EUROPE MARKETS: European Markets Stage Rebound After Monday Malaise

May 21 2019 - 6:05AM

Dow Jones News

By Dave Morris

Europe markets bounced after Monday's selloff but for the most

part, they didn't erase the day's losses.

How did markets perform?

The Stoxx 600 moved up 0.4% to 378.9, retracing some of Monday's

1.1% loss.

The U.K.'s FTSE 100 is essentially flat on the week at 7,351.2,

rising 0.5% to wipe out Monday's 0.5% decline.

The pound was hit harder, shrinking 0.3% to $1.2685, a

four-month low.

Italy's FTSE MIB recaptured part of its 2.7% plunge Monday,

increasing 0.7% to 20,680.7 on Tuesday.

In Germany, the DAX (DAX) edged up 0.2% to 5,367.2. On Monday it

fell 1.6%.

France's CAC 40 rose 0.6% to 12,111.8, after sinking 1.5%

Monday.

What's moving the markets?

U.S. officials granted Huawei a temporary reprieve

(http://www.marketwatch.com/story/us-to-offer-temporary-exemptions-to-huawei-export-ban-2019-05-20)

from some of the restrictions imposed on Friday. The Chinese

telecommunications company caught in the U.S.-China trade dispute

was granted a 90-day window to purchase equipment and parts needed

to maintain existing activities, which may be renewed. The easing

won't likely mitigate the fallout from Google's announcement that

it had suspended all business with Huawei not involving open source

software, which could freeze the company's consumer handsets out of

Google's Android operating system and various apps.

The "new and improved" Brexit deal promised by U.K. Prime

Minister Theresa May is expected to contain promises on workers'

rights and environmental protections, and will seek cabinet

approval on the concessions, according to the latest report in The

Times

(https://www.thetimes.co.uk/article/may-will-ask-cabinet-to-agree-on-concessions-cnswxbqkw).

The move will put pressure on opposition Labour Party leader Jeremy

Corbyn as some M.P.s may now support the bill, but many in the

rank-and-file will staunchly oppose it without the promise of a

confirmatory second Brexit referendum.

The U.K. pound took a drubbing Tuesday, falling to a four-month

low. Neil Wilson, chief markets analyst for Markets.com, said

Brexit uncertainty and U.S. dollar strength were the two key

drivers: "As far as Brexit goes there it is still as clear as mud

and traders are de-risking from the pound....we are heading to

either no-deal or no Brexit, a binary outcome that will keep

traders on the side lines."

Another batch of May economic data is due Tuesday. In the U.K.,

investors will be watching CBI industrial trends total orders,

while in the Eurozone the consumer confidence flash prediction is

expected to be down 7.7%.

Which stocks are active?

German chip maker Ams AG (AMS.EB) popped 6.8% after a bloodbath

Monday for Huawei's technology and equipment suppliers, when the

shares closed down 13.4%.

Telecom Italia SPA (TIT.MI) shares rose 0.8% even though the

company reported first quarter net profit

(http://www.marketwatch.com/story/telecom-italia-confirms-guidance-after-profit-slip-2019-05-21)

that was lower than the quarter a year ago. The Italian company

cited the change to accounting standard IFRS 16 as driving the

figure to EUR165 million, versus EUR199 million in the first

quarter of 2018. Absent that accounting related hit, first quarter

2019 standard net profit was EUR193 million, the company said.

Entertainment One Ltd. (ETO.LN) fell 2% after reporting fiscal

2019 earnings, as pretax profit fell 43% year over year. The

company blamed the dip on one-off charges, and pointed to strong

underlying earnings from growth in family-oriented brands such as

Peppa Pig as well as higher margins in its film, television and

music unit.

Sentiment around sales of U.K. mortgages took a hit as

Nationwide Building Society reported pressure on pricing in the

mortgage market in its fiscal 2019 earnings. Tesco Bank, the

lending arm of supermarket chain Tesco PLC (TSCO.LN), said Tuesday

that it was exiting the mortgage market

(http://www.marketwatch.com/story/tesco-to-explore-sale-of-mortgage-portfolio-2019-05-21-348518)

and looking for a buyer of its existing mortgage assets, citing

"challenging market opportunities". Shares in the unit's parent

traded 0.6% higher.

(END) Dow Jones Newswires

May 21, 2019 05:50 ET (09:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

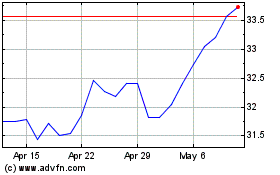

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

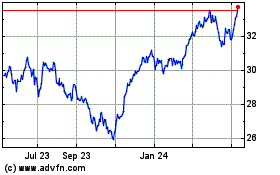

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Apr 2023 to Apr 2024