Pfizer to Buy Array BioPharma in $10.64 Billion Deal -- 3rd Update

June 17 2019 - 10:07AM

Dow Jones News

By Kimberly Chin

Pfizer Inc. agreed to buy Array BioPharma Inc. for $10.64

billion in cash, as the pharmaceutical company looks to expand its

pipeline of cancer therapies.

Pfizer said it would pay Array shareholders $48 for each of its

shares outstanding, a 62% premium to the closing price Friday.

Pfizer said it would fund the transaction with debt and existing

cash.

Shares of Array climbed 57% to $46.45 in morning trading, while

Pfizer slipped 12 cents to $42.64.

Array's portfolio includes Braftovi and Mektovi, which have been

approved for combined use in the treatment of metastatic melanoma.

The combined therapy is currently being tested in more than 30

clinical trials for other tumor-related diseases, such as

metastatic colorectal cancer.

An estimated 140,250 patients in the U.S. were diagnosed with

cancer of the colon and rectum in 2018, with roughly 50,000 people

dying from the disease annually, Pfizer said.

"The proposed acquisition of Array strengthens our innovative

biopharmaceutical business, is expected to enhance its long-term

growth trajectory, and sets the stage to create a potentially

industry-leading franchise for colorectal cancer alongside Pfizer's

existing expertise in breast and prostate cancers," Pfizer Chief

Executive Albert Bourla said in prepared remarks.

Pfizer is looking to shore up its cancer drug lineup, which it

projected to generate $8.3 billion in sales this year, according to

research firm EvaluatePharma. Pfizer expects oncology products in

2019 to outsell heart and other primary-care medicines the company

was long known for.

Upon the deal's closing, Array will be a part of Pfizer's

oncology research and development network.

The New York company said it expects the transaction to hit

adjusted per-share earnings by 4 cents to 5 cents in 2019 and 4

cents to 5 cents in 2020. Pfizer expects to the deal to add to

earnings at the beginning of 2022.

Pfizer expects the transaction, which is worth $11.4 billion

including debt and other factors, to be completed in the second

half of the year.

The Array acquisition adds to a streak of deals by

pharmaceutical companies looking to bolster their cancer treatment

portfolios, now one of the biggest pharmaceutical segments.

Cancer-drug sales are projected to reach $138 billion world-wide

this year, according to EvaluatePharma.

Last month, Merck & Co. agreed to acquire cancer drug

developer Peloton Therapeutics Inc. for $1.05 billion in cash.

Earlier this year, Eli Lilly & Co. acquired Loxo Oncology Inc.

for roughly $8 billion in cash and Bristol-Myers Squibb Co. said it

was buying Celgene Corp. in a $74 billion, which is slated to close

in the third quarter.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

June 17, 2019 09:52 ET (13:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

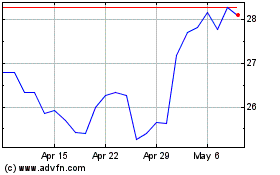

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024