UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of Report (Date of earliest event reported):

June 12,

2019

ACM Research, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-38273

|

|

94-3290283

|

|

(State or Other

Jurisdiction of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

42307 Osgood Road, Suite I

|

|

|

|

Fremont, California

|

|

94539

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(510)

445-3700

Not Applicable

(Former Name or Former Address, If Changed Since Last

Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

□

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

□

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

□

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

□

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.0001 per share

|

|

ACMR

|

|

Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or

Rule 12b-2 of the Securities Exchange Act of

1934:

Emerging

growth company

☑

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act.

☑

Unless the context otherwise requires,

references in this report to “we,” “our”

and similar terms refer to ACM Research, Inc. and its subsidiaries.

References to “ACM Research” refer to ACM Research,

Inc. and references to “ACM Shanghai” are to ACM

Research (Shanghai), Inc.

For

purposes of this report, amounts in Renminbi, or RMB, have been

translated into U.S. dollars solely for the convenience of the

reader. The translations have been made at the conversion rate of

RMB 6.8937 to U.S. $1.00 effective as of June 12, 2019 (source:

State Administration of Foreign Exchange of the People’s

Republic of China).

Item 1.01

Entry into a Material

Definitive Agreement.

As

described below under “Item 8.01 Other Events,” on June

17, 2019 we announced our plans to complete:

●

a listing of shares

of ACM Shanghai on the Shanghai Stock Exchange’s Sci-Tech

innovAtion boaRd, known as the STAR Market, which we refer to as

the Listing; and

●

a concurrent

initial public offering of ACM Shanghai shares in the

People’s Republic of China, or the PRC, at a pre-offering

valuation of not less than RMB 5.15 billion ($747.1 million),

which we refer to as the IPO.

As an

initial step in qualifying for the Listing, on June 12, 2019 ACM

Shanghai entered into a Capital Increase Agreement and an

Agreement, which we refer to as a Supplemental Agreement, with

several investors, or the Investors, consisting of private equity

funds and other entities based in the PRC as well as two entities

owned by certain employees of ACM Shanghai.

Capital Increase Agreements

Under

its Capital Increase Agreement, each Investor has agreed to pay to

ACM Shanghai by July 5, 2019 a specified RMB amount that will be

applied, upon receipt of all required governmental approvals and

subject to the other terms of the Capital Increase Agreement, to

acquire shares of ACMR Shanghai, which we refer to as such

Investor’s Placement Shares.

●

The Investors,

other than the two employee entities, have agreed to pay a total of

RMB 161.8 million ($23.5 million) to purchase their Placement

Shares at a purchase price of RMB 13 for each RMB 1 of

ACM Shanghai registered capital. This purchase price is based

on a pre-investment enterprise valuation of ACM Shanghai of

RMB 4.65 billion ($674.5 million).

●

The two employee

entities that are Investors have agreed to pay a total of

RMB 26.1 million ($3.8 million) to purchase their Placement

Shares at a purchase price of RMB 10.4 for each RMB 1 of

ACM Shanghai registered capital. This purchase price is based on a

pre-investment enterprise valuation of ACM Shanghai of

RMB 3.72 billion ($539.6 million), a discount of 20% from the

purchase price paid by the other Investors.

If all

of the Placement Shares are issued as contemplated by the several

Capital Increase Agreements, ACM Research would own 96.0% of the

outstanding ACM Shanghai shares, the Investors other than the two

employee entities would hold 3.3%, and the two employee entities

would hold 0.7%.

ACM

Shanghai is obligated under each Capital Increase Agreement to seek

to obtain all governmental approvals required for the Listing by no

later than July 31, 2019. Under each Investor’s Capital

Increase Agreement, if ACM Shanghai does not receive those

governmental approvals within three months after the Investor funds

the purchase of its Placement Share (other than for a reason not

attributable to ACM Shanghai), the Investor will have the right to

terminate its Capital Increase Agreement.

Supplemental Agreements

Under

each Supplemental Agreement, ACM Shanghai and the Investor party

thereto have agreed to use their respective best efforts to

facilitate the completion of the Listing and the IPO within three

years from the date on which the Placement Shares are issued. If,

by the end of such three-year period, the Listing and the IPO have

not been completed and the China Securities Regulatory Commission

has not otherwise approved the registration of ACM Shanghai’s

Listing application, the Investor and ACM Shanghai each will have

the right to require that ACM Shanghai repurchase the

Investor’s Placement Shares for a price equal to the initial

purchase price paid by the Investor, without interest.

