Lowe's Cuts Outlook as Profit Get Squeezed -- Update

May 22 2019 - 12:28PM

Dow Jones News

By Sarah Nassauer and Kimberly Chin

Sales growth at Lowe's Cos. outpaced rival Home Depot Inc. for

the first time since 2016, but margins fell more than expected and

the home-improvement retailer trimmed its profit expectations for

the year.

Comparable sales climbed 3.5% in the latest quarter, picking up

later in the period after a rainy February curbed demand.

Chief Executive Marvin Ellison on Wednesday attributed the gains

to strong sales for seasonal and outdoor products, better customer

service and improved store operations that kept shelves well

stocked.

"Our focus on retail fundamentals is gaining traction," said Mr.

Ellison, who took the helm of the company last year.

At the same time, missteps around product price increases

squeezed profit margins more than company executives and analysts

expected, leading to a sharp selloff in the stock. Shares of the

retailer fell 10.7% in morning trading.

Merchants agreed to price increases from some vendors last year

without finding ways to replace the profit loss elsewhere in the

business, said Mr. Ellison in a call with analysts.

Lowe's also replaced in recent months 13 key merchandising

executives while preparing for the busy spring selling season.

"There was much more disruption in [the first quarter] then we

anticipated," said Mr. Ellison. The company is upgrading its

outdated pricing tools and processes, he said.

Lowe's executives are doing a "systematic review of every single

thing we can imagine so as not to have another unexpected event

like we experienced" in the first quarter, he said.

In recent years, Lowe's has seen sales rise, but consistently

less than Home Depot. The relatively weak results led to an

executive shake-up that culminated in Mr. Ellison's hiring last

May. On Tuesday, Home Depot posted a weaker-than-expected 2.5% rise

in comparable sales due to rainy weather and a drop in lumber

prices. Comparable sales are a common metric in retail based on

revenue at stores and websites operating for at least one year.

For the year, Lowe's now expects adjusted earnings between $5.45

and $5.65 a share, lower than its previous guidance of $6.00 to

$6.10 a share.

The guidance cut is likely the biggest issue driving the stock

lower, said Budd Bugatch, retail analyst at Raymond James.

"Apparently, new management is finding that getting Lowe's to where

it believes it can be is still very much a work in progress," he

said in a note.

Mr. Ellison has called for vast improvements in the company's

inventory, customer service and work processes. Lowe's is now

stocking more faster-selling items while reducing inventory of

lower-performing ones, he said.

Those steps, along with cost pressure, also led to margin

compression, said Mr. Ellison. The company's gross margin was

31.46% of sales in the latest quarter, compared with 33.11% a year

earlier, which weighs on profitability.

Earlier this week, Lowe's agreed to buy a retail-analytics

platform from Boomerang Commerce, a move that the company expects

would help bolster its strategic and data-driven pricing and

merchandise assortment decisions.

Lowe's has said it decided to sell the assets of its businesses

in Mexico rather than exit the retail operations as initially

planned. This resulted in a tax benefit of $82 million in the

period, the company said.

Net income for the quarter was $1.05 billion, or $1.31 a share,

up 5.9% from the comparable quarter a year earlier. Its bottom line

benefited from lower expenses and taxes. Analysts polled by

Refinitiv were expecting a profit of $1.31 a share.

Excluding special items, Lowe's said earnings were $1.22 a

share. Analysts had expected $1.33 a share.

Net sales rose 2.2% to $17.74 billion from a year ago. Analysts

estimated revenue of $17.66 billion.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Kimberly

Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

May 22, 2019 12:13 ET (16:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

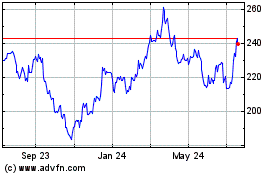

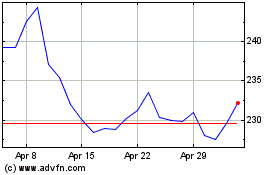

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024