Performant Financial Corporation (Nasdaq: PFMT), (the "Company"), a

leading provider of technology-enabled recovery and related

analytics services in the United States, today reported the

following financial results for its first quarter ended

March 31, 2019:

First Quarter Financial Highlights

- Total revenues of $34.9 million, compared to revenues of $57.0

million in the prior year period, down 38.8%

- Total revenues in the first quarter increased $5.7 million, or

19.5% when compared to the prior year period after excluding the

effects of the one-time release of a $27.8 million appeal reserve

in connection with the termination of our first CMS RAC contract in

the first quarter of 2018

- Net loss of $8.5 million, or $(0.16) per diluted share,

compared to net income of $8.5 million, or $0.16 per diluted share,

in the prior year period

- Adjusted EBITDA of $(4.4) million, compared to adjusted EBITDA

of $(3.4) million in the prior year period

- Adjusted net loss of $7.9 million, or $(0.15) per diluted

share, compared to an adjusted net loss of $4.3 million or $(0.08)

per diluted share in the prior year period

First Quarter 2019 Results

Total revenues in the first quarter were $34.9 million, a

decrease of (38.8)% from revenues of $57.0 million in the prior

year period. However, after excluding the one-time release of a

$27.8 million appeals reserve in connection with the termination of

the Company's first CMS RAC contract in the first quarter of 2018,

total revenues in the first quarter of 2019 increased $5.7 million,

or 19.5%, from the prior year period.

Healthcare revenues in the first quarter were $10.2 million, a

decrease of (67.4)% from revenues of $31.3 million in the prior

year period. Excluding the one-time appeals reserve release in the

first quarter of 2018, healthcare revenues in the first quarter of

2019 increased $6.7 million, or 191%, when compared to $3.5 million

in the prior year period. Combined CMS MSP and other CMS audit

recovery revenues were $5.9 million in the first quarter, a 354%

increase over the prior year period. Commercial healthcare clients

contributed revenues of $4.3 million, an increase of $2.1 million

or 95.5% from the prior year period.

Student lending revenues in the first quarter were $12.9

million, a decrease of $6.2 million, or 32.5% from revenues of

$19.1 million in the prior year period. This decrease was

related to reduced revenues from Great Lakes Higher Education

Guaranty Corporation, which had revenues of $1.2 million in the

first quarter of 2019, compared to $10.0 million in the prior year

period, offset by a $2.6 million increase in revenues from other

guaranty agencies.

Other revenues in the first quarter were $11.8 million, up from

$6.6 million in the prior year period.

Net loss for the first quarter of 2019 was $8.5 million,

or $(0.16) per share on a fully diluted basis, compared

to net income of $8.5 million or $0.16 per share on

a fully diluted basis in the prior year period. Adjusted

net loss for the first quarter of 2019 was $7.9 million,

resulting in $(0.15) per share on a fully diluted basis.

This compares to adjusted net loss of $4.3 million

or $(0.08) per fully diluted share in the prior year

period. Adjusted EBITDA for the first quarter of 2019

was $(4.4) million as compared to $(3.4)

million in the prior year period.

As of March 31, 2019, the Company had cash, cash

equivalents and restricted cash of approximately $6.0 million.

Business Outlook

“Our results in the first quarter demonstrate our continued

transition from a company that had a historical dependence on the

student lending industry to one that has increasingly diversified

its offerings and serves clients across a wider spectrum including

healthcare agencies, state and federal taxing authorities, other

federal agencies and commercial clients. While we are not out

of the initial investment stage as it relates to many of our more

recent contracts, we are beginning to see tangible benefits, such

as with our CMS MSP contract. At this point, we continue to

anticipate being able to deliver total revenues of $200 million

with margins in excess of 20% by 2021,” stated Lisa Im, CEO of

Performant.

“As for today, we feel confident with our current trajectory for

2019 and we are reiterating our guidance of revenues between $158

and $168 million, and adjusted EBITDA to be a loss of between $2

and $6 million,” concluded Im.

