Table of Contents

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

|

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

|

|

☒

|

Definitive Proxy Statement

|

|

|

|

|

|

|

☐

|

Definitive Additional Materials

|

|

|

|

|

|

|

☐

|

Soliciting Material under Rule 14a-12

|

|

|

BIOLARGO, INC.

|

|

|

|

(Name of Registrant as Specified in its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

(1) Title of each class of securities to which investment applies:

|

|

|

|

(2) Aggregate number of securities to which investment applies:

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1) Amount Previously Paid:

|

|

|

|

(2) Form, Schedule or Registration Statement No.:

|

BioLargo, Inc.

14921 Chestnut St.

Westminster, California 92683

(888) 400-2863

NOTICE OF

201

9

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

JULY 31

, 201

9

To the Stockholders of BioLargo, Inc.:

You are cordially invited to attend the 2019 Annual Meeting of Stockholders of BioLargo, Inc. The annual meeting will be held on Wednesday, July 31, 2019, at 10:00 a.m. local time, at our offices located at 14921 Chestnut St., Westminster, California 92683.

The expected actions to be taken at the annual meeting are described in the attached Proxy Statement and Notice of Annual Meeting of Stockholders. Included with the Proxy Statement is a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018. We encourage you to read the Annual Report. It includes our audited financial statements and information about our operations, markets, products and services.

Stockholders of record as of June 10, 2019 may vote at the Annual Meeting.

We are pleased to inform you that this year we will be taking advantage of the “Notice and Access” method of providing proxy materials via the Internet. On or about June 20, 2019, we will be mailing to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and Annual Report for the fiscal year ended December 31, 2018, and how to vote. This notice also contains instructions on how to receive a paper or e-mail copy of the proxy materials. We believe that this method will expedite your receipt of proxy materials, help conserve natural resources and reduce our printing and mailing costs.

Your vote is important. Whether or not you plan to attend the meeting, please promptly vote and submit your proxy by signing, dating and returning the accompanying proxy card in the enclosed postage-paid envelope, or through the voting website. Returning the proxy card will ensure your representation at the meeting but does NOT deprive you of your right to attend the meeting and to vote your shares in person. The Proxy Statement explains more about the proxy voting. Please read it carefully. We look forward to seeing you at the Annual Meeting.

|

|

Sincerely

|

|

|

|

|

|

Dennis P. Calvert

|

|

|

President and Chief Executive Officer

|

NOTICE OF

201

9

ANNUAL MEETING OF STOCKHOLDERS

|

Date:

|

Wednesday July 31, 2019

|

|

Time:

|

10:00 a.m. local time

|

|

Place:

|

BioLargo, Inc.

|

|

|

14921 Chestnut Street

|

|

|

Westminster, CA 92683

|

Matters to be voted on:

|

|

1.

|

A proposal to elect the following seven individuals to our Board of Directors: Dennis P. Calvert, Kenneth R. Code, Dennis E. Marshall, Joseph L. Provenzano, Kent C. Roberts II, John S. Runyan and Jack B. Strommen.

|

|

|

2.

|

Advisory approval of the Company’s executive compensation.

|

|

|

3.

|

A proposal to ratify the appointment of Haskell & White LLP as our independent public accounting firm for the 2019 fiscal year.

|

|

|

4.

|

A proposal to authorize a reverse stock split of our common stock at a ratio between one-for-four (1:4) and one-for-forty (1:40), if and as determined by our board of directors, at any time before the next meeting of stockholders of the Company.

|

|

|

5.

|

A proposal to authorize a reduction of the number of shares of common stock authorized by our Amended and Restated Certificate of Incorporation, if and in an amount as determined by our board of directors.

|

The annual meeting will also address such other business as may properly come before the annual meeting or any postponement or adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on June 10, 2019 are entitled to notice of and to vote at the annual meeting. A Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2018, and how to vote will be mailed on or about June 20, 2019 to all stockholders entitled to vote at the meeting.

|

|

BY ORDER OF THE BOARD OF DIRECTORS

Dennis P. Calvert

President and Chief Executive Officer

June 12, 2019

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on Wednesday

,

July 31, 2019

. The Proxy Statement and the Annual Report to Stockholders are available at www.BioLargoReport.com.

YOUR VOTE IS IMPORTANT.

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED. FOR SPECIFIC INSTRUCTIONS ON VOTING, PLEASE REFER TO THE INSTRUCTIONS INCLUDED WITH THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS OR THE PROXY CARD OR VOTING INSTRUCTION CARD INCLUDED WITH THE PROXY MATERIALS.

TABLE OF CONTENTS

TO

PROXY

STATEMENT

OF

BIOLARGO, INC.

Index of Exhibits

Exhibit A: Form of Notice of Internet Availability of Proxy Materials

Attachment A: Amendment to Certificate of Incorporation

BIOLARGO, INC.

PROXY STATEMENT FOR THE

2019 ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

The enclosed Proxy is solicited on behalf of the Board of Directors of BioLargo, Inc. (“BioLargo” or the “Company”), for use at the Annual Meeting of Stockholders to be held on Wednesday, July 31, 2019, at 10:00 a.m. local time (the “Annual Meeting”), and at any postponement or adjournment thereof. The Annual Meeting will be held at the Company’s office at 14921 Chestnut Street, Westminster, California 92683. The purposes of the Annual Meeting are set forth in the accompanying Notice of Annual Meeting of Stockholders.

As permitted by the rules adopted by the Securities and Exchange Commission, or SEC, we are making these proxy solicitation materials and the Annual Report for the fiscal year ended December 31, 2018, including the financial statements, available to our stockholders electronically via the Internet. A Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and Annual Report for the fiscal year ended December 31, 2018 and how to vote will be mailed on or about June 20, 2019, to all stockholders entitled to vote at the meeting. Our principal executive offices are located at 14921 Chestnut St., Westminster, California 92683. Our telephone number is (888) 400-2863. Our proxy materials are posted on the Internet at www.BioLargoReport.com.

GENERAL INFORMATION ABOUT THE MEETING

Who May Vote

You may vote if our records show that you own shares of BioLargo as of June 10, 2019 (the “Record Date”). As of the Record Date, we had a total of 145,480,184 shares of common stock issued and outstanding, which were held of record by approximately 650 stockholders, and beneficially by approximately 2,900. As of the Record Date, we had no shares of preferred stock outstanding. You are entitled to one vote for each share that you own.

Voting Your Proxy

If a broker, bank or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted. If a bank, broker or other nominee holds your shares and you wish to attend the meeting and vote in person, you must obtain a “legal proxy” from the record holder of the shares giving you the right to vote the shares.

