A Wall Street Journal Roundup

The increased tariffs enacted by the U.S. on products coming

from China raise the costs for many American companies and threaten

their future profits.

On Friday, the U.S. raised import tariffs to 25% on $200 billion

of Chinese goods, such as circuit boards, microprocessors, vehicle

parts and machinery. President Trump also has warned about imposing

25% tariffs on $325 billion in Chinese goods that aren't currently

taxed. Such a move would cover virtually all Chinese exports to the

U.S. and spread the pain to consumers.

Consumers haven't felt the brunt of the U.S.-China trade fight

since the tariffs so far have largely targeted components used by

manufacturers or because businesses absorbed some of the initial

10% tariffs.

Below is a look at some of the industries grappling with the

effect of tariffs.

Autos

The tariff increase will cover a range of auto-parts imports,

from spark plugs to exhaust pipes, and likely cascade through the

supply chain, potentially affecting prices on new and used cars,

industry experts said.

While the 10% tariff levied in September had little effect on

parts pricing, auto-sector lobbyists said an increase to 25% could

push up makers' costs for cars assembled in the U.S. using imported

parts. The higher duty also could increase prices for car owners

replacing worn-out parts -- some of which are built mostly in

China.

As the auto industry has globalized, Chinese suppliers have

become dominant at certain points in the supply chains. There are

few affordable alternatives for some of these materials and parts,

industry trade groups said.

"Somebody has to eat that 25%. Either it gets passed along in

the supply chain and reduces margin, or that's passed onto the

consumer," said Aaron Lowe, a senior vice president at the Auto

Care Association, a lobbying group for auto-parts manufacturers,

distributors and retailers.

More than 1,000 Chinese companies export auto parts to U.S. car

companies and retailers of replacement parts. The U.S. imports

about $10 billion in parts from China annually, according to a

recent Boston Consulting Group study.

Most auto makers didn't have an immediate comment on the

tariffs. Toyota Motor Corp. said it is investigating the impact of

tariffs on its operations and will closely monitor the

situation.

The Commerce Department delivered a report to the White House

earlier this year on whether imported cars and auto parts could

pose a national security risk, a key justification for imposing

tariffs under U.S. trade law. But so far, the administration hadn't

acted on the report.

If a 25% tariff were levied on all automotive imports, the

average price of a vehicle sold in the U.S. would increase by

$4,400, according to a report from the Center for Automotive

Research. The price of an imported vehicle could rise by as much as

by $6,875, the group said.

--Adrienne Roberts

Manufacturers

Executives at major U.S. manufacturers said they would respond

to any change in the tariff by sourcing from other countries and by

raising prices.

Caterpillar Inc. Chief Executive Jim Umpleby said this month

that the company had encouraged U.S. officials to reach a deal with

Chinese counterparts. The heavy-equipment maker had said it expects

tariffs, including those on foreign-made steel and aluminum, to

cost it between $250 million and $350 million this year.

"We're cautiously optimistic here that, as we had been for some

time, that the issues will be resolved and we'll all move forward,"

Mr. Umpleby said in a May 2 interview. "Free trade is good...for

all of us."

Washing-machine maker Whirlpool Corp. last month lowered its

estimate for the tariff impact on its business this year to between

$200 million and $250 million, down from $300 million -- assuming

the tariff on Chinese goods remained at 10%.

Caterpillar and Whirlpool didn't immediately respond to

questions Friday.

More than 1,200 companies have applied for exemptions from

tariffs for products they said they could get only from China.

Through May 3, about 13% of requests had been granted.

One manufacturer whose request was rejected is engine maker

Cummins Inc., which imports turbochargers from its own plants in

China for further assembly in the U.S.

Cummins has said tariffs would cost it $150 million this year,

$30 million more than in 2018. The company said it has relocated

production of a small number of engines to the U.K. from China to

avoid the tariff impact.

"We continue to mitigate the impact on our company by creating

supply chain efficiencies, price increases and using the

flexibility we have with our sourcing capabilities," a Cummins

spokesman said.

--Austen Hufford and Bob Tita

Farmers

Fresh data from the U.S. Department of Agriculture on Friday

underscored how much the domestic supply of crops and livestock is

piling up amid trade tensions with China.

The department's estimate for the size of U. S.corn, soybean and

wheat stockpiles grew more than expected in May to 995 million

bushels of soybeans, 2.1 billion bushels of corn and 1.2 billion

bushels of wheat.

President Trump said on Twitter Friday that the federal

government would make bigger purchases from U.S. farmers and send

the foodstuffs as aid to poor countries. The pledge appeared to be

meant to help buoy farmers in the event that officials in China

place additional retaliatory tariffs on U.S. farm goods after the

U.S. raised duties on many imports from China.

