Snack Sales at General Mills Decline -- WSJ

June 27 2019 - 3:02AM

Dow Jones News

By Micah Maidenberg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 27, 2019).

General Mills Inc.'s snack-bar business faltered in its latest

quarter, and sales of grocery staples such as cereal were flat,

highlighting the tough path the packaged-food maker faces as it

works to spark faster growth.

Shares of General Mills closed down more than 4% at $51.31

Wednesday after the company said sales, excluding the effects from

currency fluctuations and acquisitions, dropped in its fiscal

fourth quarter and were flat for the year.

The company's North America business, its largest, dragged down

results in the period, as the unit's sales fell 2% to $2.34

billion. Sales of cereals, yogurt and meals and baking items were

flat, the company said. Snack sales declined as Fiber One bars and

Nature Valley granola bars lost favor with consumers.

"The biggest challenge we face is certainly on our bars business

in the U.S.," Chief Executive Jeff Harmening said in an

interview.

The maker of Cheerios cereal, Yoplait yogurt and Nature Valley

granola bars plans to step up its efforts to create new products,

he said, and recently introduced Nature Valley bars made from

wafers.

General Mills faces robust competition to win over shoppers

looking for snack bars. Kellogg Co. now owns the protein-bar brand

Rxbar, while Clif Bar & Co. has been introducing new options.

The snack-bar market has always been a competitive one, Mr.

Harmening said.

The Minneapolis-based company reported $4.16 billion in net

sales in the quarter ended May 26, short of the $4.24 billion

analysts predicted, according to FactSet.

Like other packaged-food makers, the company owns some older

brands that have fallen out of favor as consumers opt for brands

and food they think are fresher or healthier.

General Mills diversified its lineup by purchasing the maker of

Blue Buffalo pet food last year. It has also rolled out on-trend

products, including a limited-edition, small-batch cereal that uses

a wild grain related to wheat, while developing new variations of

traditional brands, such as Cinnamon Toast Crunch Churros

cereal.

For its fiscal 2020 year, General Mills said it expects organic

sales, which exclude the effect of currency fluctuations,

acquisitions and asset sales, to rise between 1% and 2%. It

forecasts its adjusted profit to increase 3% to 5% versus the prior

year.

The company expects the Blue Buffalo pet-food business to grow

and believes it can improve other product categories, such as

cereals and yogurt, within the U.S. and Canada.

Mr. Harmening said General Mills is working on new yogurt

options. The yogurt market is crowded, with producers rolling out

new varieties. The changes have caused confusion among consumers

and a drop in U.S. yogurt sales. General Mills said retail sales of

its yogurt products declined at a slower rate in its last fiscal

year compared with the previous two years.

Overall for the quarter, the company posted a profit of $570.2

million, or 94 cents a share, up from $354.4 million, or 59 cents a

share, a year earlier. After adjustments, profit of 83 cents a

share surpassed analysts' targets.

General Mills reported an adjusted gross profit margin of 35.3%

for the latest quarter, down compared with a year earlier due to

higher input costs.

Since it acquired the Blue Buffalo pet-food brand, the company

has worked to expand its distribution, including in Walmart Inc.

stores. General Mills reported $406 million in pet-related sales in

its latest quarter.

The company faces rivals for the pet-food brand, including from

J.M. Smucker Co., which purchased the maker of Rachael Ray's

Nutrish pet food, a deal that was also completed last year.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

June 27, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

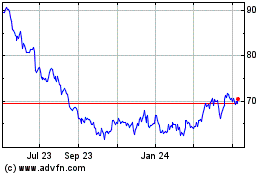

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

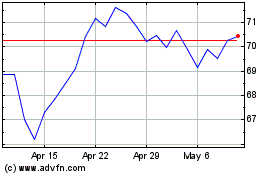

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024