UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month

of July 2019

Commission

File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified

in its charter)

Nuestra

Señora de los Ángeles 179

Las Condes,

Santiago, Chile

(Address

of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GEOPARK LIMITED

TABLE OF CONTENTS

|

ITEM

|

|

|

1.

|

Press Release dated July 15, 2019 titled “GeoPark announces Second Quarter 2019 Operational Update”.

|

Item 1

FOR IMMEDIATE DISTRIBUTION

GEOPARK ANNOUNCES SECOND QUARTER 2019

OPERATIONAL UPDATE

MORE DRILLING SUCCESS

MORE PRODUCTION GROWTH

MORE NEW ACREAGE AND BLOCKS ADDED

Bogota, Colombia – July 15, 2019 –

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading independent Latin American oil and

gas explorer, operator and consolidator with operations and growth platforms in Colombia, Peru, Argentina, Brazil, Chile and Ecuador,

today announced its operational update for the three-month period ended June 30, 2019 (“2Q2019”).

All figures are expressed in US Dollars

and growth comparisons refer to the same period of the prior year, except when otherwise specified.

Second Quarter 2019 Highlights

Oil and Gas Production

|

|

·

|

Consolidated oil and gas production up

9% to 39,201 boepd

|

|

|

·

|

Oil production increased by 13% to 34,261

bopd

|

|

|

·

|

Colombian oil production increased by 15%

to 32,021 bopd

|

|

|

·

|

Gas production decreased by 12% to 29.6

mmcfpd due to a temporary demand curtailment in Brazil

|

New Development and Exploration Successes

|

|

·

|

In Colombia, four new wells were tested

and put on production in the Llanos 34 block (GeoPark operated, 45% WI)

|

|

|

·

|

In Chile, the Jauke 2 well, adding a new

productive formation to the Jauke gas field, was successfully tested and put on production in the Fell block (GeoPark operated,

100% WI)

|

|

|

·

|

In Brazil, the Praia dos Castelhanos 1

exploration well was successfully tested in the REC-T-128 block (GeoPark operated, 70% WI)

|

New Infrastructure in Colombia

|

|

·

|

Flowline in place and operational connecting

the Llanos 34 block to regional pipeline system

|

New Significant Acreage Expansion and

New Partnership with Ecopetrol/Hocol in Colombia

|

|

·

|

Acquired three low-cost, low-risk exploration

blocks in the Llanos basin in partnership with Hocol (a 100% subsidiary of Ecopetrol) adding 86-155 mmbbl of gross unrisked exploration

resources, as independently audited by Gaffney, Cline and Associates

|

|

|

·

|

Closed divestiture of non-core La Cuerva

and Yamu blocks for up to $20 million

|

New Country Entry: Final Award of the

Blocks in Ecuador

|

|

·

|

Signed final contracts for the Espejo (GeoPark

operated, 50% WI) and Perico (GeoPark non-operated, 50% WI) blocks in the Oriente basin

|

Continued Returning Value to Shareholders

|

|

·

|

Accelerated share buyback program initiated

in December 2018, buying 3,193,800 shares (5% of total outstanding shares) for $51.2 million, while executing self-funded growth

work programs

|

Catalysts: 3Q2019

|

|

·

|

Drilling eight new exploration and development

wells and testing one well across GeoPark’s portfolio

|

Breakdown of Quarterly

Production by Country

The following table shows production figures

for 2Q2019, as compared to 2Q2018:

|

|

2Q2019

|

|

2Q2018

|

|

|

Total (boepd)

|

Oil

(bopd)

a

|

Gas

(mcfpd)

|

|

Total (boepd)

|

% Chg.

|

|

Colombia

|

32,191

|

32,021

|

1,020

|

|

27,940

|

+15%

|

|

Brazil

|

1,693

|

31

|

9,972

|

|

2,904

|

-42%

|

|

Chile

|

2,952

|

617

|

14,014

|

|

2,559

|

+15%

|

|

Argentina

|

2,365

|

1,592

|

4,636

|

|

2,467

|

-4%

|

|

Total

|

39,201

|

34,261

|

29,642

|

|

35,870

|

+9%

|

|

|

a)

|

Includes royalties paid in kind in Colombia for approximately 1,196 bopd

in 2Q2019. No royalties were paid in kind in Brazil, Chile or Argentina.

|

Quarterly Production Evolution

|

(boepd)

|

2Q2019

|

1Q2019

|

4Q2018

|

3Q2018

|

2Q2018

|

|

Colombia

|

32,191

|

32,131

|

30,641

|

29,139

|

27,940

|

|

Brazil

|

1,693

|

1,960

|

2,894

|

3,124

|

2,904

|

|

Chile

|

2,952

|

2,961

|

2,823

|

2,632

|

2,559

|

|

Argentina

|

2,365

|

2,505

|

2,383

|

2,319

|

2,467

|

|

Total

|

39,201

|

39,557

|

38,741

|

37,214

|

35,870

|

|

Oil

|

34,261

|

34,358

|

32,859

|

31,266

|

30,249

|

|

Gas

|

4,940

|

5,199

|

5,882

|

5,948

|

5,621

|

Oil and Gas Production Update

Consolidated:

Overall oil and gas production grew by 9%

to 39,201 boepd in 2Q2019 from 35,870 boepd in 2Q2018, due to increased production in Colombia and Chile, partially offset by lower

production in Brazil and to a lesser extent in Argentina.

