Current Report Filing (8-k)

July 03 2019 - 3:30PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

July 1, 2019

MARIJUANA COMPANY OF AMERICA, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Utah

(State or other jurisdiction

of incorporation

or organization)

|

Commission File Number

000-27039

|

98-1246221

(I.R.S. Employer

Identification Number)

|

1340 West Valley Parkway Suite #205

Escondido, California 92029

(Address of Principal Executive Offices

and Zip Code)

(888) 777-4362

(Issuer's telephone number)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company

☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☒

Section 3 - Securities and Trading

Markets

Item 3.03 Material Modification to

Rights of Security Holders.

(a) On July 1, 2019, stockholders of

the Company holding a majority of the shares eligible to vote, met in a Special Meeting called by the Board of Directors and approved

an amendment to the Company’s articles of incorporation to affect a sixty for one reverse stock split of its issued and outstanding

common stock.

Pursuant to the amendment, the

reverse stock split will be effective at 12:01 a.m., Eastern Time, on July 31, 2019. The Company expects, subject to approval of

the corporate action by FINRA, that upon the opening of trading on August 1, 2019, its common stock will trade on a

split-adjusted basis under the current trading symbol “MCOA” and with a new CUSIP number.

The reverse stock split

affects all issued and outstanding shares of the Company’s common stock. The par value of the Company’s common stock will

remain unchanged at $0.001 per share after the reverse stock split. The reverse stock split affects all stockholders

uniformly and will not alter any stockholder’s percentage interest in the Company’s equity.

No fractional shares will be issued

in connection with the reverse split. Stockholders who would otherwise be entitled to receive a fractional share will instead receive

one additional share, as determined in good faith by the Company’s Board of Directors.

Section 5 - Corporate Governance

and Management

Item 5.03 Amendments to Articles

of Incorporation or Bylaws; Change in Fiscal Year

(a) On July 1, 2019, the Board of Directors approved an amendment to the Company’s articles of incorporation to create and designate a class of preferred stock nominated

Class “B” Preferred Shares, with five million (5,000,000) shares authorized, $0.001 par value, and preferences designated

as follows:

Voting

. Holders of the Series

“B” Preferred Stock shall have One Thousand (1,000) times that number of votes on all matters submitted to the shareholders

that is equal to the number of shares of Common Stock (rounded to the nearest whole number), at the record date for the determination

of the shareholders entitled to vote on such matters or, if no such record date is established, at the date such vote is taken

or any written consent of such shareholders is affected.

Dividends

. The holders of Series

“B” Preferred Stock of the Corporation shall not be entitled to receive dividends paid on the Corporation’s Common

Stock.

No Liquidation Preference

. Upon

liquidation, dissolution and winding up of the Corporation, whether voluntary or involuntary, the holders of the Series “B”

Preferred Stock then outstanding shall not be entitled to receive out of the assets of the Corporation, whether from capital or

earnings available for distribution, any amounts which will be otherwise available to and distributed to the Common Stockholders.

No Conversion

. The shares of

Series “B” Preferred Stock will not be convertible into the shares of the Corporation’s Common Stock.

Covenants

1) The affirmative vote at a meeting

duly called for such purpose, or written consent without a meeting, of the holders of not less than fifty-one (51%) of the then

outstanding shares of Series B Preferred Stock shall be required for (i) any change to the Corporation’s Articles of Incorporation

that would amend, alter, change or repeal any of the voting powers, preferences, limitations or relative rights of the Series B

Preferred Stock, or (ii) any issuance of additional shares of Series B Preferred Stock.

2) So long as shares of Series B Preferred

Stock are outstanding, the Corporation shall not, without first obtaining the approval (by vote or written consent, as provided

by law) of the Series B Holders, which consent may be withheld in the Holder’s sole and absolute discretion: (i) dissolve

the Corporation or effectuate a liquidation; (ii) alter, amend, or repeal the Certificate of Incorporation of the Corporation;

(iii) agree to any provision in any agreement that would impose any restriction on the Corporation’s ability to honor the

exercise of any rights of the Holder of the Series B Preferred Stock; (iv) do any act or thing not authorized or contemplated by

this Certificate which would result in taxation of the Holder of shares of the Series B Preferred Stock under Section 305 of the

Internal Revenue Code of 1986, as amended (or any comparable provision of the Internal Revenue Code as hereafter from time to time

amended); or (v) issue any securities of the Corporation of any nature or kind, including securities convertible into any capital

stock of the Corporation.

The Company has a total of 50,000,000

shares of preferred stock, $0.001 par value, authorized, and prior to the amendment of its articles had one class of preferred

stock issued: Class A preferred stock, $0.001 par value, 10,000,000 shares designated, 10,000,000 shares issued and outstanding

as of March 31, 2019.

Section 9 – Financial Statement

and Exhibits

Item 9.01 Financial Statements and

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated July 3, 2019

MARIJUANA COMPANY OF AMERICA, INC.

By: /s/

Donald Steinberg

Donald Steinberg

(Principal Executive Officer)

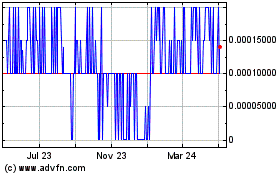

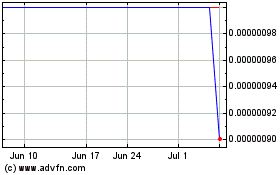

Marijuana Company of Ame... (PK) (USOTC:MCOA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marijuana Company of Ame... (PK) (USOTC:MCOA)

Historical Stock Chart

From Apr 2023 to Apr 2024