Report of Foreign Issuer (6-k)

June 07 2019 - 9:51AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of

May 2019

Commission

File Number 333-209744

TODOS

MEDICAL LTD.

(Translation

of registrant's name into English)

1 Hamada Street

Rehovot, Israel 2244427

Tel: (011) (972) 8-633-3964

(Address of Principal

Executive Offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

☒ Form 20-F ☐ Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Entry

into a Material Definitive Agreement.

Convertible

Bridge Loan Transactions

On

May 28, 2019, and May 31, 2019, we entered into convertible bridge loan agreements (each a “Loan Agreement”), and

issued a convertible note and warrants relating thereto, with each of FirstFire Global Opportunities Fund, LLC and Leonite Capital

LLC, respectively, (each a "Lender"). FirstFire provided a loan in the principal amount of $200,000 and Leonite provided

a loan in the principal amount of $100,000 (each, the “Loan Amount”). The Loan Amount is expected to be used for our

working capital needs and to finance our activities through the consummation of a proposed public offering and our planned uplisting

to the NASDAQ Capital Market.

The

Loan Amount, which had an original issue discount of ten percent (10%), bears interest at a flat rate of ten percent (10%), and

matures in six months. The loan is convertible after the maturity date into ordinary shares of our company at a conversion price

equal to 70% of the lowest closing bid price of our ordinary shares in the five days prior to the conversion. In the event we

default under the Loan Agreement, the conversion price will be reduced to 60% of the lowest closing bid price of our ordinary

shares in the 15 days prior to the conversion.

As

part of the transaction, we issued to each Lender a convertible promissory note (the “Note”) and two ordinary share

purchase warrants for the purchase of ordinary shares (the “First Warrant" and the "Second Warrant” respectively

and together "Warrants").

The

First Warrant provides the Lender with 25% warrant coverage, with the warrant exercise price to be equal to the offering price

in our proposed public offering, or, in the event the Loan Amount is converted into ordinary shares, the warrant exercise price

will be equal to the applicable closing bid price of our shares at the time of the conversion of the Loan Amount. The Second Warrant

issued to FirstFire provides for the purchase of 166,667 ordinary shares at an exercise price equal to $0.30, and the Second Warrant

issued to Leonite provides for the purchase of 69,445 ordinary shares at an exercise price equal to $0.36. The Lender may exercise

each of the Warrants at any time starting six months following the uplisting or the conversion of the Loan Amount, as applicable,

and up to three years thereafter. Each warrant may be exercised by cash payment or through cashless exercise by the surrender

of warrant shares having a value equal to the exercise price of the portion of the warrants being exercised.

The

Loan Agreement and the Note contain events of default, including, among other things, failure to repay the Loan Amount by the

maturity date, and bankruptcy and insolvency events, that could result in the acceleration of the Lender's right to convert the

Loan Amount into ordinary shares.

A

copy of the form of Loan Agreement, the form of Note, the form of the First Warrant, and the form of the Second Warrant are attached

hereto as Exhibit 4.1, Exhibit 4.2, Exhibit 4.3, and Exhibit 4.4, respectively, and are incorporated herein by reference. The

foregoing descriptions of the terms and conditions of the SPA, the Note, and the Warrants are qualified in their entirety by reference

to the full text of the SPA, the Note, and the Warrants.

We

issued the Notes and the Warrants under the exemptions from registration provided by Section 4(a)(2) of the Securities Act of

1933. We expect that any issuance of our ordinary shares pursuant to the terms of the Notes or the Warrants will be exempt from

registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and

regulations promulgated thereunder. None of these transactions involved any underwriters, underwriting discounts or commissions,

or any public offering, and the Lender had adequate access, through its relationship with us, to information about us.

Our

ordinary shares to be issued in the event of conversion of the Loan Amounts and upon exercise of the Warrants will not be registered

under the Securities Act, or any state securities laws, and may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements of the Securities Act.

Financial

Statements and Exhibits.

The

following Exhibits are filed as part of this Report.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

TODOS MEDICAL LTD.

|

|

|

|

|

Date: June 7, 2019

|

By:

|

/s/ Dr. Herman Weiss

|

|

|

|

Name:

|

Dr. Herman Weiss

|

|

|

|

Title:

|

Chief Executive Officer

|

3

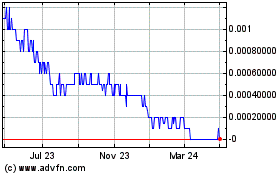

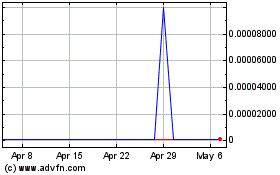

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Apr 2023 to Apr 2024