Akari Therapeutics Reports First Quarter 2019 Financial Results And Highlights Recent Clinical Progress

May 29 2019 - 7:45AM

Akari Therapeutics, Plc (Nasdaq: AKTX), a biopharmaceutical company

focused on innovative therapeutics to treat orphan autoimmune and

inflammatory diseases where complement and/or leukotriene systems

are implicated, today announced its financial results for the first

quarter ended March 31, 2019 and recent clinical progress.

“We have seen positive clinical signals in all three of our new

programs in BP, HSCT-TMA and AKC, with rapid improvement in the

relevant clinical measures and with no drug-related serious adverse

events,” said Clive Richardson, Interim Chief Executive Officer of

Akari Therapeutics. “Both AKC and BP have further planned clinical

readouts this year, providing a potential opportunity to consider

advancing both into pivotal trials in 2020 and further supporting

the therapeutic role of combined C5 and LTB4 treatment.”

First Quarter 2019 and Recent Business

Highlights

- Pediatric hematopoietic stem cell transplant-related

thrombotic microangiopathy (HSCT-TMA).

- In March 2019, the Company announced it had a successful Type

B, pre-IND meeting with the U.S. Food and Drug Administration (FDA)

regarding its proposed pivotal clinical trial program for HSCT-TMA.

A pivotal trial for HSCT-TMA with nomacopan is expected to start in

the fourth quarter of 2019. This condition has an estimated 80%

mortality rate in children with this severe disease, with currently

no approved treatments.

- Phase II clinical trial in patients with bullous

pemphigoid (BP).

- During the first quarter, the Company announced initial results

from the first three patients with mild-to-moderate BP in the

ongoing Phase II trial with nomacopan, dosed daily subcutaneously.

The data showed no drug-related adverse events and a rapid

improvement in disease such that by day 42 of treatment with

nomacopan, the BPDAI global score fell by a mean of 52% and

blisters/erosions dropped by a mean of 87%. BP is a severe orphan

inflammatory skin disease currently treated primarily with steroids

and immunosuppressants which bring with them well-known side

effects. The Company anticipates data in mild-to-moderate patients

from this study by the fourth quarter of 2019, and extension within

the current study to include more severe patients in the second

half of 2019.

- Phase I/II clinical trial in patients with atopic

keratoconjunctivitis (AKC).

- In a “first in eye” Phase I/II study in AKC, initial surface of

the eye data from the first two patients in the study, treated

topically with nomacopan demonstrated no drug-related adverse

events. In addition, there was a >35% improvement in composite

efficacy score at day 14 of treatment compared to baseline

treatment on maximal cyclosporin, the standard of care. The Company

is currently in Part A of the study and anticipates progressing

into the Part B placebo-controlled efficacy arm by mid-year 2019,

with completion of the study by the fourth quarter of 2019.

- Expanding pipeline opportunities

- The Company is identifying an expanding pipeline of

opportunities in diseases where complement and leukotriene pathways

are both potentially implicated. For example, at the 2019

Association for Research in Vision and Ophthalmology (ARVO) annual

meeting Akari described the role of C5 and LTB4 in an experimental

autoimmune uveitis model, underpinning the Company’s plans to

develop a clinical back of the eye program.

Upcoming Events and Milestones

- HSCT-TMA pivotal clinical trial expected to start in the fourth

quarter of 2019.

- Mild-to-moderate BP trial results expected in the fourth

quarter of 2019.

- Expansion of existing BP Phase II clinical trial into the

severe patient population expected in the second half of 2019.

- Expansion of the AKC Phase I/II trial into Part B

placebo-controlled efficacy arm after an independent data review of

Part A safety expected mid-year 2019.

- Completion of Part B of AKC Phase I/II trial by the fourth

quarter of 2019.

- Initiate a Phase I clinical trial with new auto-injector pen

formulation in the second half of 2019.

First Quarter 2019 Financial Results

- Research and development (R&D) income in the first quarter

of 2019 was $2.3 million, as compared to R&D expenses of $1.0

million in the same quarter the prior year. This difference is

primarily due to the receipt of an R&D tax credit of $4.9

million in the first quarter of 2019, as compared to the receipt of

an R&D tax credit of $3.8 million in the first quarter of 2018.

Excluding the R&D tax credits in both periods, R&D expenses

decreased $2.2 million, or 47%, in the first quarter of 2019

compared to the same period the prior year due primarily to lower

expenses for manufacturing as the Company had previously

manufactured clinical trial material for supply through

2019.

- General and administrative (G&A) expenses in the first

quarter of 2019 were $2.3 million, as compared to $3.3 million in

the same quarter last year. This decrease was primarily due to

lower expenses associated with professional services, personnel and

rent, as well as lower stock-based non-cash compensation

expense.

- Total other expenses for the first quarter of 2019 was $2.6

million, as compared to total other income of $3.0 million in the

same period the prior year. This change was primarily due to $5.3

million of higher expense related to the change in the fair value

of the stock option liabilities in 2019 compared to 2018, and to

higher foreign exchange gains in 2019 as compared to

2018.

