Ralph Lauren's Profit Shrinks -- WSJ

May 15 2019 - 3:02AM

Dow Jones News

Sales to department stores decline as company pulls back from

discount chains

By Suzanne Kapner and Kimberly Chin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 15, 2019).

Ralph Lauren Corp.'s profit and sales fell in the most recent

quarter, dragged down by declines in North America and a higher tax

expense.

The company's stock fell 3.7% to $113.95 even though Ralph

Lauren increased its quarterly dividend by 10%.

"We believe our strategy is working and our plan is on track,"

Ralph Lauren Chief Executive Patrice Louvet told analysts on a

conference call.

He noted that for the full fiscal year the company surpassed

many targets in its strategic plan, including revenue and profit

growth.

Mr. Louvet pointed to progress in winning over younger consumers

and focusing on more full-priced sales as signs the company was on

track. But he added it needed to do a better job attracting

shoppers to its retail stores.

Net revenue for the period that ended March 30 fell 1.5% to

$1.51 billion from the year prior, reversing three previous

quarters of growth.

Profit for the period was down 23% to $31.6 million, or 39 cents

a share, compared with $41.3 million, or 50 cents a share, a year

earlier.

In North America, revenue fell 7% to $708 million. Wholesale

revenue to third parties such as department stores fell 10%, in

part due to a planned reduction to off-price sellers such as T.J.

Maxx.

Sales excluding newly opened or closed locations at the

company's North American retail stores fell 4%, including a 7%

decline at bricks-and-mortar locations. Digital sales grew 6%. Asia

and Europe performed better, with revenue up 6% and 4%,

respectively, in the period.

The company has invigorated core products such as its Polo

shirt, which it said performed strongly in the period.

But other areas still need work, such as its moderately priced

Lauren line sold in department stores.

Mr. Louvet said the brand needs to focus more on core categories

such as denim and dresses and have a better balance of fashion and

basics. In recent seasons, the line had too much fashion, he said.

There is a new design team in place for the line, and the company

is also renovating its Lauren shops in department stores.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Kimberly

Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

May 15, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

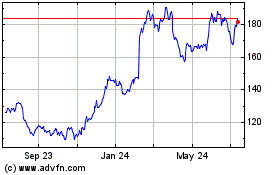

Ralph Lauren (NYSE:RL)

Historical Stock Chart

From Mar 2024 to Apr 2024

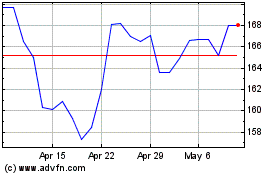

Ralph Lauren (NYSE:RL)

Historical Stock Chart

From Apr 2023 to Apr 2024