If you hold your shares in your own name as a holder of record, you may instruct the proxy holders how to vote your common stock in one of the following ways:

|

|

•

|

Vote by Internet

. You may vote via the Internet by following the instructions provided in the Notice or, if you received printed materials, on your proxy card. The website for Internet voting is as indicated on your the Notice and on proxy card. Please have your Notice or proxy card in hand. Internet voting is available 24 hours per day until 11:59 p.m., Eastern Time, on July 30, 2019. You will receive a series of instructions that will allow you to vote your shares of common stock. You will also be given the opportunity to confirm that your instructions have been properly recorded. IF YOU VOTE VIA THE INTERNET, YOU DO NOT NEED TO RETURN YOUR PROXY CARD.

|

|

|

•

|

Vote by Mail

. If you would like to vote by mail, then please mark, sign and date your proxy card and return it promptly in the postage-paid envelope provided.

|

Of course, you may also choose to attend the meeting and vote your shares in person. The proxy holders will vote your shares in accordance with your instructions on the proxy card. If you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board of Directors.

Matters to be Presented

We are not aware of any matters to be presented other than those described in this Proxy Statement. If any matters not described in the Proxy Statement are properly presented at the meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions.

Changing Your Vote

To revoke your proxy instructions if you are a holder of record, you must (i) advise our Corporate Secretary in writing before the proxy holders vote your shares, (ii) deliver later proxy instructions, or (iii) attend the meeting and vote your shares in person. If your shares are held by a bank, broker or other nominee, you must follow the instructions provided by the bank, broker or nominee.

Cost of This Proxy Solicitation

We will pay the cost of this proxy solicitation. We may, on request, reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners. In addition to soliciting proxies by mail, we expect that our directors, officers and employees may solicit proxies in person or by telephone or facsimile. None of these individuals will receive any additional or special compensation for doing this, although we will reimburse these individuals for their reasonable out-of-pocket expenses.

How Votes are Counted

The Annual Meeting will be held if a majority of the outstanding common stock entitled to vote is represented at the meeting. If you have returned valid proxy instructions or attend the meeting in person, your common stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the meeting.

Abstentions and Broker Non-Votes

Shares that are voted “WITHHELD” or “ABSTAIN” are treated as being present for purposes of determining the presence of a quorum and as entitled to vote on a particular subject matter at the Annual Meeting. If you hold your common stock through a bank, broker or other nominee, the broker may be prevented from voting shares held in your account on some proposals (a “broker non-vote”) unless you have given voting instructions to the bank, broker or nominee. Shares that are subject to a broker non-vote are counted for purposes of determining whether a quorum exists but not for purposes of determining whether a proposal has passed.

Our Voting Recommendations

When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. However, if no specific instructions are given, the shares will be voted in accordance with the following recommendations of our Board of Directors:

|

|

●

|

“FOR” the election of Dennis P. Calvert, Kenneth R. Code, Dennis E. Marshall, Joseph L. Provenzano, Kent C. Roberts II, John S. Runyan and Jack B. Strommen to the Board of Directors;

|

|

|

●

|

“FOR” the advisory vote on executive compensation.

|

|

|

●

|

“FOR” the proposal to ratify the appointment of Haskell & White LLP as our independent public accounting firm for the 2019 fiscal year.

|

|

|

●

|

“FOR” the proposal to authorize a reverse stock split of our common stock at a ratio between one-for-four (1:4) and one-for-forty (1:40), if and as determined by our board of directors, at any time before the next meeting of stockholders of the Company.

|

|

|

●

|

“FOR” the proposal to authorize a reduction of the number of shares of common stock authorized by our Amended and Restated Certificate of Incorporation, if and in an amount as determined by our board of directors.

|

Deadlines for Receipt of Stockholder Proposals

Stockholders may present proposals for action at a future meeting only if they comply with the requirements of the proxy rules established by the SEC and our bylaws. Stockholder proposals that are intended to be included in our Proxy Statement and form of Proxy relating to the meeting for our 2020 Annual Meeting of Stockholders under rules set forth in the Securities Exchange Act of 1934, as amended, or the Securities Exchange Act, must be received by us no later than December 31, 2019 to be considered for inclusion. All proposals should be addressed to the Corporate Secretary, BioLargo, Inc., 14921 Chestnut Street, Westminster, California 92683.

MATTER I

ELECTION OF DIRECTORS

The nominees listed below have been selected by the Board. Other than Mr. Strommen, all of the nominees are currently members of the Board. If elected, each nominee will serve until the annual meeting of stockholders to be held in 2020 (or action by written consent of stockholders in lieu thereof), or until his successor has been duly elected and qualified.

Composition of Board of Directors

Our bylaws provide that the Board shall consist of not less than two and not more than seven directors. The Board currently consists of seven members. The Board has fixed the size of the Board to be elected in 2019 at seven members. There are no family relationships among any of our current directors, the nominees for directors and our executive officers.

In the event that a nominee is unable or declines to serve as a director at the time of the Annual Meeting, the present Board will fill any such vacancy. As of the date of this Proxy Statement, the Board is not aware of any nominee who is unable or will decline to serve as a director.

The Board does not have a Nominating/Corporate Governance Committee primarily because capital constraints, the Company’s early operational state, and the size of the current Board make constituting and administering such a committee excessively burdensome and costly. With respect to the nominees for election in 2019, every director of the Company participated in the decisions relating to the nomination of directors.

Nominees for Election as Directors

The following is certain information as of the Record Date regarding the nominees for election as directors.

|

Name

|

|

Position with Company

|

|

Age

|

|

Director Since

|

|

Dennis P. Calvert

|

|

President, Chief Executive Officer, Chairman, and Director

|

|

56

|

|

June 2002

|

|

Kenneth R. Code

|

|

Chief Science Officer, Director

|

|

72

|

|

April 2007

|

|

Dennis E. Marshall

(

2

)(

4

)(

6

)

|

|

Director

|

|

76

|

|

April 2006

|

|

Joseph L. Provenzano

|

|

Vice President of Operations, Corporate Secretary and Director

|

|

50

|

|

June 2002

|

|

Kent C. Roberts, II

(1)(3)

|

|

Director

|

|

59

|

|

August 2011

|

|

John S. Runyan

(1)

(5)

(

6

)

|

|

Director

|

|

80

|

|

October 2011

|

|

Jack B. Strommen

|

|

Director

|

|

49

|

|

June 2017

|

|

(1)

|

Member of Audit Committee

|

|

(2)

|

Member of Compensation Committee

|

|

(3)

|

Member of Nominating and Governance Committee

|

|

(

4

)

|

Chairman of Audit Committee

|

|

(

5

)

|

Chairman of Compensation Committee

|

|

(6)

|

Chairman of Nominating and Governance Committee

|

Vote Required

If a quorum is present, the nominees receiving the highest number of votes will be elected to the Board of Directors. Abstentions and broker non-votes will have no effect on the election of directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF DENNIS P. CALVERT, KENNETH R. CODE, DENNIS E. MARSHALL, JOSEPH L. PROVENZANO, KENT C. ROBERTS II, JOHN S. RUNYAN

AND JACK B. STROMMEN

TO THE BOARD OF DIRECTORS.

