By Charlie McGee

PayPal Holdings Inc.'s Daniel Schulman collected a pay package

totaling $37.8 million in 2018, making him one of the highest-paid

bosses in the S&P 500. But for Mr. Schulman and many of his

fellow CEOs in the software industry, big paydays were backed by

healthy returns.

Most companies selling software and related services thrived

last year, with half delivering a total shareholder return of at

least 10.3%, a Wall Street Journal analysis shows. That success

translated to their CEOs, who received a median raise of 11.7%.

By contrast, median shareholder return for S&P 500 companies

as a group was minus 5.8%, the first negative showing of any

postrecession year. Despite those losses, most CEOs got a raise and

the median pay reached $12.4 million last year.

PayPal outdid many other companies in the software and services

industry with a 14.2% total return. Mr. Schulman's compensation

nearly doubled from 2017, making him the industry's top-paid CEO.

Similar to the industry's other top-paid chief executives, the bulk

of Mr. Schulman's pay raise came in the form of equity awards,

according to PayPal's proxy statement.

In its proxy, PayPal said a portion of Mr. Schulman's equity

award will be earned only if stock-price targets are achieved over

a five-year period. In comparison, PayPal's median employee

received $69,600.

Other software chiefs also saw big increases to their

compensation last year. Marc Benioff and Keith Block, co-CEOs of

cloud-based services company Salesforce.com Inc., were both paid

more than five times what they received in 2017.

Mr. Benioff -- who was Salesforce's sole chief executive until

the company named Mr. Block co-CEO in August 2018 -- received a

total of $28.4 million for the year, the third most among chief

executives in the industry and closely behind Shantanu Narayen of

Adobe Inc., whose company posted a total shareholder return of

38.3% for the year ended in November.

Mr. Block made $17 million total as co-CEO. That included a car,

which Salesforce valued at nearly $212,000, along with a watch it

priced at more than $86,000. The company also reimbursed Mr. Block

for his tax bill on the items, adding nearly $218,000 to his pay,

according to its proxy.

Salesforce's compensation committee concluded that the gifts

were warranted to recognize Mr. Block's leadership, the company

said in its proxy. Compensating the co-CEO "in a memorable and

visible way would be motivational not only for the executive, but

for other employees who observe exceptional performance being

rewarded in exceptional ways consistent with the company's

philosophy of paying for performance," the company said in the

proxy.

The median employee at Salesforce earned just under $152,000 for

the year. The company's total shareholder return for the year was

33.4%.

A Salesforce spokeswoman said in an email that the co-CEOs

received a disproportionately high amount of equity awards in 2018

because of a shift in the timing of when such awards are given.

They received none the previous year as a result of that shift.

For most software-and-services CEOs, pay generally rose or fell

in the same direction as their companies' total shareholder return

at differing magnitudes.

International Business Machines Corp. paid Virginia "Ginni" M.

Rometty -- the only woman among the 27 software-company chiefs --

$17.6 million, a slight dip from 2017 because of a decline in her

bonus. Total shareholder return for IBM was minus 22.6%, the

second-worst in the industry. IBM declined to comment.

The Journal analysis used S&P's industry group for software

and services companies, which doesn't include such high-profile

internet-service companies as Twitter Inc. or Facebook Inc., or

videogame-makers such as Activision Blizzard Inc. All three of

those companies are in the media and entertainment industry

group.

Some CEOs got pay cuts despite strong performance. Total pay for

Visa Inc.'s Alfred F. Kelly Jr. declined 10.3%, to $19.5 million,

even as the company posted a shareholder return of 43.5%, near the

industry's pinnacle.

Meanwhile, Francisco D'Souza of Cognizant Technology Solutions

Corp. received $14.1 million last year, a 13% pay raise, while his

company posted a minus 9.7% total shareholder return. Mr. D'Souza

left his role as Cognizant CEO at the end of March 2019, though he

remains on the company's board.

Cognizant declined to comment beyond its proxy filing, and Visa

didn't respond to a request for comment.

The Journal analyzed CEO compensation and company performance

data reported by S&P 500 companies through May 1, using pay

data provided by MyLogIQ LLC and performance measures from ISS

Analytics, a unit of proxy adviser Institutional Shareholder

Services.

The Journal's analysis excludes CEOs who changed jobs or served

less than a full year, and companies with fiscal years that ended

before July 1, 2018. See the full list here:

Theo Francis contributed to this article.

(END) Dow Jones Newswires

June 17, 2019 09:14 ET (13:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

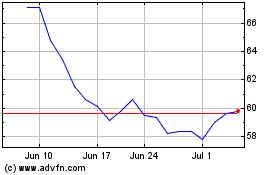

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024