CSX Warns of Revenue Shortfall -- WSJ

July 17 2019 - 3:02AM

Dow Jones News

By Paul Ziobro

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 17, 2019).

CSX Corp. cut its outlook for the year, saying economic

uncertainty and the shutdown of a major oil refinery it served

would lead to lower revenue at the freight railroad.

The company expects revenue will fall as much as 2% this year,

compared with a previous forecast of an increase of 1% to 2%.

Shares dropped 6.4% in Tuesday's after-hours trading to

$74.48.

Like other freight railroads, CSX is contending with fallout

from trade tensions and weakening in parts of the industrial

economy.

Chief Executive Jim Foote said that shipping volumes for its

industrial customers remained weak and weren't showing signs of

improving soon.

That assessment stands in contrast to upbeat economic indicators

such as employment and consumer spending.

"Global and U.S. economic conditions have been unusual to say

the least, " Mr. Foote said on Tuesday's earnings call. "The

present economic backdrop is one of the most puzzling I've

experienced in my career."

On top of that, Philadelphia Energy Solutions is closing the

largest and oldest East Coast oil refinery after a fire tore

through the complex in late June.

CSX delivered crude-oil shipments to that facility, which

accounted for 1% of the railroad's overall annual shipping

volume.

CSX said the forecast reflects current economic conditions and

could improve if there is a pickup in the economy. "This is not

doom and gloom, this is not end-of-days kind of thing," Mr. Foote

said.

The muted forecast came as CSX reported a 1% revenue decline in

the second quarter to $3.06 billion.

Profit fell in the quarter to $870 million from $877 million a

year earlier. Earnings per share increased to $1.08 from $1.01.

Both earnings and revenue were below estimates of analysts polled

by FactSet.

The latest drop in revenue comes from weakness in CSX's

intermodal business, which ships consumer goods. CSX has been

deliberately closing intermodal lanes and shedding some of that

business.

CSX reported growth in its merchandise unit, where it offers

shipping of such products as food, chemicals, minerals and

metals.

The company continued to cut as part of a new operating plan,

with expenses down 3% compared with last year to $1.76 billion.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

July 17, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

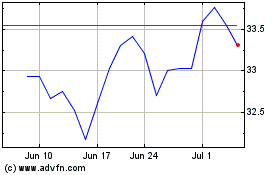

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

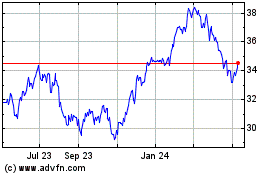

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024