Current Report Filing (8-k)

June 04 2019 - 5:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 4, 2019

|

Major League Football, Inc. (MLFB)

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

000-51132

|

|

20-1568059

|

|

(State or other jurisdiction of

Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

7319 Riviera Cove, #7, Lakewood Ranch, FL

|

|

34202

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

(847) 924-4332

|

|

_____________________________________________

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

þ

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 504 of the Securities Act of 1933 (§230.405 of this Chapter) or Rule 12b-25 of the Securities Exchange Act of 1934 (§240.12b-2 of this Chapter).

Emerging Growth Company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 8.01 – Other Events

In furtherance of MFLB’s desire to sustain and grow the business, MFLB has entered into the following transactions:

On May 2, 2019 (the Original Issue Date (OID), the Registrant received $85,450 of net proceeds for working capital purposes from the issuance of a $100,000 face value convertible redeemable promissory note with debt issue costs paid to or on behalf of the lender of $12,400 and an OID of $2,150. The terms include interest accrued at 10% annually and the principal and interest payable is payable in one year on May 2, 2020. All interest will be paid in common stock of the Registrant.

On May 8, 2019, the Registrant received $121,750 of net proceeds for working capital purposes from the issuance of a $150,000 face value convertible promissory note with debt issue costs paid to or on behalf of the lender of $28,250. The terms include interest accrued at 12% annually. In relation to the promissory note, the Registrant issued the lender a common stock purchase warrant with a three (3) year term to acquire 1,500,000 shares of common stock of the Registrant at an exercise price of $0.10 per share.

On May 29, 2019, the Registrant paid the remaining balance of $7,500 related to an office lease Settlement Agreement. With this final payment, the parties executed release agreements and the Registrant has right, title and interest to the remaining football equipment and has executed a lease agreement for the storage of the football equipment.

On May 31, 2019, the Registrant executed an addendum to a Master Business Agreement (“Master Agreement”) with a third-party consulting firm to provide the following services: (1) marketing and communications, (2) sponsorship development and sales, (3) distribution and broadcasts and (4) production and show creation. The Master Agreement is contingent on the Registrant obtaining a minimum $3,000,000 of investor funding and, the addendum extended the date for such funding to June 30, 2019.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

MAJOR LEAGUE FOOTBALL, INC.

|

|

|

|

|

|

|

By:

|

/s/ Frank Murtha

|

|

|

|

Frank Murtha, Senior Executive Vice President

|

|

Dated: June 4, 2019

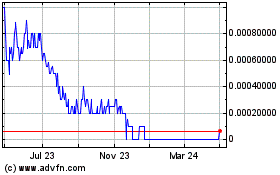

Major League Football (CE) (USOTC:MLFB)

Historical Stock Chart

From Mar 2024 to Apr 2024

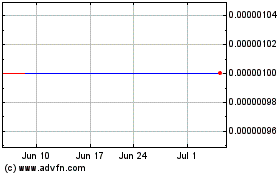

Major League Football (CE) (USOTC:MLFB)

Historical Stock Chart

From Apr 2023 to Apr 2024