Lincoln Educational Services Corporation (Nasdaq: LINC) today

reported financial results for the first quarter ended March 31,

2019 and reiterated full year 2019 guidance.

“The Lincoln team delivered another quarter of consistent

progress with solid revenue and student start growth, higher

graduation and placement rates and controlled operating expenses,”

commented Scott Shaw, President and Chief Executive Officer.

“While much is made of the low unemployment rate in America, an

estimated five million jobs in this country remain unfilled because

the available workforce doesn’t have the skills required by the

employers. For the past six consecutive quarters, we’ve been

increasing student starts at our campuses because of our ability to

provide students with the skills needed by these employers and then

successfully placing our graduates with them. As a result, our

student graduation rates are increasing and our placements of

students into jobs in the field of their study now exceeds 81%.

This growth is leading to improved financial performance for the

Company and enables us to reiterate our financial guidance for the

full year, which includes generating net income for the first time

in four years.”

FIRST QUARTER FINANCIAL RESULTS HIGHLIGHTS:

- Total revenue for the first quarter increased by $1.4 million,

or 2.2%, to $63.3 million. Revenue on a same school basis

increased by 6.3%, or $3.8 million.

- Total student starts rose 2.6%, while same school student

starts rose 5.6% resulting from improved processes in marketing and

admissions as evidenced by a slight reduction in cost per start.

Transportation and Skilled Trades segment starts were up

approximately 1% and Healthcare and Other Professions segment

starts increased 15.2%.

- Educational services and facilities expense decreased by $0.5

million, or 1.7%, to $30 million. The expense reductions were

primarily due to the Transitional segment, which accounted for $1.5

million in cost savings partially offset by $1.2 million of

increased instructional expenses directly related to the Company’s

increased student population.

- Selling general and administrative expense increased by $0.6

million, or 1.6%, to $38.1 million. Excluding the

Transitional segment, which had cost reductions of $1 million,

selling, general and administrative expenses would have increased

by $1.6 million. This increase was due to additional costs

incurred related to increases in student population, in addition to

corporate expenses incurred in connection with the evaluation of

strategic initiatives intended to increase shareholder

value.

- Operating loss improved by $1.4 million during the current

quarter to $4.9 million from $6.3 million in Q1 2018.

- Net loss for the quarter decreased by $1.4 million to $5.5

million, or $0.22 per share, as compared to $6.9 million, or $0.28

per share.

FIRST QUARTER SEGMENT FINANCIAL PERFORMANCE

Transportation and Skilled Trades Segment

Transportation and Skilled Trades segment revenue increased by

$1.6 million, or 3.7%, to $44.3 million for the three months ended

March 31, 2019, as compared to $42.7 million in the prior year

comparable period. The increase in revenue is due to a 6.3%

increase in average student population, which is attributed to the

Company’s consistent student start growth over the last year and a

half.

Operating income increased by $1.1 million, to $1.8 million from

$0.7 million in the prior year comparable period.

Educational services and facilities expense decreased by $0.1

million, or 0.6%, to $20.6 million from $20.7 million in the prior

year comparable period. The decrease in expense was a result

of reduced real estate costs of $0.3 million derived from the

successful renegotiation of lease terms at a campus, partially

offset by additional instructional expense resulting from an

increased student population quarter over quarter.

Selling, general and administrative expenses increased by $0.5

million, or 2.6%, to $21.9 million from $21.3 million in the prior

year comparable period.

Healthcare and Other Professions Segment

Healthcare and Other Professions segment revenue increased by

$2.2 million, or 13.1%, to $18.9 million as compared to $16.7

million in the prior year comparable period. The increase in

revenue was mainly due to an 11.6% increase in average student

population, which is attributed to consistent start growth over the

last year and a half.

Operating income increased by $0.6 million, to $1 million from

$0.4 million in the prior year comparable period.

Educational services and facilities expense increased by $1.1

million, or 13.3% to $9.4 million, from $8.3 million. The

increase in expense was primarily driven by increased instructional

expense and books and tools expense due to an 11.6% increase in

average student population quarter over quarter.

Selling general and administrative expense increased by $0.5

million, or 6.2%, to $8.6 million from $8.1 million in the prior

year comparable period.

