are subject to “hold period” resale restrictions under applicable Canadian securities laws such that such securities must not be traded or resold in or to a resident of Canada until four months and a day after the closing of the offering, and each purchaser of shares of common stock agrees and is deemed to agree to comply with such restrictions. Accordingly, this prospectus supplement serves as notice to each purchaser of shares of common stock of the transfer and resale restrictions applicable to the shares of common stock under Canadian securities laws described in the following legend:

“UNDER CANADIAN SECURITIES LAWS, UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY IN CANADA BEFORE THE DATE THAT IS 4 MONTHS AND A DAY AFTER THE ORIGINAL DISTRIBUTION DATE OF THE SHARES OF COMMON STOCK.”

LEGAL MATTERS

The validity of the issuance of the securities offered hereby will be passed upon for us by Davis Graham & Stubbs LLP. Certain matters with respect to Canadian law will be passed upon by Fasken Martineau DuMoulin LLP on our behalf. The placement agent is being represented in connection with this Offering by Ellenoff Grossman & Schole LLP.

EXPERTS

The consolidated financial statements of Golden Minerals Company as of December 31, 2018 and 2017 incorporated in this prospectus supplement by reference to the Golden Minerals Company

Annual Report on Form 10-K for the year ended December 31, 2018

have been so incorporated in reliance on the reports of Plante Moran PLLC and ESK&H LLLP, both independent registered public accounting firms, given on the authority of said firms as experts in auditing and accounting.

The estimates of our mineralized material with respect to the Velardeña Properties and Santa Maria and Rodeo properties incorporated by reference in this prospectus supplement and the accompanying prospectus have been included in reliance upon the technical report prepared by Tetra Tech, Inc. The estimates of our mineralized material with respect to the El Quevar project included in this prospectus supplement or incorporated by reference in this prospectus supplement and the accompanying prospectus have been included in reliance upon the technical report prepared by Amec Foster Wheeler E&C Services, Inc., a Wood Group PLC company.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus supplement and the accompanying prospectus, which means that we can disclose important information to you by referring you to other documents filed separately with the SEC. The information incorporated by reference is considered part of this prospectus supplement, and information filed with the SEC subsequent to this prospectus supplement and prior to the termination of the particular Offering referred to in such prospectus supplement will automatically be

S-

16

Table of Contents

deemed to update and supersede this information. We incorporate by reference into this prospectus supplement and the accompanying prospectus the documents listed below (excluding any portions of such documents that have been “furnished” but not “filed” for purposes of the Exchange Act):

·

Annual Report on Form 10-K for the fiscal year ended December 31, 2018;

·

Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2019;

·

Current Report on Form 8-K filed on May 21, 2019;

·

Current Report on Form 8-K filed on June 27, 2019; and

·

The description of our common stock contained in our registration statement on Form 8-A filed February 5, 2010 with the SEC under 12(b) of the Exchange Act (File No. 001-13627), including any subsequent amendment or report filed for the purpose of updating such description.

We also incorporate by reference all documents we subsequently file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the initial filing of the registration statement of which this prospectus supplement is a part (including prior to the effectiveness of the registration statement) and prior to the termination of the Offering. Any statement in a document incorporated by reference in this prospectus supplement or the accompanying prospectus will be deemed to be modified or superseded to the extent a statement contained in this prospectus supplement or any other subsequently filed document that is incorporated by reference herein modifies or supersedes such statement.

Unless specifically stated to the contrary, none of the information that we disclose under Items 2.02 or 7.01 or corresponding information furnished under Item 9.01 or included as an exhibit of any Current Report on Form 8-K that we may from time to time furnish to the SEC will be incorporated by reference into, or otherwise included in, this prospectus supplement.