Note Regarding Use of Non-GAAP Financial

Measures

In this press release, to supplement our consolidated financial

statements, the Company presents adjusted EBITDA and adjusted net

(loss) income. These measures are not in accordance with accounting

principles generally accepted in the United States of America (US

GAAP) and accordingly reconciliations of adjusted EBITDA and

adjusted net (loss) income to net (loss) income determined in

accordance with US GAAP are included in the “Reconciliation of

Non-GAAP Results” table at the end of this press release. We have

included adjusted EBITDA and adjusted net (loss) income in this

press release because they are key measures used by our management

and board of directors to understand and evaluate our core

operating performance and trends and to prepare and approve our

annual budget. Accordingly, we believe that adjusted EBITDA and

adjusted net (loss) income provide useful information to investors

and analysts in understanding and evaluating our operating results

in the same manner as our management and board of directors. Our

use of adjusted EBITDA and adjusted net (loss) income has

limitations as an analytical tool and should not be considered in

isolation or as a substitute for analysis of our results as

reported under US GAAP. In particular, many of the adjustments to

our US GAAP financial measures reflect the exclusion of items,

specifically interest, tax and depreciation and amortization

expenses, equity-based compensation expense and certain other

non-operating expenses, that are recurring and will be reflected in

our financial results for the foreseeable future. In addition,

these measures may be calculated differently from similarly titled

non-GAAP financial measures used by other companies, limiting their

usefulness for comparison purposes.

Earnings Conference Call

The Company will hold a conference call to discuss its first

quarter 2019 results today at 5:00 p.m. Eastern. A live

webcast of the call may be accessed on the Investor Relations

section of the Company’s website at investors.performantcorp.com.

The conference call is also available by dialing 877-705-6003

(domestic) or 201-493-6725 (international).

A replay of the call will be available on the Company's website

or by dialing 844-512-2921 (domestic) or 412-317-6671

(international) and entering the passcode 13690399. The telephonic

replay will be available approximately three hours after the call,

through May 14, 2019.

About Performant Financial Corporation

Performant helps government and commercial organizations enhance

revenue and contain costs by preventing, identifying and recovering

waste, improper payments and defaulted assets. Performant is a

leading provider of these services in several industries, including

healthcare, student loans and government. Performant has been

providing recovery audit services for more than nine years to both

commercial and government clients, including serving as a Recovery

Auditor for the Centers for Medicare and Medicaid

Services.

Powered by a proprietary analytic platform and workflow

technology, Performant also provides professional services related

to the recovery effort, including reporting capabilities, support

services, customer care and stakeholder training programs meant to

mitigate future instances of improper payments. Founded in 1976,

Performant is headquartered in Livermore, California.

Forward Looking Statements

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements regarding our outlook for revenues,

net income and adjusted EBITDA in 2019 and 2021. These

forward-looking statements are based on current expectations,

estimates, assumptions and projections that are subject to change

and actual results may differ materially from the forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, the high level of

revenue concentration among the Company's largest customers and any

termination in the Company’s relationship with any of our

significant clients would result in a material decline in our

revenues, that many of the Company's customer contracts are subject

to periodic renewal, are not exclusive, do not provide for

committed business volumes and may be changed or terminated

unilaterally and on short notice, that there can be no assurance

that the Company is able to retain its new contract with the

Department of Education as the result of the protests filed by

unsuccessful bidders, that continuing limitations on the scope of

our audit activity under our RAC contracts have significantly

reduced our revenue opportunities with this client, that the

Company faces significant competition in all of its markets, that

the U.S. federal government accounts for a significant portion of

the Company's revenues, that future legislative and regulatory

changes may have significant effects on the Company's business,

that failure of the Company's or third parties' operating systems

and technology infrastructure could disrupt the operation of the

Company's business and the threat of breach of the Company's

security measures or failure or unauthorized access to confidential

data that the Company possesses. More information on potential

factors that could affect the Company's financial condition and

operating results is included from time to time in the "Risk

Factors" and "Management's Discussion and Analysis of Financial

Condition and Results of Operations" sections of the Company's

annual report on Form 10-K for the year ended December 31, 2018 and

subsequently filed reports on Forms 10-Q and 8-K. The

forward-looking statements are made as of the date of this press

release and the Company does not undertake to update any

forward-looking statements to conform these statements to actual

results or revised expectations.

