Gold Stocks to Watch as Investors

Flock to the Precious Metal

May 15, 2019 -- InvestorsHub NewsWire -- Microcap Speculators --

Gold has been a safe haven for investors avoiding the market

fallout from Trump’s tariffs. Here are a few gold stocks to

watch.

One under the radar gold company worth your time,

Inception Mining, Inc (USOTC:

IMII), owns and operates a producing mine with the

capacity to produce 1000 tons per day. They have recently released

a report on the mine, so now may be the time to dig in.

The 5 Gold Stocks we are highlighting: Inception Mining,

Inc. (USOTC:

IMII), YAMANA GOLD INC. (NYSE:

AUY), Hecla Mining Company (NYSE:

HL), McEwen Mining Inc. (NYSE:

MUX) and U.S. Gold Corp. (USAU).

Inception Mining, Inc. (USOTC:

IMII) (Market Cap: $19.352M; Share Price:

$0.338) announced in March that the company has

completed a National Instrument 43-101 Technical Report that

includes an estimate on its Clavo Rico Project, located in El

Corpus, Departamento Choluteca, Honduras. The Technical

Report can be found on the company’s website at http://inceptionmining.com/clavorico/43-101-report/.

Highlights of the Report include:

- Economic mineralization at Clavo Rico is contained in three

distinct zones, including an oxide zone, a supergene enrichment

zone, and a sulfide zone.

- Data on 96 recent and historic drill holes totaling 6264 meters

of drill core yielding 2552 assays together with 827 channel

samples collected from historic adits.

- Data on an oxide zone. The oxide zone has been producing since

2015.

- Data on a sulfide zone that was calculated using two different

modeling techniques to reflect geologic uncertainties:

- Data of the supergene enrichment zone

- The conceptual geologic model, supported by field mapping,

production records and both recent and historic drill programs

suggests that significant potential exists to increase the known

mineral resource with additional drilling.

Inception Mining is a producing gold mining company engaged in

the identification, exploration, acquisition and development of

mineral properties. IMII owns and operates the Clavo Rico

mine.

________

YAMANA GOLD INC. (NYSE:

AUY) (Market Cap: $1.958B; Share Price:

$2.0500) announced on Monday it has agreed to sell

the wholly-owned Chapada mine to Lundin Mining Corporation for

total consideration of over $1.0 billion. Chapada, located in

the State of Goiás, Brazil, is a copper mine with additional gold

production that was developed by the company and began production

in 2007. Under the terms of the agreement with Lundin, Yamana

will receive cash consideration of $800 million at closing,

additional consideration of up to $125 million based on the price

of gold, a $100 million payment contingent on the development of a

pyrite circuit to optimize the operation, and a royalty on the

adjacent Suruca gold project.

The Sale Transaction provides a significant improvement to the

company's financial flexibility going forward due to annualized

interest savings in excess of $35 million. The up-front cash

consideration of $800 million provides for significant deleveraging

benefits. The improved balance sheet and interest savings

will enable the company to increase its dividend significantly

thereby improving its returns to shareholders and allowing the

company flexibility of further capital returns, including a share

buyback.

Yamana Gold Inc. engages in operating mines, development stage

projects, and exploration and mineral properties primarily in

Canada, Brazil, Chile, and Argentina. The company primarily

sells precious metals, including gold, silver, and copper. Its

principal mining properties comprise the Chapada and Jacobina mines

in Brazil, the Canadian Malartic mine in Canada, and the Cerro Moro

mine in Argentina and the El Peñón and Minera Florida mines in

Chile. The company was formerly known as Yamana Resources

Inc. and changed its name to Yamana Gold Inc. in July 2003.

________

Hecla Mining Company (NYSE:

HL) (Market Cap: $753.66M; Share Price:

$1.55) announced 2 weeks ago it is filing a National

Instrument (NI) 43-101 Technical Report on the Greens Creek Mine in

Alaska and the Casa Berardi Mine in Quebec. Some of the

highlights for the Greens Creek mine include:

- Reserves are calculated at price assumption of $14.50 per ounce

silver.

- The current Proven and Probable Reserve of 107.1 million silver

ounces is the highest since 2008, the year Hecla acquired 100% of

the mine.

- The Life of Mine Plan (LOM) extends production to 2030 without

including any resources.

- Measured and Indicated Resources are 97.4 million silver

ounces.