Biographical Information Regarding Directors and Nominees

Dennis P. Calvert

is our President, Chief Executive Officer and Chairman of the Board. He also serves in the same positions for BioLargo Life Technologies, Inc. and BioLargo Water U.S.A., Inc., both wholly owned subsidiaries, and chairman of the board of directors of our subsidiaries Odor-No-More, Inc., Clyra Medical Technologies, Inc. and BioLargo Water, Inc. (Canada). Mr. Calvert was appointed a director in June 2002 and has served as President and Chief Executive Officer since June 2002, Corporate Secretary from September 2002 until March 2003 and Chief Financial Officer from March 2003 through January 2008. Mr. Calvert holds a B.A. degree in Economics from Wake Forest University, where he was a varsity basketball player. Mr. Calvert also studied at Columbia University and Harding University. He also serves on the board of directors at The Maximum Impact Foundation, a 501(c)(3), committed to bridging the gap for lifesaving work around the globe for the good of man and in the name of Christ. He serves as a Director of Sustain SoCal (formerly known as Sustain OC) in and serves on their “Technology Breakthrough” committee. Sustain SoCal is a trade association that seeks to promote economic growth in the Orange County clean technology industry. Most recently, he joined the Board of Directors at The Maritime Alliance of San Diego and also serves on the Board of Directors of Tilly’s Life Center, a nonprofit charitable foundation aimed at empowering teens with a positive mindset and enabling them to effectively cope with crisis, adversity and tough decisions. He is also an Eagle Scout. He is married and has two children. He has been an active coach in youth sports organizations and ministry activity in his home community. Mr. Calvert has an extensive entrepreneurial background as an operator, investor and consultant. Prior to his work with BioLargo, he had participated in more than 300 consulting projects and more than 50 acquisitions as well as various financing transactions and companies that ranged from industrial chemicals, healthcare management, finance, telecommunications and consumer products.

Kenneth R. Code

is our Chief Science Officer. He has been a director since April 2007. Mr. Code is our single largest stockholder. He is the founder of IOWC, which is engaged in the research and development of advanced disinfection technology, and from which the Company acquired its core iodine technology in April 2007. Mr. Code has authored several publications and holds several patents, with additional pending, concerning advanced iodine disinfection. Mr. Code graduated from the University of Calgary, Alberta, Canada.

Dennis E. Marshall

has been a director since April 2006. Mr. Marshall has over 45 years of experience in real estate, asset management, management level finance and operations-oriented management. Since 1981, Mr. Marshall has been a real estate investment broker in Orange County, California, representing buyers and sellers in investment acquisitions and dispositions. From March 1977 to January 1981, Mr. Marshall was a real estate syndicator at McCombs Corporation as well as the assistant to the Chairman of the Board. While at McCombs Corporation, Mr. Marshall became the Vice President of Finance, where he financially monitored numerous public real estate syndications. From June 1973 to September 1976, Mr. Marshall served as an equity controller for the Don Koll Company, an investment builder and general contractor firm, at which Mr. Marshall worked closely with institutional equity partners and lenders. Before he began his career in real estate, Mr. Marshall worked at Arthur Young & Co. (now Ernst & Young) from June 1969 to June 1973, where he served as Supervising Senior Auditor and was responsible for numerous independent audits of publicly held corporations. During this period, he obtained Certified Public Accountant certification. Mr. Marshall earned a degree in Accounting from the University of Texas, Austin in 1966 and earned a Master of Science Business Administration from the University of California, Los Angeles in 1969. Mr. Marshall serves as Chairman of the Audit Committee.

Joseph L. Provenzano

has been a director since June 2002, assumed the role of Corporate Secretary in March 2003, was appointed Executive Vice President of Operations in January 2008, was elected President of our subsidiary, Odor-No-More, Inc., upon the commencement of its operations in January 2010. He is a co-inventor on several of the company's patents and proprietary manufacturing processes, and has developed over 30 products from our CupriDyne® technology. Mr. Provenzano began his corporate career in 1988 in the marketing field. In 2001 he began work with an investment holding company to manage their mergers and acquisitions department, participating in more than 50 corporate mergers and acquisitions.

Kent C. Roberts II

has been a director since August 2011. He is a partner at Acacia Investment Partners, a management consulting firm serving the asset management industry. Mr. Roberts has had a long and successful career in the asset management business as a north American practice leader or at the senior partner level. His investment experience spans 25 years where he served in senior positions in business management, trading, currency risk management, business development and marketing strategy, as well as governance and oversight roles. He has worked for both large firms as well as boutiques that bring unique investment expertise to investors around the world. Those firms include: Global Evolution USA, First Quadrant and Bankers Trust Company. He has presented at numerous industry conferences and as a guest speaker at numerous industry conferences and events. Prior to entering the financial services industry Mr. Roberts worked in the oil and gas exploration industry. Mr. Roberts received a MBA in Finance from the University of Notre Dame and a BS in Agriculture and Watershed Hydrology from the University of Arizona. Mr. Roberts holds a series 3 securities license.

John S. Runyan

has been a director since October 2011. He has spent his career in the food industry. He began as a stock clerk at age 12, and ultimately served the Fleming Companies for 38 years, his last 10 years as a Senior Executive Officer in its corporate headquarters where he was Group President of Price Impact Retail Stores with annual sales of over $3 billion. He retired from Fleming in 2001, and established JSR&R Company Executive Advising, with a primary emphasis in the United States and international food business. His clients have included Coca Cola, Food 4 Less Price Impact Stores, IGA, Inc., Golden State Foods, Bozzuto Companies Foodstuffs New Zealand, Metcash Australia and McLane International. In 2005, he joined Associated Grocers in Seattle Washington as President and CEO, overseeing its purchase in 2007 by Unified Grocers, at which time he became Executive Advisor to its CEO and to its President. Mr. Runyan currently serves on the board of directors of Western Association of Food Chains and Retailer Owned Food Distributors of America. Additionally, Mr. Runyan served eight years as a board member of the City of Hope’s Northern California Food Industry Circle, which included two terms as President, and was recognized with the City of Hope “Spirit of Life” award. He was the first wholesale executive to be voted “Man of the Year” by Food People Publication. He is a graduate of Washburn University, which recognized his business accomplishments in 2007 as the honoree from the School of Business “Alumni Fellow Award.” Mr. Runyan serves as Chairman of the Compensation Committee.

