Current Report Filing (8-k)

May 13 2019 - 5:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 9, 2019

Defense Technologies International Corp.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-54851

|

99-0363802

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

2683 Via De La Valle, Suite G418, Del Mar, CA

92014

(Address of principal executive offices)

Registrant's telephone number, including area code: (800) 520-9485

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the

registrant under any of the following provisions:

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

FORM 8-K

When used in this Current Report on Form 8-K, the terms “company”, “Defense Technologies,”

“DTII”, “we,” “us,” “our” and similar terminology, reference Defense Technologies International Corp.

Item 2.02 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of

a Registrant

On May 10, 2019, the company entered into a Settlement Agreement and Release (“

Settlement Agreement

”) with Firstfire Global Opportunities Fund LLC (“

Firstfire

”), relating to a prior convertible promissory note with Firstfire dated July 18, 2016 in the principal amount of $189,000.00 (the “

Note

”). The Settlement Agreement revises the terms of the Note as follows:

|

(a)

|

DTII agrees to pay Firstfire the sum of $75,000 as follows:

|

|

(i) $65,000.00 on May 10, 2019; and

|

|

(ii) $10,000.00 on or before May 31, 2019.

|

|

|

|

|

(b)

|

Firstfire is authorized to convert a portion of the Note into 150,000 shares of DTII common stock, pursuant

to the conversion provisions of the Note.

|

|

|

|

|

(c)

|

Upon the company’s payments set forth in paragraph (a) above and Firstfire’s Note conversion into DTII

common stock as per paragraph (b) above, neither Firstfire or the company will have any further claims against the other party whatsoever, the Note shall be deemed satisfied and paid in full, and Firstfire shall have no further rights to any

conversion to the company’s stock.

|

On May 10, 2019, DTII made the initial payment to Firstfire of $65,000.00 as required in paragraph (a)

above.

If any of the above Settlement Agreement terms are not fulfilled, Firstfire will have the right to convert

the Note at any time on or after May 31, 2019, as per the conversion terms of the Note. The current amount owed to Firstfire under the Note is approximately $160,000.00.

Item 3.03 Material Modification to Rights of Security Holders.

On May 9, 2019, DTII’s Board of Directors unanimously resolved to revise the terms of the company’s Series

A and Series B Preferred Shares. Under the new terms, the conversion right of both Series A and B Preferred Shares was changed from five (5) shares of DTII common stock for each one (1) share of Preferred Stock, to a new conversion right of ten

(10) shares of DTII common stock for each one (1) share of Preferred Stock. The revised conversion terms apply to all issued and outstanding Preferred Shares and to future issuances of Series A and Series B Preferred Stock. The Board received the

unanimous consent to the changed terms from each current Preferred shareholder.

Previously on December 11, 2018, the Board of Directors resolved to change the terms of the company’s

Series A and Series B Preferred Shares from ten (10) shares of DTII common stock for each one (1) share of Preferred Stock, to five (5) shares of DTII common stock for each one (1) share of Preferred Stock. The revised conversion terms applied to

all issued and outstanding Preferred Shares and to future issuances of Series A and Series B Preferred Stock.

As of the date hereof, there are issued and outstanding 2,925,369 shares of Series A Preferred Stock and

520,000 shares of Series B Preferred Stock. In addition to the conversion right, the Series A Preferred Shares have common stock voting rights on the basis of 100 votes per each Series A Share. Series B shares carry no voting rights.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits

|

Exhibit No.

|

Description

|

|

|

|

|

10.1

|

Settlement Agreement and Release

|

Cautionary Note About Forward-looking Statements

Statements contained in this current report which are not historical facts, may be

considered "forward-looking statements," which term is defined by the Private Securities Litigation Reform Act of 1995. Any “safe harbor under this Act does not apply to a “penny stock” issuer, which definition would include the company.

Forward-looking statements are based on current expectations and the current economic environment. We caution readers that such forward-looking statements are not guarantees of future performance. Unknown risks and uncertainties as well as other

uncontrollable or unknown factors could cause actual results to materially differ from the results, performance or expectations expressed or implied by such forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf by the undersigned hereunto duly authorized.

Defense Technologies International Corp.

|

Date: May 13, 2019

|

By:

/s//

Merrill W. Moses

|

|

|

Merrill W. Moses

|

|

|

President, CEO and

|

|

|

Interim Chief Financial Officer

|

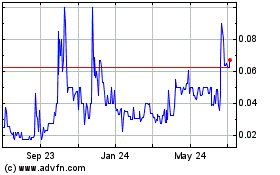

Defense Technologies (PK) (USOTC:DTII)

Historical Stock Chart

From Mar 2024 to Apr 2024

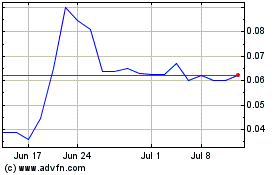

Defense Technologies (PK) (USOTC:DTII)

Historical Stock Chart

From Apr 2023 to Apr 2024