New iShares ESG Fund Off to Roaring Start

May 10 2019 - 7:29AM

Dow Jones News

By Asjylyn Loder

A brand new exchange-traded fund that tries to invest in the

best corporate citizens in the U.S. is slated to begin trading at

Friday's opening bell, but is already on track to be one of the

most successful fund launches in history.

The fund, BlackRock Inc.'s iShares ESG MSCI USA Leaders, expects

to raise more than $800 million in its Friday debut. It is

especially noteworthy because the ETF fits into a small but

increasingly crowded corner of the market devoted to responsible

investing.

Asset managers have long heralded sustainable strategies as the

next big thing in the $4 trillion ETF industry, but growth has been

painfully slow. That is now changing.

ETFs that invest based on environmental, social and governance

metrics have raised $1.9 billion this year, boosting assets to $12

billion. All told 30 of the 75 ETFs, including some of the most

successful, are less than two years old.

While still a vanishingly small piece of the market, ESG funds

are quickly gaining traction. For example, three other iShares ESG

ETFs have nearly tripled in size in the past year, according to

FactSet. Nuveen's ESG fund that invests in smaller companies has

more than doubled in size in that time. Vanguard introduced two new

ETFs in September that already have almost $670 million in

assets.

Advisers have begun to realize that sustainable strategies are

critical to retaining clients, especially younger investors who

will inherit wealth amassed by their baby boomer parents, said

Sarah Kjellberg, head of sustainable investing for the U.S. iShares

business. That is one reason why big banks, digital advice

platforms and large independent wealth managers have begun offering

ESG portfolios in recent years.

Last year, Bank of America Corp., the largest provider of ETF

model portfolios, added ESG strategies for Merrill Lynch and

Merrill Edge clients, and TD Ameritrade Holding Corp. added

"Socially Aware" portfolios to its Essential Portfolios robo

adviser business.

"If you're not talking to your clients about it, your competitor

is probably talking to them about it," Ms. Kjellberg said.

The big buyer of the iShares ETF debuting Friday is Ilmarinen,

Finland's largest pension-insurance company. Ilmarinen was also the

anchor investor in an identical ETF launched in March by DWS Group

Inc., the asset-management business of Deutsche Bank AG. That fund

now has $884 million in assets, according to FactSet.

Ilmarinen, which manages EUR47 billion ($52.8 billion), in 2017

adopted MSCI ESG indexes as the benchmark for roughly half of its

listed equity investments, but couldn't find inexpensive, easily

traded ETFs that met its needs, Anna Hyrske, head of responsible

investment for Ilmarinen, said in a March interview.

ESG is a contemporary offshoot of socially responsible investing

that tries to deliver a feel-good flavor of investing without

sacrificing diversification or returns. Unlike older strategies,

ESG doesn't categorically ban unloved industries but tries to find

those companies that perform the best on issues like pollution and

pay parity.

The new iShares ETF, like DWS Group's Xtrackers fund that

launched in March, invests in an index that picks the companies

with the best scores on MSCI Inc.'s sustainability ratings. To come

up with the scores, MSCI analysts scour news stories, financial

records, company reports and regulatory filings looking for hazards

that a traditional financial analysis might miss.

Write to Asjylyn Loder at asjylyn.loder@wsj.com

(END) Dow Jones Newswires

May 10, 2019 07:14 ET (11:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

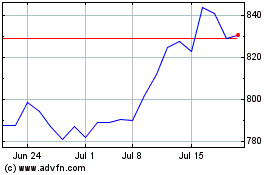

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

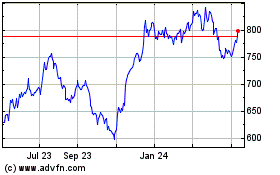

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024