Livestock futures have been rising despite the trade fight. That

is due largely to an outbreak of African swine fever, a fatal pig

disease that has sparked large-scale culling of China's pig herd.

That is prompting Chinese buyers to restart purchases of U.S.

pork.

Some analysts were optimistic that Friday's tariff increases

would give the U.S. leverage to secure a better trade deal for

farmers overall.

"President Trump wants a deal, but you never want a car salesman

to see how bad you want the car on his lot," INTL FCStone chief

commodities economist Arlan Suderman said in a note.

Some traders said any government purchases of U.S. farm goods

were unlikely to make up for business lost to China's huge and

growing market.

"Farmers are getting welfare instead of trade," said Joel

Karlin, an economist with Western Milling LLC of Goshen, Calif.

--Kirk Maltais

Semiconductors

U.S. chip makers that manufacture in China won't face an

additional sting from the new tariffs because their products are

already subject to a 25% duty, industry insiders say. At the same

time, they have blunted the hit by routing chips through third

countries instead of importing them directly from China to the

U.S.

China's reliance on the U.S. for its computer chips, meanwhile,

could discourage any retaliation against the industry after the

latest round of tariffs. Only about 14% of China's semiconductors

are forecast to come from domestic suppliers this year, according

to International Business Strategies Inc. China imported about $6.7

billion worth of chips from the U.S. last year, trade statistics

show.

--Asa Fitch

Consumer Electronics

The higher tariffs will encompass telecommunication and

networking equipment, as well as electronic devices ranging from TV

components to burglar alarms. Naomi Wilson, senior policy director

for Asia at the Information Technology Industry Council in

Washington, said that while the Trump administration's challenge to

China's trade practices was welcome, the tariff increase would only

"raise the toll" on American businesses, workers and consumers.

"This specific tariff increase will affect everyday

telecommunications equipment like modems and routers that help

Americans connect to the internet and with each other," Ms. Wilson

said. "Increased tariffs on hardware components also mean that

companies large and small will find it more difficult to use

digital and cost-saving solutions in their daily business."

--Asa Fitch

5G Wireless Networks

U.S. development of next-generation 5G wireless networks will

feel the effects of 25% tariffs, the Consumer Technology

Association warned Friday.

In less than a year of 10% tariffs, U.S. tech companies have

already paid more than $745 million extra for 5G-related products,

which include routers, switches and gateways that form the backbone

of new networks, CTA president Gary Shapiro said.

"Beyond the damage to American businesses, the tariffs actually

hurt us -- and help China -- in the global race to 5G technology,"

he said in a statement.

American companies such as Juniper Networks Inc. and Cisco

Systems Inc. are among the biggest purveyors of networking

equipment in the world. A Cisco spokeswoman declined to comment.

Juniper didn't respond to a request for comment.

--Asa Fitch

Bicycles

Higher tariffs mean more pain for the bicycle industry, which

was already struggling with weak sales. The number of bicycles sold

in the U.S. dropped by about 15% in the first quarter compared with

the same period a year earlier, according to the market research

firm NPD Group. Revenue dropped by about 2% as bicycle companies

passed along higher costs.

The tariffs added to the pain from the bankruptcy filings by

retailers Toys "R" Us and Performance Bicycle.

"It's made it a much more challenging environment," said Matt

Moore, general counsel of Quality Bicycle Products Inc., a

distributor.

Bicycle companies have been looking to shift production to other

locations, but such moves are very disruptive to the industry's

supply chain, which operates with a three- to six-month lead time,

he said.

Kent International Inc., which sells about 3 million bicycles a

year, said the 10% tariffs imposed by the Trump administration last

year pushed the company from a profit to a loss. Kent passed along

much, but not all, of the added cost to its customers in the form

of higher prices, but "sales dropped 5% to 10% below forecast

because of sticker shock," said Arnold Kamler, chief executive for

more than 30 years.

The Kearny, N.J., company early last year put a hold on plans to

expand production at its Manning, S.C., factory because of higher

tariffs on imported steel and parts. Its main supplier recently

purchased a large property in Cambodia, but Kent slowed plans to

shift production when it appeared a trade deal was near. Given the

company's size, that type of shift isn't easy, said Mr. Kamler, who

plans to revisit a potential move at the end of May.

Some companies already have made the move. Pedego Electric

Bikes, based in Fountain Valley, Calif., had been looking to shift

manufacturing out of China because of European tariffs imposed

early last year. It accelerated that shift in response to the

tariffs imposed by the Trump administration; the company now makes

70% of its bicycles in Vietnam and 30% in Taiwan.

