Current Report Filing (8-k)

June 03 2019 - 5:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

_________________

Date of Report (Date of earliest event reported): May 31, 2019

Centrus Energy Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

1-14287

|

52-2107911

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

6901 Rockledge Drive, Suite 800

Bethesda, MD 20817

(301) 564-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

Class A Common Stock, par value $0.10 per share

|

LEU

|

NYSE American

|

|

Rights to purchase Series A Participating Cumulative Preferred Stock, par value $1.00 per share

|

LEU*

|

NYSE American

|

*The rights currently transfer with the shares of Common Stock

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On May 31, 2019, American Centrifuge Operating, LLC, a Delaware limited liability company (“ACO”) and a wholly owned subsidiary of Centrus Energy Corp. (“Centrus”), entered into a Letter Agreement with the United States Department of Energy (“DOE”). Under the terms of the letter agreement, ACO will demonstrate the capability to produce high assay low enriched uranium (“HALEU”) with existing United States origin enrichment technology and provide DOE with HALEU for near term use in its research and development for the advancement of civilian nuclear energy and security, and other programmatic missions. HALEU is an advanced nuclear reactor fuel that is not commercially available today.

Pursuant to the letter agreement, ACO and DOE will work to enter into a definitive contract by October 31, 2019. The letter agreement authorizes up to $6.4 million in payments to ACO as the parties work to enter into a definitive contract. According to the letter agreement, the definitive contract is anticipated to be an incrementally funded, cost reimbursable contract with DOE reimbursing up to 80% of the costs and the Company incurring 20% of the project costs. The total amount of DOE’s share of the definitive contract is $115 million, and it is anticipated that the definitive contract will run through June 1, 2022.

In connection with the letter agreement, United States Enrichment Corporation, a Delaware corporation (“Enrichment”) and a wholly owned subsidiary of Centrus, entered into an Amendment to the Lease Agreement between Enrichment and DOE for the lease of the gas centrifuge enrichment plant facilities in Piketon, Ohio for the American Centrifuge plant and related personal property (the “GCEP Lease”) and has entered into a sub-lease with ACO. Pursuant to the amendment, the GCEP Lease, which was scheduled to expire by its terms on June 30, 2019, was renewed and extended until May 31, 2022, provided, however, that DOE has the right to terminate the GCEP Lease if the parties do not enter into a definitive contract as contemplated by the letter agreement. Any facilities or equipment constructed or installed under contract with DOE will be owned by DOE, may be returned to DOE in an “as is” condition at the end of the lease term, and DOE would be responsible for its decontamination and decommissioning.

The foregoing descriptions of the letter agreement and the amendment do not purport to be complete and are qualified in their entirety by the text of the agreements, copies of which are expected to be filed as exhibits to Centrus’ quarterly report on Form 10-Q for the second quarter ending June 30, 2019.

Centrus, or its subsidiaries, are also a party to a number of other agreements or arrangements with the United States government, as described in Centrus’ annual report on Form 10-K and other filings with the Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Centrus Energy Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

June 3, 2019

|

By:

|

/s/ Marian K. Davis

|

|

|

|

|

|

Marian K. Davis

|

|

|

|

|

|

Senior Vice President, Chief Financial Officer and Treasurer

|

|

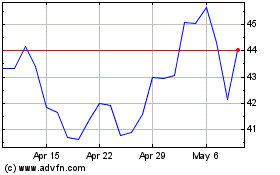

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Mar 2024 to Apr 2024

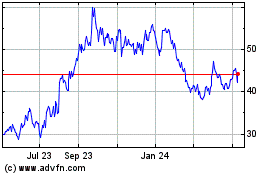

Centrus Energy (AMEX:LEU)

Historical Stock Chart

From Apr 2023 to Apr 2024