Amended Current Report Filing (8-k/a)

May 17 2019 - 1:59PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K/A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 5, 2019

2050

MOTORS, INC.

(Exact

name of Registrant as specified in its Charter)

|

California

|

|

001-13126

|

|

83-3889101

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

No.)

|

|

(IRS

Employer

Identification

No.)

|

1340 Brook Street, Unit M, St. Charles, Illinois 60714

(Address of principal executive offices)

(630) 708-0750

(Registrant’s Telephone Number)

(Former name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [X]

2050

Motors, Inc. is referred to herein as “we”, “us”, or “us”

Background

On

May 5, 2019, 2050 Motors, Inc. executed a Securities Purchase Agreement (SPA) with our CEO, Vikram Grover, for an investment of

$483,000.00 in value for 400,000 Series B Convertible Preferred Shares priced at $1.2075 per share. The transaction closed on

May 15, 2019. Further, on May 16, 2019, Vikram Grover executed a one-year Lock-UP Agreement regarding all of his Convertible Preferred

Shares. This filing supplements our original Form 8-K filing dated May 6, 2019 with the May 16, 2019

Lock-Up Agreement.

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On

May 5, 2019, 2050 Motors, Inc. executed a Securities Purchase Agreement with our CEO, Vikram Grover, for an investment in the

Company of $483,000.00 in the form of 210,000,000 free-trading common shares of Peer to Peer Network aka Mobicard Inc. As consideration,

the Company is issuing the investor 400,000 newly created 1% Cumulative Series B Preferred Shares, each of which bears a restrictive

legend, is convertible into 1,000 common shares, and has 1,000 votes on corporate matters. The investment is intended to strengthen

the Company’s balance sheet, provide liquidity and facilitate capital raising.

Item

9.01. Exhibits

(a)

Exhibits. The following exhibit is filed with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

2050

MOTORS, INC.

|

|

|

|

|

|

Date:

May 17, 2019

|

By:

|

/s/

Vikram Grover

|

|

|

|

Vikram

Grover

|

|

|

|

Chief

Executive Officer

|

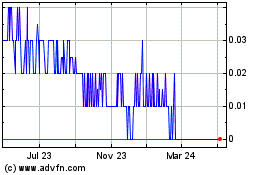

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

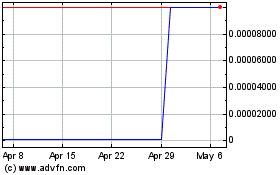

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Apr 2023 to Apr 2024