Contact InformationRichard ZubekInvestor

Relations925-960-4988investors@performantcorp.com

PERFORMANT FINANCIAL CORPORATION AND

SUBSIDIARIESConsolidated Balance Sheets(In thousands,

except per share amounts)

| |

March 31, 2019 |

|

December 31, 2018 |

| |

(Unaudited) |

|

|

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

4,364 |

|

|

$ |

5,462 |

|

|

Restricted cash |

1,659 |

|

|

1,813 |

|

|

Trade accounts receivable, net of allowance for doubtful accounts

of $130 and $22, respectively |

17,877 |

|

|

20,879 |

|

|

Prepaid expenses and other current assets |

3,792 |

|

|

3,420 |

|

|

Income tax receivable |

14 |

|

|

179 |

|

|

Total current assets |

27,706 |

|

|

31,753 |

|

| Property, equipment, and leasehold improvements,

net |

21,488 |

|

|

22,255 |

|

| Identifiable intangible assets, net |

1,101 |

|

|

1,160 |

|

| Goodwill |

81,572 |

|

|

81,572 |

|

| ROU assets |

9,714 |

|

|

— |

|

| Other assets |

1,019 |

|

|

1,019 |

|

|

Total assets |

$ |

142,600 |

|

|

$ |

137,759 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Current maturities of notes payable, net of unamortized debt

issuance costs of $144 and $126, respectively |

$ |

2,806 |

|

|

$ |

2,224 |

|

|

Accrued salaries and benefits |

7,364 |

|

|

5,759 |

|

|

Accounts payable |

1,989 |

|

|

1,402 |

|

|

Other current liabilities |

4,317 |

|

|

3,414 |

|

|

Deferred revenue |

658 |

|

|

1,078 |

|

|

Estimated liability for appeals |

255 |

|

|

210 |

|

|

Lease liabilities |

2,882 |

|

|

— |

|

|

Total current liabilities |

20,271 |

|

|

14,087 |

|

| Notes payable, net of current portion and unamortized

debt issuance costs of $2,095 and $2,345, respectively |

40,755 |

|

|

41,105 |

|

| Deferred income taxes |

53 |

|

|

22 |

|

| Earnout payable |

2,212 |

|

|

1,936 |

|

| Lease liabilities |

8,028 |

|

|

— |

|

| Other liabilities |

2,167 |

|

|

3,383 |

|

|

Total liabilities |

73,486 |

|

|

60,533 |

|

| Commitments and contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Common stock, $0.0001 par value. Authorized, 500,000 shares at

March 31, 2019 and December 31, 2018 respectively; issued and

outstanding 53,146 and 52,999 shares at March 31, 2019 and

December 31, 2018, respectively |

5 |

|

|

5 |

|

|

Additional paid-in capital |

77,747 |

|

|

77,370 |

|

|

Accumulated deficit) |

(8,638 |

) |

|

(149 |

) |

|

Total stockholders’ equity |

69,114 |

|

|

77,226 |

|

|

Total liabilities and stockholders’ equity |

$ |

142,600 |

|

|

$ |

137,759 |

|

|

|

|

|

|

|

|

|

|

PERFORMANT FINANCIAL CORPORATION AND

SUBSIDIARIESConsolidated Statements of Operations(In

thousands, except per share amounts)(Unaudited)