- Net loss for the first quarter of 2019 was $2.5 million,

compared to a net loss of $1.3 million for the same period in 2018.

The increase in net loss in the first quarter of 2019 was due

primarily to the change in the fair value of the stock option

liabilities and foreign exchange gains previously cited, offset by

the receipt of a higher R&D tax credit in the first quarter of

2019.

- As of March 30, 2019, the Company had cash of $6.1 million, as

compared to cash of $5.4 million as of December 31, 2018. During

the first quarter of 2019, the Company received an R&D tax

credit of $4.9 million.

- On September 26, 2018, the Company entered into a securities

purchase agreement (the “Purchase Agreement”) with Aspire Capital

Fund, LLC (“Aspire Capital”), which provides that, upon the terms,

Aspire Capital is committed to purchase up to an aggregate of $20.0

million of the Company’s ADSs over the 30-month term of the

Purchase Agreement. In consideration for entering into the Purchase

Agreement, concurrently with the execution of the Purchase

Agreement, the Company issued 30,000,000 ordinary shares to Aspire

Capital and sold to Aspire Capital 25,000,000 ordinary shares for

$0.02 per share (equivalent to $2.00 per ADS and $500,000).

Currently, approximately $1.2 million of the $20.0 million facility

has been drawn.

About Akari Therapeutics

Akari is a biopharmaceutical company focused on developing

inhibitors of acute and chronic inflammation, specifically for the

treatment of rare and orphan diseases, in particular those where

the complement (C5) or leukotriene (LTB4) systems, or both

complement and leukotrienes together, play a primary role in

disease progression. Akari's lead drug candidate, nomacopan

(Coversin), is a C5 complement inhibitor that also independently

and specifically inhibits leukotriene B4 (LTB4) activity. Nomacopan

(Coversin) is currently being clinically evaluated in four

indications: bullous pemphigoid (BP), atopic keratoconjunctivitis

(AKC), thrombotic microangiopathy, or TMA, and paroxysmal nocturnal

hemoglobinuria (PNH). Akari believes that the dual action of

nomacopan (Coversin) on both C5 and LTB4 may be beneficial in AKC

and BP. Akari is also developing other tick derived proteins,

including longer acting versions.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements in this press release constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements reflect our current views about our plans, intentions,

expectations, strategies and prospects, which are based on the

information currently available to us and on assumptions we have

made. Although we believe that our plans, intentions, expectations,

strategies and prospects as reflected in or suggested by those

forward-looking statements are reasonable, we can give no assurance

that the plans, intentions, expectations or strategies will be

attained or achieved. Furthermore, actual results may differ

materially from those described in the forward-looking statements

and will be affected by a variety of risks and factors that are

beyond our control. Such risks and uncertainties for our company

include, but are not limited to: needs for additional capital to

fund our operations, our ability to continue as a going concern;

uncertainties of cash flows and inability to meet working capital

needs; an inability or delay in obtaining required regulatory

approvals for nomacopan and any other product candidates,

which may result in unexpected cost expenditures; our ability to

obtain orphan drug designation in additional indications; risks

inherent in drug development in general; uncertainties in obtaining

successful clinical results for nomacopan (Coversin) and any other

product candidates and unexpected costs that may result therefrom;

difficulties enrolling patients in our clinical trials; failure to

realize any value of nomacopan (Coversin) and any other product

candidates developed and being developed in light of inherent risks

and difficulties involved in successfully bringing product

candidates to market; inability to develop new product candidates

and support existing product candidates; the approval by the FDA

and EMA and any other similar foreign regulatory authorities of

other competing or superior products brought to market; risks

resulting from unforeseen side effects; risk that the market for

nomacopan (Coversin) may not be as large as expected; risks

associated with the departure of our former Chief Executive

Officers and other executive officers; risks related to material

weaknesses in our internal controls over financial reporting and

risks relating to the ineffectiveness of our disclosure controls

and procedures; risks associated with the SEC investigation;

inability to obtain, maintain and enforce patents and other

intellectual property rights or the unexpected costs associated

with such enforcement or litigation; inability to obtain and

maintain commercial manufacturing arrangements with third party

manufacturers or establish commercial scale manufacturing

capabilities; the inability to timely source adequate supply of our

active pharmaceutical ingredients from third party manufacturers on

whom the company depends; unexpected cost increases and

pricing pressures and risks and other risk factors detailed in our

public filings with the U.S. Securities and Exchange Commission,

including our most recently filed Annual Report on Form 20-F filed

with the SEC. Except as otherwise noted, these forward-looking

statements speak only as of the date of this press release and we

undertake no obligation to update or revise any of these statements

to reflect events or circumstances occurring after this press

release. We caution investors not to place considerable reliance on

the forward-looking statements contained in this press release.

| |

|

|

|

| |

|

|

|

|

AKARI THERAPEUTICS, Plc |

| |

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

As of March 31, 2019 and December 31, 2018 |

|

(in U.S. Dollars, except share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

