Regulator to Oppose TPG, Vodafone Hutchison Australia Merger -- Update

May 08 2019 - 6:05AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--One of the biggest recent deals in

Australia faces collapse after the country's antitrust regulator

said it would block the combination of TPG Telecom Ltd. and

Vodafone Hutchison Australia.

The companies had been seeking approval to create a company with

an enterprise value of about 15 billion Australian dollars (US$10.5

billion), including debt, bringing together TPG's more than 1.9

million broadband subscribers and Vodafone's roughly 6 million

mobile-service subscribers.

However, the Australian Competition and Consumer Commission said

Wednesday it opposed the deal, which it said would reduce

competition in the country's already very concentrated

telecommunications markets.

In response, the two companies said they planned to launch legal

action and would seek approval for the tie-up in the federal court.

The pair have given their deal until the end of August next year to

allow for the court case and the merger process.

The regulator's decision was inadvertently published online on

its mergers register and quickly confirmed in a brief statement to

the Australian Securities Exchange, sparking a sharp drop in TPG

shares. The company, which now has a market value of about A$5.63

billion, ended the day down almost 14%.

The ACCC said the proposed merger would, in particular,

substantially lessen competition in the supply of mobile services

since it would preclude TPG from entering as a fourth

mobile-network operator in Australia.

"TPG is the best prospect Australia has for a new mobile network

operator to enter the market, and this is likely the last chance we

have for stronger competition in the supply of mobile services,"

Rod Sims, chairman of the regulator, said.

Analysts had considered there was a greater chance of regulatory

approval for the deal after TPG abandoned efforts in January to

build a mobile network to challenge Vodafone and the country's two

biggest operators, Telstra Corp. and Singapore Telecommunications

Ltd.-owned Optus. TPG made that decision, having invested about

A$100 million in early work, after Canberra blocked use of

equipment made by China's Huawei Technologies Co. in the rollout of

next-generation 5G mobile infrastructure on national security

grounds.

Australia's telecommunications operators have struggled in

recent years with intense competition in the mobile market and in

fixed-line services as the federal government pushes ahead with a

nationwide broadband network, which sells capacity to

operators.

In rejecting the planned merger, Mr. Sims said the ACCC

anticipated TPG would end up rolling out its mobile network if it

didn't combine with Vodafone Hutchison, characterizing it as a

"commercial imperative" for TPG to offer a mix of fixed and mobile

services.

He said TPG has a record for disrupting the telecom sector and

was expected to bring cheaper mobile plans and large data

allowances with its own network, competing strongly with the

incumbents. He added the company had already purchased mobile

spectrum and had an extensive fiber transmission network, a large

customer base and well-established brands.

The regulator said Vodafone has moved beyond mobile, entering

the fixed-broadband sector, which was also likely to improve

competition.

The ACCC said Telstra, Optus and Vodafone control about 87% of

the mobile-services market. Similarly, in the fixed-broadband

market Telstra, TPG and Optus collectively have a roughly 85%

share.

Vodafone Hutchison Chief Executive Inaki Berroeta said the

company remained committed to a merger with TPG and believed a

combination would bring real benefits to consumers. He said

Vodafone had a less than 1% share of the fixed-broadband sector,

and there was little overlap with TPG.

TPG Chairman David Teoh said while the company respected the

regulator's process, the decision had significant implications for

Australian consumers and had to be challenged. A combination would

create a new competitive force, and the biggest companies in the

industry would only entrench their power if left unchallenged, he

said.

Billed as a merger of equals, the combined company was to have

been 50.1% owned by Vodafone Hutchison, a 50-50 venture between the

U.K.'s Vodafone Group PLC and an Australian company controlled by

Hong Kong-based CK Hutchison Holdings Ltd. The remaining interest

would have been held by TPG's shareholders.

TPG and Vodafone Hutchison anticipated substantial cost savings

and revenue benefits from cross-selling products, and an enlarged

company with revenue, estimated when the merger was first announced

last August, of about A$6 billion.

The deal was one of the biggest mergers and acquisitions

unveiled in 2018, according to data compiled by Mergermarket, which

estimated it was the third-biggest deal of the year, behind the

spinoff of supermarket chain Coles Group Ltd. by Wesfarmers Ltd.

and the sale of a majority interest in Sydney Motorway Corp. by the

government of the state of New South Wales.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

May 08, 2019 05:50 ET (09:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

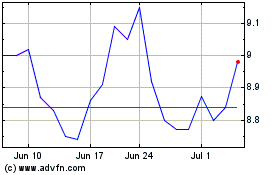

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

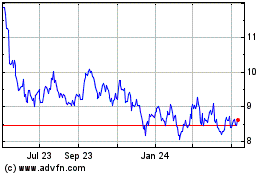

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024