| |

|

Three Months

Ended March 31, |

| |

|

2019 |

|

2018 |

| Revenues |

|

$ |

34,876 |

|

|

$ |

57,021 |

|

| Operating expenses: |

|

|

|

|

|

Salaries and benefits |

|

29,116 |

|

|

21,781 |

|

|

Other operating expenses |

|

12,953 |

|

|

23,020 |

|

|

Total operating expenses |

|

42,069 |

|

|

44,801 |

|

|

(Loss) income from operations |

|

(7,193 |

) |

|

12,220 |

|

| Interest expense |

|

(1,136 |

) |

|

(1,270 |

) |

| Interest income |

|

11 |

|

|

6 |

|

|

(Loss) income before provision for income taxes |

|

(8,318 |

) |

|

10,956 |

|

| Provision for income taxes |

|

171 |

|

|

2,501 |

|

|

Net (loss) income |

|

$ |

(8,489 |

) |

|

$ |

8,455 |

|

| Net (loss) income per share |

|

|

|

|

|

Basic |

|

$ |

(0.16 |

) |

|

$ |

0.16 |

|

|

Diluted |

|

$ |

(0.16 |

) |

|

$ |

0.16 |

|

| Weighted average shares |

|

|

|

|

|

Basic |

|

53,059 |

|

|

51,320 |

|

|

Diluted |

|

53,059 |

|

|

53,455 |

|

|

|

|

|

|

|

|

|

PERFORMANT FINANCIAL CORPORATION AND

SUBSIDIARIESConsolidated Statements of Cash Flows(In

thousands)(Unaudited)

