KKR in New Partnership to Hunt For U.S. Oil And Gas Deals

May 14 2019 - 8:16AM

Dow Jones News

By Micah Maidenberg

KKR & Co. (KKR) has formed a new venture to hunt for energy

deals in the U.S., striking its first acquisition in the Permian

Basin, the epicenter of the fracking boom.

The private-equity firm said Tuesday it will work with Spur

Energy Partners LLC to buy oil and gas production and development

assets in the continental U.S.

Spur Energy Partners was formed this year with a financial

commitment from KKR. The company is led by Jay Graham, the former

chief executive of WildHorse Resource Development Corp., which

Chesapeake Energy Corp. (CHK) purchased in February.

Private-equity firms have been looking to bet on oil and gas

assets. NGP Energy Capital Management raised about $4 billion to

invest in the sector, The Wall Street Journal reported earlier this

year. Some firms are looking to buy so-called noncore assets that

publicly traded producers are selling as those companies focus on

their main fields.

In its first deal, the companies agreed to buy interests in 380

gross producing wells and 22,000 net acres on the New Mexico side

of the Permian Basin from Percussion Petroleum LLC. Deal terms

weren't announced. The assets produced 9,200 net barrels of oil

equivalent per day in the first quarter.

The deal in New Mexico kicks off an expected multi-billion

investment partnership, Dash Lane, managing director on KKR's

energy real assets team, said in a statement. The companies didn't

specify how much KKR will invest.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

May 14, 2019 08:01 ET (12:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

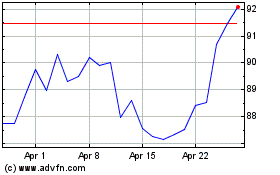

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

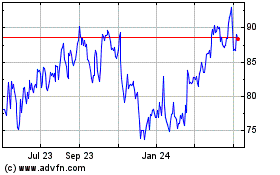

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024