Toshiba Memory to Buy Out Apple, Dell -- WSJ

May 21 2019 - 3:02AM

Dow Jones News

By Kosaku Narioka

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 21, 2019).

TOKYO -- Apple Inc., Dell Technologies Inc. and two other U.S.

technology companies are set to give up their preferred shares in

Japanese chip maker Toshiba Memory Holdings Corp. for more than $4

billion under a refinancing plan, according to people familiar with

the plan.

The U.S. companies, which are customers for Toshiba Memory's

semiconductors, helped a Bain Capital-led consortium take over the

chip maker from former parent Toshiba Corp. in June, preventing

Western Digital Corp. from taking control of its memory joint

venture with Toshiba. A takeover by Western Digital might have

further consolidated a market in which Samsung Electronics Co. has

already established a dominant presence.

A package of Yen1.3 trillion ($11.8 billion) in financing to be

in place soon from Japanese banks would enable Toshiba Memory to

buy out the preferred shares from the four American companies,

according to the people. A simplified capital structure would also

make it easier for Toshiba Memory to list itself, one of the people

said. The listing would allow the capital-intensive chip business

to access funds from the public-equity market.

Apple, Dell, Kingston Technology Co. and Seagate Technology PLC

are set to sell their preferred shares back to Toshiba Memory for

about Yen500 billion yen ($4.5 billion) by the end of May,

according to the people familiar with the plan. Together those

companies made a few hundred million dollars on their investments,

one of the people said. Apple and Kingston declined to comment.

Dell and Seagate didn't respond to requests for comment.

Toshiba Memory aims for a listing in Tokyo near the end of the

year or at the beginning of next year, according to one person

involved with the planning, with the timing dependent on market

conditions for semiconductors and public equities. Some bankers

have said the listing would take place this year.

A recent slump in chip prices means now wouldn't be the best

timing for a listing, the person said.

Under the refinancing plan, three major Japanese banks would

lend Yen1 trillion, and the government-owned Development Bank of

Japan Inc. would invest in preferred shares worth Yen300 billion,

replacing existing bank loans and the preferred shares owned by the

four American companies, according to the people familiar with the

plan.

The refinancing doesn't change the ratio of voting rights: 49.9%

for Bain Capital; 40.2% for Toshiba; and the remaining 9.9% for

Japanese optical product maker Hoya Corp.

Write to Kosaku Narioka at kosaku.narioka@wsj.com

(END) Dow Jones Newswires

May 21, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

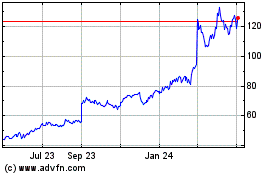

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

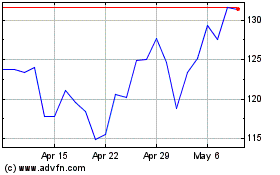

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From Apr 2023 to Apr 2024