Jack B. Strommen

is a member of the board of directors of our subsidiary, Clyra Medical Technologies, as the representative of Sanatio Capital LLC. Mr. Strommen is the CEO of PD Instore, a leader in the design, production and installation of retail environments and displays for many Fortune 500 companies including Target, Adidas, Verizon, Disney and Sony. He is also the Chairman of Our House Films, an angel investor in several private companies ranging from bio-tech to med-tech to real estate, and serves on the board of directors of several private and public companies. A relentless force of growth, Mr. Strommen has taken his company, PD Instore, to new and ever increasing levels of success. Mr. Strommen purchased the family owned, local based printing firm, from his grandfather in 1999. With Jay’s vision and leadership, it went from a local company with $25M in revenues to a global company with $180M in global sales. Jay led the company in a private sale in 2015, remaining as CEO.

Other Executive Officer of the Company

The following is certain information as of the Record Date regarding the executive officer of the Company not discussed above.

|

Name

|

|

Position with Company

|

|

Age

|

|

Officer Since

|

|

Charles K. Dargan, II

|

|

Chief Financial Officer

|

|

64

|

|

2008

|

Charles K. Dargan II

is our Chief Financial Officer and has served as such since February 2008. Since January 2003, Mr. Dargan has served as founder and principal of CFO 911, an organization of senior executives that provides accounting, finance and operational expertise to both public and private companies who are at strategic inflection points of their development and helps them effectively transition from one business stage to another. From March 2000 to January 2003, Mr. Dargan was the Chief Financial Officer of Semotus Solutions, Inc., an American Stock Exchange-listed wireless mobility software company. Mr. Dargan also serves as a director of Hiplink Software, Inc. and CPSM, Inc. Further, Mr. Dargan began his finance career in investment banking with Drexel Burnham Lambert and later became Managing Director of two regional firms, including Houlihan Lokey Howard & Zukin, where he was responsible for the management of the private placement activities of the firm. Mr. Dargan received his B.A. degree in Government from Dartmouth College, his M.B.A. degree and M.S.B.A. degree in Finance from the University of Southern California. Mr. Dargan is a CPA (inactive).

CORPORATE GOVERNANCE

Our corporate website,

w

w

w.biolargo.com

, contains the charters for our Audit, Compensation and Nominating/Corporate Governance Committees, and certain other corporate governance documents and policies, including our Code of Ethics. Any changes to these documents and any waivers granted with respect to our code of ethics will be posted at

www.biolargo.com

. In addition, we will provide a copy of any of these documents without charge to any stockholder upon written request made to Corporate Secretary, BioLargo, Inc., 14921 Chestnut St., Westminster, California 92683. The information at

www.biolargo.com

is not, and shall not be deemed to be, a part of this Proxy Statement or incorporated by reference into this or any other filing we make with the SEC.

Director Independence

The Board has determined that each of Messrs. Marshall, Roberts, Runyan and Strommen is independent as defined under applicable Nasdaq Stock Market, LLC (“Nasdaq”) listing standards. The Board has determined that none of Messrs. Calvert, Code or Provenzano is independent as defined under applicable Nasdaq listing standards. None of Messrs. Calvert, Code or Provenzano serves on any committees of the Board.

Meetings of the Board

Our board of directors held four meetings during 2018, and acted via unanimous written consent seven times. Each of the incumbent directors attended all the meetings of our board of directors and committees on which the director served, except for one absence at the annual board meeting in May 2018, and two absences at a meeting in July 2018. Each of our directors is encouraged to attend our Annual Meeting of Stockholders, when these are held, and to be available to answer any questions posed by stockholders to such director.

Communications with the Board

The following procedures have been established by the Board in order to facilitate communications between our stockholders and the Board:

|

|

•

|

Stockholders may send correspondence, which should indicate that the sender is a Stockholder, to the Board or to any individual director, by mail to Corporate Secretary, BioLargo, Inc., 14921 Chestnut Street, Westminster, California 92683.

|

|

|

•

|

Our Corporate Secretary will be responsible for the first review and logging of this correspondence and will forward the communication to the director or directors to whom it is addressed unless it is a type of correspondence which the Board has identified as correspondence which may be retained in our files and not sent to directors. The Board has authorized the Corporate Secretary to retain and not send to directors communications that: (a) are advertising or promotional in nature (offering goods or services), (b) solely relate to complaints by clients with respect to ordinary course of business customer service and satisfaction issues or (c) clearly are unrelated to our business, industry, management or Board or committee matters. These types of communications will be logged and filed but not circulated to directors. Except as set forth in the preceding sentence, the Corporate Secretary will not screen communications sent to directors.

|

|

|

•

|

The log of stockholder correspondence will be available to members of the Board for inspection. At least once each year, the Corporate Secretary will provide to the Board a summary of the communications received from stockholders, including the communications not sent to directors in accordance with the procedures set forth above.

|

Our stockholders may also communicate directly with the non-management directors as a group, by mail addressed to Dennis E. Marshall, c/o Corporate Secretary, BioLargo, Inc., 14921 Chestnut Street, Westminster, California 92683.

Our Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding questionable accounting, internal controls, and financial improprieties or auditing matters. Any of our employees may confidentially communicate concerns about any of these matters by mail addressed to Audit Committee, c/o Corporate Secretary, BioLargo, Inc., 14921 Chestnut Street, Westminster, California 92683.

All of the reporting mechanisms are also posted on our corporate website,

www.biolargo.com

. Upon receipt of a complaint or concern, a determination will be made whether it pertains to accounting, internal controls or auditing matters and, if it does, it will be handled in accordance with the procedures established by the Audit Committee.

Committees of the Board of Directors

Our board of directors has established an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee.

The Audit Committee meets with management and our independent registered public accounting firm to review the adequacy of internal controls and other financial reporting matters. Dennis E. Marshall served as Chairman of the Audit Committee during 2018 and continues to serve in that capacity. John S. Runyan and Kent C. Roberts II, current board members, also serve on the Audit Committee. Our board of directors has determined that Mr. Marshall qualifies as an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K of the Securities Exchange Act of 1934, as amended. The Audit Committee met four times in 2018.

The Compensation Committee reviews the compensation for all our officers and directors and affiliates. The Committee also administers our equity incentive option plan. Mr. Runyan served as Chairman of the Compensation Committee during 2018. Mr. Marshall also serves on the Compensation Committee. The Compensation Committee met once and acted by consent three times during 2018.

Our board of directors did not modify any action or recommendation made by the Compensation Committee with respect to executive compensation for the 2017 or 2018 fiscal years. It is the opinion of the Compensation Committee that the executive compensation policies and plans provide the necessary total remuneration program to properly align their performance and the interests of our stockholders using competitive and equitable executive compensation in a balanced and reasonable manner, for both the short and long term.

The Nominating and Corporate Governance Committee was established in November 2018. Its responsibilities include to identify and screen individuals qualified to become members of the Board, to make recommendations to the Board regarding to the Board regarding the selection and approval of the nominees for director to be submitted to a stockholder vote at the annual meeting of stockholders, subject to approval by the Board, to development corporate governance guidelines and oversee corporate governance practices, to develop a process for an annual evaluation of the Board and its committees, to review all director compensation and benefits, to review, approve and oversee and related party transaction, to develop and recommend director independent standards, and to develop and recommend a company code of conduct, to investigate any alleged breach and enforce the provisions of the code. This committee did not meet in 2018.

