Bayer Adds Legal Help To Resolve Liabilities -- WSJ

June 27 2019 - 3:02AM

Dow Jones News

By Ruth Bender and Ben Dummett

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 27, 2019).

BERLIN -- Bayer AG on Wednesday bowed to pressure from

investors, saying it would seek outside help and review its

approach in the legal battle with thousands of cancer patients who

blame the herbicide Roundup for their illness.

The chemicals and pharmaceutical giant said it would create a

special committee of eight supervisory board members to monitor

Roundup lawsuits and consult with management on legal

strategies.

It also named U.S. lawyer John H. Beisner, an expert on mass

tort and product litigation at Skadden, Arps, Slate, Meagher &

Flom LLP, to advise the board on all Roundup legal matters,

including trial tactics and mediation.

Bayer cited Mr. Beisner's experience in negotiating high-profile

settlements and said it looked forward to "constructively engaging

in the mediation process." A U.S. judge has provisionally appointed

Kenneth Feinberg to serve as mediator in the consolidation of

hundreds of Roundup cases filed in federal court. Mr. Feinberg has

served as mediator in high-profile cases, including the Deepwater

Horizon oil spill in the Gulf of Mexico in 2010.

Bayer has faced mounting pressure from shareholders to show it

is taking concrete action to resolve litigation over its Roundup

weedkillers -- a legal battle involving more than 13,000 plaintiffs

that has wiped out some 40% of the company's market value over the

past year. Shareholders have been venting their anger at management

for entangling the company in a damaging legal fight by buying

Roundup creator Monsanto Co. last year.

U.S. hedge fund Elliott Management Corp., which owns some EUR1.1

billion ($1.25 billion) worth of Bayer shares, or about 2% of the

company, backed Bayer's latest steps. It said the new committee

would provide "a new level of oversight and a fresh perspective to

a litigation strategy in need of radical overhaul and help guide

the company towards a rational, fair and swift settlement."

Since taking over Monsanto, Bayer has lost the first three

Roundup jury trials in California, with the last award topping $2

billion. Analysts have warned the legal fight could take years to

resolve and potentially cost the company billions.

Bayer, which argues that Roundup and its active ingredient,

glyphosate, are safe, is appealing the verdicts.

The German company has been trying to win back investors' trust

after the mounting legal woes engendered enormous frustration with

management.

"The supervisory board recognizes the negative effect the

litigation uncertainty has had on the stock price and stakeholder

perception, and is determined to help the company decisively but

prudently advance the matter," Bayer said Wednesday.

The company said it was also considering adding new experts in

food and agriculture to the board.

Chief Executive Werner Baumann, the architect of the Monsanto

deal, has drawn most of the criticism. At Bayer's general meeting

in late April, a majority of shareholders for the first time in

German postwar history voted against the chief executive of a

DAX-listed company. While the vote isn't binding, it was a clear

warning to Mr. Baumann and his team that management had mishandled

the Roundup crisis and needed to change its approach.

Some shareholders accused Bayer managers of underestimating the

legal and reputational risks of acquiring Monsanto. Bayer said it

acted conscientiously and commissioned a law firm to back its

defense that its due diligence was thorough.

Furious about the loss in value and fearing further damage to

Bayer, some institutional shareholders, including Germany's Deka

Investment, demanded that Bayer reshape its supervisory board to

better deal with the current legal challenge and the group's

increased presence in crop science. Some also said they wanted the

company to bring in an expert to deal with the Roundup

litigation.

Elliott said that while resolving the legal challenge is an

immediate priority, "Bayer could do more to maximize long-term

value for all its stakeholders." Some analysts have said Bayer's

fragile position could lead to activist investors pushing for a

more drastic change at the company, such as splitting the drugs

business from its crop-science operations.

Write to Ruth Bender at Ruth.Bender@wsj.com and Ben Dummett at

ben.dummett@wsj.com

(END) Dow Jones Newswires

June 27, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

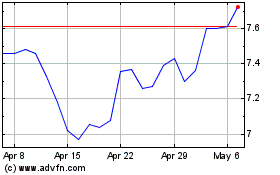

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

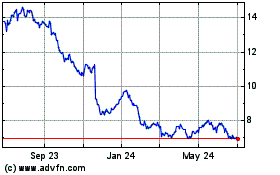

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024