Seadrill Posts Larger-Than-Expected 1Q Loss

May 23 2019 - 2:03AM

Dow Jones News

By Dominic Chopping

Seadrill Ltd. (SDRL) posted a bigger-than-expected first-quarter

net loss on Thursday, but said that the deepwater drilling market

is continuing to improve with more contracting activity and better

terms.

Seadrill, which operates a fleet of 35 drilling rigs and manages

a further 18, reported a net loss of $295 million in the three

months to March 31. A FactSet-provided estimate forecast a net loss

of $237 million.

Revenue came in at $302 million compared with a FactSet-provided

estimate of $284 million, while adjusted earnings before interest,

tax, depreciation and amortization totaled $72 million.

Seadrill expects adjusted Ebitda for the second quarter of 2019

will be lower than the first quarter, at around $55 million.

"We continue to see increased contracting activity in the

deepwater market, in many instances with improved contract terms

such as mobilization payments and certain capex being paid for by

the customer," Chief Executive Anton Dibowitz said.

"While the spot market for short term work remains competitive,

we are starting to see improvements in rates for longer term

work."

The company said its backlog as of May 23 stood at around $1.9

billion, having gained $130 million since February.

Write to Dominic Chopping at dominic.chopping@wsj.com;

@domchopping @WSJNordics

(END) Dow Jones Newswires

May 23, 2019 01:48 ET (05:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

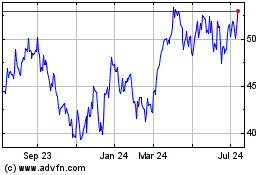

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

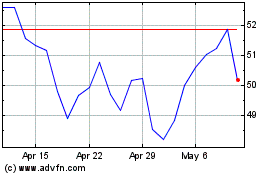

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Apr 2023 to Apr 2024