Warehouse Clubs Lift Costco -- WSJ

May 31 2019 - 3:02AM

Dow Jones News

By Sarah Nassauer

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 31, 2019).

Costco Wholesale Corp. booked another quarter of sales gains,

boosted by increasing visits to its warehouse clubs as the retail

giant tries to navigate the U.S.-China trade fight.

Comparable sales -- those in stores and through websites in

operation for at least 12 months -- rose 5.6% in the quarter ended

May 12. The gain excludes the effect of gasoline prices and

currency fluctuations.

E-commerce sales rose 20% during the quarter. Costco offers some

items on its website and has teamed with Instacart to offer

same-day grocery deliveries. But it has kept its focus on getting

shoppers to buy in bulk at its cavernous stores.

It is unclear how this month's tariff increase to 25% on around

$200 billion worth on Chinese imports including bicycles, furniture

and luggage will affect store prices or cost of goods, said Costco

Chief Financial Officer Richard Galanti on a call with analysts

Thursday.

Costco has brought in some imports early to reduce tariffs,

reduced costs with some suppliers, cut orders for some goods and is

looking at sourcing outside of China in some cases, he said. Price

increases are being passed on to shoppers on some items.

"At the end of the day, prices will go up," said Mr.

Galanti.

As many retailers struggle to adapt to shifting shopping habits

online, Costco has fared well offering bulk products at lower

prices to fee-paying members. Costco's primary source of profit is

membership fees, allowing it to offer lower prices on goods, often

undercutting competitors. The model tends to attract middle- and

high-income shoppers. In the most recent quarter one shopper bought

a $400,000 diamond ring, said Mr. Galanti.

But it is taking a comparatively cautious approach to online

growth versus other retailers. Walmart Inc. and Target Corp. have

invested heavily to speed online delivery and offer curbside

pickup, but Costco doesn't have plans to offer groceries for online

pickup in stores, said Mr. Galanti.

"We continue to look at it. We continue to scratch our head at

it," he said. The chain is adding lockers to more stores so

shoppers can pick up online orders this year, mostly for small,

high-priced items, he said. "We still want to drive the customer to

the warehouse."

Total revenue, including membership fees, rose to $34.74 billion

in the quarter, up from $32.36 billion for the same period the

previous year. Profits rose to $906 million, up from $750 million

in the year-ago period.

Costco has added to its store base in recent years, particularly

outside the U.S., which carries some risk, as well as some cost

benefits including in health care, said Mr. Galanti. Costco's first

Chinese store will open this summer in Shanghai, he said.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

May 31, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

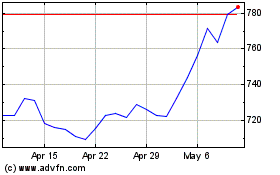

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

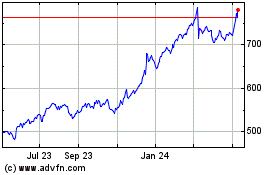

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024