Microgrid Solar Play Gets Gov’t

Approval

May 7, 2019 -- InvestorsHub NewsWire -- Microcap Speculators --

It is an exciting time for solar energy. As per Solar

Energy Industries Association, the next five years is projected to

bring an additional 68 gigawatts of solar capacity, more than

doubling the current capacity. More than three-quarters of

Americans feel that their utility provider should invest more

heavily in solar energy.

In 2018, according to the Solar Energy Industries

Association, a new solar energy project launched every 100

seconds. Companies considered to be solar-focused come from

multiple sectors, including utilities, industrials, energy, and

more.

CleanSpark, Inc. (USOTC:

CLSK), a microgrid company which helps companies get

the most out of their energy including solar, announced

last week its solar plus storage microgrid located at the Marine

Corps Base Camp Pendleton has achieved government

acceptance. This shows that CLSK has more than a

great idea, they have a government verified technology that is in

major demand in several industries.

This announcement capped off a big week for

CLSK. CLSK also announced the release of a

production version of its Microgrid Value Stream Optimizer

(mVSO). Rather than rely on a black box algorithm coupled

with a spreadsheet of projected savings, CLSK’s mVSO displays in

great detail how real savings can be achieved, down to 15-minute

intervals. Customers only need to provide CleanSpark with a

year's worth of utility interval data for their mVSO to begin its

calculations. In some cases, an overall cost reduction of up

to 90% can be achieved. Start your research today.

Today we are highlighting: CleanSpark, Inc. (USOTC:

CLSK), Vivint Solar, Inc. (VSLR), Canadian Solar, Inc.

(NASDAQ:

CSIQ), Pattern Energy Group Inc. (NASDAQ:

PEGI), and TerraForm Power, Inc. (NASDAQ:

TERP).

CleanSpark, Inc. (USOTC:

CLSK) (Market Cap: $116.690M; Share Price:

$2.71) has had quite the year.

The company engaged a firm to navigate their up listing, announced

the near completion of a $900k contract to install a CLSK microgrid

at a U.S. Marine Corps Base and has been progressing on a $18.3

million deal with NYSE company, MAC. Now is the time to start

your research on CLSK.

CLSK has a microgrid energy solution for the cannabis industry that

dramatically decreases the cost of energy associated with producing

each pound of valuable cash crop. A cannabis business using

$90,000 per year in energy has the potential to reduce its

operating costs (flowering stage) from $270/lb. to $200/lb.,

producing a 15% ROI over 10 years.

CLSK currently has several revenue generating projects. It

also released an Edgar filing reporting $20 million in financing in

the form of Debenture, the Series B Preferred Stock, the Warrant

and the Common Stock. With the warrants being priced $3.50

per share with respect to 2,000,000 Warrant Shares, $4.00 with

respect to 100,000 Warrant Shares, $5.00 with respect to 100,000

Warrant Shares, $7.50 with respect to 50,000 Warrant Shares and

$10.00 with respect to 50,000 Warrant Shares, the parties are

surely anticipating growth. This committed financing will

help accelerate the development and deployment of CleanSpark's

Distributed Energy Resource (DER) Solutions to commercial

customers.

CLSK has outlined several initiatives in their recent letter to

shareholders. CLSK is planning to initiate a marketing

campaign to start reaching indoor cannabis growers dealing with

inefficient energy usage in need of their services, push forward

their projects with recent acquisition of Intellectual Property of

Pioneer Critical Power Inc, and facilitate growth in their R&D

to find new industries their solution can improve. Start your

research now.

________

Vivint Solar, Inc. (VSLR) (Market Cap: $745.382M;

Share Price: $6.18) plans to report financial results

for the first quarter of 2019 after the U.S. financial markets

close on Thursday, May 9, 2019. The company will host a

conference call and simultaneous audio-only webcast at 5 p.m.

Eastern Time to discuss its financial results for the

quarter.

Vivint Solar is a leading full-service residential solar provider

in the United States. With Vivint Solar, customers can

power their homes with clean, renewable energy and typically

achieve significant financial savings over time. Vivint Solar

designs and installs solar energy systems for its customers and

offers monitoring and maintenance services.

