Argentine Banks Stumble in Adoption of New Accounting Standard

June 24 2019 - 5:59AM

Dow Jones News

By Maria Armental

New accounting requirements aimed at establishing a common set

of standards around the world hit Argentine banks in the middle of

a recession and runaway inflation.

Four Argentine financial firms missed filing deadlines for their

annual reports during the second quarter and were deemed delinquent

by the U.S. Securities and Exchange Commission. The companies,

which are required to make U.S. regulatory filings because they

issue American depositary receipts, blamed the adoption of the

International Financial Reporting Standards for the filing

delay.

The firms are Grupo Financiero Galicia SA, whose largest holding

is Banco de Galicia; Banco Macro SA; BBVA Banco Francés SA, the

Argentine unit of Spain's Banco Bilbao Vizcaya Argentaria SA; and

Grupo Supervielle SA, which owns Banco Supervielle.

At issue was a switch to IFRS accounting standards during

skyrocketing inflation in Argentina. IFRS rules require companies

to monitor inflation and implement special procedures for reporting

in the currency of a hyperinflationary economy when the three-year

cumulative inflation rate exceeds 100% for several months.

Argentina's economy has been considered hyperinflationary for

accounting purposes since July 1, 2018, a determination that

required the companies to account for that inflation.

Companies had to change their accounting and reporting practices

and train staff to process adjustments for inflation in addition to

restating comparative figures in financial reports to reflect the

loss of purchasing power of the Argentine peso. All four firms have

since filed the required reports.

The application of hyperinflation accounting under IFRS drove

Grupo Galicia to a loss of 3.83 billion pesos in 2018 ($89.5

million at the current exchange rate), from a year-earlier profit

of 7.28 billion pesos, according to its SEC filing.

Similarly, the BBVA Argentine unit swung to a loss of 1.57

billion pesos in 2018, compared with a profit of 1.86 billion pesos

in 2017, it said in a filing.

Separately, BBVA disclosed this month that Argentine authorities

are investigating it for alleged violations of

anti-money-laundering and terrorist financing regulations. A

representative for BBVA had no immediate comment for this

article.

Grupo Supervielle reported a loss of 3.06 billion pesos in 2018,

compared with a restated loss of 755.3 million pesos in 2017,

according to its filing. Under the old accounting standards, it had

reported a 2017 profit of 2.44 billion pesos. A representative for

Grupo Supervielle said the firm opted to deploy the new standards

in full, in line with the Argentine Central Bank's planned

adoption.

Meanwhile, Banco Macro reported a net loss of 734.1 million

pesos in 2018 under IFRS, compared with a profit of 6.02 billion

pesos in 2017.

Representatives for Banco Macro, Grupo Galicia and the SEC

didn't respond to requests for comment.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

June 24, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

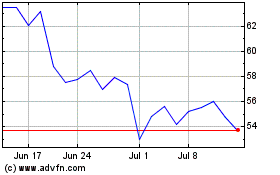

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

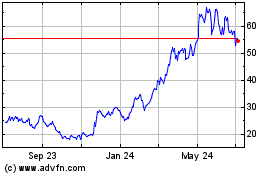

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024