We will provide without charge upon written or oral request, a copy of any or all of the documents which are incorporated by reference into this prospectus. Requests should be directed to:

Golden Minerals Company

350 Indiana Street, Suite 650

Golden, Colorado 80401

Attention: Secretary

Telephone: (303) 839-5060

Except as provided above, no other information, including information on our internet site, is incorporated by reference in this prospectus supplement.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement and the accompanying prospectus do not contain all of the information included in the related registration statement on Form S-3. We have omitted parts of the registration statement in accordance with the rules and regulations of the SEC. In addition, statements contained in this prospectus supplement and the accompanying prospectus about the provisions or contents of any agreement or other document are not necessarily complete. For further information, we refer you to the registration statement on Form S-3, including its exhibits. We file annual, quarterly and current reports, proxy statements and other information with the SEC. See “

Where You Can Find More Information

” in the accompanying prospectus for information on the documents we incorporate by reference in this prospectus supplement and the accompanying prospectus. Our SEC filings are available to the public at the SEC’s website at

http://www.sec.gov

. You may also read and copy our Form S-3 registration statement and any reports, statements or other information that we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Our SEC filings are also available to the public from

S-

17

Table of Contents

commercial document retrieval services. Information contained on our website should not be considered part of this prospectus.

We also file reports, statements or other information with the Alberta, British Columbia, Saskatchewan,

Manitoba, Quebec, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland

and Ontario Securities Commissions. Copies of these documents that are filed through the System for Electronic Document Analysis and Retrieval, or “SEDAR,” of the Canadian Securities Administrators are available at its web site

http://www.sedar.com

.

S-

18

Table of Contents

PROSPECTUS

$200,000,000

Senior Debt Securities

Subordinated Debt Securities

Common Stock

Preferred Stock

Warrants

Rights

Units

Depositary Shares

Golden Minerals Company (“Golden Minerals,” “the Company,” “we,” “us,” or “our”) may offer and sell from time to time up to $200,000,000 of our senior and subordinated debt securities, common stock, $0.01 par value, preferred stock, $0.01 par value, warrants to purchase any of the other securities that may be sold under this prospectus, rights to purchase common stock, preferred stock and/or senior or subordinated debt securities, depositary shares, units consisting of two or more of these classes or series of securities and securities that may be convertible or exchangeable to other securities covered hereby, in one or more transactions.

We will provide specific terms of any offering in supplements to this prospectus. The securities may be offered separately or together in any combination and as separate series. You should read this prospectus and any supplement carefully before you invest.

We may sell securities directly to you, through agents we select, or through underwriters or dealers we select. If we use agents, underwriters or dealers to sell the securities, we will name them and describe their compensation in a prospectus supplement. The net proceeds we expect to receive from these sales will be described in the prospectus supplement.

Our common stock is listed on the NYSE American (“NYSE American”) under the symbol “AUMN.” On September 11, 2017 the last reported sales price of our common stock on the NYSE American was $0.57 per share. Our common stock is also listed on the Toronto Stock Exchange (“TSX”) under the symbol “AUMN.” The closing price for our common stock on September 11, 2017 as quoted on the TSX, was Cdn$0.70. The applicable prospectus supplement will contain information, where applicable, as to any other listing on any securities exchange of the securities covered by the prospectus supplement.

As of September 11, 2017, the aggregate market value of our outstanding common stock held by non-affiliates was $28,065,666. We have previously sold $720,000 of securities pursuant to General Instruction I.B.6 of Form S-3 during the prior twelve calendar month period that ends on, and includes, the date of this prospectus.

The securities offered in this prospectus involve a high degree of risk. See “Risk Factors” on page 5 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 29, 2017.

Table of Contents

TABLE OF CONTENTS(1)

As used in this prospectus, the terms “Golden Minerals,” “the Company,” “we,” “our,” “ours” and “us” may, depending on the context, refer to Golden Minerals Company, to one or more of Golden Minerals Company’s consolidated subsidiaries or to Golden Minerals Company and its consolidated subsidiaries, taken as a whole. When we refer to “shares” throughout this prospectus, we include all rights attaching to our common stock under any shareholder rights plan then in effect.

(1)

NTD: DGS to update prior to filing.

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”), which we refer to as the SEC or the Commission, using a “shelf” registration process. Under the shelf registration, we may sell any combination of the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities that we may offer. Each time that we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement also may add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information incorporated by reference in this prospectus before making an investment in our securities. See “Where You Can Find More Information” for more information. We may use this prospectus to sell securities only if it is accompanied by a prospectus supplement.

You should not assume that the information in this prospectus, any accompanying prospectus supplement or any document incorporated by reference is accurate as of any date other than the date of such document.