"We were big enough that we could afford to do it, but not so

big that we can't find production capacity," said Don DiConstanzo,

chief executive of Pedego, which sold about 12,000 electric

bicycles last year. Mr. DiConstanzo is looking at building bicycles

in the U.S., but so far can't find anyone here who can make bicycle

frames. "We our considering opening our own frame factory," he

said.

--Ruth Simon

Solar Equipment

The higher tariffs will impact Chinese-made solar inverters, a

piece of electrical equipment that converts the output of solar

panels to alternating current. But the effect may be muted, because

many inverter makers have already begun to shift manufacturing away

from China to avoid the existing 10% tariffs and in anticipation of

potentially higher tariffs.

Both Enphase Energy Inc. and SolarEdge Technologies Inc., which

between them control the majority of the residential market for

solar inverters, are expected to open manufacturing operations in

Mexico and Vietnam this year, said Jeffrey Osborne, an analyst who

covers the solar industry for Cowen Inc.

"I really don't see solar having an issue," he said.

The higher tariff could accelerate a move by solar-industry

manufacturing away from China. Existing tariffs and anti-dumping

duties have significantly affected the cost of Chinese solar panels

in the U.S. Manufacturing of panels has shifted to Southeast

Asia.

There has been a small increase in U.S manufacturing as well.

Existing taxes on imported panels has slowed the growth of solar

installations in the U.S., said John Smirnow, general counsel of

the Solar Energy Industries Association, a Washington, D.C., trade

group.

--Russell Gold

Apparel and Footwear

Apparel and footwear aren't affected by the current round of

tariffs and wouldn't be impacted unless the U.S. administration

targeted all remaining Chinese imports. If that were to happen, the

categories could take a big hit. Sixty-nine percent of all footwear

and 42% of all apparel sold in the U.S. is imported from China,

according to the American Apparel and Footwear Association.

--Suzanne Kapner

Retailers

Walmart Inc. and other large retailers have prepared for

potential tariff increases since last year, importing goods early

and working with suppliers and manufacturers to lower production

costs. But shelf prices are likely to rise on a host of common

products with a 25% tariff, Walmart said in a September letter to

trade officials arguing against the measure.

The largest U.S. retailer by revenue could weather higher

tariffs better than smaller rivals, said retail analysts. Stores

that earn a higher percentage of sales from groceries, including

Walmart, Costco Wholesale Corp. and others, will see lesser

impacts, according to a Bernstein report. Larger retailers also

have more robust sourcing teams and greater ability to pressure

suppliers to lower prices.

Around 56% of Walmart's U.S. sales come from groceries, which

are less likely to come from China than other products like

Christmas lights or apparel. Around two-thirds of Walmart's

purchases are made in the U.S., company executives have told

investors.

Prices are already rising on some goods like home products and

bicycles at Walmart and its competitors under the earlier 10%

tariff, said Walmart finance chief Brett Biggs at a March analyst

conference. "Our merchants are watching day by day, category by

category. They've always been working with suppliers on their own

cost structure," he said. "But we want to continue to be the

low-price leader."

Retailers have worked to fight tariffs, with the National Retail

Federation calling the tactic "taxes paid by American businesses

and consumers, not by China." Many retailers started to move supply

chains outside China, but those efforts take time and are still in

progress, said Jonathan Gold, a vice president at the NRF. "Folks

are still trying to figure out what the right thing to do is."

--Sarah Nassauer

Medical Devices

The U.S. tariff hike on certain Chinese imports largely spares

finished medical devices, though they include some categories such

as electrical nerve-stimulation machines and medical-imaging

components.

Medical-technology manufacturers and their allies in Congress

have lobbied to exclude many products from the Trump

administration's tariff actions.

In a prior round of tariff actions last year, industry lobbyists

persuaded the administration to reduce the total value of medical

technologies subject to new tariffs to less than $1 billion, from

initial proposals of about $3 billion.

Industry trade group AdvaMed, whose members include Johnson

& Johnson and Medtronic PLC, has opposed the tariffs. "We

remain hopeful for a successful conclusion of the negotiations,

which are delicate and with broad-reaching implications that our

industry is watching closely on behalf of the patients we serve,"

Ralph Ives, AdvaMed executive vice president of global strategy and

analysis, said in a statement.

--Peter Loftus

(END) Dow Jones Newswires

May 10, 2019 18:49 ET (22:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

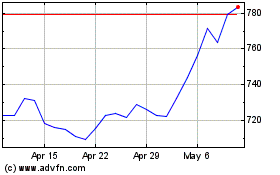

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

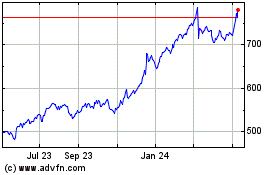

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024