Oil represented 87% of total reported production

compared to 84% in 2Q2018.

Colombia:

Average net production in Colombia grew

15% to 32,191 boepd in 2Q2019 compared to 27,940 boepd in 2Q2018, reflecting continued successful exploration, appraisal and development

drilling in the Llanos 34 block.

One of the two Llanos 34 drilling rigs was temporarily out of

service in May 2019 due to maintenance, mobilization and demobilization activities.

The Llanos 34 block 2Q2019 main operational

highlights were:

Development and appraisal drilling:

|

|

·

|

Four new wells were tested and put on production,

currently adding 3,600 bopd gross. Tigana Sur Oeste 9 and Tua 12 wells were put on production in late April 2019, while Jacana

15 and Jacana 16 wells were put on production in June 2019.

|

Exploration drilling:

|

|

·

|

Civil works and other preliminary activities

carried out during 2Q2019 related to the Guaco exploration prospect, expected to initiate drilling in 3Q2019.

|

Infrastructure update:

|

|

·

|

The flowline connecting the Llanos 34 block

to the Oleoducto de los Llanos (“ODL”), one of Colombia’s principal pipelines, became fully operational during

2Q2019 with oil flowing from the Jacana oil field to the ODL regional infrastructure. The flowline (with a capacity of up to 100,000

bopd) supports future production growth in the Llanos 34 block, reduces overall operational risk and contributes to further reductions

in transportation and operating costs.

|

Acreage Expansion in Colombia in Partnership with Ecopetrol/Hocol:

|

|

·

|

On July 11, GeoPark signed final contracts for the Llanos 86, Llanos

87 and Llanos 104 blocks, in partnership with Hocol (a 100% subsidiary of Ecopetrol).

|

|

|

·

|

The acquired blocks represent significant

and attractive, low-risk, low-cost, high potential exploration acreage in the Llanos basin in proximity to GeoPark's successful

Llanos 34 block, surrounded by multiple producing oil and gas fields, as well as existing infrastructure. GeoPark will be the operator

with a 50% WI.

|

|

|

·

|

The Llanos 87 block is located adjacent

to and on trend with the Llanos 34 block. The Llanos 86 and Llanos 104 blocks are contiguous areas (20 kilometers southeast of

the Llanos 34 block) on trend with large nearby producing oil fields. The three blocks cover an aggregate area of 679,292 acres

(2,752 sq km) – eight times the size of the Llanos 34 block.

|

|

|

·

|

Unrisked exploration resources associated

to these blocks amount to approximately 86-155 mmbbl gross in aggregate, as independently audited by Gaffney, Cline & Associates.

|

|

|

·

|

For further detail, please refer to the

release published on June 27, 2019.

|

Sale of La Cuerva and Yamu Assets:

|

|

·

|

In late June 2019, GeoPark completed the

divestiture of the La Cuerva and Yamu blocks for a total consideration of $18 million plus a contingent payment of up to $2 million

based on future oil prices.

|

|

|

·

|

The sale of the La Cuerva and Yamu blocks

allows GeoPark to reallocate resources to its core Llanos 34 block and new exploration acreage recently awarded in the Llanos basin.

|

|

|

·

|

During 1H2019 the La Cuerva and Yamu blocks

produced approximately 700 bopd that were included as part of GeoPark’s consolidated oil and gas production.

|

Brazil:

Planned maintenance activities and lower

gas demand resulting from increased hydroelectric power availability in the northeastern region of the country temporarily reduced

net production in the Manati field by 42% to 1,693 boepd in 2Q2019, compared to 2,904 boepd in 2Q2018. Regardless of decreased

production levels in 2Q2019, the impact in cash terms is smaller due to take or pay (“ToP”) clauses that significantly

reduce demand risk.

Net gas production during June 2019 was

approximately 900 boepd below minimum monthly ToP levels, thus allowing GeoPark to collect cash amounts for the difference between

actual deliveries and minimum ToP levels.