Transitional Segment

During the year ended December 31, 2018, one campus, the LCNE

campus at Southington, Connecticut was categorized in the

Transitional segment. This campus has been fully taught out

of as of December 31, 2018 and financial information for this

campus has been included in the Transitional segment for the period

ending March 31, 2018. As of March 31, 2019, no campuses have

been categorized in the Transitional segment.

Revenue was zero and $2.4 million for the three months ended

March 31, 2019 and 2018 respectively. Operating loss was zero

and $0.1 million for the three months ended March 31, 2019 and 2018

respectively.

Corporate and Other

This category includes unallocated expenses incurred on behalf

of the entire Company. Corporate and other expenses were $7.7

million for the three months ended March 31, 2019 as compared to

$7.2 million in the prior year comparable period. The $0.5

million increase was primarily driven by costs incurred in

connection with the evaluation of strategic initiatives intended to

increase shareholder value.

2019 OUTLOOK

The Company is reiterating full year 2019

guidance first provided on March 6, 2019 as follows:

- Revenue and student starts are expected to increase 3% to 5%

from prior year, excluding the Transitional segment.

- Net income and EBITDA are projected to be approximately $2

million and $12 million, respectively.

CONFERENCE CALL INFO

Lincoln will host a conference call today at 10:00 a.m. Eastern

Daylight Time. To access the live webcast of the conference

call, please go to the Investor Relations section of Lincoln’s

website at http://www.lincolntech.edu. Participants can also

listen to the conference call by dialing 844-413-0946 (domestic) or

216-562-0456 (international) and providing access code 5519039.

Please log in or dial into the call at least 10 minutes prior to

the start time.

An archived version of the webcast will be accessible for 90

days at http://www.lincolntech.edu. A replay of the call will

also be available for seven days by calling 855-859-2056 (domestic)

or 404-537-3406 (international) and providing access code

5519039.

ABOUT LINCOLN EDUCATIONAL SERVICES

CORPORATION

Lincoln Educational Services Corporation is a provider of

diversified career-oriented post-secondary education and helping to

provide solutions to America’s skills gap. Lincoln offers

recent high school graduates and working adults degree and diploma

programs. The Company operates under three reportable

segments: Transportation and Skilled Trades, Healthcare and Other

Professions and Transitional. Lincoln has provided the nation’s

workforce with skilled technicians since its inception in 1946. For

more information, go to www.lincolntech.edu.

SAFE HARBOR

Statements in this press release and in oral

statements made from time to time by representatives of Lincoln

Educational Services Corporation regarding Lincoln’s business that

are not historical facts may be “forward-looking statements” as

that term is defined in the federal securities law. The words

“may,” “will,” “expect,” “believe,” “anticipate,” “project,”

“plan,” “intend,” “estimate,” and “continue,” and their opposites

and similar expressions are intended to identify forward-looking

statements. Forward-looking statements should not be read as a

guarantee of future performance or results and will not necessarily

be accurate indications of the times at, or by, which such

performance or results will be achieved, if at all.

Generally, these statements relate to business plans or strategies,

projected or anticipated benefits from acquisitions or dispositions

to be made by the Company or projections involving anticipated

revenues, earnings or other aspects of the Company’s operating

results. The Company cautions you that these statements

concern current expectations about the Company’s future performance

or events and are subject to a number of uncertainties, risks and

other influences many of which are beyond the Company’s control,

that may influence the accuracy of the statements and the projects

upon which the statements are based. The events described in

forward-looking statements may not occur at all. Factors which may

affect the Company’s results include, but are not limited to, the

risks and uncertainties discussed in the Company’s Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K filed with the Securities and Exchange Commission.

Any one or more of these uncertainties, risks and other influences

could materially affect the Company’s results of operations and

financial condition and whether forward-looking statements made by

the Company ultimately prove to be accurate and, as such, the

Company’s actual results, performance and achievements could

materially differ from those expressed or implied in these

forward-looking statements. Forward-looking statements are based on

information available at the time those statements are made and/or

management’s good faith belief as of that time with respect to

future events, and are subject to risks and uncertainties that

could cause actual performance or results to differ materially from

those expressed in or suggested by the forward-looking statements.