________

Canadian Solar, Inc. (NASDAQ:

CSIQ) (Market Cap: $1.187B; Share Price:

$20.03) announced it won two accolades in the 2018

Power Finance & Risk Deal of the Year Awards.

Canadian Solar was named the Latin America Project Finance Borrower

of the Year, and was further recognized as Latin America Project

Finance Deal of the Year for the financing of its 100 MWp solar

project in Cafayate, Argentina.

Canadian Solar was founded in 2001 in Canada and is one

of the world's largest and foremost solar power companies. It

is a leading manufacturer of solar photovoltaic modules and

provider of solar energy solutions and has a geographically

diversified pipeline of utility-scale power projects in various

stages of development. Over the past 18 years, Canadian Solar

has successfully delivered over 32 GW of premium quality modules to

customers in over 150 countries around the world.

________

Pattern Energy Group Inc. (NASDAQ:

PEGI) (Market Cap: $2.262B; Share Price:

$23.02) announced that it will release its first

quarter 2019 financial results by press release on Friday, May 10,

2019, prior to market open. The company will subsequently

hold a conference call that same day, Friday, May 10 , at 10:30 am

Eastern Time hosted by Mr. Michael Garland , President and Chief

Executive Officer, and Mr. Esben Pedersen , Chief Financial

Officer.

Pattern Energy has a portfolio of 24 renewable energy projects with

an operating capacity of approximately 4 GW in the United States ,

Canada and Japan that use proven, best-in-class technology.

Pattern Energy's wind and solar power facilities generate stable

long-term cash flows in attractive markets and provide a solid

foundation for the continued growth of the business.

________

TerraForm Power, Inc. (NASDAQ:

TERP) (Market Share: $2.876B; Share Price:

$13.75) is expected to deliver a year-over-year

decline in earnings on higher revenues when it reports results for

the quarter ended March 2019, as per Zacks Investment

Research. This widely-known consensus outlook gives a good

sense of the company's earnings picture, but how the actual results

compare to these estimates is a powerful factor that could impact

its near-term stock price.

________

Signed by

Priyanka Goel, CFA

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting has agreed to a three-month

term consulting agreement with CLSK dated 9/12/18. The

agreement calls for $10,000 in cash, and 30,000 restricted 144

shares of CLSK per month. Regal and CLSK have signed an

amendment to extend the contract for twelve months starting

10/10/18, and increased the cash component to $20,000 per month.

CLSK has paid an additional $12,000 for services provided in

November. CLSK has paid an additional $88,000 for services provided

in December. CLSK has paid an additional $100,000 for

services for January. CLSK has paid an additional $100,000

for services for February. Regal was paid an additional

$100,000 for March services. CLSK has paid an additional

$100,000 for services for March. CLSK has paid an additional

$80,000 for services for April. CLSK has paid All payments

were made directly by Clean Spark, Inc. to Regal Consulting, LLC.

to provide investor relations services, of which this article is a

part of. Regal Consulting also paid one thousand dollars cash

to microcapspeculators.com to distribute this article. Regal

Consulting may have a position in the securities mentioned in this

article at the time of publication, and may increase or decrease

its position without notice. This article is based on public

information and the opinions of Regal Consulting. CLSK was given an

opportunity to edit this article. This article contains

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially

from any results predicted herein. Regal Consulting is not

registered with any financial or securities regulatory authority,

and does not provide or claim to provide investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Full Legal Disclaimer Click Here.

Contact Information:

Company Name: ACR Communication LLC.

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

SOURCE: Microcap Speculators

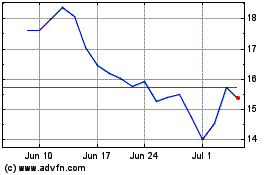

Canadian Solar (NASDAQ:CSIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

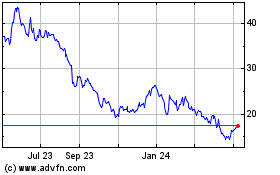

Canadian Solar (NASDAQ:CSIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024