Our board of directors follows the written code of ethics that applies to its principal executive officers, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Board Leadership Structure

Mr. Calvert serves as both principal executive officer and Chairman of the Board. The Company does not have a lead independent director. Messrs. Marshall, Roberts, Strommen and Runyan serve as independent directors who provide active and effective oversight of our strategic decisions. As of the date of this filing, the Company has determined that the leadership structure of the Board has permitted the Board to fulfill its duties effectively and efficiently and is appropriate given the size and scope of the Company and its financial condition.

The Board’s Role in Risk Oversight

As a smaller company, our executive management team, consisting of Messrs. Calvert and Code, are also members of our Board. Our board of directors, including our executive management members and independent directors, is responsible for overseeing our executive management team in the execution of its responsibilities and for assessing our company’s approach to risk management. Our board of directors exercises these responsibilities on an ongoing basis as part of its meetings and through its committees. Each member of the management team has direct access to the other Board members, and our committees of our board of directors, to ensure that all risk issues are frequently and openly communicated. Our board of directors closely monitors the information it receives from management and provides oversight and guidance to our executive management team regarding the assessment and management of risk. For example, our board of directors regularly reviews our company’s critical strategic, operational, legal and financial risks with management to set the tone and direction for ensuring appropriate risk taking within the business.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, certain officers and persons holding 10% or more of the Company’s Common stock to file reports regarding their ownership and regarding their acquisitions and dispositions of our Common stock with the SEC. Such persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To our knowledge, based solely upon review of Forms 3, 4, and 5 (and amendments thereto) and written representations provided to us by executive officers, directors and stockholders beneficially owning 10% or greater of the outstanding shares, we believe that such persons filed pursuant to the requirements of the SEC on a timely basis during the year ended December 31, 2018, with the exception of one report filed by our chief financial officer.

EXECUTIVE COMPENSATION

The following table sets forth all compensation earned for services rendered to our company in all capacities for the fiscal years ended December 31, 2017 and 2018, by our principal executive officer and our three most highly compensated executive officers other than our principal executive officer, collectively referred to as the “Named Executive Officers.”

Summary Compensation Table

|

Name and

Principal

Positions

|

|

|

Year

|

|

Salary

|

|

|

Stock

Awards

(1)

|

|

|

Option

Awards

(1)

|

|

|

All other

Compensation

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dennis P. Calvert,

|

|

|

2017

|

|

$

|

288,603

|

(2)

|

|

$

|

—

|

(3)

|

|

$

|

195,894

|

(4)

|

|

$

|

49,600

|

(5)

|

|

$

|

534,097

|

|

|

Chairman, Chief Executive Officer and President

|

|

|

2018

|

|

$

|

288,603

|

(2)

|

|

$

|

—

|

(3)

|

|

$

|

335,820

|

(4)

|

|

$

|

31,325

|

(5)

|

|

$

|

655,748

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth R. Code,

|

|

|

2017

|

|

$

|

288,603

|

(6)

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

72,600

|

(5)

|

|

$

|

361,203

|

|

|

Chief Science Officer

|

|

|

2018

|

|

$

|

288,603

|

(6)

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

12,600

|

(5)

|

|

$

|

301,203

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charles K. Dargan

|

|

|

2017

|

|

$

|

—

|

|

|

|

|

|

|

$

|

236,250

|

(7)

|

|

$

|

—

|

|

|

$

|

236,250

|

|

|

Chief Financial Officer

|

|

|

2018

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

87,750

|

(7)

|

|

$

|

—

|

|

|

$

|

87,750

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joseph Provenzano,

|

|

|

2017

|

|

$

|

169,772

|

(8)

|

|

$

|

—

|

|

|

$

|

47,000

|

(9)

|

|

$

|

12,900

|

(10)

|

|

$

|

229,672

|

|

|

Corporate Secretary; President Odor-No-More, Inc

|

|

|

2018

|

|

$

|

169,772

|

(8)

|

|

$

|

—

|

|

|

$

|

37,600

|

(9)

|

|

$

|

16,565

|

(5)

|

|

$

|

224,937

|

|

____________

|

(1)

|

Our company recognizes compensation expense for stock option awards on a straight-line basis over the applicable service period of the award, which is the vesting period. Share-based compensation expense is based on the grant date fair value estimated using the Black-Scholes method. The amounts in the “Stock Awards” and “Option Awards” columns reflect the aggregate fair value of awards of stock or options calculated as of the grant date. These amounts do not represent cash paid to or realized by any of the recipients during the years indicated.

|

|

(2)

|

In 2017 and 2018 the employment agreement for Mr. Calvert provided for a base salary of $288,603 and other compensation for health insurance and an automobile allowance. During the year ended December 31, 2017, Mr. Calvert agreed to forego $27,796 of cash compensation due to him and accept 71,273 shares of our common stock in lieu thereof, at $0.39 per share. During the year ended December 31, 2018, Mr. Calvert agreed forego $151,149 of cash compensation due to him and accept 534,619 shares of our common stock in lieu thereof, at prices ranging between $0.24 - $0.43 per share. The common stock issued to Mr. Calvert is subject to a “lock up agreement” that prohibits Mr. Calvert from selling the shares until the earlier of (i) the sale of the Company; (ii) the successful commercialization of BioLargo’s products or technologies as demonstrated by its receipt of at least $3,000,000 in cash, or the recognition of $3,000,000 in revenue, over a 12-month period from the sale of products and/or the license of technology; and (iii) the Company’s breach of the employment agreement between the Company and Calvert dated May 2, 2017 and resulting in Calvert’s termination. (See “Employment Agreements—

Dennis P. Calvert

” and “Outstanding Equity Awards at Fiscal Year-End” below for more details).

|

|

(3)

|

On May 2, 2017, pursuant to his employment agreement, we granted to our president, Dennis P. Calvert, 1,500,000 shares of common stock, subject to a “lock-up agreement” whereby the shares remain unvested until the occurrence of certain events. As no such events occurred during 2017, and thus no shares vested, the value of the award in 2017 was recorded as zero. (See “Employment Agreements—

Dennis P. Calvert

” and “Outstanding Equity Awards at Fiscal Year-End” below for more details.)

