NGL Energy Partners LP Closes Combination with Mesquite and Announces Investment from EIG and FS Energy and Power Fund

July 02 2019 - 4:55PM

Business Wire

NGL Energy Partners LP (NYSE:NGL) (the “Partnership” or “NGL”)

today announced the closing of its previously announced acquisition

of all of the assets of Mesquite Disposals Unlimited, LLC

(“Mesquite”) for a total purchase price of $892.5 million on a

cash-free, debt-free basis, a portion of which will be funded in

deferred payments.

“The closing of our Mesquite transaction creates the largest

water disposal system in the Delaware Basin with permitted capacity

exceeding two million barrels per day, but more importantly, the

redundancy required by our customers,” stated Mike Krimbill, NGL’s

CEO. “The combined system provides multiple transportation,

disposal and recycling options throughout Lea and Eddy Counties

that allows NGL to deliver on its commitments. The Mesquite family

will work alongside NGL, operating these assets while expanding the

business with additional facilities and contracts.”

The acquisition purchase price was funded with the following

sources of capital:

- $400 million aggregate gross proceeds from privately placed

equity securities sold for cash to investment funds managed by EIG

Global Energy Partners (“EIG”) and FS Energy and Power Fund

(“FSEP”);

- $100 million of additional NGL preferred units based on market

value of an existing class, issued to certain beneficial owners of

Mesquite as part of the acquisition consideration;

- $250 million gross proceeds from a new 5-year secured term loan

with TD Securities (USA) LLC, as lead arranger and bookrunner, and

The Toronto-Dominion Bank, New York Branch, as initial lender;

and

- Any remaining funding requirements are expected to be paid from

borrowings under the Partnership’s existing revolving credit

facility.

“We are also excited to announce the investment in NGL by EIG,”

stated Mr. Krimbill. “In conjunction with our partnership with EIG,

we welcome Brian Boland to our Board of Directors. We appreciate

EIG’s support in the diligence and financing of this highly

strategic acquisition and look forward to working with Brian and

the EIG team on new opportunities in the near future.”

Brian Boland, Managing Director and Co-head of Midstream at EIG

added, “We are thrilled to be making this investment in NGL and its

diversified, high-quality asset base that includes what we believe

to be the preeminent, multi-basin water solutions platform in the

United States. We expect the acquisition of the Mesquite assets,

together with NGL’s existing footprint in the Northern Delaware

basin, to provide NGL with unmatched scale and capabilities that

will facilitate best-in-class execution for its customers. NGL’s

system is strategically located in the core of the Delaware basin

and is well-positioned to capture significant volume growth as

produced water levels continue to rise alongside rapidly growing

oil production. We look forward to working with the NGL team

towards this next phase of growth for the Partnership and its

stakeholders.”

“Thank you to EIG and to the team at TD Securities for their

support in completing the financing strategy for the closing of the

Mesquite transaction,” stated Trey Karlovich, NGL’s CFO. “Pro forma

for Mesquite’s first year contribution, we were able to complete

this financing while maintaining our 3.25x compliance leverage

target and managing our cost of capital, while maintaining

flexibility around our capital structure and debt maturities.”

Advisors

Barclays acted as financial advisor and placement agent for NGL.

Winston & Strawn LLP acted as legal counsel to NGL on the

Mesquite transaction. Hunton Andrews Kurth LLP and Paul Hastings

LLP served as legal counsel to NGL on the financing transactions.

Kirkland & Ellis LLP acted as legal counsel to EIG and

FSEP.

Forward-Looking Statements

Certain matters contained in this Press Release include

"forward-looking statements." All statements, other than statements

of historical fact, included in this Press Release may constitute

forward-looking statements. Although we believe that the

expectations reflected in these forward-looking statements are

reasonable, we cannot assure you that these expectations will prove

to be correct. These forward-looking statements are subject to

certain known and unknown risks and uncertainties, as well as

assumptions that could cause actual results to differ materially

from those reflected in these forward-looking statements. Factors

that might cause actual results to differ include, but are not

limited to, the risk factors discussed from time to time in each of

our documents and reports filed with the SEC.

Readers are cautioned not to place undue reliance on any

forward-looking statements contained in this Press Release, which

reflect management's opinions only as of the date hereof. Except as

required by law, we undertake no obligation to revise or publicly

release the results of any revision to any forward-looking

statements.

About NGL Energy Partners

LP

NGL Energy Partners LP is a Delaware limited partnership. NGL

owns and operates a vertically integrated energy business with four

primary businesses: water solutions, crude oil logistics, NGL

logistics and refined products/renewables. For further information,

visit the Partnership’s website at www.nglenergypartners.com.

About EIG Global Energy

Partners

EIG Global Energy Partners is a leading institutional investor

to the global energy sector with $22.4 billion under management as

of March 31, 2019. EIG specializes in private investments in energy

and energy-related infrastructure on a global basis. During its

37-year history, EIG has committed over $30.8 billion to the energy

sector through more than 345 projects or companies in 36 countries

on six continents. EIG’s clients include many of the leading

pension plans, insurance companies, endowments, foundations and

sovereign wealth funds in the U.S., Asia and Europe. EIG is

headquartered in Washington, D.C. with offices in Houston, London,

Sydney, Rio de Janeiro, Hong Kong and Seoul. For additional

information, please visit EIG Partners website at

https://www.eigpartners.com/.

About FS Energy and Power

Fund

FS Energy and Power Fund is a publicly registered, non-traded

business development company sponsored by FS Investments and

advised by FS/EIG Advisor, LLC, a joint venture of EIG and FS

Investments. FSEP focuses primarily on investing in the debt and

income-oriented equity securities of privately held U.S. companies

in the energy and power industry. FSEP’s investment objectives are

to generate current income and long-term capital appreciation. FS

Investments is a leading asset manager dedicated to helping

individuals, financial professionals and institutions design better

portfolios. FS Investments had $23.7 billion under management as of

March 31, 2019. Visit www.fsinvestments.com to learn more.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190702005683/en/

Trey Karlovich, 918-481-1119 Executive Vice President and Chief

Financial Officer Trey.Karlovich@nglep.com or Linda Bridges,

918-481-1119 Senior Vice President – Finance and Treasurer

Linda.Bridges@nglep.com

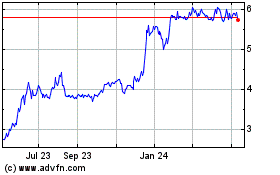

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

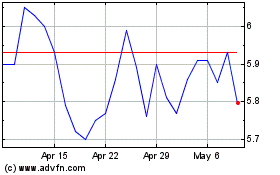

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Apr 2023 to Apr 2024