By Jared S. Hopkins

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 26, 2019).

Pricing pressures and patent expirations for top-selling drugs

are opening up opportunities for pharmaceutical companies to make

major deals at relatively bargain prices. But questions remain

about whether the transactions will lead to long-term growth.

AbbVie Inc.'s $63 billion planned acquisition of Allergan PLC

announced Tuesday is the latest example of two challenged

pharmaceutical companies hoping to be more successful as a combined

entity. Similar scenarios helped bring together Takeda

Pharmaceutical Company Ltd. and Shire PLC last year, as well as

Bristol-Myers Squibb & Co. and Celgene Corp. in January.

AbbVie is facing pressure to navigate the end of patent

protection for the world's top-selling drug, Humira, a rheumatoid

arthritis treatment that accounts for more than half of its

revenue. Allergan, which dominates the $8 billion-plus market for

anti-wrinkle drug Botox and other beauty drugs, is losing patent

protection for its No. 2-selling drug Restasis and has struggled

with its drug-development program, sowing doubts that have

pressured shares.

The Allergan deal surprised analysts, who said AbbVie's

acquisition reflected diversification and short-term growth, rather

than advancing innovative science like recent deals that have

largely focused on the cancer space. Both companies have suffered

from disappointing clinical outcomes outside of their core

franchises.

"This is a play from the traditional playbook of 'when facing

challenges, go and buy someone,' " said David Maris, an analyst at

Wells Fargo & Co. who covers the industry.

In that sense, much of the deal's logic followed the industry's

two other recent big mergers.

Bristol-Myers Squibb Co.'s blockbuster $74 billion deal to buy

rival Celgene Corp. created a cancer-drug powerhouse, but it was

largely driven by each player's need to find new revenue.

Bristol-Myers had lost its advantage in immunotherapy treatment of

lung cancer to rival Merck & Co. And Celgene struggled to find

new products whose sales could offset the looming patent expiration

of Revlimid for multiple myeloma.

Japan-based Takeda's $62 billion deal to buy Shire and its

rare-disease treatments -- its biggest deal ever -- made Takeda one

of the world's largest global pharmaceutical companies and enabled

it to expand its footprint as Japan became more vigilant in

drug-price controls. At the time, Shire's deal making saddled it

with debt and left some analysts and investors questioning whether

it overpaid for questionable assets, including a $32 billion

takeover of Baxalta Inc.

All three recent deals involved a large company buying a smaller

one that was reliant on a single dominant franchise, with few

drivers of short-term growth and trading at valuations lower than

normal, said Ronny Gal, an analyst at Sanford C. Bernstein &

Co. That suggests an emphasis on near-term benefits, which presents

an attractive opportunity for the buyer, Mr. Gal said.

"That was enough for strategic buyers to come in," Mr. Gal

said.

It has been a busy year in deal making for the health-care

sector, with deals in 2019 valued at more than $307 billion,

trailing only the computer and electronics sector, according to

data from Deal Logic.

In addition to the recent bigger deals, companies like Pfizer

Inc. and Merck & Co. have been acquiring smaller companies in a

race to bulk up their development pipelines.

Major deals came when the acquired companies were in severe

slumps after peak share prices. Celgene had fallen over 50% from

more than a year earlier when Bristol made its move. Allergan's

shares were down more than 50% from a peak in 2015.

Last year was quieter, in part because many potential targets'

valuations were out of reach, many analysts and industry officials

have said. The Takeda deal alone accounted for about half of the

drug industry's total deal value through the first nine months of

2018, according to EvaluatePharma.

Some industry observers believe that smaller and midsize deals

are likely to dominate the rest of the year. "I would guard against

thinking this is a trend that we should be expecting -- all of

these large pharma companies going out and gobbling up people,"

said Ambar Boodhoo, a partner at Ernst & Young who heads its

U.S. life-sciences deal making practice.

If the major deals this year aren't enough to boost longer-term

growth, companies will be going back to the trough for smaller

deals, some observers said.

Geoffrey Porges, an analyst at SVBLeerink LLC, said that by the

mid-2020s, both Bristol and AbbVie "better pull some rabbits out of

the hat" through deals or their pipelines in order to grow.

Meanwhile, some pharmaceuticals deals are drawing scrutiny from

the Federal Trade Commission over anticompetitive concerns -- and

even over drugs still in the pipeline.

On Monday, Bristol-Myers said its merger with Celgene would be

delayed as Celgene seeks to sell its blockbuster anti-inflammatory

drug Otezla to appease regulators. Otezla treats psoriasis, and

Bristol doesn't market a psoriasis drug currently, but it does have

an experimental drug in late stage trials.

Roche Holding AG said the FTC had asked for more information

regarding its planned takeover of Spark Therapeutics Inc.

Regulators may be focusing on overlap between Roche's hemophilia

treatment Hemlibra and Spark's experimental gene therapy for the

disease, analysts speculated.

While there is little in common between AbbVie and Allergan's

core franchises, overlapping gastrointestinal franchises will

likely need to be shed, according to Mr. Gal, the analyst. Allergan

currently sells Viberzi and Linzess, both of which are approved to

treat gastrointestinal ailments; AbbVie's Humira is also approved

to treat GI ailments including Crohn's disease.

(END) Dow Jones Newswires

June 26, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

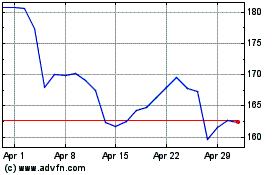

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Apr 2023 to Apr 2024