Exploration drilling in the REC-T-128 block:

|

|

·

|

Praia dos Castelhanos 1 well was successfully

tested during 2Q2019. A production test in the Agua Grande formation resulted in a production rate of 300 bopd of 34 degrees API,

with no water. Additional production history is required to determine stabilized flow rates and the extent of the reservoir. Long-term

testing activities are expected to initiate in 3Q2019.

|

Chile:

Average net oil and gas production in Chile

increased by 15% to 2,952 boepd in 2Q2019 compared to 2,559 boepd in 2Q2018 due to increased production from the Jauke gas field.

The production mix during 2Q2019 was 79% gas and 21% light oil (compared to 69% gas and 31% light oil in 2Q2018).

Development and appraisal drilling in the

Fell block:

|

|

·

|

Jauke 2 gas well was successfully tested

during June 2019. A production test in the Tobifera formation (deeper than the Springhill formation that is in production in the

Jauke gas field) resulted in an average production rate of 5.9 mmcfpd (988 boepd). Additional production history is required to

determine stabilized flow rates of the well and the extent of the reservoir.

|

Argentina:

Average net production in Argentina decreased

by 4% to 2,365 boepd in 2Q2019 (67% oil, 33% gas) compared to 2,467 boepd in 2Q2018. Lower production in 2Q2019 resulted from planned

maintenance activities carried out in compression facilities in the Puesto Touquet block (GeoPark operated, 100% WI) and limited

production from Challaco Bajo field in the El Porvenir block (GeoPark operated, 100% WI) due to the initial calibration of surface

production facilities.

Peru:

In June 2019, GeoPark withdrew the Environmental

Impact Assessment (EIA) for the development of the Situche Central oil field in the Morona block (GeoPark operated, 75% WI) to

incorporate additional information and for further review.

Ecuador

:

On May 22, 2019, GeoPark signed final participation

contracts for the Espejo (GeoPark operated, 50% WI) and Perico (GeoPark non-operated, 50% WI) blocks in Ecuador, which were awarded

to GeoPark in the Intracampos Bid Round held in Quito, Ecuador in March 2019.

For further detail, please refer to the

release published on June 3, 2019.

3Q2019 Drilling Schedule

The following is a summary of expected drilling

and testing activities scheduled for 3Q2019:

|

|

Prospect/Well

a

|

Country

|

Block

|

WI

|

Type

|

|

1

|

Tigana Sur 8

b

|

Colombia

|

Llanos 34

|

45%

|

Development

|

|

2

|

Tigana Sur 12

|

Colombia

|

Llanos 34

|

45%

|

Development

|

|

3

|

Tigana Sur 13

|

Colombia

|

Llanos 34

|

45%

|

Development

|

|

4

|

Jacana 29

|

Colombia

|

Llanos 34

|

45%

|

Development

|

|

5

|

Jacana 51

|

Colombia

|

Llanos 34

|

45%

|

Development

|

|

6

|

Tigui 18

|

Colombia

|

Llanos 34

|

45%

|

Development

|

|

7

|

Guaco 1

|

Colombia

|

Llanos 34

|

45%

|

Exploration

|

|

8

|

Aguada Baguales Sur 1

|

Argentina

|

Aguada Baguales

|

100%

|

Exploration

|

|

9

|

Mandacarú 1

|

Brazil

|

POT-T-747

|

70%

|

Exploration

|

|

a)

|

Information included in the table above is subject to change and may also

be subject to partner or regulatory approval

|

|

b)

|

Drilling initiated or completed with testing activities expected in 3Q2019

|

OTHER NEWS / RECENT EVENTS

Annual General Meeting

GeoPark’s 2019 Annual General Meeting

was held on June 27, 2019, at which (i) all candidates were elected as members of the Board of Directors; (ii) Price Waterhouse & Co SRL was appointed as independent auditor of the Company; (iii) the Audit Committee was authorized to fix the remuneration

of the auditor; and (iv) the annual report and the audited consolidated financial statements for the fiscal year ended December

31, 2018 have been duly informed and presented.

Reporting Dates for 2Q2019 Results Release and Conference

Call

GeoPark will report its 2Q2019 financial

results on August 7, 2019, after the market close. In conjunction with the 2Q2019 results press release, GeoPark management will

host a conference call on August 8, 2019 at 10:00 am (Eastern Time) to discuss 2Q2019 financial results.

To listen to the call, participants can access the webcast located

in the Investor Support section of the Company’s website at

www.geo-park.com

.

Interested parties may participate in the conference call by

dialing the numbers provided below:

United States Participants: 866-547-1509

International Participants: +1 920-663-6208

Passcode: 4273485

Please allow extra time prior to the call to visit the website

and download any streaming media software that might be required to listen to the webcast. An archive of the webcast replay will

be made available in the Investor Support section of the Company’s website at www.geo-park.com after the conclusion of the

live call.

