UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2019

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified

in its charter)

Nuestra Señora de los Ángeles

179

Las Condes, Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GEOPARK LIMITED

TABLE OF CONTENTS

Press Release dated June 3, 2019 titled “GeoPark Provides Portfolio Activity Update with New Operational

Successes”

FOR IMMEDIATE DISTRIBUTION

GEOPARK PROVIDES PORTFOLIO ACTIVITY UPDATE

WITH NEW OPERATIONAL SUCCESSES

Santiago, Chile - June 3, 2019 - GeoPark

Limited (“GeoPark” or the “Company”) (NYSE: “GPRK”), a leading independent Latin American oil

and gas explorer, operator and consolidator with operations and growth platforms in Colombia, Peru, Argentina, Brazil, Chile and

Ecuador, today announced new operational successes across its Latin American asset platform.

Colombia Flowline On Stream

The flowline connecting the Llanos 34 block

(GeoPark operated, 45% WI) to the Oleoducto de los Llanos (ODL), one of Colombia’s principal pipelines, is now fully operational

with oil flowing from the Jacana oil field to the ODL regional infrastructure. The flowline (with a capacity of up to 100,000 bopd)

supports future production growth in the Llanos 34 block, reduces overall operational risk and contributes to further reductions

in transportation and operating costs. Net capital expenditures totaled approximately $16 million (gross $36 million), within budget.

Brazil Oil Field Discovery

GeoPark drilled and completed the Praia

dos Castelhanos 1 exploration well in the REC-T-128 block (GeoPark operated, 70% WI) to a total depth of 8,431 feet. A production

test in the Agua Grande formation resulted in a production rate of approximately 300 bopd of 34 degrees API, with no water. Long-term

testing is expected to begin in the coming weeks. Additional production history is required to determine stabilized flow rates

and the extent of the reservoir.

Exploration drilling in Brazil is expected

to continue during 3Q2019 with the drilling of an exploration well in the POT-T-747 block (GeoPark operated, 70% WI), in the mature,

onshore Potiguar basin.

Chile Gas Discovery

GeoPark drilled and completed the Jauke

2 gas well in the Fell block (GeoPark operated, 100% WI) to a total depth of 9,701 feet to the Tobifera formation which is deeper

than the formation currently under production. A production test resulted in an average production rate of 5.9 million standard

cubic feet of gas per day (988 boepd) with a wellhead pressure of 1,646 pounds per square inch. Additional production history is

required to determine stabilized flow rates of the well and the extent of the reservoir. Surface facilities are already in place,

the well is in production, and the gas is being sold to Methanex.

The Jauke gas field was discovered during

August 2018 with production in the Springhill formation. It forms part of the large Dicky geological structure, which has the potential

for multiple development drilling opportunities targeting the Springhill and the Tobifera formations. Petrophysical analysis also

indicates hydrocarbon potential in the shallower El Salto formation which will be tested in the future.

Additional drilling is expected during 2H2019

to continue developing and delineating the large Jauke/Dicky geological structure.

Ecuador Blocks Final Signature

On May 22, 2019, GeoPark signed final participation

contracts for the Espejo (GeoPark operated, 50% WI) and Perico (GeoPark non-operated, 50% WI) blocks in Ecuador, which were awarded

to GeoPark in the Intracampos Bid Round held in Quito, Ecuador in March 2019.

The Espejo and Perico blocks are attractive,

low-risk exploration blocks located in the northeastern part of Ecuador, in the Oriente basin. Both blocks are covered with 3D

seismic and are adjacent to multiple discoveries, producing fields and existing infrastructure. From existing 3D seismic and other

relevant data, more than five multilayer, ready-to-drill light oil prospects and leads have been identified. Geoscience evaluation

is ongoing and field operations are expected to start in late 2019 or early 2020.

The Oriente basin is one of the most prolific

petroleum systems in Latin America, currently producing more than 500,000 bopd, with access to infrastructure, spare capacity and

a well-developed service industry.

James F. Park, Chief Executive Officer of

GeoPark, said: "The richness and variety of GeoPark’s deep organic project inventory, over our expansive Latin American

platform, provides multiple upside growth drivers and secures downside protection across this big, exciting, underexplored continent."

For further information please contact:

|

INVESTORS:

|

|

|

Stacy Steimel – Shareholder Value Director

Santiago, Chile

T: +562 2242 9600

|

ssteimel@geo-park.com

|

|

|

|

|

Miguel Bello – Market Access Director

Santiago, Chile

T: +562 2242 9600

|

mbello@geo-park.com

|

|

|

|

|

MEDIA:

|

|

|

|

|

|

Jared Levy – Sard Verbinnen & Co

|

jlevy@sardverb.com

|

New

York, USA

T: +1 (212) 687-8080

|

|

|

|

|

|

Kelsey Markovich – Sard Verbinnen &

Co

New York, USA

T: +1 (212) 687-8080

|

kmarkovich@sardverb.com

|

GeoPark

can be visited online at

www.geo-park.com

NOTICE

Additional information about GeoPark can

be found in the “Investor Support” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain

amounts and percentages included in this press release have been rounded for ease of presentation. Percentage figures included

in this press release have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts

prior to rounding. For this reason, certain percentage amounts in this press release may vary from those obtained by performing

the same calculations using the figures in the financial statements. In addition, certain other amounts that appear in this press

release may not sum due to rounding.

CAUTIONARY

STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that

constitute forward-looking statements. Many of the forward-looking statements contained in this press release can be identified

by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’

‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’

‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in

a number of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations,

regarding various matters, including expected production growth, planned drilling activities, payback timing, IRR and capital expenditures

plan. Forward-looking statements are based on management’s beliefs and assumptions, and on information currently available

to the management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those

expressed or implied in the forward-looking statements due to various factors.

Forward-looking statements speak only as

of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future

developments or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to

reflect the occurrence of unanticipated events. For a discussion of the risks facing the Company which could affect whether these

forward-looking statements are realized, see filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

GeoPark Limited

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Andrés Ocampo

|

|

|

|

|

|

Name:

|

Andrés Ocampo

|

|

|

|

|

|

Title:

|

Chief Financial Officer

|

|

Date: June 4,

2019

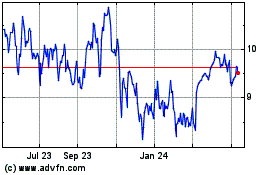

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024