We have

determined, voluntarily and not pursuant to any requirement of any

of the Capital Increase Agreements or Supplemental Agreements or

any other contractual or legal obligation, that ACM Shanghai will

deposit, and hold in reserve, all of the proceeds received from the

sale of Placement Shares in segregated cash and cash-equivalent

accounts pending either (a) completion of the Listing and the IPO

or (b) application to repurchase such Placement

Shares.

If the

Listing and the IPO are completed, each Investor, pursuant to the

terms of its Supplemental Agreement, will be prohibited from (a)

for a period of one year from the listing date, selling or

otherwise transferring its Placement Shares and (b) holding,

directly or indirectly, more than five percent of the total

registered capital of ACM Shanghai.

On June

17, 2019 we announced our intention to complete the Listing, under

which shares of ACM Shanghai would be listed on the STAR Market,

and the IPO, a public offering of ACM Shanghai shares in the PRC

that would be completed contemporaneously with the Listing. ACM

Shanghai currently is our primary operating subsidiary and a wholly

owned subsidiary of ACM Research.

Background of Proposed Listing and IPO

We will

seek to complete, within three years after the date on which the

Placement Shares are issued, the Listing on the STAR Market, a new

exchange organized by the Shanghai Stock Exchange in order to

support innovative companies in the PRC. We believe the Listing

will enable us to access a new source of growth capital in our

primary market, raise our profile with investors and potential

customers in the PRC, and help us achieve our goal of becoming a

global supplier to the semiconductor capital equipment

market.

To

qualify for the Listing, ACM Shanghai must have multiple

independent shareholders in the PRC. In order to satisfy this

requirement, ACM Shanghai entered into the Capital Increase

Agreements and Supplemental Agreements with the several Investors

on June 12, 2019, as described above under “Item 1.01 Entry

into a Material Definitive Agreement.” Upon, and subject to,

the Investors’ funding of the purchase prices for the

Placement Shares in accordance with the respective Capital Increase

Agreements, ACM Shanghai will receive aggregate proceeds of

RMB 187,924,000 ($27.3 million) and will have satisfied the

STAR Market requirement as to multiple independent PRC

shareholders.

We may

determine to enter into additional agreements in the quarter ending

September 30, 2019 pursuant to which certain existing ACM Research

stockholders could purchase shares of ACM Shanghai, which we refer

to as the Additional Shares, for an aggregate purchase price of up

to $40 million. The purchase price of the Additional Shares

would be RMB 13 per RMB 1 of registered capital, which is

the same price as is to be paid by Investors other than the two

employee entities. We expect that, if we were to enter any such

agreements for Additional Shares, the other terms of those

agreements would be substantially similar to those under the

Capital Increase Agreements and Supplemental Agreements entered

into with the Investors. As of the date of this report, we not

entered into any agreements or understandings with respect to the

issuance of Additional Shares. ACM Shanghai will not need to

complete any sale of Additional Shares in order to comply with the

Listing requirements, and we are not obligated–by the Listing

requirements, any contractual obligations or otherwise–to

enter into any agreements to sell Additional Shares.

As

described above under “Item 1.01 Entry into a Material

Definitive Agreement—Supplemental Agreements,” we have

voluntarily determined that ACM Shanghai will deposit, and hold in

reserve, the proceeds of the Placement Shares (and any Additional

Shares), in segregated cash and cash-equivalent accounts pending

either (a) completion of the Listing and the IPO or (b) application

to repurchase Placement Shares pursuant to the Supplemental

Agreements (or to repurchase Additional Shares pursuant to

equivalent agreements). Upon completion of the Listing and the IPO,

ACM Shanghai will have broad discretion in the use of the proceeds

of the sale of the Placement Shares (and any Additional Shares) and

of the IPO.

Our

global headquarters will continue to be located in Fremont,

California, and we are committed to maintaining the listing of ACM

Research Class A common stock on the Nasdaq Global Market. We

believe the listing of ACM Shanghai shares on the STAR Market will

help us scale our business in mainland PRC, as we continue to seek

to broaden our markets in Europe, Japan, Korea, Taiwan and the

United States.

Accounting Treatment

For

purposes of our consolidated financial statements prepared in

accordance with U.S. generally accepted accounting principles, we

expect that, pending completion of the Listing and the IPO or the

application of the proceeds of the Placement Shares (and any

Additional Shares) to repurchase such Placement Shares (or

Additional Shares):

●

the proceeds of the

sales of Placement Shares (and any Additional Shares) will be

reflected in our consolidated balance sheets as investment deposits

(under non-current assets) and as a long-term liability;

and

●

the Placement

Shares (and any Additional Shares) will not be reflected as

non-controlling or minority equity interests in ACM

Shanghai.