- Significant exploration potential.

For Casa Berardi Mine, the key highlights include:

- Reserves are calculated at price assumption of $1,200 per gold

ounce.

- Gold Proven and Probable Reserves increased approximately 28%

to 1.91 million ounces.

- Substantial reserve increases occurred in the proposed West

Mine Crown Pillar and Principal pits, Casa Berardi's highest-grade

pits.

- The LOM extends production to 2034 without including any

resources.

- Measured and Indicated Resources are 1.2 million gold

ounces.

- Significant exploration potential.

Hecla Mining Company, together with its subsidiaries, discovers,

acquires, develops, and produces precious and base metal properties

worldwide. The company offers lead, zinc, and bulk flotation

concentrates to custom smelters and brokers and unrefined gold and

silver bullion bars to precious metals traders. It owns 100%

interests in the Greens Creek mine located on Admiralty Island in

southeast Alaska, Lucky Friday mine located in northern Idaho, Casa

Berardi mine located in the Abitibi region of northwestern Quebec,

Canada, and San Sebastian mine located in the city of Durango,

Mexico. It is a leading low-cost U.S. silver producer with

operating mines in Alaska, Idaho and Mexico, and is a growing gold

producer with operating mines in Quebec, Canada and

Nevada.

________

McEwen Mining Inc. (NYSE:

MUX) (Market Cap: $514.806M; Share Price:

$1.43) reported last week consolidated production for

Q1 2019 of 26,789 gold ounces and 703,217 silver ounces, or 36,166

gold equivalent ounces (“GEOs”). McEwen has the goal to

qualify for inclusion in the S&P 500 Index by creating a

profitable gold and silver producer focused in the

Americas.

McEwen Mining Inc. engages in the exploration, development,

production, and sale of gold and silver. It also explores for

copper deposits. The company owns 100% interests in the El

Gallo and Fenix projects located in Mexico, and the Black Fox Mine

and Stock Mill, Grey Fox, and Froome and Tamarack properties in

Canada. It also owns interests in the Fuller,

Davidson-Tisdale, Buffalo Ankerite, and Paymaster exploration

properties located in Canada; and a 49% interest in the San José

mine located in Argentina.

________

U.S. Gold Corp. (USAU) (Market Cap: $25.548M; Share

Price: $1.36), a gold exploration and development

company, announced as recently as last month, the completion and

compilation of additional district-wide geochemical surveys on the

Keystone project. Commensurate detailed geological mapping

has also been completed with potentially significant new

Carlin-type deposit target characteristic implications. The

geochemical data, combined with earlier gravity and other

geophysical survey assessments, and scout drilling programs to

date, have provided the necessary information to identify, and zero

in on, site-specific discovery opportunities in 2019. Today, it

announced that the Honorable Ryan K. Zinke has been appointed to

the Board of Directors.

U.S. Gold Corp. operates as a gold exploration and development

company in the United States. It has a portfolio of development and

exploration properties. The company's properties include the

Copper King project, an advanced stage gold and copper exploration

and development project located in southeast Wyoming; Keystone

project, an exploration property on the Cortez Trend in Nevada; and

the Gold Bar North project, a gold exploration property located in

Eureka County, Nevada. It is a publicly traded U.S.-focused gold

exploration and development company.

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting has agreed to a three-month

term consulting agreement with IMII signed 02/12/2019. The

agreement calls for $25,000 in cash and 10,000 restricted shares of

IMII per month. All payments were made directly by Inception

Mining, Inc. to Regal Consulting, LLC to provide investor relations

services, of which this article is a part of. Regal

Consulting also paid one thousand dollars cash to

microcapspeculators.com to distribute this article. Regal

Consulting may have a position in the securities mentioned in this

article at the time of publication, and may increase or decrease

its position without notice. This article is based on public

information and the opinions of Regal Consulting. IMII was given an

opportunity to edit this article. This article contains

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially

from any results predicted herein. Regal Consulting is not

registered with any financial or securities regulatory authority,

and does not provide or claim to provide investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Full Legal Disclaimer Click

Here.

Contact Information:

Company Name: ACR Communication LLC.

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

SOURCE: Microcap Speculators

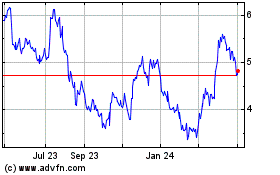

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2023 to Apr 2024