WHERE YOU CAN FIND MORE INFORMATION

We file and furnish annual, quarterly and current reports and other information, including proxy statements, with the SEC. You may read and copy any document we file or furnish with the SEC at the SEC’s Public Reference Room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549.

Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. Our SEC filings are available to the public on the SEC’s website at

www.sec.gov.

Our SEC filings are also available through the “Investor Relations” section of our website at

www.goldenminerals.com

.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus and any accompanying prospectus supplement, which means that we can disclose important information to you by referring you to other documents filed separately with the SEC. The information incorporated by reference is considered part of this prospectus, and information filed with the SEC subsequent to this prospectus and prior to the termination of the particular offering referred to in such prospectus supplement will automatically be deemed to update and supersede this information. We incorporate by reference into this prospectus and any accompanying prospectus supplement the documents listed below (excluding any portions of such documents that have been “furnished” but not “filed” for purposes of the Exchange Act of 1934 (the “Exchange Act”)):

(a)

the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, as filed with the Commission on February 28, 2017;

(b)

the Company’s Quarterly Report on Form 10-Q for the fiscal

quarter ended March 31, 2017, as filed with the Commission on May 9, 2017

, and

Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2017, as filed with the Commission on August 8, 2017

;

(c)

the Company’s Current Reports on Form 8-K, as filed with the Commission on

May 17, 2017

and

August 3, 2017

; and

(d)

the description of the Company’s common stock contained in our registration statement on Form 8-A filed February 5, 2010 with the Commission under Section 12(b) of the Exchange Act (File No. 001-13627), including any subsequent amendment or report filed for the purpose of updating such description.

1

Table of Contents

We also incorporate by reference all documents we subsequently file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the initial filing of the registration statement of which this prospectus is a part (including prior to the effectiveness of the registration statement) and prior to the termination of the offering. Any statement in a document incorporated by reference in this prospectus will be deemed to be modified or superseded to the extent a statement contained in this prospectus or any other subsequently filed document that is incorporated by reference in this prospectus modifies or supersedes such statement.

Unless specifically stated to the contrary, none of the information that we disclose under

Items 2.02 or 7.01 or corresponding information furnished under Item 9.01 or related exhibits of any Current Report on Form 8-K that we may from time to time furnish to the SEC will be incorporated by reference into, or otherwise included in, this prospectus.

We will provide without charge upon written or oral request, a copy of any or all of the documents which are incorporated by reference into this prospectus. Requests should be directed to:

Golden Minerals Company

350 Indiana Street, Suite 800

Golden, Colorado 80401

Attention: Secretary

Telephone: (303) 839-5060

Except as provided above, no other information, including information on our internet site, is incorporated by reference in this prospectus.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and the documents incorporated by reference herein, contain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. These statements include statements relating to our plans, expectations and assumptions concerning our Velarden

˜

a Properties (as defined in this prospectus), including expectations regarding the oxide plant lease; anticipated plans and expectations regarding the El Quevar project; planned drill programs and other exploration and related spending and costs at exploration properties and anticipated timing of drill results from certain exploration properties; anticipated spending on general and administrative activities; planned spending and expected cash needs; and statements concerning our financial condition, operating strategies and operating and legal risks.

We use the words “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “could,” “will,” “project,” “should,” “believe” and similar expressions (including negative and grammatical variations) to identify forward-looking statements and information. Statements that contain these words discuss our future expectations, contain projections or state other forward-looking information. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct.

Our actual results could differ materially from those expressed or implied in these forward-looking statements and information as a result of the factors described under “Risk Factors” in this prospectus and other factors set forth in this prospectus, and the documents incorporated by reference herein, including:

·

Lower revenue than anticipated from the oxide lease, which could result from delays or problems at the third party’s mine or at the oxide plant, permitting problems at the third party’s mine or the oxide plant, delays in constructing additional tailings capacity at the oxide plant, earlier than expected termination of the lease or other causes;

2

Table of Contents

·

Higher than anticipated care and maintenance costs at the Velardeña Properties in Mexico or at the El Quevar project in Argentina;

·

Continued decreases or insufficient increases in silver and gold prices;

·