Risks and Uncertainties of Proposed Listing and IPO

Our

plans for the Listing and the IPO are subject to a number of risks

and uncertainties, and our actual results may vary significantly

from our expectations. The occurrence of any of the following risks

and uncertainties, or additional risks and uncertainties with

respect to the proposed Listing that are not presently known to us

or that we currently believe to be immaterial, could materially and

adversely affect our business, financial condition, results of

operations or cash flows. In any such case the trading price of our

Class A common stock could decline.

We may

not be able to complete the Listing and the IPO. One or more of the

Investors may not fund the purchase of their Placement Shares as

required by their Capital Increase Agreements. Even if the

Investors fund those purchases, ACM Shanghai must succeed in

obtaining PRC governmental approvals required to permit the Listing

and the IPO, and one or more of those approvals may be denied, or

significantly delayed, by the PRC regulators for numerous reasons,

many of which are outside of our control. Similarly, ACM

Shanghai’s Listing application may be denied or delayed by

the Shanghai Stock Exchange in its discretion.

If we

are unable to complete the Listing and the IPO, we may not

otherwise be able to realize the anticipated advantages in our PRC

operations. Because it may be more than three years before we know

whether the Listing and the IPO will be completed, we may, in the

interim, forego or postpone other alternative actions to strengthen

our market position and operations in the PRC. During that time,

the process underlying the Listing and the IPO could result in

significant diversion of management time as well as substantial

out-of-pocket costs.

We

cannot assure you that, even if the Listing and the IPO are

completed, we will realize any or all of our anticipated benefits

of the Listing and the IPO, including the strengthening of our

market position and operations in the PRC Market. If the listing is

completed, ACM Shanghai will have broad discretion in the use of

the proceeds from sales of Placement Shares and any Additional

Shares and from the IPO, and it may spend or invest those proceeds

in a way with which ACM Research stockholders

disagree.

In any

event, the proceeds from sales of Placement Shares and any

Additional Shares and from the IPO are not expected to be available

to expand our operations outside the PRC, and that global expansion

will be critical to our long-term business success. As a result, it

is likely that we will require additional capital in the future in

order to fund global operations and we cannot give any assurance

that such capital will be available at all in terms acceptable to

us. Under existing PRC laws and regulations, it may be difficult,

if not impossible, for ACM Research to be able to receive dividends

comprised of funds generated by ACM Shanghai and, even if such

dividends can be paid from the PRC to the United States, after the

completion of the Listing and the IPO, any such dividends can be

paid to ACM Research only if other holders of ACM Shanghai shares

receive their pro rata dividends.

In

order to help ensure that proceeds from the Placement Shares and

any Additional Shares can be repaid if necessary under the terms of

the applicable agreements, ACM Shanghai will reserve those proceeds

in segregated accounts and therefore those proceeds will not be

available to fund our operations in the PRC or elsewhere. In the

event, however, ACM Shanghai were to incur an unexpected

significant financial obligation, those proceeds may be subject to

claims of third parties, in which case we would need to find an

alternative source of funds to repurchase the Placement Shares and

any Additional Shares.

As of

the date of this report, no company with stock publicly traded in

the United States has effected a STAR Market listing of stock of a

PRC-based subsidiary. No assurance can be given regarding the

effect of the Listing and the IPO on the market price of ACM

Research Class A common stock. The market price of Class A common

stock may be volatile or may decline, for reasons other than the

risk and uncertainties described above, as the result of investor

negativity or uncertainty with respect to the impact of the

proposed Listing and IPO.

ACM Research stockholders are not entitled to purchase ACM Shanghai

shares in the pre-Listing placement, and they may have limited

opportunities to purchase ACM Shanghai shares even if the Listing

and the IPO are completed. Investors may elect to invest in our

business and operations by purchasing ACM Shanghai shares in the

IPO or on the STAR Market rather than purchasing ACM Research Class

A common stock, and that reduction in demand could lead to a

decrease in the market price for the Class A common

stock.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the Registrant has duly caused this report to be signed on

its behalf by the undersigned, hereunto duly

authorized.

|

|

ACM RESEARCH,

INC.

|

|

|

|

|

|

|

|

Date

:

June 18, 2019

|

By:

|

/s/ David H.

Wang

|

|

|

|

|

David

H. Wang

|

|

|

|

|

Chief Executive

Officer and President

|

|

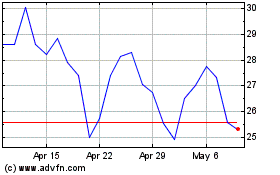

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

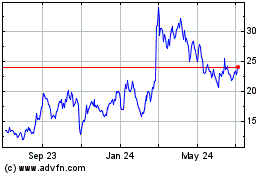

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Apr 2023 to Apr 2024