|

|

(4)

|

On May 2, 2017, pursuant to his employment agreement, we granted to our president, Dennis P. Calvert, an option to purchase 3,731,322 shares of the Company’s common stock. The option is a non-qualified stock option, exercisable at $0.45 per share, the closing price of our common stock on the grant date, exercisable for ten years from the date of grant, and vesting in equal increments on the anniversary of the option agreement for five years. Any portion of the option which has not yet vested shall immediately vest in the event of, and prior to, a change of control, as defined in the employment agreement. The option cliff vests in 4 equal amounts on each anniversary of the option agreement. The option agreement contains the other terms standard in option agreements issued by the Company, including provisions for a cashless exercise. The fair value of this option totaled $1,679,095 and will be amortized monthly through May 2, 2022. During the year ended December 31, 2017 and 2018, we recorded $195,894 and $335,820, respectively, of selling, general and administrative expense related to the option.

|

|

(5)

|

Includes health insurance premiums, automobile allowance, and bonus.

|

|

(6)

|

In 2017 and 2018 the employment agreement for Mr. Code provided for a base salary of $288,603 and other compensation of $12,600. During the year ended December 31, 2017, Mr. Code agreed to forego $30,198 of cash compensation due to him and accept 77,432 shares of our common stock in lieu thereof, at $0.39 per share. During the year ended December 31, 2018, Mr. Calvert agreed forego $167,535 of cash compensation due to him and accept 596,417 shares of our common stock in lieu thereof, at prices ranging between $0.24 - $0.43 per share. See “Employment Agreements—Kenneth R. Code” and “Outstanding Equity Awards at Fiscal Year-End” below for more details.

|

|

(7)

|

Our Chief Financial Officer, Charles K. Dargan II, did not receive any cash compensation during the years ended December 31, 2017 and 2018. His only compensation is the issuance, each year, of an option to purchase 300,000 shares of our common stock, with 25,000 shares vesting each month. The value set forth in the table reflects the fair value of the options issued that vested during the 12 months of the years indicated. See “Employment Agreements—Charles K. Dargan II” and “Outstanding Equity Awards at Fiscal Year-End” below for more details.

|

|

(8)

|

In 2017 and 2018, the employment agreement for Mr. Provenzano provided for a base salary of $169,772, and other compensation for health insurance and automobile allowance. See “Employment Agreements – Joseph Provenzano” and “Outstanding Equity Awards at Fiscal Year-End” below for more details.

|

|

(9)

|

On October 23, 2017, we issued to Mr. Provenzano an option to purchase 100,000 shares of our common stock at $0.47 per share, which expires October 23, 2027, and vests monthly in 10,000 share increments beginning November 23, 2017. The remaining fair value of $37,600 vested during 2018.

|

|

(10)

|

Includes a $7,500 cash bonus and $5,400 in automobile expense.

|

Employment Agreements

Dennis P. Calvert

On May 2, 2017, BioLargo, Inc. (the “Company”) and its President and Chief Executive Officer Dennis P. Calvert entered into an employment agreement (the “Calvert Employment Agreement”), replacing in its entirety the previous employment agreement with Mr. Calvert dated April 30, 2007.

The Calvert Employment Agreement provides that Mr. Calvert will continue to serve as the President and Chief Executive Officer of the Company and receive base compensation equal to his current rate of pay of $288,603 annually. In addition to this base compensation, the agreement provides that he is eligible to participate in incentive plans, stock option plans, and similar arrangements as determined by the Company’s Board of Directors, health insurance premium payments for himself and his immediate family, a car allowance of $800 per month, paid vacation of four weeks per year, and bonuses in such amount as the Compensation Committee may determine from time to time.

The Calvert Employment Agreement provides that Mr. Calvert will be granted an option (the “Option”) to purchase 3,731,322 shares of the Company’s common stock. The Option shall be a non-qualified stock option, exercisable at $0.45 per share, which represents the market price of the Company’s common stock as of the date of the agreement, exercisable for ten years from the date of grant and vesting in equal increments over five years. Notwithstanding the foregoing, any portion of the Option which has not yet vested shall be immediately vested in the event of, and prior to, a change of control, as defined in the Calvert Employment Agreement. The agreement also provides for a grant of 1,500,000 shares of common stock, subject to the execution of a “lock-up agreement” whereby the shares remain unvested unless and until the earlier of (i) a sale of the Company, (ii) the successful commercialization of the Company’s products or technologies as demonstrated by its receipt of at least $3,000,000 in cash, or the recognition of $3,000,000 in revenue, over a 12-month period from the sale of products and/or the license of technology, and (iii) the Company’s breach of the employment agreement resulting in his termination. The Option contains the other terms standard in option agreements issued by the Company, including provisions for a cashless exercise.

The Calvert Employment Agreement has a term of five years, unless earlier terminated in accordance with its terms. The Calvert Employment Agreement provides that Mr. Calvert’s employment may be terminated by the Company due to his death or disability, for cause, or upon a merger, acquisition, bankruptcy or dissolution of the Company. “Disability” as used in the Calvert Employment Agreement means physical or mental incapacity or illness rendering Mr. Calvert unable to perform his duties on a long-term basis (i) as evidenced by his failure or inability to perform his duties for a total of 120 days in any 360-day period, or (ii) as determined by an independent and licensed physician whom Company selects, or (iii) as determined without recourse by the Company’s disability insurance carrier. “Cause” means that Mr. Calvert has (i) engaged in willful misconduct in connection with the Company’s business; or (ii) been convicted of, or plead guilty or

nolo contendre

in connection with, fraud or any crime that constitutes a felony or that involves moral turpitude or theft. If Mr. Calvert’s employment is terminated due to merger or acquisition, then he will be eligible to receive the greater of (i) one year’s compensation plus an additional one half year for each year of service since the effective date of the employment agreement or (ii) one year’s compensation plus an additional one half year for each year remaining in the term of the agreement. Otherwise, he is only entitled to receive compensation due through the date of termination.

The Calvert Employment Agreement requires Mr. Calvert to keep certain information confidential, not to solicit customers or employees of the Company or interfere with any business relationship of the Company, and to assign all inventions made or created during the term of the Calvert Employment Agreement as “work made for hire”.

Kenneth R. Code

We entered into an employment agreement dated as of April 29, 2007 with Mr. Code, our Chief Science Officer (the “Code Employment Agreement”), which we amended on December 28, 2012 such that his salary will remain at $288,603, the level paid in April 2012, with no further automatic increases. The Code Employment Agreement can automatically renew for one year periods on April 29th of each year but may be terminated “without cause” at any time upon 120 days’ notice, and upon such termination, Mr. Code would not receive the severance originally provided for. All other terms in the 2007 agreement remain the same in the Code Employment Agreement.

In addition, Mr. Code will be eligible to participate in incentive plans, stock option plans, and similar arrangements as determined by our board of directors. When such benefits are made available to our senior employees, Mr. Code is also eligible to receive health insurance premium payments for himself and his immediate family, a car allowance of $800 per month, paid vacation of four weeks per year plus an additional two weeks per year for each full year of service during the term of the agreement up to a maximum of 10 weeks per year, life insurance equal to three times his base salary and disability insurance.