|

|

Three Months

Ended March 31, |

| Cash flows from operating

activities: |

2019 |

|

2018 |

|

Net (loss) income |

$ |

(8,489 |

) |

|

$ |

8,455 |

|

|

Adjustments to reconcile net (loss) income to net cash provided by

(used in) operating activities: |

|

|

|

|

Release of net payable to client related to contract

termination |

— |

|

|

(9,860 |

) |

|

Release of estimated liability for appeals due to termination of

contract |

— |

|

|

(17,932 |

) |

|

Derecognition of subcontractor receivable for appeals due to

termination of contract |

— |

|

|

5,535 |

|

|

Derecognition of subcontractor receivable for overturned

claims |

— |

|

|

1,536 |

|

|

Provision for doubtful accounts for subcontractor receivable |

— |

|

|

1,868 |

|

|

Depreciation and amortization |

2,312 |

|

|

2,576 |

|

|

Deferred income taxes |

31 |

|

|

283 |

|

|

Stock-based compensation |

499 |

|

|

639 |

|

|

Interest expense from debt issuance costs |

232 |

|

|

331 |

|

|

Earnout mark-to-market |

276 |

|

|

— |

|

|

ROU assets amortization |

660 |

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Trade accounts receivable |

3,002 |

|

|

(5,905 |

) |

|

Prepaid expenses and other current assets |

(372 |

) |

|

(82 |

) |

|

Income tax receivable |

165 |

|

|

2,316 |

|

|

Other assets |

— |

|

|

41 |

|

|

Accrued salaries and benefits |

1,605 |

|

|

1,417 |

|

|

Accounts payable |

587 |

|

|

(80 |

) |

|

Deferred revenue and other current liabilities |

483 |

|

|

1,571 |

|

|

Estimated liability for appeals |

45 |

|

|

— |

|

|

Net payable to client |

— |

|

|

(2,940 |

) |

|

Lease liabilities |

(723 |

) |

|

— |

|

|

Other liabilities |

43 |

|

|

395 |

|

|

Net cash provided by (used in) operating activities |

356 |

|

|

(9,836 |

) |

| Cash flows from investing

activities: |

|

|

|

|

Purchase of property, equipment, and leasehold improvements |

(1,486 |

) |

|

(2,500 |

) |

|

Net cash used in investing activities |

(1,486 |

) |

|

(2,500 |

) |

| Cash flows from financing

activities: |

|

|

|

|

Repayment of notes payable |

— |

|

|

(550 |

) |

|

Taxes paid related to net share settlement of stock awards |

(156 |

) |

|

(299 |

) |

|

Proceeds from exercise of stock options |

34 |

|

|

116 |

|

|

Net cash used in financing activities |

(122 |

) |

|

(733 |

) |

|

Effect of foreign currency exchange rate changes on cash |

— |

|

|

1 |

|

|

Net decrease in cash, cash equivalents and restricted cash |

(1,252 |

) |

|

(13,068 |

) |

| Cash, cash equivalents and restricted cash at

beginning of period |

7,275 |

|

|

23,519 |

|

| Cash, cash equivalents and restricted cash at end of

period |

$ |

6,023 |

|

|

$ |

10,451 |

|

| Supplemental disclosures of cash flow

information: |

|

|

|

|

Cash received for income taxes |

$ |

(54 |

) |

|

$ |

(299 |

) |

|

Cash paid for interest |

$ |

— |

|

|

$ |

939 |

|

| Reconciliation of the Consolidated Statements

of Cash Flows to the Consolidated Balance Sheets: |

|

|

|

|

Cash and cash equivalents |

$ |

4,364 |

|

|

$ |

8,663 |

|

|

Restricted cash |

1,659 |

|

|

1,788 |

|

|

Total cash, cash equivalents and restricted cash at end of

period |

$ |

6,023 |

|

|

$ |

10,451 |

|

|

|

|

|

|

|

|

|

|

PERFORMANT FINANCIAL CORPORATION AND

SUBSIDIARIESReconciliation of Non-GAAP Results(In

thousands, except per share amount)(Unaudited)

| |

|

Three Months

Ended March 31, |

| |

|

2019 |

|

2018 |

| Adjusted Loss Per Diluted Share: |

|

|

|

|

| Net (loss)

income |

|

$ |

(8,489 |

) |

|

$ |

8,455 |

|

| Plus: Adjustment items per reconciliation of adjusted

net (loss) income |

|

573 |

|

|

(12,791 |

) |

| Adjusted net loss |

|

(7,916 |

) |

|

(4,336 |

) |

| Adjusted Loss Per Diluted Share |

|

$ |

(0.15 |

) |

|

$ |

(0.08 |

) |

| Diluted avg shares outstanding |

|

53,059 |

|

|

51,320 |

|

| |

|

Three Months

Ended March 31, |

| |

|

2019 |

|

2018 |

| Adjusted EBITDA: |

|

|

|

|

| Net (loss)

income |

|

$ |

(8,489 |

) |

|

$ |

8,455 |

|

| Provision for income taxes |

|

171 |

|

|

2,501 |

|

| Interest expense (1) |

|

1,136 |

|

|

1,270 |

|

| Interest income |

|

(11 |

) |

|

(6 |

) |

| Depreciation and amortization |

|

2,312 |

|

|

2,576 |

|

| CMS Region A contract termination

(5) |

|

— |

|

|

(18,816 |

) |

| Stock-based compensation |

|

499 |

|

|

639 |

|

| Adjusted EBITDA |

|

$ |

(4,382 |

) |

|

$ |

(3,381 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months

Ended March 31, |

| |

|

2019 |

|

2018 |

| Adjusted Net Loss: |

|

|

|

|

| Net loss

(income) |

|

$ |

(8,489 |

) |

|

$ |

8,455 |

|

| Stock-based compensation |

|

499 |

|

|

639 |

|

| Amortization of intangibles (2) |

|

59 |

|

|

203 |

|

| Deferred financing amortization costs (3) |

|

232 |

|

|

331 |

|

| CMS Region A contract termination

(5) |

|

— |

|

|

(18,816 |

) |

| Tax adjustments (4) |

|

(217 |

) |

|

4,852 |

|

| Adjusted Net Loss |

|

$ |

(7,916 |

) |

|

$ |

(4,336 |

) |

| |

|

|

|

|

|

|

|

|

(1) Represents interest expense and amortization of

issuance costs related to the refinancing of our indebtedness.

