Investors Present Chapter 11 Plan for PG&E -- WSJ

June 26 2019 - 3:02AM

Dow Jones News

By Peg Brickley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 26, 2019).

PG&E Corp. bondholders have challenged the California

utility over control of its bankruptcy proceeding, offering Wall

Street's version of a solution to wildfire liabilities estimated at

$30 billion or more.

Investors including Elliott Management Corp. and Pacific

Investment Management Co. filed court papers outlining a chapter 11

plan that would include up to $18 billion for victims of blazes

linked to PG&E's equipment.

Bondholders say they would raise $30 billion, most of it in the

form of equity investment, to help PG&E pay off its damages,

according to court papers.

Ratepayers wouldn't pay more, California's green power future

would be assured and Gov. Gavin Newsom would see the state's

largest utility exit from bankruptcy by next year, if PG&E and

its creditors accept the offer, the bondholders say.

PG&E is looking at all options, according to a statement

from the company.

Providers of wind and solar power that count PG&E as a big

customer were thrown into financial jeopardy when PG&E filed

for chapter 11 bankruptcy in January. The utility earlier this

month won a round in court when Bankruptcy Judge Dennis Montali

said he, not the Federal Energy Regulatory Commission, would decide

whether PG&E can get out from its alternative power

contracts.

The San Francisco utility has been under pressure to produce a

chapter 11 exit plan quickly, with Mr. Newsom and others

complaining about a lack of action from a company blamed for years

of fires that took lives and homes.

The Jan. 29 bankruptcy filing gave PG&E a limited period of

exclusive chapter 11 plan rights, but that time runs out near the

end of September.

At a hearing in May, Judge Montali said he would take seriously

a request to open the door to competing restructuring proposals, if

such a request was accompanied by a concrete offer.

Tuesday, an ad hoc group of bondholders outlined terms of an

offer, and said its members are "an obvious source of new capital"

that PG&E has been ignoring. They have set their challenge for

a court hearing July 23.

The offer that arrived Tuesday in the U.S. Bankruptcy Court in

San Francisco likely won't be the only one to be floated in

PG&E's bankruptcy proceeding. At least two other major groups

of investors with money riding on the outcome of the case are

exploring the possibilities.

Rich in assets and cash flow and an irreplaceable element of

California's power grid, PG&E is considered a prime opportunity

for Wall Street investors, despite its poor safety record.

In addition to the $16 billion to $18 billion trust for wildfire

damages, the Elliott and Pimco bondholder group says its plan calls

for a $4 billion contribution to a broad-based wildfire fund for

utilities serving California.

Bondholders say customers wouldn't see higher bills, and they

would get to nominate a board member for PG&E. Ratepayer groups

have criticized the company for paying dividends to shareholders

while they say it let the aged power structure fall into

disrepair.

Other members of the bondholder group include large

private-equity funds and distressed debt players, including Apollo

Global Management LLC, Centerbridge Partners LP, and Citadel

Advisors LLC, all of them with hundreds of millions of dollars

invested in PG&E bonds.

In March, Pimco had nearly $2 billion tied up in PG&E senior

bonds, and had provided $700 million of the bankruptcy loan.

Elliott had money riding on PG&E's stock, as well as nearly

$1.2 billion invested in bond debt.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

June 26, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

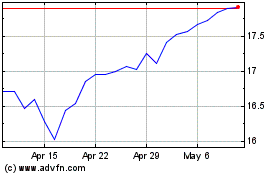

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

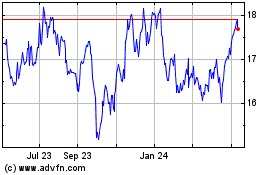

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024