The Code Employment Agreement further requires Mr. Code to keep certain information confidential, not to solicit customers or employees of our company or interfere with any business relationship of our company, and to assign all inventions made or created during the term of the Code Employment Agreement as “work made for hire”.

Charles K. Dargan II

Charles K. Dargan, II has served as our Chief Financial Officer since February 2008 pursuant to an engagement agreement with his company, CFO 911, that has been renewed each year. For the renewal effective February 1, 2015, Mr. Dargan was compensated through the issuance of an option to purchase an additional 300,000 shares of our common stock, at an exercise price of $0.57 per share, to expire September 30, 2025, and vest over the term of the engagement with 120,000 shares vested as of September 30, 2015, and the remaining shares to vest 15,000 monthly, provided that the Engagement Extension Agreement with Mr. Dargan has not been terminated prior to each vesting date. Mr. Dargan receives no cash compensation from our company and continues to serve as our Chief Financial Officer.

On February 10, 2017, we and Mr. Dargan further extended his engagement agreement. The extension provides for an additional term to expire September 30, 2017 (the “Extended Term”), and is retroactively effective to the termination of the prior extension on October 1, 2016. This more recent extension again compensates Mr. Dargan through the issuance of an option to purchase 300,000 shares of the Company’s common stock. The strike price of the option is $0.69 per share, which is equal to the closing price of the Company’s common stock on February 10, 2017, expires February 10, 2027, and vests over the term of the engagement with 125,000 shares having vested as of February 10, 2017, and the remaining shares to vest 25,000 shares monthly beginning March 1, 2017, and each month thereafter, so long as his agreement is in full force and effect.

On December 31, 2017, we and Mr. Dargan further extended his engagement agreement. The extension provides for an additional term to expire September 30, 2018 (the “Extended Term”), and is retroactively effective to the termination of the prior extension on October 1, 2017. This more recent extension again compensates Mr. Dargan through the issuance of an option to purchase 300,000 shares of the Company’s common stock. The strike price of the option is $0.39 per share, which is equal to the closing price of the Company’s common stock on December 29, 2017, expires December 31, 2027, and vests over the term of the engagement with 75,000 shares having vested as of December 31, 2017, and the remaining shares to vest 25,000 shares monthly beginning January 31, 2018, and each month thereafter, so long as his agreement is in full force and effect.

On January 16, 2019, we and Mr. Dargan formally agreed to extend his engagement agreement. The extension provides for an additional term to expire September 30, 2019, and is retroactively effective to the termination of the prior extension on September 30, 2018. Mr. Dargan has been serving as the Company’s Chief Financial Officer since such termination pursuant to the terms of the December 31, 2017 extension. This extension again compensates Mr. Dargan through the issuance of an option to purchase 300,000 shares of the Company’s common stock, at a strike price equal to the closing price of the Company’s common stock on January 16, 2019 of $0.223, to expire January 16, 2029, and to vest over the term of the engagement with 75,000 shares having vested as of December 31, 2018, and the remaining shares to vest 25,000 shares monthly beginning January 31, 2019, and each month thereafter, so long as the engagement agreement is in full force and effect. The Option was issued pursuant to the Company’s 2018 Equity Incentive Plan. The issuance of the Option is Mr. Dargan’s sole source of compensation for the extended term. As was the case in all prior terms of his engagement, there is no cash component of his compensation for the Extended Term. Mr. Dargan is eligible to be reimbursed for business expenses he incurs in connection with the performance of his services as the Company’s Chief Financial Officer (although he has made no such requests for reimbursement in the past). All other provisions of the Engagement Agreement not expressly amended pursuant to the Engagement Extension Agreement remain the same, including provisions regarding indemnification and arbitration of disputes.

Joseph Provenzano

Mr. Provenzano has served as Vice President of Operations since January 1, 2008, in addition to continuing to serve as our Corporate Secretary.

Mr. Provenzano’s employment agreement provided a base compensation in 2016 of $169,772 annually. Mr. Provenzano is also entitled to reimbursement for authorized expenses he incurs in the course of his employment. In addition, Mr. Provenzano is eligible to receive discretionary bonuses, participate in benefits made generally available to our employees and receive grants under our 2007 Equity Plan.

Mr. Provenzano’s employment agreement automatically renews each year unless we give at least 90 days’ notice of non-renewal, and contains additional provisions typical of an agreement of this nature.

D

irector Compensation

Each director who is not an officer or employee of our company receives an annual retainer of $60,000, paid in cash or shares of our common stock, or options to purchase our common stock (pursuant to a plan put in place by our board of directors), in our sole discretion. Historically, all but one director has received the entirety of his fees in the form of options to purchase stock, rather than cash. In addition, Mr. Marshall and Mr. Runyan each receive an additional $15,000 for their services as the chairman of the Audit Committee and chairman of the Compensation Committee, respectively. The following table sets forth information for the fiscal years ended December 31, 2018 regarding compensation of our non-employee directors. Our employee directors do not receive any additional compensation for serving as a director.

|

Name

|

|

Fees Earned

or Fees Paid

in Cash

|

|

|

Option

Awards

|

|

|

Non-Equity

Incentive Plan

Compensation

|

|

|

All Other

Compensation

|

|

|

Total

|

|

|

Dennis E. Marshall

|

|

$

|

75,000

|

(1)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

75,000

|

|

|

Jack B. Strommen

|

|

$

|

60,000

|

(2)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

60,000

|

|

|

Kent C. Roberts III

|

|

$

|

60,000

|

(3)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

60,000

|

|

|

John S. Runyan

|

|

$

|

75,000

|

(4)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

75,000

|

|

___________

|

(1)

|

In 2018, Mr. Marshall earned director fees of $75,000, which included compensation for serving as Chairman of the Audit Committee of our board of directors. None of these fees was paid in cash. During 2018, Mr. Marshall received options in lieu of cash consisting of (i) on March 31, 2018, an issuance of an option to purchase 72,394 shares of our common stock at $0.26 per share, (ii) on June 30, 2018, an issuance of an option to purchase 43,605 shares of our common stock at $0.43 per share, (iii) on September 30, 2018, an issuance of an option to purchase 69,444 shares of our common stock at $0.27 per share, and (iv) on December 31, 2018, an issuance of an option to purchase 78,125 shares of our common stock at $0.24 per share.

|

|

|

|

|

(2)

|

In 2018 Mr. Strommen earned director fees of $60,000. During 2018, Mr. Strommen received options in lieu of cash consisting of (i) on March 31, 2018, an issuance of an option to purchase 57,916 shares of our common stock at $0.43 per share, (ii) on June 30, 2018, an issuance of an option to purchase 34,884 shares of our common stock at $0.43 per share, (iii) on September 30, 2018, an option to purchase 55,556 shares of our common stock at $0.27 per share, and (iv) on December 31, 2018, an option to purchase 62,500 shares of our common stock at $0.34 per share.