For further information, please contact:

INVESTORS:

|

Stacy Steimel – Shareholder Value Director

Santiago, Chile

|

ssteimel@geo-park.com

|

|

T: +562 2242 9600

|

|

|

|

|

|

Miguel Bello – Market Access Director

Santiago, Chile

T: +562 2242 9600

|

mbello@geo-park.com

|

MEDIA:

|

Jared Levy – Sard Verbinnen & Co

|

jlevy@sardverb.com

|

|

New York, USA

|

|

|

T: +1 (212) 687-8080

|

|

|

|

|

|

Kelsey Markovich – Sard Verbinnen & Co

New York, USA

T: +1 (212) 687-8080

|

kmarkovich@sardverb.com

|

|

|

|

GLOSSARY

|

Adjusted EBITDA

|

Adjusted EBITDA is defined

as profit for the period before net finance costs, income tax, depreciation, amortization, certain non-cash items such as impairments

and write-offs of unsuccessful efforts, accrual of share-based payments, unrealized results on commodity risk management contracts

and other non-recurring events

|

|

Adjusted EBITDA per boe

|

Adjusted EBITDA divided

by total boe deliveries

|

|

Operating netback per boe

|

Revenue, less production

and operating costs (net of depreciation charges and accrual of stock options and stock awards) and selling expenses, divided

by total boe deliveries. Operating netback is equivalent to Adjusted EBITDA net of cash expenses included in Administrative, Geological

and Geophysical and Other operating costs

|

|

Bbl

|

Barrel

|

|

Boe

|

Barrels of oil equivalent

|

|

Boepd

|

Barrels of oil equivalent

per day

|

|

Bopd

|

Barrels of oil per day

|

|

CEOP

|

Contrato Especial de

Operación Petrolera (Special Petroleum Operations Contract)

|

|

D&M

|

DeGolyer and MacNaughton

|

|

F&D costs

|

Finding and development

costs, calculated as capital expenditures divided by the applicable net reserves additions before changes in Future Development

Capital

|

|

Mboe

|

Thousand barrels of

oil equivalent

|

|

Mmbo

|

Million barrels of oil

|

|

Mmboe

|

Million barrels of oil

equivalent

|

|

Mcfpd

|

Thousand cubic feet

per day

|

|

Mmcfpd

|

Million cubic feet per

day

|

|

Mm

3

/day

|

Thousand cubic meters

per day

|

|

NPV10

|

Present value of estimated

future oil and gas revenues, net of estimated direct expenses, discounted at an annual rate of 10%

|

|

PRMS

|

Petroleum Resources

Management System

|

|

SENACE

|

Servicio Nacional de

Certificación Ambiental Para Las Inversiones Sostenibles

|

|

Sq km

|

Square Kilometer

|

|

WI

|

Working Interest

|

|

|

|

NOTICE

Additional information about GeoPark can

be found in the “Investor Support” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain

amounts and percentages included in this press release have been rounded for ease of presentation. Percentage figures included

in this press release have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts

prior to rounding. For this reason, certain percentage amounts in this press release may vary from those obtained by performing

the same calculations using the figures in the financial statements. In addition, certain other amounts that appear in this press

release may not sum due to rounding.

CAUTIONARY

STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that

constitute forward-looking statements. Many of the forward- looking statements contained in this press release can be identified

by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’

‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’

‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in

a number of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations,

regarding various matters, including expected production growth, expected schedule, economic recovery, payback timing, IRR, drilling

activities, demand for oil and gas, capital expenditures plan, regulatory approvals, reserves and exploration resources. Forward-looking

statements are based on management’s beliefs and assumptions, and on information currently available to the management. Such

statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in

the forward-looking statements due to various factors. Oil and gas production figures included in this release are stated before

the effect of royalties paid in kind, consumption and losses, except when specified.

Forward-looking statements speak only as

of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future

developments or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to

reflect the occurrence of unanticipated events. For a discussion of the risks facing the Company which could affect whether these

forward-looking statements are realized, see filings with the U.S. Securities and Exchange Commission.

Readers are cautioned that the exploration

resources disclosed in this press release are not necessarily indicative of long-term performance or of ultimate recovery. Unrisked

prospective resources are not risked for change of development or chance of discovery. If a discovery is made, there is no certainty

that it will be developed or, if it is developed, there is no certainty as to the timing of such development. There is no certainty

that any portion of the Prospective Resources will be discovered. If discovered, there is no certainty that it will be commercially

viable to produce any portion of the resources. Prospective Resource volumes are presented as unrisked.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

GeoPark Limited

|

|

|

|

|

|

|

|

|

By:

|

/s/ Andrés Ocampo

|

|

|

|

|

|

Name:

|

Andrés Ocampo

|

|

|

|

|

|

Title:

|

Chief Financial Officer

|

Date: July 15, 2019

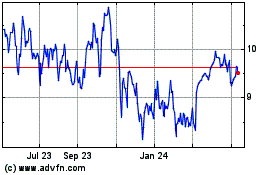

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024