Current Report Filing (8-k)

June 19 2019 - 4:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

|

CURRENT REPORT

|

|

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): June 13, 2019

|

|

|

|

|

LendingClub Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Commission File Number: 001-36771

|

|

|

|

|

Delaware

|

51-0605731

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

595 Market Street, Suite 200, San Francisco, CA 94105

|

|

(Address of principal executive offices and zip code)

|

|

(415) 632-5600

(Registrant’s telephone number, including area code)

|

|

N/A

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

LC

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

Emerging growth company

|

o

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

o

|

|

|

|

|

|

|

|

Item 1.01

|

|

Entry into a Material Definitive Agreement

|

On June 13, 2019, Rincon Point LLC (“Warehouse”), a wholly-owned subsidiary of LendingClub Corporation (the “Company”), entered into a Warehouse Credit Agreement (the “Warehouse Agreement”) with certain lenders from time to time party thereto (the “Lenders”), JPMorgan Chase Bank, N.A. as administrative agent (the “Administrative Agent”), and Wilmington Trust, National Association as collateral trustee (in such capacity, the “Collateral Trustee”) and as paying agent. Pursuant to the Warehouse Agreement, the Lenders agree to provide a $250 million secured revolving credit facility (the “Credit Facility”) to Warehouse, which Warehouse may draw upon from the Credit Facility closing date until the earlier of June 15, 2020 or another event that constitutes a “Commitment Terminate Date” under the Warehouse Agreement. Proceeds under the Credit Facility may only be used to purchase certain unsecured consumer loans from the Company and related rights and documents and pay fees and expenses related to the Credit Facility.

In connection with the Warehouse Agreement, on June 13, 2019, Warehouse also entered into a Security Agreement (the “Security Agreement”) with the Administrative Agent and the Collateral Trustee. The Credit Facility is secured by a first priority lien and security interest in all of Warehouse’s assets. The Warehouse Agreement and Security Agreement contain customary representations and warranties, as well as affirmative and negative covenants. The covenants include restrictions on Warehouse’s ability to make certain restricted payments, including restrictions on Warehouse’s ability to pay dividends, incur indebtedness, place liens on assets, merge or consolidate, make investments and enter into certain affiliate transactions. In addition, the Warehouse Agreement contains customary indemnification provisions pursuant to which Warehouse will indemnify the Lenders and affiliated parties for certain losses arising out of the Warehouse Agreement and certain other matters. The Warehouse Agreement also contains customary events of default.

The foregoing descriptions of the Warehouse Agreement and Security Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the agreements, which are filed as Exhibit 10.1 and 10.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

|

|

|

|

|

|

|

Item 7.01

|

|

Regulation FD Disclosure

|

In connection with discussions that the Company may have with investors in the ordinary course of business, the Company may use the presentation materials (the “Investor Presentation”) attached hereto as Exhibit 99.1, which will also be posted to the Investor Relations page of the Company’s website (

http://ir.lendingclub.com/

). The Investor Presentation attached as Exhibit 99.1 to this Current Report on Form 8-K is incorporated herein by reference.

The information furnished under Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

|

|

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits

|

|

(d)

|

|

Exhibits

|

|

|

|

|

|

Exhibit

Number

|

|

Exhibit Title or Description

|

|

|

|

|

|

|

|

|

|

|

|

|

* Certain information in the exhibit has been omitted pursuant to Item 601(b)(2) of Regulation S-K because it is both not material and would be competitively harmful if publicly disclosed. The Company undertakes to furnish, supplementally, a copy of the unredacted exhibit to the SEC upon request.

SIGNATURE(S)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

LendingClub Corporation

|

|

Date: June 19, 2019

|

By:

|

/s/ Brandon Pace

|

|

|

|

Brandon Pace

|

|

|

|

General Counsel and Secretary

|

|

|

|

(duly authorized officer)

|

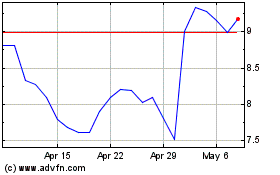

LendingClub (NYSE:LC)

Historical Stock Chart

From Mar 2024 to Apr 2024

LendingClub (NYSE:LC)

Historical Stock Chart

From Apr 2023 to Apr 2024