|

|

|

|

|

(3)

|

In 2018 Mr. Roberts earned director fees of $60,000. During 2018, Mr. Roberts received options in lieu of cash consisting of (i) on March 31, 2018, an issuance of an option to purchase 57,916 shares of our common stock at $0.43 per share, (ii) on June 30, 2018, an issuance of an option to purchase 34,884 shares of our common stock at $0.43 per share, (iii) on September 30, 2018, an option to purchase 55,556 shares of our common stock at $0.27 per share, and (iv) on December 31, 2018, an option to purchase 62,500 shares of our common stock at $0.34 per share.

|

|

|

|

|

(4)

|

In 2018, Mr. Runyan earned director fees of $75,000. None of these fees was paid in cash. During 2018, Mr. Runyan received options in lieu of cash consisting of (i) on March 31, 2018, an issuance of an option to purchase 72,394 shares of our common stock at $0.26 per share, (ii) on June 30, 2018, an issuance of an option to purchase 43,605 shares of our common stock at $0.43 per share, (iii) on September 30, 2018, an issuance of an option to purchase 69,444 shares of our common stock at $0.27 per share, and (iv) on December 31, 2018, an issuance of an option to purchase 78,125 shares of our common stock at $0.24 per share.

|

Equity Compensation Plans

We have one ongoing, and one expired (but with outstanding awards), equity compensation plans.

2007 Plan

On August 7, 2007, our Board adopted the BioLargo, Inc. 2007 Equity Incentive Plan (“2007 Plan”) as a means of providing our directors, key employees and consultants additional incentive to provide services. Both stock options and stock grants were made under this plan, as administered by the Compensation Committee. The plan automatically terminated on September 7, 2017.

Under this plan, as amended in 2011, 12,000,000 shares of our common stock were reserved for issuance under awards, and at March 31, 2019, awards of options authorizing a total of 9,721,586 shares were outstanding.

2018 Plan

On March 7, 2018, our board of directors adopted BioLargo, Inc. 2018 Equity Incentive Plan (“2018 Equity Plan”) as a means of providing our directors, key employees, and consultants additional incentive to provide services. This plan was approved by our stockholders at our annual meeting on May 23, 2018. The Compensation Committee administers this plan, except for awards made to non-employee directors. The plan allows for the grant of stock options, restricted stock awards, stock bonus awards, stock appreciation rights, restricted stock units and performance awards in any combination, separately or in tandem. Subject to the terms of the 2018 Equity Plan, the Compensation Committee will determine the terms and conditions of awards, including the times when awards vest or become payable and the effect of certain events such as termination of employment. Under the 2018 Equity Plan, 40,000,000 shares of our common stock are reserved for issuance under awards. Each January 1, through January 1, 2028, the number of shares available for grant and issuance will be increased by the lesser of 2,000,000 and such number of shares set by the Board. As of March 31, 2019, we had issued options under the plan to purchase 890,280 shares.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information regarding unexercised stock options and equity incentive plan awards for each of the Named Executive Officers outstanding as of December 31, 2018. All stock or options that were granted to the Named Executive Officers during the fiscal year ended December 31, 2018 have fully vested, except as indicated.

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

|

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

|

|

|

Option

Exercise

Price

|

|

|

Share

Price on

Grant Date

|

|

Option

Expiration

Date

|

|

Dennis P. Calvert

|

|

|

3,731,322

|

|

|

|

|

--

|

|

|

$

|

0.45

|

|

|

$

|

0.45

|

|

May 2, 2027

|

|

|

|

|

60,000

|

|

|

|

|

--

|

|

|

$

|

0.55

|

|

|

$

|

0.37

|

|

April 27, 2019

|

|

|

|

|

691,974

|

|

|

|

|

--

|

|

|

$

|

0.55

|

|

|

$

|

0.37

|

|

April 27, 2019

|

|

|

|

|

200,000

|

|

|

|

|

--

|

|

|

$

|

0.575

|

|

|

$

|

0.50

|

|

February 1, 2020

|

|

Charles K. Dargan II

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.38

|

|

|

$

|

0.38

|

|

January 31, 2019

|

|

|

|

|

50,000

|

|

|

|

|

--

|

|

|

$

|

0.28

|

|

|

$

|

0.28

|

|

February 23, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.30

|

|

|

$

|

0.30

|

|

April 29, 2019

|

|

|

|

|

36,000

|

|

|

|

|

--

|

|

|

$

|

0.50

|

|

|

$

|

0.30

|

|

April 29, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.45

|

|

|

$

|

0.45

|

|

May 31, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.45

|

|

|

$

|

0.45

|

|

June 30, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.50

|

|

|

$

|

0.50

|

|

July 31, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.43

|

|

|

$

|

0.43

|

|

August 31, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.40

|

|

|

$

|

0.40

|

|

September 30, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.45

|

|

|

$

|

0.45

|

|

October 31, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.57

|

|

|

$

|

0.57

|

|

November 30, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.70

|

|

|

$

|

0.70

|

|

December 31, 2019

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.50

|

|

|

$

|

0.50

|

|

January 31, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.45

|

|

|

$

|

0.45

|

|

February 28, 2020

|

|

|

|

|

60,000

|

|

|

|

|

--

|

|

|

$

|

0.575

|

|

|

$

|

0.50

|

|

February 1, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.50

|

|

|

$

|

0.50

|

|

March 31, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.39

|

|

|

$

|

0.39

|

|

April 29, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.31

|

|

|

$

|

0.31

|

|

May 31, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.25

|

|

|

$

|

0.25

|

|

June 30, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.24

|

|

|

$

|

0.24

|

|

July 31, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.23

|

|

|

$

|

0.23

|

|

August 30, 2020

|

|

|

|

|

200,000

|

|

|

|

|

--

|

|

|

$

|

0.30

|

|

|

$

|

0.30

|

|

August 4, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.35

|

|

|

$

|

0.35

|

|

September 30, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.42

|

|

|

$

|

0.42

|

|

October 31, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.40

|

|

|

$

|

0.40

|

|

November 30, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.50

|

|

|

$

|

0.50

|

|

December 31, 2020

|

|

|

|

|

10,000

|

|

|

|

|

--

|

|

|

$

|

0.42

|

|

|

$

|

0.42

|

|

January 31, 2021

|

|

|

|

|

120,000

|

|

|

|

|

--

|

|

|

$

|

0.41

|

|

|

$

|

0.41

|

|

February 28, 2021

|

|

|

|

|

300,000

|

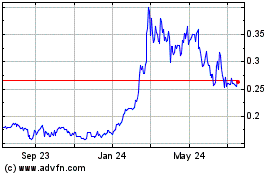

|

|

|

|

--

|

|

|

$

|

0.35

|

|

|

$

|

0.35

|

|

April 10, 2022

|

|