(2) Represents amortization of capitalized expenses

related to the acquisition of Performant by an affiliate of

Parthenon Capital Partners in 2004.

(3) Represents amortization of capitalized financing costs

related to our Credit Agreement for 2018.

(4) Represents tax adjustments assuming a marginal tax

rate of 27.5%.

(5) Represents the net impact of the termination of our

2009 CMS Region A contract during the first quarter of 2018,

comprised of release of $27.8 million of the estimated liability

for appeals and the net payable to client balances into revenue,

net of derecognition of $9.0 million of prepaid expenses and other

current assets, with a charge to other operating expenses,

reflecting accrued receivables associated with amounts due from

subcontractors for decided and yet-to-be decided appeals.

PERFORMANT FINANCIAL CORPORATION AND

SUBSIDIARIESReconciliation of Non-GAAP Results(In

thousands, except per share amount)(Unaudited)

We are providing the following preliminary estimates of our

financial results for the year ended December 31, 2019:

| |

|

Three Months Ended |

|

Nine Months Ended |

|

Year

Ended |

| |

|

March 31, 2019 |

|

December 31, 2019 |

|

December 31, 2018 |

|

December 31, 2019 |

| |

|

Actual |

|

Estimate |

|

Actual |

|

Estimate |

| Adjusted EBITDA: |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(8,489 |

) |

|

$ (11,471) to (19,456) |

|

$ |

(8,010 |

) |

|

$ (19,960) to (27,945) |

| Provision for (benefit from) income taxes |

|

171 |

|

|

(421) to 579 |

|

1,542 |

|

|

(250) to 750 |

| Interest expense (1) |

|

1,136 |

|

|

5,614 to 6,614 |

|

4,699 |

|

|

6,750 to 7,750 |

| Interest income |

|

(11 |

) |

|

(29) to (44) |

|

(28 |

) |

|

(40) to (55) |

| Depreciation and amortization |

|

2,312 |

|

|

7,188 to 8,188 |

|

10,234 |

|

|

9,500 to 10,500 |

| Impairment of goodwill and customer relationship

(6) |

|

— |

|

|

— |

|

2,988 |

|

|

— |

| CMS Region A contract termination (5) |

|

— |

|

|

— |

|

(19,415 |

) |

|

— |

| Stock-based compensation |

|

499 |

|

|

1,501 to 2,501 |

|

2,750 |

|

|

2,000 to 3,000 |

| Adjusted EBITDA |

|

$ |

(4,382 |

) |

|

$ 2,382 to (1,618) |

|

$ |

(5,240 |

) |

|

$ (2,000) to (6,000) |

(1) Represents interest expense and amortization of issuance

costs related to the refinancing of our indebtedness.

(5) Represents the net impact of the termination of our 2009 CMS

Region A contract during the first quarter of 2018, comprised of

release of $27.8 million of the estimated liability for appeals and

the net payable to client balances into revenue, net of

derecognition of $9.0 million of prepaid expenses and other current

assets, with a charge to other operating expenses, reflecting

accrued receivables associated with amounts due from subcontractors

for decided and yet-to-be decided appeals.

(6) Represents intangible assets impairment charge related to

Great Lakes Higher Education Guaranty Corporation customer

relationship.

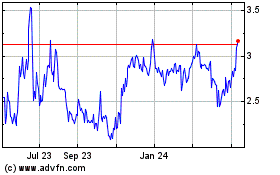

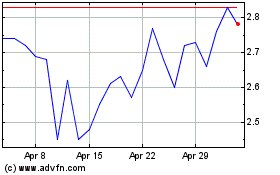

Performant Financial (NASDAQ:PFMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Performant Financial (NASDAQ:PFMT)

Historical Stock Chart

From Apr 2023 to Apr 2024