Current Report Filing (8-k)

June 25 2019 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 25, 2019

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-13958

|

13-3317783

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

The Hartford Financial Services Group, Inc.

One Hartford Plaza

Hartford, Connecticut

|

06155

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (860) 547-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

HIG

|

The New York Stock Exchange

|

|

6.10% Notes due October 1, 2041

|

HIG 41

|

The New York Stock Exchange

|

|

7.875% Fixed-to-Floating Rate Junior Subordinated Debentures due 2042

|

HGH

|

The New York Stock Exchange

|

|

Depositary Shares, Each Representing a 1/1,00th Interest in a Share of 6.000% Non-Cumulative Preferred Stock, Series G, par value $0.01 per share

|

HIG PR G

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

[ ] Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

|

|

|

|

|

Item 2.02

|

Results of Operations and Financial Condition

|

The Hartford Financial Services Group, Inc. (the "Company") made revisions to its Investor Financial Supplement ("IFS") for each of the quarters ended from March 31, 2017 to March 31, 2019 and the years ended December 31, 2018, 2017 and 2016, as referenced in Item 7.01 below. These revisions are incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

|

|

|

|

|

|

Item 7.01

|

Regulation FD Disclosure

|

On June 25, 2019, the Company made available to investors selected quarterly financial information for each of the quarters ended from March 31, 2017 to March 31, 2019 and the years ended December 31, 2018, 2017, and 2016 to illustrate the impact on certain of the Company’s Commercial Lines segment financial measures of realigning the lines of business among small commercial, middle & large commercial, and global specialty (formerly small commercial, middle market and specialty commercial) to reflect the Company's management reporting structure, as announced on February 4, 2019 and effective upon the closing of the acquisition of The Navigators Group, Inc. ("Navigators Group") on May 23, 2019. In total, the previously reported financial information for the Commercial Lines segment has not changed--only the realignment of business lines within the segment has changed as a result of the new management reporting structure. The realignment included moving a portion of excess and surplus lines from small commercial to global specialty, moving livestock business from middle market to global specialty and moving national accounts and captive programs from specialty commercial to middle & large commercial. In addition, financial products and bond, that had been included in specialty commercial, are now included in global specialty. The Company is making this information available to provide investors an opportunity to become familiar with the impact of these changes prior to the Company’s earnings release for the quarter ending June 30, 2019. A copy of the revised IFS is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference and furnished herewith.

The recast does not incorporate Navigators' results for the periods presented.

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date:

|

June 25, 2019

|

By:

|

/s/ Scott R. Lewis

|

|

|

|

Name:

|

Scott R. Lewis

|

|

|

|

Title:

|

Senior Vice President and Controller

|

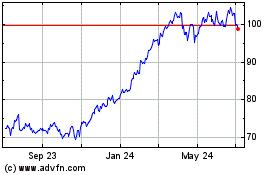

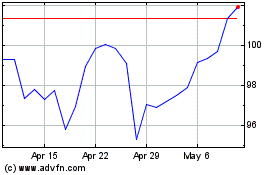

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2023 to Apr 2024