American Financial Group, Inc. Enters Into Transaction with Atlas Financial Holdings, Inc. for its Paratransit Business

June 10 2019 - 9:00AM

Business Wire

American Financial Group, Inc. (NYSE: AFG) today announced that

its commercial transportation specialist, National Interstate, has

entered into an agreement with Atlas Financial Holdings, Inc. (AFH)

to become the exclusive underwriter of AFH’s paratransit book of

business. The transaction is effective June 10, 2019 and National

Interstate expects to begin issuing policies in the third quarter

of 2019. National Interstate estimates that the majority of AFH’s

$110 million paratransit business will be eligible for quotation

under this arrangement over the first 12 months following inception

of the agreement.

Under the terms of the agreement, an AFH subsidiary will act as

an underwriting manager for National Interstate for at least 12

months following the transaction, after which time National

Interstate is entitled to acquire the renewal rights for the

business held by AFH and certain of its subsidiaries.

In addition, AFG has been granted a five-year warrant to acquire

19.9% of AFH’s common stock outstanding at an exercise price of

$0.69 per share, which represents the average closing price per

share for AFH’s common stock over the preceding five trading

days.

Carl H. Lindner III, Co-CEO of American Financial Group,

commented, “Passenger transportation is a business we know well,

and we are well-positioned to act on opportunities in a market that

remains in a correction mode. This paratransit book of business is

a great strategic fit for AFG. It complements National Interstate’s

existing paratransit book, and will allow us to grow our footprint

within an existing specialty transportation niche that has

performed very well for us. We look forward to working with Atlas

and its agents to provide a smooth transition for

policyholders.”

About American Financial

Group, Inc.

American Financial Group is an insurance holding company, based

in Cincinnati, Ohio with assets over $65 billion. Through the

operations of Great American Insurance Group, AFG is engaged

primarily in property and casualty insurance, focusing on

specialized commercial products for businesses, and in the sale of

traditional fixed, fixed-indexed and variable-indexed annuities in

the retail, financial institutions, broker-dealer and registered

investment advisor markets. Great American Insurance Group’s roots

go back to 1872 with the founding of its flagship company, Great

American Insurance Company.

Forward Looking

Statements

This press release contains certain statements that may be

deemed to be "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. All statements in this press

release not dealing with historical results are forward-looking and

are based on estimates, assumptions and projections. Examples of

such forward-looking statements include statements relating to: the

Company's expectations concerning market and other conditions and

their effect on future premiums, revenues, earnings, investment

activities and the amount and timing of share repurchases;

recoverability of asset values; expected losses and the adequacy of

reserves for asbestos, environmental pollution and mass tort

claims; rate changes; and improved loss experience.

Actual results and/or financial condition could differ

materially from those contained in or implied by such

forward-looking statements for a variety of reasons including, but

not limited to: changes in financial, political and economic

conditions, including changes in interest and inflation rates,

currency fluctuations and extended economic recessions or

expansions in the U.S. and/or abroad; performance of securities

markets, including the cost of equity index options; new

legislation or declines in credit quality or credit ratings that

could have a material impact on the valuation of securities in

AFG’s investment portfolio; the availability of capital; changes in

insurance law or regulation, including changes in statutory

accounting rules and changes in regulation of the Lloyd’s market,

including modifications to the establishment of capital

requirements for and approval of business plans for syndicate

participation; changes in the legal environment affecting AFG or

its customers; tax law and accounting changes, including the impact

of recent changes in U.S. corporate tax law; levels of natural

catastrophes and severe weather, terrorist activities (including

any nuclear, biological, chemical or radiological events),

incidents of war or losses resulting from civil unrest and other

major losses; disruption caused by cyber-attacks or other

technology breaches or failures by AFG or its business partners and

service providers, which could negatively impact AFG’s business

and/or expose AFG to litigation; development of insurance loss

reserves and establishment of other reserves, particularly with

respect to amounts associated with asbestos and environmental

claims; availability of reinsurance and ability of reinsurers to

pay their obligations; trends in persistency and mortality;

competitive pressures; the ability to obtain adequate rates and

policy terms; changes in AFG’s credit ratings or the financial

strength ratings assigned by major ratings agencies to AFG’s

operating subsidiaries; the impact of the conditions in the

international financial markets and the global economy relating to

AFG’s international operations; and other factors identified in

AFG’s filings with the Securities and Exchange Commission.

The forward-looking statements herein are made only as of the

date of this press release. The Company assumes no obligation to

publicly update any forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190610005387/en/

Diane P. Weidner, IRCAsst. Vice President - Investor

Relations513-369-5713

Websites:www.AFGinc.comwww.GreatAmericanInsuranceGroup.com

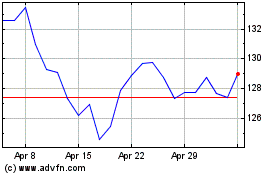

American Financial (NYSE:AFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

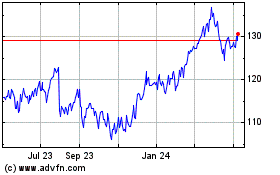

American Financial (NYSE:AFG)

Historical Stock Chart

From Apr 2023 to Apr 2024