Fulcrum Therapeutics Sets IPO at 4.5 Million Shares; Sees Pricing at $16-$18 Apiece

July 08 2019 - 7:13AM

Dow Jones News

By Colin Kellaher

Fulcrum Therapeutics Inc., a biopharmaceutical company backed by

GlaxoSmithKline PLC (GSK), on Monday said it will sell 4.5 million

common shares in its initial public offering, with an expected

price range of $16 to $18 each.

At the $17 midpoint of that range, the Cambridge, Mass., company

said it expects net proceeds of about $68 million, or roughly $78.7

million if the underwriters exercise their option to buy an

additional 675,000 shares.

Fulcrum said it will use the proceeds, along with cash on hand,

to advance losmapimod, its first product candidate, along with

other programs and discovery efforts. The company is developing

losmapimod for the treatment of facioscapulohumeral muscular

dystrophy, a rare, progressive and disabling muscle wasting

disorder.

Fulcrum it will have about 23.3 million shares outstanding after

the IPO, for a valuation of about $397 million at the $17

midpoint.

Biotech investor Third Rock Ventures will hold a 34.9% stake in

Fulcrum after the IPO, while GlaxoSmithKline will own 7.7%,

according to a filing with the Securities and Exchange

Commission.

Fulcrum said it has applied to list its shares on the Nasdaq

Global Market under the symbol FULC.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

July 08, 2019 06:58 ET (10:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

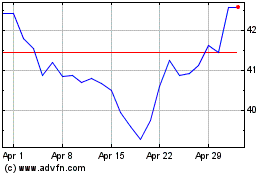

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024