WCVC Cannabis Edibles Stock Undervalued At $0.07 With Comparable At $0.20

June 14 2019 - 10:12AM

InvestorsHub NewsWire

WCVC Cannabis Edibles Stock

Undervalued At $0.07 With Comparable At $0.20

June 14, 2019 -- InvestorsHub NewsWire --

via www.nextbigticker.com --

Yesterday, West Coast Venture Group, Corp. (OTCBB:

WCVC) published a shareholder letter in a press release that

included conventional restaurant comparable valuations. WCVC

is the owner and operator of Illegal Burger operating in cannabis

friendly Colorado and introducing their very own cannabis infused

menu. WCVC is a fully reporting company with audited

financials reporting over $3 million in annual revenue. On

conventional market comparable valuations alone, WCVC can support a

$0.20 PPS. Mix in the cannabis valuation factor and that PPS

could go much higher.

Market Comparable Valuation Segment From WCVC

News Published Yesterday

It is

important to also note that the indicated $.20 market comp price,

is expected to be substantially higher than conventional

restaurants because WCVC growth from CBD edibles has the potential

to be several orders of magnitude higher than simply being a fast

food enterprise. West Coast Ventures Group owns the

fast-growing “Illegal Burger” franchise chain and the Mexican

Restaurant chain , “El Senor Sol” that are pioneers in the cannabis

edibles industry and is positioned to garner a substantial market

share in a booming industry.

Company

Sales

Market Cap

Shake Shack

(SHAK)

$492,000,000

$2,370,000,000

FAT Brands

(FAT)

$19,000,000

$48,000,000

Jack in the

Box (JACK)

$872,000,000

$2,230,000,000

Wendy’s

(WEN)

$1,300,000,000

$4,600,000,000

Rave

Restaurant Group

$12,000,000

$44,000,000

Dunkin’Brands

(DNKN)

$1,340,000,000

$6,500,000,000

Chipotle

(CMG)

$5,000,000,000

$19,600,000,000

TOTAL

$9,035,000,000

$35,392,000,000

The average

share price ratio to sales for this group is 3.91 to

1.

WCVC reported

2018 sales of $3,054,623. The current ratio of 3.91 times

$3,054,623 equals a fair market comp price for WCVC of slightly

over $.20 and does not give any weight to the fact that they are a

new venture with an unsaturated high growth market. We will save

forecasting price projections for those better suited to the task,

but for now it is clear that WCVC shares are an exceptional bargain

at anything under $.20.

So far WCVC’s

cannabis infused menu has been focused on CBD infusions. WCVC

has been experimenting and exploring cannabis infused menu items,

the resale of other cannabis infused products such as EVERx CBC

Sports Water from Puration, Inc . (PURA)

and an ongoing partnership with North American Cannabis Holdings,

Inc. (USMJ)

to introduce a Cannabis Themed Food Truck targeting dispensary

parking lots.

Disclaimer:

NextBigTicker.com (NBT)is a third party

publisher and news dissemination service provider. NBT is NOT

affiliated in any manner with any company mentioned herein. NBT is

news dissemination solutions provider and are NOT a registered

broker/dealer/analyst/adviser, holds no investment licenses and may

NOT sell, offer to sell or offer to buy any security. NBT's

market updates, news alerts and corporate profiles are NOT a

solicitation or recommendation to buy, sell or hold securities. The

material in this release is intended to be strictly informational

and is NEVER to be construed or interpreted as research material.

All readers are strongly urged to perform research and due

diligence on their own and consult a licensed financial

professional before considering any level of investing in

stocks. All material included herein is republished content

and details which were previously disseminated by the companies

mentioned in this release or opinion of the writer. NBT is not

liable for any investment decisions by its readers or subscribers.

Investors are cautioned that they may lose all or a portion of

their investment when investing in stocks. NBT has not been

compensated for this release and HOLDS NO SHARES OF ANY

COMPANY NAMED IN THIS RELEASE.

Disclaimer/Safe

Harbor:

This news release contains forward-looking

statements within the meaning of the Securities Litigation Reform

Act. The statements reflect the Company's current views with

respect to future events that involve risks and uncertainties.

Among others, these risks include the expectation that any of the

companies mentioned herein will achieve significant sales, the

failure to meet schedule or performance requirements of the

companies' contracts, the companies' liquidity position, the

companies' ability to obtain new contracts, the emergence of

competitors with greater financial resources and the impact of

competitive pricing. In the light of these uncertainties, the

forward-looking events referred to in this release might not

occur.

Source: www.nextbigticker.com

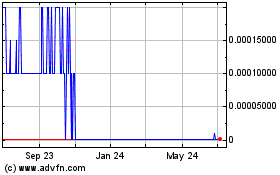

North American Cannabis (CE) (USOTC:USMJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

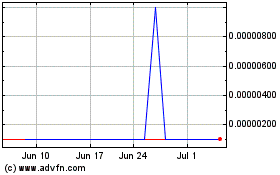

North American Cannabis (CE) (USOTC:USMJ)

Historical Stock Chart

From Apr 2023 to Apr 2024