Current Report Filing (8-k)

June 06 2019 - 5:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 4, 2019

POLAR POWER, INC.

(Exact Name of Registrant as Specified in

Charter)

|

Delaware

(State or Other Jurisdiction

of Incorporation)

|

001-37960

(Commission File Number)

|

33-0479020

(IRS Employer

Identification No.)

|

240 E. Gardena Boulevard, Gardena, California

90248

(Address of Principal Executive Offices)

(Zip Code)

(310) 830-9153

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

|

Common Stock, par value $0.0001 per share

|

|

POLA

|

|

The NASDAQ Stock Market, LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company

☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

|

|

Item 1.01.

|

Entry Into a Material Definitive Agreement.

|

On May 20, 2019, Polar Power, Inc. (the “

Company

”)

executed a Supplier Agreement with Citibank, N.A., which Supplier Agreement was executed by Citibank N.A., and became effective

with respect to all parties, on June 4, 2019. Under the terms of the Supplier Agreement, the Company may from time to time offer

to sell to Citibank certain of the Company’s accounts receivable relating to invoiced sales made by the Company to its customer,

AT&T and its affiliates. Once AT&T approves the invoice issued by the Company, AT&T sends payment instructions to

Citibank. The sale price is equal to the face amount of the receivable less the applicable discount charge calculated by multiplying

the face amount of the receivable by (i) the annual discount rate (which is equal to the 90-day London Inter-bank Offered Rate

(“

LIBOR

”) plus 1.00%) and (ii) the discount acceptance period (which is equal the number of days in the payment

terms (e.g., net 90) less the number of days necessary to approve the invoice (e.g., 10 days)) divided by 360. By way of example,

based upon the current pricing terms contained in the Supplier Agreement, on a $100 invoice payable in 90 days, and assuming a

LIBOR rate of 2.80% and invoice approval period of 10 days, the Company would be eligible to receive $99.16 approximately 11 days

after the issuance of the invoice to AT&T. This is equivalent to discounted terms of 0.84% 10 net 90.

Citibank may change the pricing terms at any

time in its sole discretion upon at least thirty (30) days prior written notice to the Company. In addition, either party may terminate

the Supplier Agreement upon thirty (30) business days prior written notice to the other party, provided that either party may terminate

the agreement upon five (5) business days prior written notice if the other party is in breach of, or fails to perform any of its

material obligations under the agreement.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

The following is furnished as an exhibit to this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 6, 2019

|

|

POLAR POWER, INC.

|

|

|

|

|

|

|

By:

|

/s/ Arthur D. Sams

|

|

|

|

Arthur D. Sams

|

|

|

|

President, Chief Executive Officer and Secretary

|

EXHIBIT INDEX

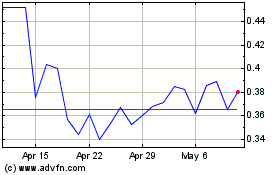

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From Apr 2023 to Apr 2024