Important factors that could cause such differences include, but

are not limited to, our failure to comply with the extensive

regulatory framework applicable to our industry or our failure to

obtain timely regulatory approvals in connection with acquisitions

or a change of control of our Company; our success in updating and

expanding the content of existing programs and developing new

programs for our students in a cost-effective manner or on a timely

basis; risks associated with changes in applicable federal laws and

regulations; uncertainties regarding our ability to comply with

federal laws and regulations, such as the 90/10 rule and prescribed

cohort default rates; risks associated with the opening of new

campuses; risks associated with integration of acquired schools;

industry competition; our ability to execute our growth strategies;

conditions and trends in our industry; general economic conditions;

and other factors discussed in the “Risk Factors” section of our

Annual Reports and Quarterly Reports filed with the Securities and

Exchange Commission. All forward-looking statements are

qualified in their entirety by this cautionary statement, and

Lincoln undertakes no obligation to publicly revise or update any

forward-looking statements, whether as a result of new information,

future events or otherwise after the date hereof.

(Tables to Follow)(In Thousands)

| |

|

| |

|

| |

Three Months

Ended |

| |

March

31, |

| |

(Unaudited) |

|

|

2019 |

|

2018 |

|

|

|

|

|

|

REVENUE |

$ |

63,263 |

|

|

$ |

61,889 |

|

| COSTS AND EXPENSES: |

|

|

|

|

Educational services and facilities |

|

29,980 |

|

|

|

30,503 |

|

|

Selling, general and administrative |

|

38,146 |

|

|

|

37,531 |

|

|

Loss on sale of assets |

|

1 |

|

|

|

117 |

|

|

Total costs & expenses |

|

68,127 |

|

|

|

68,151 |

|

| OPERATING LOSS |

|

(4,864 |

) |

|

|

(6,262 |

) |

| OTHER: |

|

|

|

|

Interest income |

|

4 |

|

|

|

10 |

|

|

Interest expense |

|

(557 |

) |

|

|

(572 |

) |

|

Other income |

|

- |

|

|

|

- |

|

|

LOSS BEFORE INCOME TAXES |

|

(5,417 |

) |

|

|

(6,824 |

) |

| PROVISION FOR INCOME

TAXES |

|

50 |

|

|

|

50 |

|

| NET LOSS |

$ |

(5,467 |

) |

|

$ |

(6,874 |

) |

| Basic |

|

|

|

| Net loss per share |

$ |

(0.22 |

) |

|

$ |

(0.28 |

) |

| Diluted |

|

|

|

| Net loss per share |

$ |

(0.22 |

) |

|

$ |

(0.28 |

) |

| Weighted average number of

common shares outstanding: |

|

|

|

| Basic |

|

24,534 |

|

|

|

24,138 |

|

| Diluted |

|

24,534 |

|

|

|

24,138 |

|

| |

|

|

|

| Other

data: |

|

|

|

| |

|

|

|

| EBITDA (1) |

$ |

(2,814 |

) |

|

$ |

(4,162 |

) |

| Depreciation and

amortization |

$ |

2,050 |

|

|

$ |

2,100 |

|

| Number of campuses |

|

22 |

|

|

|

23 |

|

| Average enrollment |

|

10,589 |

|

|

|

10,214 |

|

| Stock-based compensation |

$ |

52 |

|

|

$ |

429 |

|

| Net cash used in operating

activities |

$ |

(10,922 |

) |

|

$ |

(10,042 |

) |

| Net cash provided by (used in)

investing activities |

$ |

(639 |

) |

|

$ |

(468 |

) |

| Net cash used in financing

activities |

$ |

(24,204 |

) |

|

$ |

(30,691 |

) |

| |

|

|

|

| Selected Consolidated

Balance Sheet Data: |

March 31, 2019 |

| |

(Unaudited) |

| |

|

|

Cash and cash equivalents |

$ |

5,683 |

|

|

Current assets |

|

37,736 |

|

|

Working capital deficit |

|

(22,015 |

) |

|

Total assets |

|

155,989 |

|

|

Current liabilities |

|

59,751 |

|

|

Long-term debt obligations, including current portion |

|

24,593 |

|

|

Total stockholders' equity |

|

34,587 |

|

|

|

|

On March 6, 2019, the Company entered into a fourth amendment of

the existing credit agreement with Sterling National Bank.

