By Liz Hoffman and Geoffrey Rogow

Wall Street's role as matchmaker between big money managers and

corporate executives is under threat.

Next year, five large investing companies overseeing more than

$7 trillion are banding together to directly organize a series of

meetings with company executives, according to people familiar with

the matter. The first meeting, set for Boston next spring, will

host the heads of consumer-staples companies.

The existence of the meetings is a direct threat to the hundreds

of millions of dollars in fees banks make each year introducing

their investor clients to the executives in whose companies they

own stock. Fund managers pack into hotel ballrooms to hear

presentations and take guided tours of company factories. A

one-on-one meeting with a chief executive can run $50,000 or more

in some cases.

Now, some of the biggest managers are planning to go it alone.

No banks needed, or even invited.

Fidelity Investments, Capital Group, Wellington Management, T.

Rowe Price Group Inc. and Norway's government fund are planning a

series of private conferences where their analysts can meet CEOs,

according to people familiar with the matter. The agenda: cocktails

and dinner, followed by a full day of one-on-one meetings, 75

minutes each. CEOs only.

"There was this idea that brokers had magical access to the

C-suite," said Octavio Marenzi of Opimas, a consulting firm to

banks. "Asset managers are starting to realize, 'I can pick up the

telephone as well.'"

The workaround is just the latest way that banks are losing

their spots as Wall Street's indispensable middlemen. They once

underwrote loans, stood in between buyers and sellers of

securities, and organized meetings between investors and corporate

executives -- all for hefty fees.

Today, companies are increasingly borrowing straight from loan

funds, without hiring a bank to underwrite and place the debt.

Online platforms allow investors to trade directly with each other,

sidestepping a bank's trader. Solo advisers help companies design

complex derivatives for a fraction of what Goldman Sachs Group Inc.

or JPMorgan Chase & Co. would charge.

Responding to the access initiative is tricky for banks, who are

unlikely to panic or start a war with some of their biggest trading

clients.

Moreover, there are thousands of smaller asset managers in the

world that still need introductions to corporate management. Some

bank executives say they are happy to run conferences at a loss

because they gin up follow-up calls and trading ideas that can

generate revenue.

Corporate access is one of the few cash cows left for banks and

their research departments. Greenwich Associates estimates that

corporate access was worth $900 million to banks last year, about

12% of their total equities revenues. It can also spur trading

revenue and draw corporate clients closer.

The average big U.S. company sent executives to six investor

conferences and on five roadshows in 2017, where they typically met

with investors curated by a bank research department, according to

data provider IHS Markit.

Chief executives get the chance to tell their stories to

sometimes skeptical audiences and soften up the ground for shifts

in direction. These meetings are generally unrecorded, with

analysts taking notes that they may later disseminate, in edited

form, to other clients.

Executives are forbidden from sharing nonpublic information at

closed meetings, but investors focus on their body language and

parse their words in the hopes of picking up a useful nugget or

two. A 2011 academic study found that fund managers who took

corporate meetings made more money than peers who didn't.

The practice traces to 2003, when Wall Street securities firms

paid $1.4 billion to settle allegations that they routinely issued

overly optimistic stock research to flatter corporate clients and

win their investment-banking business. Regulators forced banks to

wall-off their research departments from their deal makers.

So analysts turned to the access business, finding another way

to profit from their ties to big companies. In the year following

the settlement, at least eight firms set up dedicated units to

arrange intimate meetings between investors and corporate brass.

Some charged fees for entry; others sought to curry favor with

funds that might send more trades their way.

Banks have been relying more on that business recently as

trading commissions have dwindled and a shift to passive, indexed

investing has hit banks' trading desks hard. The dense financial

reports their analysts produce are less relevant as computer-driven

"quants" and index funds displace traditional stock pickers.

Consulting firm Oliver Wyman expects banks to lose as much as $3

billion as asset managers cut back on research spending. Charging

for corporate meetings helps compensate. Investment banks are now

required by new regulation that began in Europe to tell their

clients how much they are charging them for research, rather than

bundling its cost in with trading commissions.

But their asset-manager clients are similarly under pressure.

The race toward low-fee funds pioneered by Vanguard Group and

BlackRock Inc. -- two giants notably absent from this latest effort

-- has forced rivals to slash costs, cut jobs and even move their

corporate headquarters to cheaper locations.

As ownership has become more concentrated in the hands of a few

asset managers, some investors question the need to have banks in

the middle at all. Just four companies -- BlackRock, Vanguard,

Fidelity and State Street Corp. -- were the largest shareholders in

nearly 90% of the companies listed in the S&P 500 at the

beginning of 2018, according to Brookings Institution.

The conferences are just one way banks may see lost access

business. BlackRock, Janus Henderson Group PLC and others have set

up their own internal corporate access teams, in part to cut out

the fees some asset managers had been paying banks.

The conference being organized by the five firms could threaten

popular conferences hosted by banks including Barclays PLC and Bank

of America Corp. The latter's is historically held in March, around

the time Fidelity, T. Rowe and the others will gather in

Boston.

"We plan to partner on corporate access events and conferences

that will provide a tailored research experience for our

investors," a spokeswoman for T. Rowe said.

Write to Liz Hoffman at liz.hoffman@wsj.com and Geoffrey Rogow

at geoffrey.rogow@wsj.com

(END) Dow Jones Newswires

June 26, 2019 17:14 ET (21:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

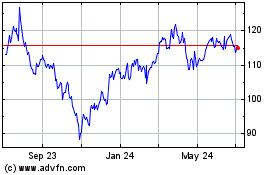

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

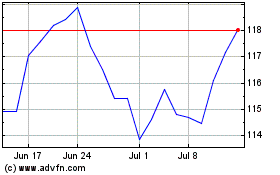

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Apr 2023 to Apr 2024