U.S. Oil Exports Rising Amid Middle Eastern Turmoil

June 24 2019 - 3:58PM

Dow Jones News

By Ryan Dezember

U.S. crude exports are surging, reflecting strife along the

Strait of Hormuz that has given oil buyers second thoughts about

the Persian Gulf.

The hostilities, including attacks on oil tankers passing

through the important supply route, have lifted crude prices, sent

tanker rates surging and opened a window for U.S. producers to sell

more barrels abroad, taking market share from the Organization of

the Petroleum Exporting Countries in the process.

RBC Capital Markets forecasts that 21 very large crude carriers,

or VLCCs, will be loaded this month along the U.S. Gulf Coast, well

above the monthly average this year of 13 ships and the record of

17 reached in March.

The average day rate for modern VLCCs, used to ship crude and

petroleum products, has risen 69% to $30,759 since tensions flared

in the strait earlier this month, according to Jefferies Financial

Group Inc.

West Texas Intermediate futures for August deliver gained 0.8%

to $57.90 a barrel Monday on the New York Mercantile Exchange, a

three-week high. Brent crude, the global benchmark, declined 0.5%

to $64.86 a barrel on London's ICE Futures exchange.

The $6.96 difference between the two prices is the slimmest it

has been since April.

The spread is even narrower between Brent and a widely cited

price set in Houston, though at a few dollars it remains enough to

entice buyers to make the trip to U.S. waters, said RBC analyst

Michael Tran.

"If you don't have to buy a barrel that comes through the Strait

of Hormuz you're certainly inclined to do so," Mr. Tran said.

"Security of supply is a huge topic."

President Trump weighed in on Monday, calling for countries that

are dependent on Middle Eastern oil to ensure safe passage of their

own vessels. He specified China and Japan.

"All of these countries should be protecting their own ships on

what has always been...a dangerous journey," the president wrote on

Twitter on Monday morning. "We don't even need to be there in that

the U.S. has just become (by far) the largest producer of Energy

anywhere in the world!"

Mr. Trump's administration has blamed Iran for the tanker

attacks. Iran has denied involvement but the country's

Revolutionary Guard has claimed responsibility for shooting down a

U.S. drone last week. That claim came hours after a Saudi

desalination plant was struck by a missile that appeared to come

from Yemen.

Mr. Trump declined to launch retaliatory attacks on Iran and

instead has said his administration will tighten economic sanctions

on the country, which have been aimed at choking off Iranian oil

exports. Iran, meanwhile, has threatened to shut down the strait if

sanctions aren't lifted.

The equivalent of 21% of the petroleum liquids consumed globally

in 2018 passed through the strait, according to the U.S. Energy

Information Administration. Increasingly, those ships are bound

somewhere besides the U.S., which has been producing crude in

record volume and gaining global market share as sanctions take

barrels from Venezuela and Iran off the market.

EIA data released last week showed U.S. crude exports on the

rise, pushing to 3.4 million barrels a day during the week ended

June 14. The record, set in mid February, is 3.6 million barrels a

day. At the same time, imports from OPEC members are at a 30-year

low.

Those factors, along with a weakening dollar and strong demand

from U.S. drivers, have traders reversing what had been a bearish

outlook on oil prices heading into a summit between OPEC and its

allies, which is expected to take place later this month in

Vienna.

"Oil traders will be hard pressed to push short bets in light of

the possibility of meaningful Persian Gulf supply disruptions,

unless they truly see tensions moderate significantly," said Pearce

Hammond, an analyst with Simmons Energy.

Write to Ryan Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

June 24, 2019 15:43 ET (19:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

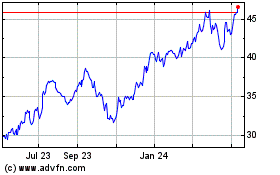

Jefferies Financial (NYSE:JEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

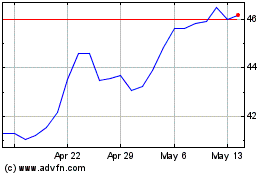

Jefferies Financial (NYSE:JEF)

Historical Stock Chart

From Apr 2023 to Apr 2024