The amendment provides the Company with an additional $5 million

for working capital needs through October of this year. In

addition, the amendment converts Facility 1 from a revolving line

of credit to a term loan for 5 years; extends the maturity date of

the credit agreement until March 31, 2024; and revised the

financial covenants to better align with our projected results for

2019.

As of March 31, 2019, total debt outstanding was $25.2 million

comprised of $22.7 million under Facility 1 and an advance of $2.5

million under Facility 2 for working capital purposes during the

quarter. Further, under the new term loan, principal payments

are payable monthly from July through December each year to

correspond to the seasonality of our business. Accordingly,

principal payments for 2019 will occur between the months of July

through December. The working capital advance of $2.5 million

will be repaid in October of this year.

(1) Reconciliation of Non-GAAP Financial

Measures

The Company believes it is useful to present non-GAAP financial

measures that exclude certain significant items as a means to

understand the performance of its business. EBITDA and same school

basis revenue are measurements not recognized in financial

statements presented in accordance with accounting principles

generally accepted in the United States of America (“GAAP”). We

define EBITDA as income (loss) before interest expense (net of

interest income), provision for income taxes, depreciation, and

amortization. We define same school basis revenue as Total Company

revenue less the Transitional segment revenue. EBITDA and

same school revenue are presented because we believe they are a

useful indicator of our performance and our ability to make

strategic acquisitions and meet capital expenditure and debt

service requirements. However, it is not intended to represent cash

flows from operations as defined by GAAP and should not be used as

an alternative to net income (loss) as an indicator of operating

performance or to cash flow as a measure of liquidity. EBITDA and

same school basis revenue are not necessarily comparable to

similarly titled measures used by other companies.

Following is a reconciliation of net loss to EBITDA and same

school basis revenue:

| |

|

| |

Three Months Ended March

31, |

| |

(Unaudited) |

|

|

|

|

|

|

|

2019 |

|

2018 |

| |

|

|

|

|

Net loss |

$ |

(5,467 |

) |

|

$ |

(6,874 |

) |

|

Interest expense, net |

|

553 |

|

|

|

562 |

|

|

Provision for income taxes |

|

50 |

|

|

|

50 |

|

|

Depreciation and amortization |

|

2,050 |

|

|

|

2,100 |

|

| EBITDA |

$ |

(2,814 |

) |

|

$ |

(4,162 |

) |

| |

|

|

|

| |

| |

Three Months Ended March

31, |

| |

(Unaudited) |

|

|

Transportation and Skilled Trades |

|

Healthcare and Other Professions |

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

|

Net income |

$ |

1,816 |

|

$ |

675 |

|

|

$ |

972 |

|

|

$ |

375 |

|

|

Interest expense, net |

|

- |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Provision (benefit) for income taxes |

|

- |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Depreciation and amortization |