March 31, 2019 |

|

December 31, 2018 |

|

Assets |

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

Cash |

$ |

6,145,555 |

|

|

$ |

5,446,138 |

|

|

Prepaid expenses and other current assets |

|

1,887,780 |

|

|

|

1,423,184 |

|

|

Deferred financing costs |

|

579,810 |

|

|

|

585,000 |

|

|

Total Current Assets |

|

8,613,145 |

|

|

|

7,454,322 |

|

|

|

|

|

|

|

|

|

|

| Restricted cash |

|

147,924 |

|

|

|

521,829 |

|

| Property and equipment,

net |

|

15,834 |

|

|

|

20,425 |

|

| Patent acquisition costs,

net |

|

32,867 |

|

|

|

32,978 |

|

|

Total Assets |

$ |

8,809,770 |

|

|

$ |

8,029,554 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

1,763,182 |

|

|

$ |

1,586,285 |

|

|

Accrued expenses |

|

1,625,228 |

|

|

|

1,489,558 |

|

|

Liabilities related to options |

|

4,201,196 |

|

|

|

1,842,424 |

|

|

Total Liabilities |

|

7,589,606 |

|

|

|

4,918,267 |

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders' Equity: |

|

|

|

|

|

|

|

|

Share capital of £0.01 par value |

|

|

|

|

|

|

|

|

Authorized: 10,000,000,000 ordinary shares; issued and outstanding:

1,585,693,413 |

|

|

|

|

|

|

|

|

and 1,580,693,413 at March 31, 2019 and December 31, 2018,

respectively |

|

23,716,875 |

|

|

|

23,651,277 |

|

|

Additional paid-in capital |

|

107,097,477 |

|

|

|

106,616,083 |

|

|

Accumulated other comprehensive loss |

|

(245,258 |

) |

|

|

(352,426 |

) |

|

Accumulated deficit |

|

(129,348,930 |

) |

|

|

(126,803,647 |

) |

| Total Shareholders'

Equity |

|

1,220,164 |

|

|

|

3,111,287 |

|

| Total Liabilities and

Shareholders' Equity |

$ |

8,809,770 |

|

|

$ |

8,029,554 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

AKARI THERAPEUTICS, Plc |

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS -

UNAUDITED |

|

For the Three Months Ended March 31, 2019 and 2018 |

|

(in U.S. Dollars) |

|

|

|

|

|

| |

Three Months Ended |

|

|

Mar 31, 2019 |

|

Mar 31, 2018 |

|

Operating Expenses: |

|

|

|

|

|

|

|

|

Research and development (income) expenses |

|

(2,318,360 |

) |

|

$ |

1,008,388 |

|

|

General and administrative expenses |

|

2,306,398 |

|

|

|

3,296,973 |

|

| Total Operating Expenses |

|

(11,962 |

) |

|

|

4,305,361 |

|

| Income (Loss) from

Operations |

|

11,962 |

|

|

|

(4,305,361 |

) |

| |

|

|

|

|

|

|

|

| Other Income (Expenses): |

|

|

|

|

|

|

|

| Interest income |

|

1,286 |

|

|

|

64,638 |

|

| Changes in fair value of

option liabilities - (loss)/gains |

|

(2,358,772 |

) |

|

|

2,945,531 |

|

| Foreign currency exchange

losses |

|

(195,635 |

) |

|

|

(40,975 |

) |

| Other expenses |

|

(4,124 |

) |

|

|

(2,408 |

) |

| Total Other Income

(Expenses) |

|

(2,557,245 |

) |

|

|

2,966,786 |

|

| |

|

|

|

|

|

- |

|

|

Net Loss |

|

(2,545,283 |

) |

|

|

(1,338,575 |

) |

| |

|

|

|

|

|

|

|

|

Other Comprehensive Income: |

|

|

|

|

|

|

|

|

Foreign Currency Translation Adjustment |

|

107,168 |

|

|

|

32,799 |

|

|

|

|

|

|

|

|

|

|

|

Comprehensive Loss |

$ |

(2,438,115 |

) |

|

$ |

(1,305,776 |

) |

|

|

|

|

|

|

|

|

|

|

Loss per ordinary share (basic and diluted) |

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

|

|

|

|

|

|

|

|

|

Weighted average ordinary shares (basic and diluted) |

|

1,580,860,080 |

|

|

|

1,525,693,393 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For more informationInvestor Contact:

Peter VozzoWestwicke Partners(443)

213-0505peter.vozzo@westwicke.com

Media Contact:

Sukaina Virji / Nicholas Brown / Lizzie SeeleyConsilium

Strategic Communications+44 (0)20 3709

5700Akari@consilium-comms.com

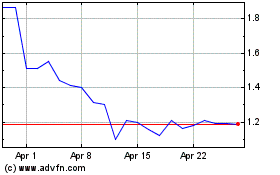

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

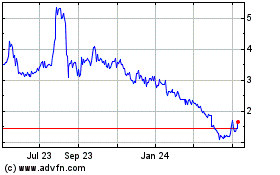

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024