|

1,844 |

|

|

1,884 |

|

|

|

95 |

|

|

|

51 |

|

| EBITDA |

$ |

3,660 |

|

$ |

2,559 |

|

|

$ |

1,067 |

|

|

$ |

426 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended March

31, |

| |

(Unaudited) |

| |

Transitional |

|

Corporate |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

| Net loss |

$ |

- |

|

$ |

(131 |

) |

|

$ |

(8,255 |

) |

|

$ |

(7,793 |

) |

|

Interest expense, net |

|

- |

|

|

- |

|

|

|

553 |

|

|

|

562 |

|

|

Provision for income taxes |

|

- |

|

|

- |

|

|

|

50 |

|

|

|

50 |

|

|

Depreciation and amortization |

|

- |

|

|

3 |

|

|

|

111 |

|

|

|

162 |

|

| EBITDA |

$ |

- |

|

$ |

(128 |

) |

|

$ |

(7,541 |

) |

|

$ |

(7,019 |

) |

| |

| |

Three Months Ended March

31, |

| |

(Unaudited) |

| |

|

|

|

|

|

| |

Total |

|

Total |

|

%

Change |

|

|

Company |

|

Company |

|

Same School

Basis |

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

Total Company Revenue |

$ |

63,263 |

|

$ |

61,889 |

|

|

|

|

Less: Transitional Revenue |

|

- |

|

|

(2,401 |

) |

|

|

|

Revenue on Same School Basis |

$ |

63,263 |

|

$ |

59,488 |

|

|

6.3 |

% |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

Three Months Ended March 31, 2018 |

| |

|

2019 |

|

|

|

2018 |

|

|

% Change |

| Revenue: |

|

|

|

|

|

|

Transportation and Skilled Trades |

$ |

44,325 |

|

|

$ |

42,747 |

|

|

3.7 |

% |

| Healthcare and Other

Professions |

|

18,938 |

|

|

|

16,741 |

|

|

13.1 |

% |

| Transitional |

|

- |

|

|

|

2,401 |

|

|

-100.0 |

% |

|

Total |

$ |

63,263 |

|

|

$ |

61,889 |

|

|

2.2 |

% |

| |

|

|

|

|

|

| Operating Income

(Loss): |

|

|

|

|

|

| Transportation and Skilled

Trades |

$ |

1,817 |

|

|

$ |

675 |

|

|

169.2 |

% |

| Healthcare and Other

Professions |

|

972 |

|

|

|

374 |

|

|

159.9 |

% |

| Transitional |

|

- |

|

|

|

(131 |

) |

|

100.0 |

% |

| Corporate |

|

(7,653 |

) |

|

|

(7,180 |

) |

|

-6.6 |

% |

|

Total |

$ |

(4,864 |

) |

|

$ |

(6,262 |

) |

|

22.3 |

% |

| |

|

|

|

|

|

| Starts: |

|

|

|

|

|

| Transportation and Skilled

Trades |

|

1,821 |

|

|

|

1,806 |

|

|

0.8 |

% |

| Healthcare and Other

Professions |

|

1,038 |

|

|

|

901 |

|

|

15.2 |

% |

| Transitional |

|

- |

|

|

|

79 |

|

|

-100.0 |

% |

|

Total |

|

2,859 |

|

|

|

2,786 |

|

|

2.6 |

% |

| |

|

|

|

|

|

| Average

Population: |

|

|

|

|

|

| Transportation and Skilled

Trades |

|

7,044 |

|

|

|

6,627 |

|

|

6.3 |

% |

| Healthcare and Other

Professions |

|

3,545 |

|

|

|

3,176 |

|

|

11.6 |

% |

| Transitional |

|

- |

|

|

|

411 |

|

|

-100.0 |

% |

|

Total |

|

10,589 |

|

|

|

10,214 |

|

|

3.7 |

% |

| |

|

|

|

|

|

| End of Period

Population: |

|

|

|

|

|

| Transportation and Skilled

Trades |

|

7,016 |

|

|

|

6,736 |

|

|

4.2 |

% |

| Healthcare and Other

Professions |

|

3,664 |

|

|

|

3,329 |

|

|

10.1 |

% |

| Transitional |

|

- |

|

|

|

419 |

|

|

-100.0 |

% |

|

Total |

|

10,680 |

|

|

|

10,484 |

|

|

1.9 |

% |

| |

|

|

|

|

|

LINCOLN EDUCATIONAL SERVICES CORPORATIONBrian

Meyers, CFO973-736-9340

EVC GROUP LLCInvestor Relations: Doug Sherk,

dsherk@evcgroup.com; 415-652-9100Media Relations: Tom Gibson,

201-476-0322

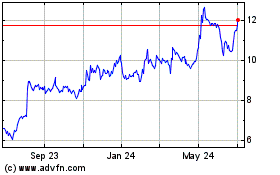

Lincoln Educational Serv... (NASDAQ:LINC)

Historical Stock Chart

From Mar 2024 to Apr 2024

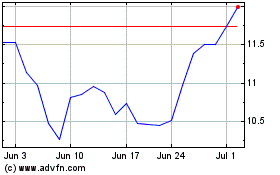

Lincoln Educational Serv... (NASDAQ:LINC)

Historical Stock Chart

From Apr 2023 to Apr 2024